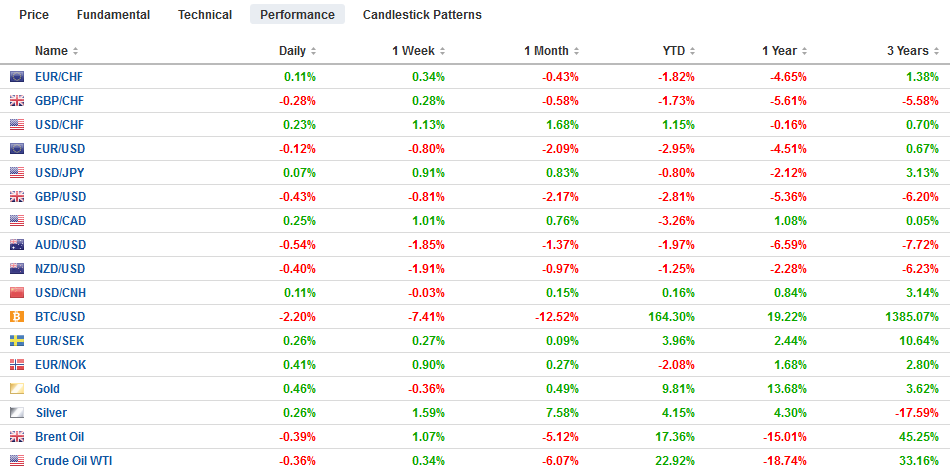

Swiss FrancThe Euro has risen by 0.13% at 1.1056 |

EUR/CHF and USD/CHF, July 26(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Investors are happy for the weekend. Between the ECB, Brexit, and next week’s FOMC, BOJ, and BOE meetings, the markets are mostly in a consolidative mode ahead of the weekend. The first look at Q2 US GDP is the last important data point of the week, though it is unlikely to impact next week’s Fed decision. Russia is widely expected to join the rate-cutting central banks today with a 25 bp reduction in its key rate to 7.25%. Asia Pacific equities mostly followed yesterday’s US lead and slipped lower today. The regional benchmark finished marginally lower on the week.European equities are mixed through the morning session and are holding on to about a 0.8% gain here in the last week of July. The Dow Jones Stoxx 600 has fallen only one week in two months. US shares are trading with a firmer bias, and coming into today, the S&P 500 is up a little less than 1% this week. The US dollar is posting modest gains against the major currencies and most of the emerging market currencies. |

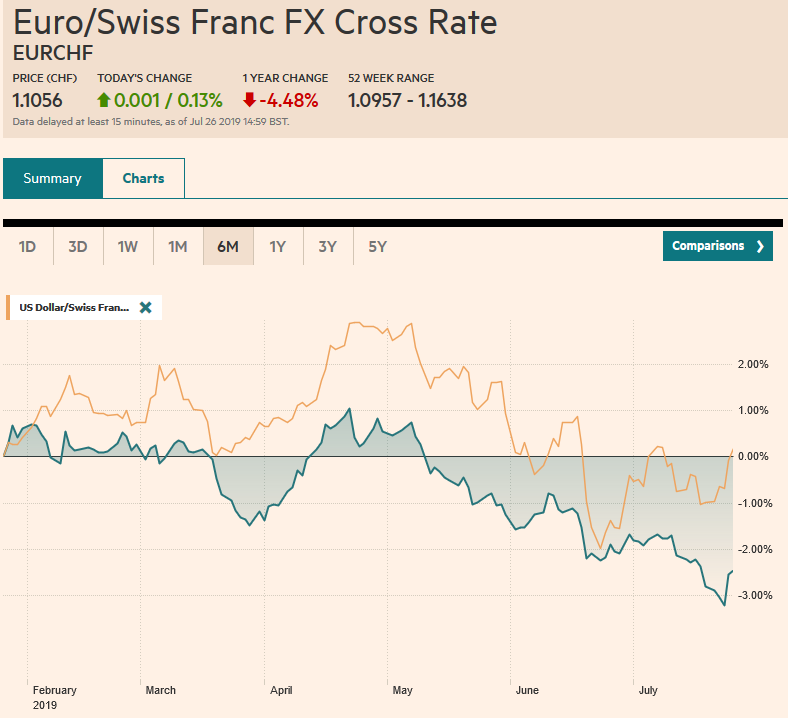

FX Performance, July 26 |

Asia Pacific

After what was reportedly a brief call earlier this week, Mnuchin and Lighthizer are going to China next week to resume trade talks. Unlike previously, expectations are being managed in a way as to emphasize the difficulty going forward. Although Chinese officials say there is no connection with the trade talks, reports indicate that they will allow some companies to import fixed amounts of US agriculture products (cotton, sorghum, and pork) without the punitive tariffs.

Iran joined North Korea in testing weapons this week. North Korea was said to fire a couple projectiles, which the US dismissed as a negotiating tactic, and the US want to proceed with talks. Iran fired a ballistic missile as it too wants to engage the US directly.

The dollar has been confined to about 1/5 of a yen below JPY108.75 but is firm near three-week highs. The JPY109 area is important technically, and the dollar has traded above it in two months. We have suggested a convincing move above it would target the JPY111.00 area. The Australian dollar is extending is downdraft for the sixth consecutive session today. Near $0.6930, the Aussie is off by about 1.6% this week. These losses have retraced (61.8%) of the rally from the mid-June low near $0.6830. Initial support is seen near $0.6900, but there is little on the charts that prevent a return to the lows. This week the market has moved to discount a higher chance of a rate cut in September (~53% vs. 40%).

Europe

When everything was said and done, the Draghi said more than he did and for all practical purposes, the euro was net-net flat on the day. Besides a couple of tweaks in its statement, the ECB revealed very little new to the market. As widely anticipated the forward guidance was adjusted to allow for lower rates and underscored that the inflation target was symmetrical. That appears to soften “near but less than 2%” inflation target over the medium term. Investors learned very little new about what the ECB will do in September. Innovations, like tiering, or excluding some deposits from negative or as negative interest rates, or buying bank bonds or equities, still seemed controversial. There was some talk that the ECB could target average inflation.

At the same time, although Draghi explicitly played down the risk of a recession, he acknowledged that the “outlook was getting worse and worse.” He also revealed that there was no discussion of a rate cut, which many in the market, including us, thought was a material risk even if not the base case. What we do know is that the ECB will take action in September. The overnight index swaps imply about an 85% chance of a 10 bp cut in the deposit rate then. Draghi acknowledged that the unorthodox measures may generate diminishing returns, i.e., be less effective. Europe may realize too late that fiscal measures are likely needed. We expect an asset purchase plan to be announced as well that would start probably in October. This will likely entail some adjustment to the self-imposed position limits (e.g., no more than a third of a country’s debt). Greek bonds may be included as well, and the anticipation may have helped drive the 10-year yield below comparable US Treasury yield.

It was also reported that in a secret ballot, Lagarde was approved by the ECB to replace Draghi. She is the first woman, but also the first non-economist at the helm. Word was leaked to reporters that there were two votes against and one abstention. We do not see much point in trying to guess who the nays and abstention were. And even then, it would seem to matter if the objections were procedural or substantive and whether the votes were directed. Given that Lagarde is seen likely to follow the broad course Draghi has steered, it would not be surprising if the lack of support emanated from northern European creditor/surplus countries.

UK Prime Minister Johnson was predictably rebuffed in his first attempt to renegotiate the withdrawal agreement. He reportedly told Juncker that the plan had been defeated several times and that the backstop provisions must be dropped. As the EC has said many times, and Juncker reiterated, the agreement is the best and only agreement. The risks of a no-deal exit remain palpable.

How high of interest rates are needed to support the Turkish lira? The central bank surprised investors with a 425 bp cut in one-week repo rate to 19.75%. Inflation is falling, and the central bank will soon (next week) lower its forecast, which in turn, will give some guidance of the magnitude of interest rate cuts that will be delivered in the coming months. The central bank meets next on September 12. The larger than expected rate cut generated some volatility for an hour or so, but things settled down relatively quickly. The lira gained about 0.2% against the US dollar yesterday and is a little firmer today. On the week, with the dollar around TRY5.8650, the lira is off a little less than half of one percent this week.

The euro has been confined to about a fifth of a cent range below $1.1150 through the Asian session and the European morning. There is a 775 mln euro option at $1.1150 that expires today and about 520 mln euros in options between $1.1170 and $1.1175. The low since the end of Draghi’s press conference yesterday is about $1.1125. Yesterday’s negligible gain of less than 0.1% was the euro’s only advance in the last six sessions through today. The option defense of the $1.1100 area may continue next week. Sterling also has managed to gain against the dollar once in the past six sessions, and that was in the middle of this week. Support yesterday near $1.2460 is serving as resistance today, and it has not been above $1.2640 in the European morning. The two-year low recorded in the middle of this month near $1.2380 appears to be beckoning. However, sterling is poised to end the record-long 11-week slide against the euro. The euro closed last week near GBP0.8975 and will not give up the streak without a little fight today.

America

The market remains convinced the Fed will cut the target rate by 25 bp next week, and those that don’t think so expect it to move by 50 bp. The news yesterday drives home why many in the market may be skeptical of the need. Leaving aside near record-high equity prices, the current economic performance does not need lower rates. Durable good orders, excluding defense and aircraft, jumped 1.9%, well more than the 0.2% gain that the median forecast in the Bloomberg survey anticipated, and the fifth gain in six months. Separately, weekly initial jobless claims unexpectedly fell 10k to 206k. Economists had expected a 2k increase. Admittedly, next week’s non-farm payroll growth is expected to moderate to around 160k from 224k in June, but that is still sufficient to keep the unemployment rate near the lows in a generation.

| Separately, household consumption likely recovered smartly from the sub-1% reading in Q1 to something closer to 4% in Q2. That would make it the strongest in nearly five years. Investors will learn today the magnitude of the slowdown in Q2, and since economists have been underestimating the strength of the high-frequency data, the risk seems to be on the upside of the 1.8-1.9% median forecast that surveys have picked-up. Would a 2-handle really be that surprising? It will be slower than the 3.1% pace of Q1, but the quality of it, in the sense of consumption and business investment, as opposed to government spending and inventories, maybe better. |

U.S. Gross Domestic Product (GDP) QoQ, Q2 2019(see more posts on U.S. Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

The US dollar is headed for its longest advancing streak against the Canadian dollar since March. The greenback is firmer against the Loonie for the sixth consecutive session. It is the first back-to-back gain for the US dollar since April. Although the CAD1.3200 offers psychological resistance for the US dollar, the more significant chart level is closer to CAD1.3225, which corresponds to retracements of the decline from May’s high as well as last month’s high. Initial support is now seen near CAD1.3150. The dollar began the week rising against the Mexican peso and surrendered the gains in the past two sessions. These gyrations left the dollar practically flat on the week. It is up about 0.2% today (around MXN19.0650). The high yields and tight fiscal stance continues to draw yield-hungry strategies. The Dollar Index is also rising for its sixth consecutive session and is trading near two-month high a little below 98.00. The high for the year was set on May 23, a little above 98.35.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Brexit,Currency Movements,ECB,EUR/CHF,EUR/CHF and USD/CHF,newsletter,U.S. Gross Domestic Product,USD/CHF