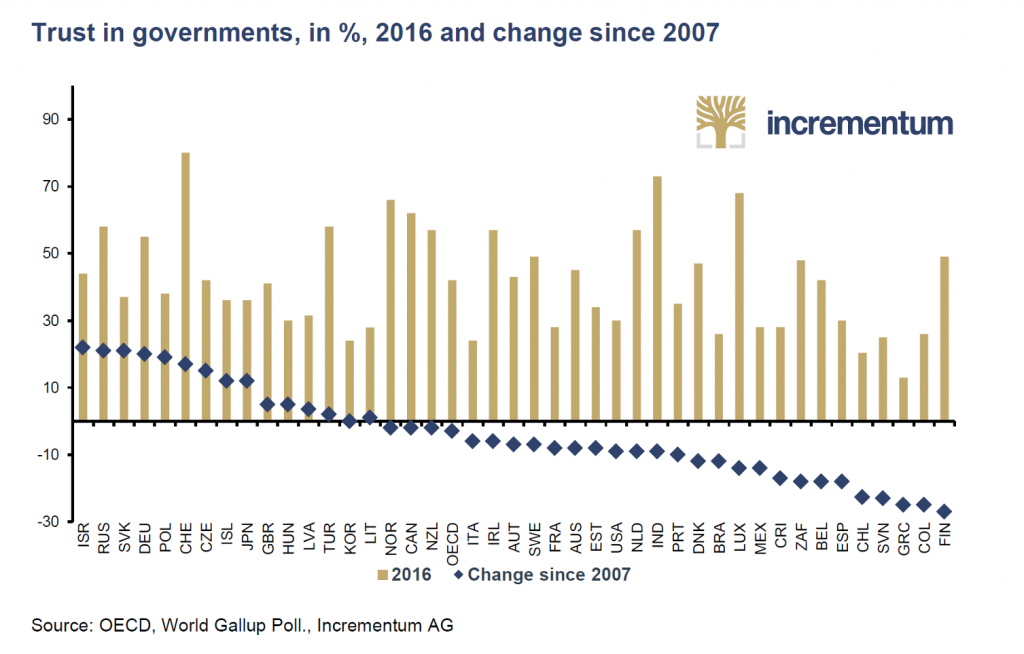

The New Annual Gold Report from Incrementum is HereWe are happy to report that the new In Gold We Trust Report for 2019 has been released today (the download link can be found at the end of this post). Ronnie Stoeferle and Mark Valek of Incrementum and numerous guest authors once again bring you what has become the reference work for anyone interested in the gold market. Gold in the Age of Eroding TrustThis year’s report is entitled “Gold in the Age of Eroding Trust” and has been published in German, English and for the first time in Mandarin as well. The extended English version of the report is quite voluminous this year – it has 325 pages. Trust in once well-respected institutions (see chart above) is increasingly eroding. Eventually this erosion of trust is likely to engulf the global monetary order and gold is without a doubt one of the most reliable hedges against such a development. As always, the report not only contains a wealth of interesting analysis, it is also an extremely useful reference work that can be consulted whenever one needs a statistic or a historical chart relevant to the gold market. To our knowledge it is the most comprehensive collection of valuable gold-related data that exists. |

Eroding TrustA chart from the introduction to the 2019 IGWT report: trust in governments is eroding all over the world from what were already extremely low levels. The same applies to the realms of the media and science. Many people are (rightly, we believe) concerned that these once well-respected spheres can no longer be trusted to be neutral. In many cases they have become extremely politicized and are pushing agendas that are opposed by a growing number of people. |

| All aspects of the gold market are discussed, from the political and economic backdrop to technical and sentiment conditions. There are even forays into the realm of philosophy (particularly interesting in this context is the chapter “Acceleration and the Monetary Order”, see the Table of Contents further below).

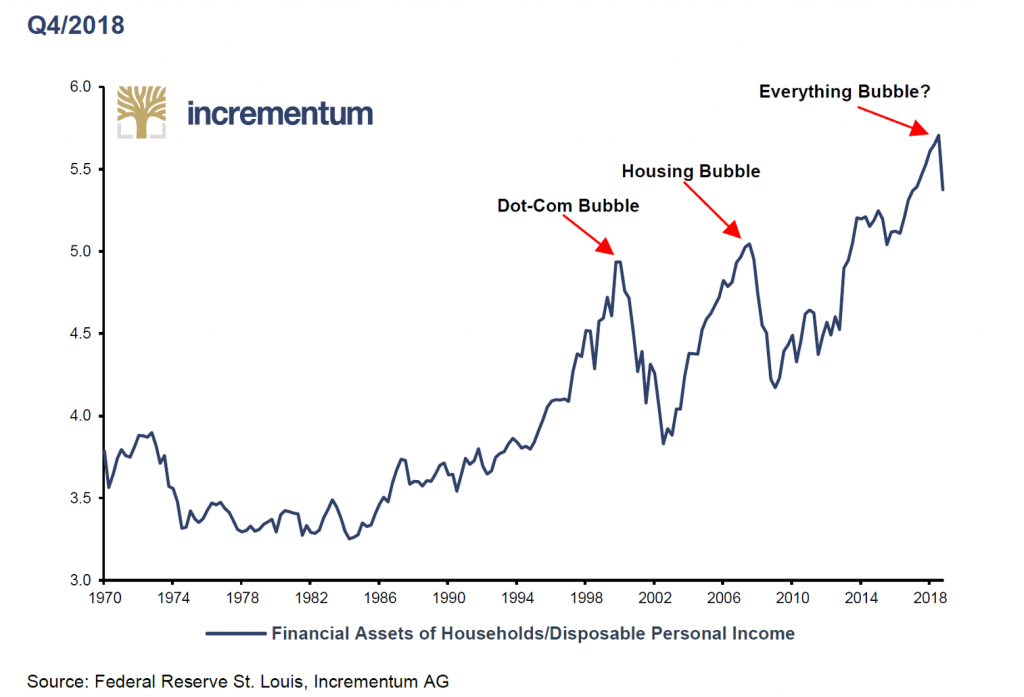

We are currently at a very interesting juncture – up until now, the so-called “Everything Bubble” (which we also like to refer to as the “Great Bernanke Echo Bubble”, or GBEB for short, naming it after its creator) has proved remarkably resilient. That could be about to change. |

Everything Bubble 1970-2018 |

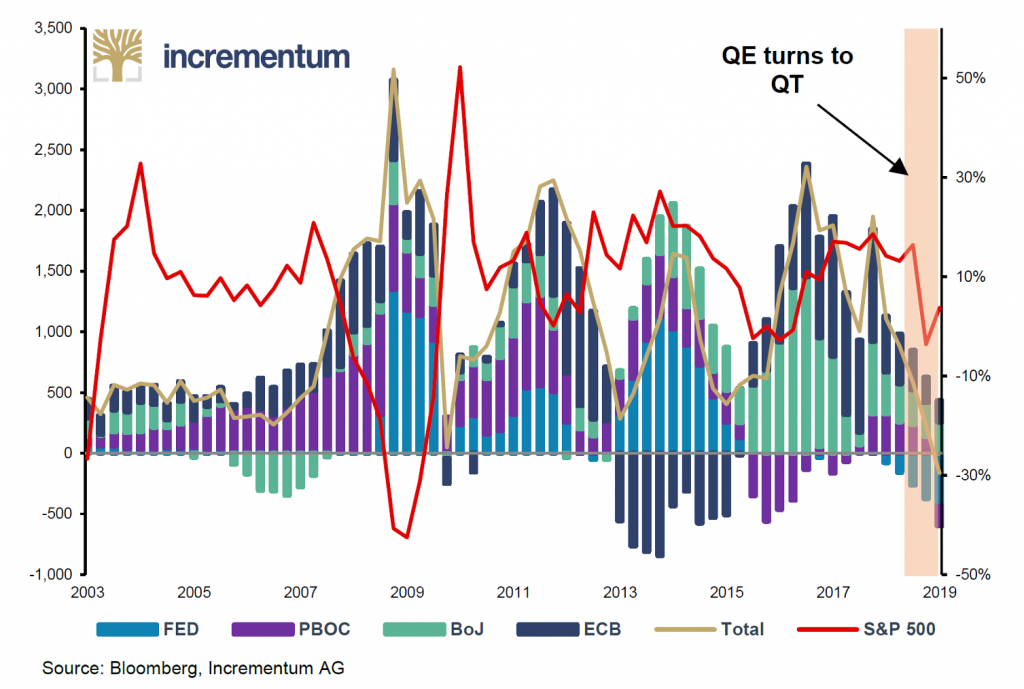

| The fact that the Fed has tightened its monetary policy – even though it remains highly accommodative compared to the past – may well be what it takes to stop the enormous asset price inflation of recent years dead in its tracks. Year-on-year growth in the US broad true money supply TMS-2 has recently declined to a new 12-year low of 2%, which is well below the level we believe is needed to keep asset price inflation going without a hitch.

Gold has been neglected in recent years, as market participants have become increasingly convinced that they won’t need a portfolio hedge – a decision that some may come to regret. It is actually quite remarkable how well the gold price has held up in the face of the relentless rise in risk asset prices. Evidently there exists fairly strong underlying demand for gold despite the fact that the macroeconomic fundamentals driving gold prices were for quite some time at best in neutral and often even in slightly bearish mode (in recent months they have shifted to a somewhat more bullish configuration, but in our opinion it is not yet what we would consider unequivocally bullish). |

The Pin 2003-2019 |

We suspect many investors remain uneasy about the current economic situation and the risks posed by the vast increase in outstanding debt and the monetary policy experiments of today’s central bankers. Obviously gold’s short term performance – particularly in USD terms – is disappointing for investors in the sector, as neither gold nor gold stocks seem to be able to go anywhere.

One should keep in mind though that the longer a consolidation period lasts, the bigger the eventual move is likely to be. With regard to gold’s ability to serve as a hedge: it is always better to have insurance and not need it, than to find out one day that one needs it but doesn’t have it.

IGWT 2019 – Table of Contents

To give you a quick overview of what to expect from the 2019 IGWT report, here is the Table of Contents:

- Introduction 4

- The Status Quo of Gold 20

- Gold and the Dragon – China Stabilizes Its Ascent with Gold 70

- De-Dollarization: Europe Joins the Party 101

- Highlights: 20 Years Later – a Freegold Project: Interview with “FOFOA” 122

- The Enduring Relevance of Exter’s Pyramid 130

- Portfolio Characteristics: Gold as Equity Diversifier in Recessions 143

- Gold Storage: Fact Checking Liechtenstein, Switzerland, and Singapore 166

- History Does (not) Repeat Itself – Plaza Accord 2.0? 176

- Acceleration and the Monetary Order 193

- The Crumbling Trust in Politics and Its Economic Root Cause 209

- Hyperinflation: Much Talked About, Little Understood 223

- Gold Bonds: Bringing Back an Extinguisher of Debt to the Bond Market 231

- Gold vs. Bitcoin vs. Stablecoins 242

- Gold and Bitcoin: Stronger Together? 254

- Gold Mining Stocks – After the Creative Destruction, a Bull Market? 263

- Reform, Returns, and Responsibility 275

- ESG: Environment, Social, Governance –three words worth more than USD 20 trillion? 285

- Gold Mining: Disruptive Innovation at Its Core 301

- Technical Analysis 314

- Quo Vadis, Aurum? 326

And here is the download link to the 2019 IGWT Report – enjoy!

In Gold We Trust 2019 – Gold in the Age of Eroding Trust (PDF)

Charts by Incrementum, OECD/World Gallup Poll, St. Louis Fed, Bloomberg

Full story here Are you the author? Previous post See more for Next postTags: Chart Update,newsletter,Precious Metals