Just as there is gradation for positive numbers, there is color to negative ones, too. On the plus side, consistently small increments marked by the infrequent jump is never to be associated with a healthy economy let alone one that is booming. A truly booming economy is one in which the small positive numbers are rare. The recovery phase preceding the boom takes that to an extreme.

If conditions swing the other way, the same holds true. This is about probability, derived from consistent patterns taken from understanding how economies work. Momentum is often a key piece, therefore sentiment. It’s just not sentiment as is commonly derived in the form of surveys.

Economists and central bankers talk endlessly about the virtuous circle for a reason. People get to feeling good and so they start acting on those feelings. More action in people, more buying, building, and servicing. The economy jumpstarts to life, what Keynes called pump priming. Only to Keynes, pump priming wasn’t pop psychology it was hard action.

Orthodox Economics declares that it is nearly sufficient enough for those feelings. This is one reason why there is no money in monetary policy; the entire official paradigm has shifted to psychological manipulation.

Real economic momentum may not be so simple. People may get to feeling positive even very positive, but still remain cautious in becoming so. I think things are getting better but I’m going to wait to make sure (once bitten and all that). The economic breakout can stall, which is pretty much the story of the last decade around the world.

They call these a boom each and every time anyway (the psychology) yet they end up being so fragile. The reason is because the process stops far short of one, never achieving momentum from the positive turn in feelings. People start toward optimism in sentiment and while they are waiting for confirmation, bam, “something” hits the system (eurodollar #n) and everyone scurries back toward what the Japanese call the “deflationary mindset.”

It unravels sometimes quickly because it never really got going.

| Yesterday and today it is Germany upon center stage. On Monday, DeStatis reported that factory orders sunk at a rate not seen since the last recession in Europe (2011-12). Today, Germany’s statistical agency tells us that current production in that key industrial country dropped at a rate not seen since the Great Recession.

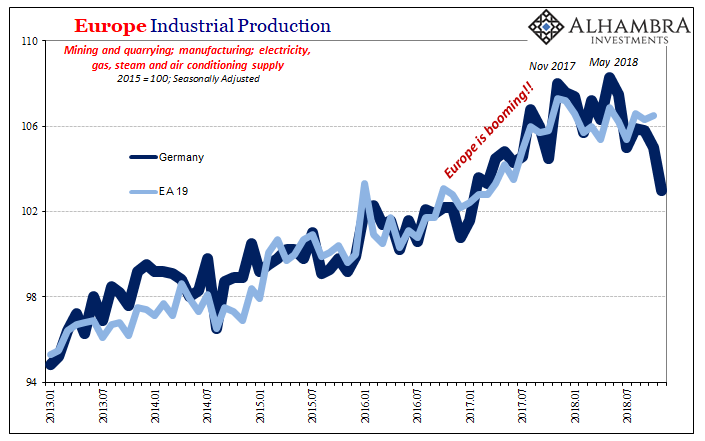

Since orders are falling, the forward-looking indication, the outlook isn’t good for a quick turnaround from the current starkly bleak situation. People were feeling good about globally synchronized growth in 2017, no question. It even came out as a pickup in low positive numbers from really low positive numbers (you can see it easily on the chart above). But it never left that stage, keeping the economy vulnerable to January 2018. It has fallen off very quickly, with that turn accelerating (gamma) late in the year thus matching market action. |

Germany Industrial Production, Jan 2007 - 2019(see more posts on Germany Industrial Production, ) |

| We often forget that there are real players in these markets not just evil speculators as central bankers claim when prices turn inconveniently the wrong way. Why did markets turn so bad so fast last month? It surely wasn’t just vague perceptions about future dangers. There is increasingly data that shows very real deterioration in economic conditions which translate directly into market action (oil contango, for one).

And that brings us to the gradation of negative numbers. Small minuses even a string of them might not be much to get too concerned about. That wouldn’t be good, obviously, but it doesn’t necessarily go right to recession (or crash). Like larger positives, larger negatives skew the probability distribution in the direction of the extremes, further precluding inflections. Significant contraction in German manufacturing and industry data (orders and production) if repeated in the series (for more months) or in other series tells us that the probability of escaping (transitory) is substantially reduced and that consequently the probability of outright, broad contraction is raised. |

Germany Industrial Production Destatis, Jan 2013 - 2019(see more posts on Germany Industrial Production, ) |

We care about the possibility of German recession or anything in between because:

Being an export powerhouse, Germany’s economic direction is as much determined outside of its borders as inside…Taken by itself, it’s another soft economic warning that we should take serious the prospects beyond just the latest false dawn (globally synchronized growth). Like the narrow upswing of the ZEW index itself, what’s suggested is that whatever little growth there might have been during Reflation #3 it may have since disappeared; the unpleasant scenario of the global economy having already started rolling over.

I wrote that back in July. Soft economic warnings earlier in 2018 became hard economic warnings toward its end. Markets followed even if the boom narrative won’t/can’t. May 29 so far really has proved decisive in erasing what was left of real economic sentiment.

That’s the only near certainty as yet. The boom is dead, meaning it wasn’t really a boom it was grade school psychology being turned into more than it was. These numbers are entirely inconsistent with the sort of trend envisioned.

What will follow is surely stronger denial. Just as Brazil’s chaos was dismissed as Brazil’s chaos, so will people say Germany’s problems are just Germany’s problems (without anyone specifying exactly what they are, or why they seem to be just like Brazil’s). People may be willing to set aside Brazil, but will be far more skeptical about doing the same when it comes to Germany – people in markets.

Tags: currencies,economy,EuroDollar,Federal Reserve/Monetary Policy,Germany,Germany Industrial Production,global trade,industrial production,manufacturing,Markets,newsletter