The Recline and Flail of Western Civilization and Other 2019 Predictions

“I think it’s a tremendous opportunity to buy. Really a great opportunity to buy.” – President Donald Trump, Christmas Day 2018

Darts in a BlizzardToday, as we prepare to close out the old, we offer a vast array of tidings. We bring words of doom and despair. We bring words of contemplation and reflection. And we also bring words of hope and sunshine. After all, the New Year’s nearly here. What better time than now to turn over a new leaf? New dreams, new directions, and new delusions, are all before us like a patch of ripe strawberries. Today’s the day to make a double-fisted grab for all of them – and more. Rest assured, 2019 will be the year that everything happens precisely as it should. Some good. Some bad. Indeed, each day shall unfold before you in symbiotic disharmony. You can count on it. But what else? What are the essential anticipations as we embark on a new voyage around the sun? What about stocks, the 10-Year Treasury note, gold, and everything else? Are we fated for complete societal breakdown? Will this be the year the Fed put finally bites the dust? |

|

| Today we attempt to answer these questions – and many others – with meekness and modesty. Predicting the future, like Fed monetary policy, is primarily guesswork. But unlike the Fed, we acknowledge we’re merely throwing darts in a blizzard.

By all accounts, our methodology is as unscientific as prophecy via tarotology. We shun common forecasting techniques for a conjectural approach. First, we engage all matters of fact, fiction, fakery, and fraud. Then, through induction, deduction, biased interpolation, gut check filtration, and metaphysical reduction, we arrive at precise, unequivocal answers. But before we get to it, a brief disclaimer’s in order. This proviso from Yogi Berra should do:

With that out of the way, we face our limitations with purpose and intent. What follows, for fun and for free, are several simple guesses for the year ahead. |

Two styles of forecasting: the all-knowing Zoltar, and the less certain Yogi Berra (here at bat), who inter alia noted that “a lot can be observed by watching” and “it ain’t over until it’s over” – both of which we find to be true. And don’t forget, when you come to a fork in the road, take it. [PT] |

Stocks, Treasuries, and Gold in 2019Stocks – A Major MeltdownWe recognize the stock market’s comprised of many stocks and that they don’t all move in tandem. Certainly, it’s presumptuous of us to lump all stocks into the same prediction. But today’s conjectures, by their very nature, are presumptuous. Thus, stocks, for our purposes here, are the broad U.S. stock market – the S&P 500. To begin, the great stock market break that’s followed the S&P 500’s all-time high of 2,940, which was notched on September 21, will gain momentum as 2019 progresses. In fact, the S&P 500 won’t see 2,940 again for at least a decade – possibly much longer. Here’s why… |

S&P 500 Index with a possible wave count.(see more posts on S&P 500 Index, )Note: this wave count suggests that the index is currently in the third wave of an initial impulsive wave 1 down, in other words it represents the alternative indicating a beginning bear market. There are always other possibilities (alternate counts) that may only reveal themselves at a later stage as the fractals evolve. This one strikes us as the one that currently has the highest probability, given the many technical warning signs accompanying the peak in late September. [PT] |

| The Fed’s monetary tightening program of increasing the federal funds rate and reducing its balance sheet has dented the structure of the stock market, which has been fabricated over the last nine years. A vital prerequisite of the bull market – ultra cheap credit, courtesy of the Fed – has been removed. Without it, the stock market is unable to hold its extreme valuations.

Over the first six months of the New Year, wild hundred point swings in the S&P 500 will be commonplace. Pre-programmed algorithmic trades will trip the market back and forth in wild stomach churning gyrations. Bulls and bears – both human and artificial – will fight to the death for the upper hand. By mid-year, however, the bulls will have exhausted their resources. Shrewd investors will sell the multiple bounces leading up to the summer months, and go to cash and gold. About this time, the brief boon to businesses from President Trump’s tax cuts will be over. The economy will be en route to recession. Predictive models based on faulty earnings estimates will be thrown out the window. Pre-programmed buying will morph to pre-programmed selling, and an abrupt collapse will be triggered. The bottom will drop out of the stock market in short order. By October, as Wall Street and Washington scream for the Fed to do something, new experiments in ZIRP, NIRP, QE, and Fed equity purchases, will be rolled out with poise and confidence. Yet the Fed’s efforts to pump liquidity into the financial system will have little avail. Reality will be delivered to investors like buckets of ice water to the face. An abrupt, yet destructive, bear market will extend into early 2020. When the dust clears, the S&P 500 will have decline by 60 percent from its record high. Yet that’s nothing. Treasury investors are in for much greater levels of capital destruction… |

The garrote chart: Assets held by the Fed vs. the effective FF rate. |

The End of the Great Treasury Bond BubbleAs we close out the year, the yield on the 10-Year Treasury note has settled at about 2.77 percent. This is down from a yield of about 3.20 percent as recently as early November. Still, the current yield of 2.77 is above the 2.40 percent the 10-Year Treasury note yielded this time last year. From a historical perspective, a 10-Year Treasury note yield of 2.77 percent is extraordinarily low. But it’s more than double that of July 2016, when the 10-Year Treasury note bottomed out at a yield of just 1.34 percent. What to make of it? We have anticipated the conclusion of the great Treasury bond bubble for at least 8 years. But over much of this time, we were consistently fooled by brief episodes of rising rates, followed by even greater periods of declining rates. Over the last 30 months, the trend that commenced in 1981, a trend of ever lower interest rates, has reversed. Moreover, we are 100 percent certain that 2019 will be the year that yields commence their long-term rise in earnest. After many years of being wrong about the end of the great Treasury bond bubble, it is about time we were right. The price of credit will become more and more expensive over the next several decades. This one thing will change everything. What’s more, the Fed won’t be able to stop it… |

10-year Treasury note yield, weekly: amazingly10-year yields declined to a new post-WW2 low of 1.34% in mid 2016. Since then, the trend has been up. The recent stock market downturn and a decrease in inflation expectations (per market-based measures) have pushed yields down from their recent highs, but not to the extent one would normally expect. [PT] |

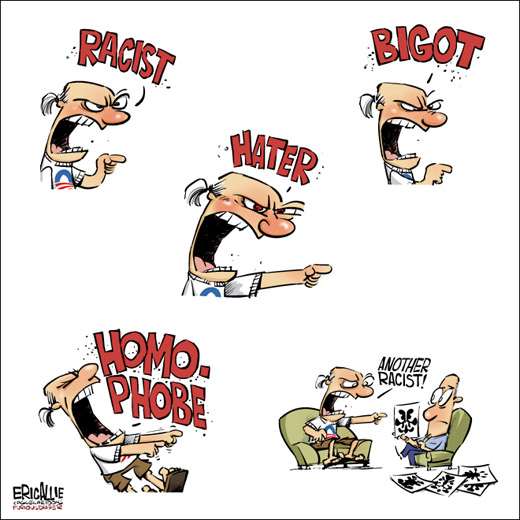

Death to the Fed PutA fallacy that is borne out of the last three decades of extreme credit market intervention is the dogma that the Fed disappears risk from financial markets. That by expanding and moderating the money supply by just the right amount, and at just the right time, stock and bond prices can grow within a pleasant setting of near nonexistent volatility. There is also unwavering trust that whenever a major stock market crash occurs, the Fed can soften the landing and quickly put things back upon a path of righteous asset price inflation. Believers in the all-powerful controls of the Fed have a 30 year track record they can point to with conviction. Over this period, the Fed has inflated stock and bond markets with steadfast rigor. But what if the Fed’s adventures in fabricating a market without risk are approaching the end of the road? |

When Alan Greenspan first executed the “Greenspan put” following the 1987 Black Monday crash, markets were well positioned for this centrally coordinated intervention. Interest rates, after peaking out in 1981, were still high. The yield on the 10-Year Treasury note was about 9 percent. There was plenty of room for borrowing costs to fall.

The mechanics of the Greenspan put – and later the Fed put – are extraordinarily simple. When the stock market drops by about 20 percent, the Fed intervenes by lowering the federal funds rate. This typically results in a negative real yield, and an abundance of cheap credit.

This gimmick has a twofold effect of seen and observable market distortions. First, the burst of liquidity puts an elevated floor under how far the stock market falls. Hence, the put option effect. Second, the interest rate cuts inflate bond prices, as bond prices move inversely to interest rates.

Wall Street money managers wholeheartedly endorse the reciprocal forgiveness of the Fed put. For this form of central planning largely mitigates market uncertainty; markets can be expected to behave in more or less predictable ways.

With the Fed put backstopping the market, a portfolio manager can sleep soundly at night during a stock market crash because they know their bond holdings are rising. Then, after a pleasant dip buying opportunity, their stocks soon run back up to new highs. This constituted U.S. financial markets and money management from 1987 to 2016.

No doubt, there were several gut wrenching sell offs during this period – like 1987, 2001, and 2008. But each time the Fed came to the rescue by cutting interest rates, bumping up bond values, and engineering an extended stock market rally. Few questioned whether this Fed intervention would ever cease to be available.

Over the decades, risk management strategies were invented that advocated the virtues of a 60/40 stock-to-bond allocation portfolio. And why not? The Fed put brought a comforting certainty to the market. When stocks go down, bonds go up. But what if, in the year 2019, the flight to bonds is no longer a flight to safety; but, to danger?

What may come as a great big surprise in the next market downturn is that this relationship between stocks and bonds is not set in stone. And over the next decade we suspect this relationship will be revealed to have been an aberration; an artifact of a now defunct disinflationary world.

You see, the conditions that made the Fed put possible are the opposite of the conditions that exist today. Rates are low and are moving higher. The world’s over-saturated with debt. Policies of mass money debasement have bubbled stocks and Treasuries out to extremes well beyond what is honestly conceivable.

Yes, the doom and gloom of a combined stock and bond market meltdown may arrive in 2019. And when the Fed lowers the federal funds rate to counteract the dual busts, expect the unexpected to happen. The Fed put – the market savior – will be overwhelmed by a panic that’s so massive and so violent it’ll have little effect. The Fed put will be exposed to be a myth of a prior era.

Gold ShinesGold has had a terrible run since peaking out at $1,895 per ounce in 2011. After that, gold fell to around $1,200 at the start of 2015. Then it slid to $1,060 per ounce by the close of 2015. That’s a loss of about 44 percent in dollar terms. At the close of 2018, gold is priced at about $1,275 per ounce – roughly the same as this time last year. However, the trends that pushed gold up 645 percent from 2001 to 2011 are still in place. The federal debt – now approaching $22 trillion – continues to rise unabated. The dollar’s status as the world’s reserve currency continues to become increasingly suspect. The combined stock and bond market collapse will leave few options for investor’s precious capital. Gold and cash will be the two asset classes left standing. Gold – a much better option than the fiat dollar – will inevitably resume its uptrend as the safe haven of last resort. As of late-2018, despite the awful beating over the last several years, gold’s price has stabilized and is setting up for a considerable rebound. What’s more, gold mining stocks are incredibly cheap. Quite frankly, this could be the mother of all speculations. |

Gold, monthly candlesWill it shine in 2019? Gold bottomed in 1999 at $255 per ounce. In April 2001 it revisited the $270 level for one last time before taking off for good. The long term chart looks like a temporally stretched version of the 1970s bull market. If this similarity persists, a resumption of the secular bull market would definitely be in the cards. The fundamental backdrop for gold has become increasingly bullish in recent weeks. This bullish shift in gold’s macroeconomic drivers is not yet unequivocal, but things are clearly beginning to turn in the precious metal’s favor. [PT] |

The Recline and Flail of Western CivilizationComplete Societal BreakdownBy and large, the tests facing the economy have little to do with markets and everything to do with central government. Over the last 30 years, as the Fed and the Treasury colluded to rig the financial system in totality, wealth has become ever more concentrated in fewer and fewer insider hands. The effect over this latest period of expansion has been a disparity that is so magnified few can ignore it. This trend will be further intensified by the forthcoming depression, which we anticipate will be in full swing in 2020. Bitterness and contempt for wealthy insiders is already much higher than it was during prior business cycles. Without question, this bitterness and contempt will increase to a fever pitch when this business cycle turns down. Discontent throughout the broad population will take a financial crash and an economic collapse, and transform it into a complete societal breakdown. Then the central government will fail the test of its making. Rather than employing small government and sound money solutions, the discord will provide Washington the perfect cover for a much larger central authority. They’ll offer promises to fix things while delivering a much wider range of wealth inequality. In short, big government will grow bigger in 2019 and the years to follow. At the same time, dissatisfaction, disappointment, and discontent will simmer over into mass movements, often having little clarity of purpose or tangible objective. Many will demand big government solutions to problems of big government. What’s left of the middle class will be destroyed as society breaks down and ceases to function.

|

|

Culture Circling the Toilet BowlThis past year brought forward many novel insights. New areas of enlightenment pushed out via social media came fast and furious. The impetus for much of it came courtesy of public Universities and a foolish ethos of political correctness. For example, on Thanksgiving Day, we learned that Charlie Brown is racist. According to highly intelligent twitter users, A Charlie Brown Thanksgiving is prejudiced because Franklin, the lone black character, is shown seated by himself on one side of the table. Do you follow the logic? Another innovative achievement was realized here in California, with the legal recognition of a third – non-binary – gender option. Hence, if you’re uncertain about your gender, or the nature of your gender, when applying for a driver’s license or state identification card, you can select ‘non-binary’ and move on. Problem solved. We also learned, while navigating the sensitivities of Happy Holidays vs Merry Christmas, that the old Christmas hit song, Baby, It’s Cold Outside, is about rape. Having this new knowledge, many radio stations in the U.S. and Canada banned it from their playlist. Alas, the countless examples like these are not signs of a culture that’s becoming more enlightened and intelligent. Rather, they’re evidence of the recline and flail of western civilization. To clarify, the recline and flail stage is one of many interim downward steps of the greater decline and fall of western civilization that’s been underway for the last 50 years. Regrettably, western culture will further circle the toilet bowl in 2019. |

Fake News Haymaker

But it’s not all doom and despair in 2019. In fact, we shall end our speculations with words of hope and sunshine…

Bright minds of honest intent and high aims are working overtime to deliver an epic haymaker to the fake news media. Be on the lookout for a major disruption in mid-2019.

Here’s to a healthy and prosperous New Year!

Charts by: StockCharts, St. Louis Fed

Chart annotations and image captions by PT

Full story here Are you the author? Previous post See more for Next post

Tags: Chart Update,newsletter,On Economy,On Politics,S&P 500 Index

![The garrote chart: Assets held by the Fed vs. the effective FF rate. [PT]](https://snbchf.com/wp-content/uploads/2018/12/2-Fed-assets-and-FF-rate-b-1024x564.png)