This week, we will delve into something really abstract. Not like monetary economics, which is so simple even a caveman can do it.

A Clever Ruse

We refer to a clever rhetorical trick. It’s when someone makes a broad and important assertion, in very general terms. But when challenged, the assertion is switched for one that is entirely uncontroversial but also narrow and unimportant. The trick is intended to foreclose debate of the broad assertion, not really to retreat to the narrow one.

The essence is bait-and-switch, or equivocation.

So let’s start with a simple example: diversity in a corporate board body is good. Suppose you demand why. The predictable answer is that it would be a boring world with less creative solutions if everyone on the board had the same background and perspective. Most people would agree with this, of course.

And that is the trick.

In the broad assertion, diversity implies quotas, or at least explicit preferences for women, minorities, and LGBT. But quotas cannot really be defended. Most people can see that corporations won’t serve customers better, if they choose unqualified people based on race or gender. So of course, this is not the place where the Diversity Defenders set up their defense.

They say that if everyone has identical backgrounds and the same perspective, there is less creative thinking, and outside-the-box solutions. This is true, and no one could refute it.

It is also a switcheroo. It is not what diversity meant in the original, broad and important assertion. That assertion was not about a mix of engineers and artists, accountants and sales people. The broad and important assertion is about public policy and, if not quotas, explicit preferences for members of some groups.

Diversity in the narrow assertion is easily defensible, but not politically significant. Yes, corporate boards should not be full of Agent Smiths from The Matrix.

We are talking about the Motte and Bailey Fallacy. It is named after a medieval fortification. When under attack, the people retreated to the inner motte. It was easily defended, but not a pleasant place to live. Otherwise, they wanted to be in the outer bailey.

In this fallacy, as we saw with the Diversity Defenders, the arguer will move to the small and easily defensible motte when challenged, or back to the bailey promoting something big and important otherwise. The fallacy is that the argument made from the motte does not actually defend the assertion. It only makes it seem as if it has been defended.

Monetary Mottes and Baileys

Regular readers by now will be wondering what this has to do with money. Which of the many fallacies promoted by modern mainstream mongers of monetary magic fall into this category?

One that comes to mind is the assertion that we have a free market in credit. The broad assertion in the motte is saying that the Fed is not really controlling interest rates. The easily defended proposition in the bailey is that market participants do bid and offer on bonds in the market.

Another is that the monetary system is fine because GDP and the stock market are rising. GDP and the S&P index are observable numbers that anyone can see. No argument there. But this is a move from the bailey to the motte. Of course, the monetary system is not fine. If it were, then why did the Fed have to become the pawn shop of last resort? Why has the interest rate been falling for four decades? Why is there no interest available to bank depositors? Why is the interest rate negative in many parts of the world?

This bailey cannot be defended. So they move to the motte. GDP and the stock market are rising. The motte cannot be assailed. But the motte does not bolster the bailey in any way. It is not true that rising GDP and rising stock market mean that the economy is good, much less that the monetary system is sound. Indeed, the rising stock market is just a reflection of falling interest rates, a sign of monetary disease. And rising GDP is just a function of the GDP formula itself: borrowing to consume adds to GDP. This does not mean that borrowing to consume is good, it means that GDP is a bad metric.

However, we want to get to the root. The mother of all Motte and Bailey Fallacies in monetary economics. That the dollar is money, and gold is not.

The Mother of All Mottes and Baileys

The broad assertion implies that the dollar is the unit of account, the measure of value, the store of value, and the extinguisher of debt. And that gold is a barbarous relic. This bailey cannot be defended. This unit changes value due to the Fed’s policy. It is a poor store over long periods of time. It cannot extinguish debt, it can only shift it. And the gold market is deep and liquid.

So they defend the motte. The dollar is used as the medium of exchange in virtually all transactions in America, and a very large number even in countries where another currency is legal tender. And nearly all transactions between parties domiciled in different countries.

For example, a Swiss manufacturer of equipment who sells to a Hungarian firm does not want forint. An Indian exporter of basmati rice does not want ringgit or dong, when he sells to distributors in Malaysia or Vietnam.

The Mottle and Bailey fallacy is challenging to defeat. That’s because the motte is true. It is true that the dollar is the medium of exchange. That’s what makes the motte so easy to defend. You will have no credibility if you argue that the dollar is not the universal medium of exchange.

You could argue that use as the medium of exchange does not necessarily mean that the dollar is money. We have made this argument. It’s hard to make.

To properly defeat the fallacy, you have to expose it. You have to show that the arguer has switched contexts. Part of this is showing that use as medium does not necessarily mean money. Beyond that, you have to call out the fallacy itself. You have to show that a unit which is losing value—by design—sends false signals when used as unit of account and measure of value. You have to show that, being a debt instrument, it does not extinguish a debt when it is tendered in payment.

You have to say you agree that the dollar is medium of exchange, but that this is not the assertion under contention.

Clear Terms, Clear Thinking

When terms are not well defined, and arguments are largely implicit, then charlatans and swindlers are advantaged. And the opposite is also true. When terms are clear, and arguments explicit, then the truth will win out.

The dollar is not money, the most marketable commodity and the extinguisher of debt. The dollar is currency, the most marketable credit instrument.

If we were asked: what is our single most important purpose in writing this Report? Our answer is to define terms and present explicit arguments. And do this in an obscure area which even the good guys often accept loosely defined terms and implicit arguments.

A vitally important area: money and credit.

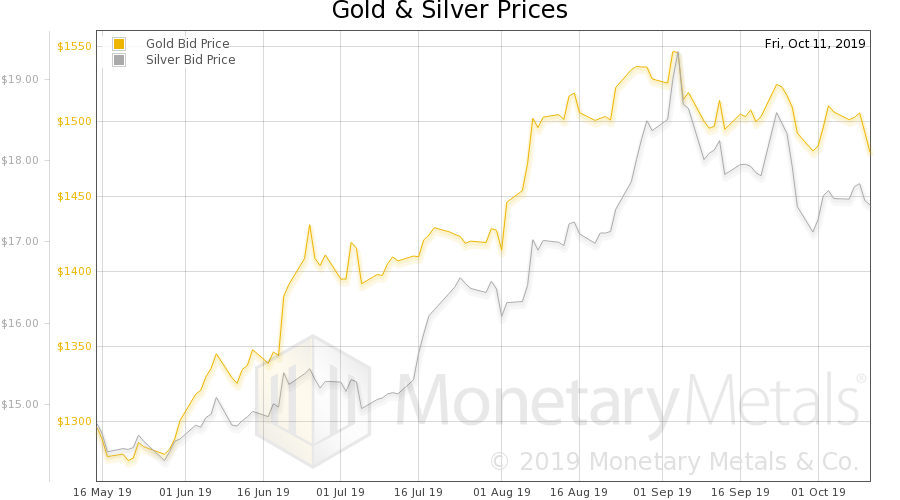

Supply and DemandThe price of gold dropped $16, but the price of silver was all but unchanged. Whereas last week, we said: “…the consumer goods stockpile stored in Treasury bonds (to extend our half sarcastic, half tongue-in-cheek analogy) increased this week.” This week, it was the opposite. Consumer goods spilled out of the storage tank of Treasury bonds. The interest rate on the 10-year ended the week at a higher level not seen since September 20. Those pesky apples and orange and gasoline and rent may have poured into crude oil. Or bitcoin. Not to beat a dead horse, but we hope we have made it clear that assets are not stores of consumer goods, of purchasing power. We also hope to make it clear that a price move higher does not compensate for a prior drop. Or in this case, a price drop of the bond (i.e. rising interest rate) does not compensate for previous price increases (i.e. falling interest rate). It just imposes capital losses to new investors, not necessarily the ones who made the capital gains. The principle virtue of the unadulterated gold standard is not static prices. That’s neither possible nor desirable. The virtue is stable interest rates, and hence stable asset prices. And hence little opportunity to speculate outside of agricultural commodities which are subject to the weather. We are far from that today. It is highly likely that in the restless churn of our markets, one price or other will jump higher. Perhaps that will be the price of gold? Read on for a look at the only true picture of the supply and demand fundamentals. But, first, here is the chart of the prices of gold and silver. |

Gold and Silver Prices(see more posts on gold price, silver price, ) |

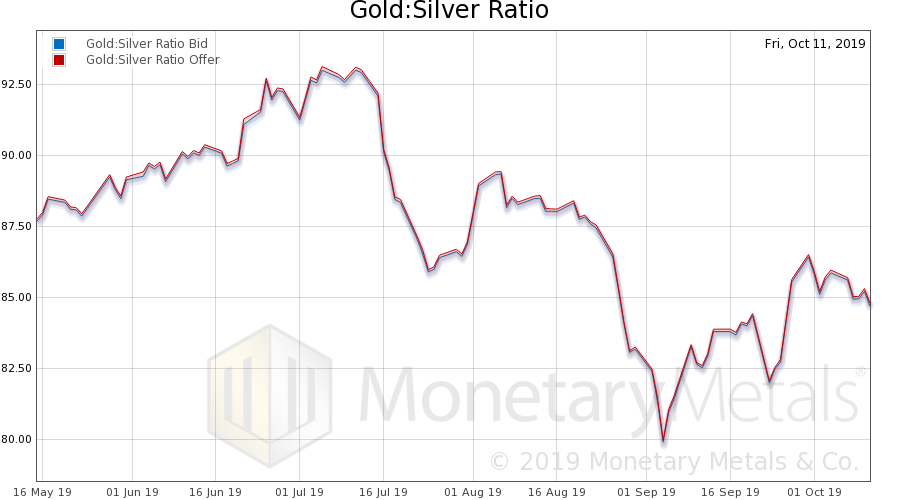

Gold to Silver RatioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). The ratio fell this week. |

Gold: Silver Ratio(see more posts on gold silver ratio, ) |

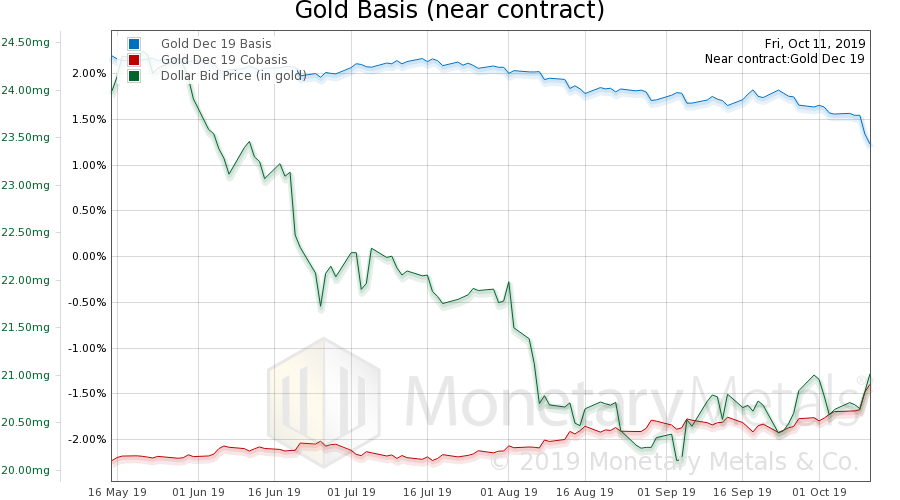

Gold Basis and Co-basis and the Dollar PriceHere is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price. Uncanny how the scarcity (i.e. cobasis) rose with the price of the dollar in gold (i.e. inverse of the price of gold, in dollars). This usually indicates speculators repositioning. In this case, the Monetary Metals Gold Fundamental Price, after falling the first half of the week, firmed up $24, to $1,464. |

Gold Basis and Co-basis and the Dollar Price(see more posts on dollar price, gold basis, Gold co-basis, ) |

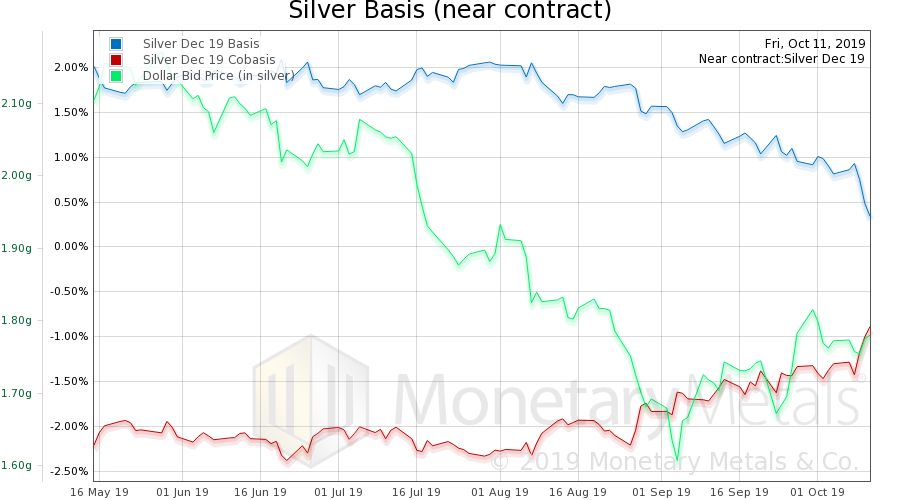

Silver Basis and Co-basis and the Dollar PriceNow let’s look at silver. In silver, the same thing happened to the cobasis, though the price didn’t move. And like in gold, the Monetary Metals Silver Fundamental Price rose, 44 cents to $17.25. |

Silver Basis and Co-basis and the Dollar Price(see more posts on dollar price, silver basis, Silver co-basis, ) |

© 2019 Monetary Metals

Full story here Are you the author? Previous post See more for Next postTags: Basic Reports,Currency,dollar price,GDP,gold basis,Gold co-basis,gold price,gold silver ratio,money,newsletter,silver basis,Silver co-basis,silver price,stock market