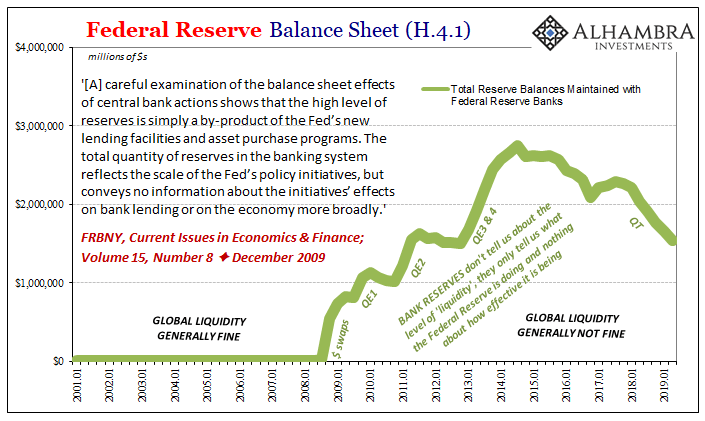

They remain just as confused as Richard Fisher once was. Back in ’13 while QE3 was still relatively young and QE4 (yes, there were four) practically brand new, the former President of the Dallas Fed worried all those bank reserves had amounted to nothing more than a monetary head fake. In 2011, Ben Bernanke had admitted basically the same thing.

But who was falling for it?

The stock market, sure.

Investors on Wall Street are still betting as if it will work any day now. The financial media, absolutely. I’ve yet to see an article that doesn’t treat bank reserves as “base money”, therefore QE as “money printing.”

| Did policymakers also fool themselves?

No doubt, as Fisher was suggesting. Less straightforward than it is ever made out to be, even monetary officials have come to realize there’s a ton of gray area where this liquidity business is concerned. As I wrote recently, it is the rest of the monetary zoo which should concern everyone. And yet, it’s the one thing nobody bothers to consider; and for perfectly understandable reasons. Central bankers have a vested interest in the public believing in their “printing press” and the byproduct of bank reserves. Therefore, they are perfectly happy if you think that’s all there is to it. Don’t ever look behind the curtain. |

Federal Reserve Balance Sheet, 2001-2019 |

| Or they were happy about your exclusive attention. Right now, maybe not so much.

The reason is the repo market. Not only did it blow up on them and make people (even in the financial media) begin questioning their worldview for once, it demonstrated quite clearly that monetary aptitude shouldn’t just be assumed on the part of central bankers. To try and put the matter to rest, however, Jay Powell has a problem. Or, he thinks he has this problem. What I mean by that is the same head fake. He wants to raise the level of bank reserves again but is unsure how to do it (and very likely less sure privately about why he is doing it). A standing repo facility, as has been discussed for months, would have accomplished that narrow goal (raising the level of bank reserves, though leaving the broader question about effective liquidity unanswered). The Fed, however, has opted against it. We don’t know the exact reason but we can guess. I wrote all the way back in March about what a standing facility would look like:

|

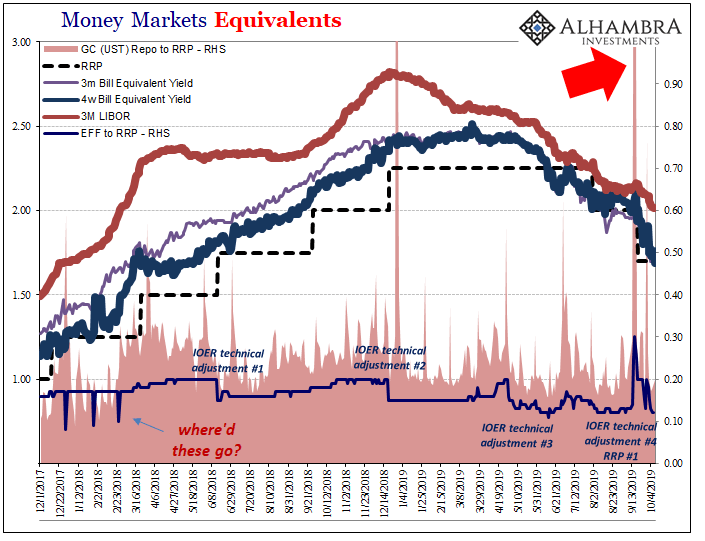

Money Markets Equivalents, 2017-2019 |

| It’s that last part which has made policymakers nervous; again, the head fake. What if they opened the repo facility and the demand for reserves suddenly skyrockets? If you let the market dictate the quantity then effectively there is no cap.

The way policymakers see it, that could be terribly inflationary, or, as concerned Fisher once upon a time, bubbly. That’s the head fake. Without a cap or some restraint, authorities have clearly decided they can’t trust the market to determine the “correct” amount of reserves that are required. Instead, Powell just announced that the Fed will again make that determination (the Q part of QE) just as it did during the QE period. For a central bank supposedly worried about how the market is starved for liquidity, this is an odd choice. Put it in terms of the head fake, however, and its par for the expectations policy course. Despite everything that has happened since QE1, really since the first serious balance sheet expansion back around Lehman, these central bankers continue to try to send the message that what they do and what they hold is truly powerful stuff. No inflation from all that supposed money printing, doesn’t matter. These guys and gals really want you to appreciate just how careful they are being with all that power at their fingertips. They want you to see it as liquidity and money, but never “too much.” The question is, are they acting this way for their own benefit, truly believing this nonsense, or for yours? Is it all part of the playacting for the latest puppet show? Or an attempt by the central bank to appear relevant? This money printing stuff is so powerful, we just can’t trust the markets to decide how much. Great theater. Entertaining. Effective liquidity? Not so much. Nearing a month of overnight repo operations which will now hand off to this new as-yet untitled balance sheet expansion (Powell: don’t you dare call it QE!) and the money markets look exactly the same as they did before all this. The bottleneck passed; the illiquidity did not. Thus, what did the overnight repos (and the few term repos) legitimately accomplish? In the markets – nothing. In the media – they aren’t writing nearly as many stories about repo, at least negative stories that paint officials as behind the curve if not neglectful. Go back to sleep, Mr. and Mrs. John Q Public, it took him a few minutes but Jay Powell’s got this! Whether he does or not, doesn’t matter (in theory) so long as you feel reassured and start accelerating your spending and your boss at work starts hiring and investing. You know who doesn’t buy any of it? The bond market – which has been warning you and Jay Powell for a very long time this was coming. |

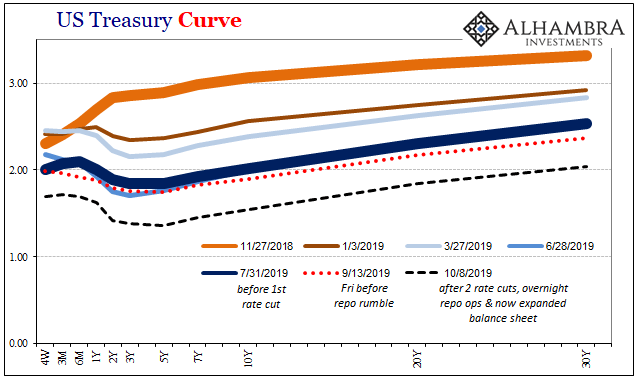

US Treasury Curve, 2018-2019(see more posts on US Treasury, ) |

| Even today when announcing this next genius “liquidity” plan, bonds (and other parts of the money markets) barely noticed. Just like the ECB’s recent restart of QE, the last month of Fed action just hasn’t registered. It has fallen flat.

Look at the yield curve: Still inverted, still moving downward. Does that look like a market thinking the central bank is on top of…anything? And eurodollar futures continue to price many more rate cuts, in fact a better chance of renewed ZIRP and probably a full QE (though buying what this time around, exactly?) These are not the market trends for market participants convinced policymakers have the right solution for market problems. These are instead the trends for markets thinking this is all going to continue regardless – escalating policy measures that have little effect both because of and in response to escalating liquidity pressures that originate in the other parts of the monetary zoo. |

Federal Reserve Balance Sheet, 2001-2019 |

The empty parts you still aren’t supposed to realize were emptied a long time ago and were never repopulated even though official QT policy was counting on it.

The bond markets know it. It’s all a head fake. Every last bit of it. Everywhere it happens.

Full story here Are you the author? Previous post See more for Next postTags: bank reserves,bond market,Bonds,currencies,economy,EFF,federal funds,Federal Reserve/Monetary Policy,gc repo rate,Interest rates,jay powell,Liquidity,Markets,newsletter,QE,QT,repo,U.S. Treasuries,US Treasury,Yield Curve