After a horrible December and a rough start to the year, as if manna from Heaven the clouds parted and everything seemed good again. Not 2019 this was early February 2015. If there was a birth date for Janet Yellen’s “transitory” canard it surely came within this window. It didn’t matter that currencies had crashed and oil, too, or that central banks had been drawn into the fray in very unexpected ways.

Actually it did, at least with that last one. The world’s default setting remains central bankers. No matter how thoroughly they discredit themselves, in times of trouble people really, really want to believe there exists this technocratic savoir.

They can get it wrong time after time after time, but when things appear most dire it is almost like a defense mechanism this running back to “home” the Yellen’s, Bernanke’s, and Powell’s. The world looks like it is falling apart leading a central bank, any central bank to try something and for a time it appears to work.

It never does.

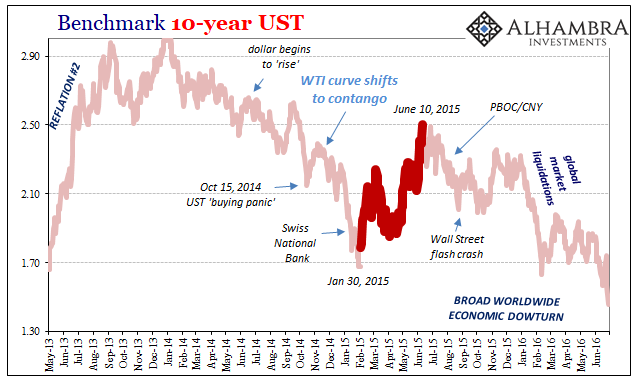

| That was the winter and spring of 2015. After tremendous global upheaval, beginning in early February the BOND ROUT!!! was back on and Economists were all over the media pairing the “best jobs market in decades” with “oil price crash is a tax cut” nonsense. Relief was palpable. Even WTI rebounded sharply, from a low around $44 to back above $60 by May.

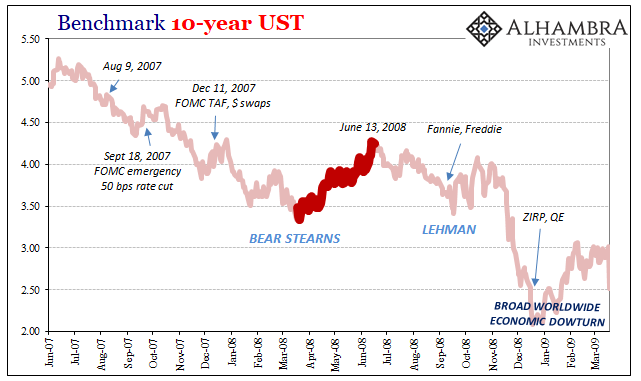

The UST 10s had been heavily bid, as they often are during these “unexpectedly” bad outbreaks, the yield falling sharply from about 2.40% in early November 2014 to a low around 1.70% at the end of January 2015. Long rates would retrace that entire decline and then some, arriving at 2.50% after nearly five months of cautious optimism. These countertrends can last that long. The pattern repeats time and again. In 2008, following the announcement of Bear Stearns’ near failure (of all things), the same process played out. Throughout the spring of that year there was some level of speculation in markets that maybe, perhaps the Fed had finally caught up to the crash. |

Benchmark 10-year UST 2013-2016 |

| Sure, Bernanke had said subprime was contained but then he realized his error. The central bank then spent the rest of 2007 and early 2008 experimenting and working behind the scenes. The relatively orderly shepherding of Bear into JP Morgan convinced many there was at least a chance he had at long last succeeded. Some started to speculate, literally, the US would avoid a recession altogether.

Policymakers, at least, convinced themselves of that very outcome. It didn’t work out that way, to put it charitably. In the grand scheme, central banks don’t matter. They just don’t. But people believe they do even those who have become legitimately jaded over their performance. The current version is Yellen/Powell has screwed up this exit, but the latter will realize his error(s) before it’s too late. This is where we are in January 2019. Powell after being unshakably confident about the US economy in particular he has said all the right things this month. His dove is as chicken as chickens can get (until whatever comes next comes next). In the short run, aided by promised RRR cuts and stimulus in China, softening in Mario Draghi, and whatever else some central banker might dream up, optimism can catch on and drive the markets for a while. Maybe even months at a time. In fact, if a months-long rally failed to materialize it would be the first time. Nothing goes in a straight line. Markets move on probabilities, spectrums pieced together from incomplete information as well as outdated, outmoded myths and legends. Even during those mid-stride rallies in 2008 and 2015 the bond market (or oil) wasn’t actually saying Bernanke or Yellen had come up with the definitive solution, rather it was saying there wasn’t a 100% chance they hadn’t. |

Benchmark 10-year UST 2007-2009 |

| This is going to be a give and take; action and reaction like always. The more serious it becomes, the more serious the counterpunching. Powell’s already moved on skipping higher dots and going right to a “Fed pause.” It’s really easy if maybe he starts to sound more dovish still – hinting at rate cuts “if conditions warrant.”

You know it’s coming. Markets will jump when he does. They always jump for the Fed in the short run. Then the anesthesia wears off and everyone feels the pain again. That’s really all central banks offer. People have said monetary policy is like speed or heroin, some sort of highly effective stimulant. That’s not really an accurate characterization (especially given how there is no money in monetary policy; it is entirely psychology). The Bernanke’s of the world can only dull the pain for a little while at a time, so that you might forget all the big stuff that’s bothering you. It’s like going to a psychiatrist for a gun shot wound, a medical professional predisposed to believing your gaping, bleeding hole is all in your mind; on to the pharmacy for Xanax instead of emergency surgery. Anesthesia is a very good thing if at the same time the doctor giving it to you actually treats what’s wrong. Which, obviously, assumes he can diagnose and then remedy the disease or wound. If all he gives you is something to temporarily numb the agony? Your relief can feel so good but it comes with its own expiration. |

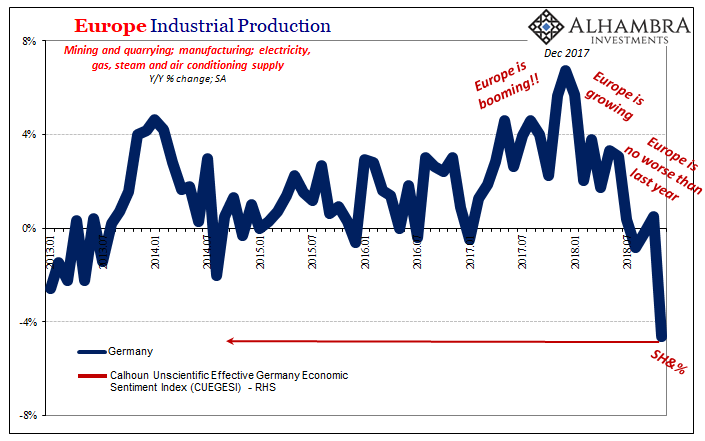

Europe Industrial Production 2013-2018(see more posts on Eurozone Industrial Production, ) |

Tags: Ben Bernanke,Bonds,central-banks,currencies,downturn,economy,EuroDollar,Eurozone Industrial Production,Federal Reserve/Monetary Policy,Markets,newsletter,U.S. Treasuries