The investment climate will be shaped by three events next week. ECB President Draghi’s testimony before the European Parliament to kick-off the week. Fed Chairman Powell speaks to the NY Economic Club in the middle of the week. Presidents Trump and Xi are to meet at the G20 meeting to end the week in hopes of dialing back the escalating trade conflict. Also at the G20 summit, the NAFTA2.0 is expected to be signed, and the steel and aluminum tariffs on Canada and Mexico may be modified (turned into quotas?) shortly.

Draghi speaks a couple of weeks before the next ECB meeting. Market participants may be sensitive to two topics. First is the state of the eurozone economy. The German unexpectedly contracted in Q3, and the flash PMIs suggest weakness has continued Q4. The forward-looking orders data continues to flag weakness that goes beyond the auto sector.

The ECB always has conditioned the end of its asset purchases to the incoming data, but it has been widely understood for the conditionality was for decorum purposes and in fact, the bar to extending net asset purchases into next year was high. Draghi has pinned his optimism to the labor market. This has not changed. At the same time, Draghi recognizes the economy still needs an extraordinary monetary policy, and he can tell the European Parliament that policy will remain easy after the asset purchases are complete. Refi operations are fully allocated at a fixed rate (zero), there are liberal collateral rules, the deposit rate remains at minus 40 bp.

The ECB also emphasizes its forward guidance. The ECB’s pre-commitment not to raise rates until after next summer has been an important stabilizing factor. However, the market’s reaction function is quicker still. Since the start of the month, the implied odds that the ECB will not raise rates until after Draghi steps down next Oct has doubled to over 50% now. The implied yield on the December 2019 Euribor futures contract has fallen by about 15 bp since a fortnight before the October ECB meeting.

In addition to comments on the economy and monetary policy, investors will pay attention to what Draghi, Italy’s former central bank governor says about his country. Draghi is unlikely to demur from the EC’s recommendation to initiate excess deficit procedures against Italy after it refused to substantially alter its budget proposals. It warned that Italy was “sleepwalking into instability.” However, the EU moves slowly, and many observers think investors will investors will exert pressures on Italy. The poor reception to the recent bonds sales would seem to bear this out.

However, contrary to expectations, Italian bonds rallied strongly last week. The 10-year yield fell from a high above 3.70% on November 20 to 3.35% ahead of the weekend before settling at almost 3.41%, the lowest close in two weeks. Consider the move at the short-end. The two-year yield peaked near 151 bp on November 20 and fell to almost 82 bp before finishing the week a little more than 95 bp. Italy is back in the market next week with a range of issues, from six-month bills, and 1-year bonds, five-year inflation-linker, and five and 10-year bonds.

Also, we suspect investors will become more sensitive to the tensions within the Italian coalition government. The League and the Five-Star Movement are not natural allies and entered into a marriage of convenience. Salvini, the junior coalition partner, outshines less experienced Di Maio and his support has been rising in the polls. Strains are inevitable, and it is too early to think about the next government. However, if the League’s support continues to rise, Salvini may be tempted to precipitate a break after the European Parliamentary elections next May.

II

The market has never accepted the FOMC’s indication that three rate hikes are likely to be appropriate in 2019, but recently it has retreated from even pricing in more than one hike. According to the CME’s model, there is a little more than a 30% chance that the Fed is either done or within one hike of being done with its tightening cycle. There is a 36% chance that fed funds target is at 2.50%-2.75%. At the end of next year, up from the current target of 2.00%-2.25%. Between these two scenarios, there is a 2/3 chance. The CME’s model shows a 23% chance of a 2.75-%-3.0% funds target, and less than a 9% chance it would be higher.

United StatesThe implied yield December 2019 fed funds futures contract fell by nearly 25 bp since November 8 to hit 2.70%, the lowest in two months. Similarly, the December 2019 Eurodollar futures contract rallied after its third attempt to push through 96.70 failed. The implied yield fell about 27 bp since the November 8 low. Some observers attribute the US stock market slide to Chairman Powell’s comment in early October that there was still some way to go to reach a neutral setting. However, given the relative performance of the various sectors, a more compelling case would link the fall in equities to other factors, like the drop in oil prices, the MSCI/S&P rejig of telecom and communications, concern about peak earnings, regulatory changes, and the trade tensions. In past business cycles, the real fed funds rate, when adjusted for headline CPI, has often had to move into negative territory to facilitate recovery. Now, nine years into the recovery and expansion, and the fed funds target is below the 2.5% CPI. How can monetary policy be considered tight when the policy rate is negative in real term, unemployment is near its lowest level in half a century, and the economy has expanded by an average annualized rate of more than 3.8% over the past two quarters? |

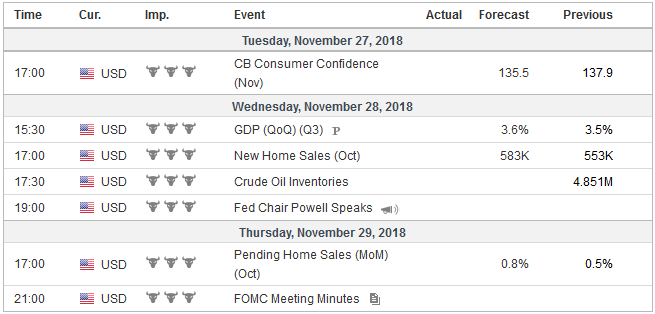

Economic Events: United States, Week November 26 |

Switzerland |

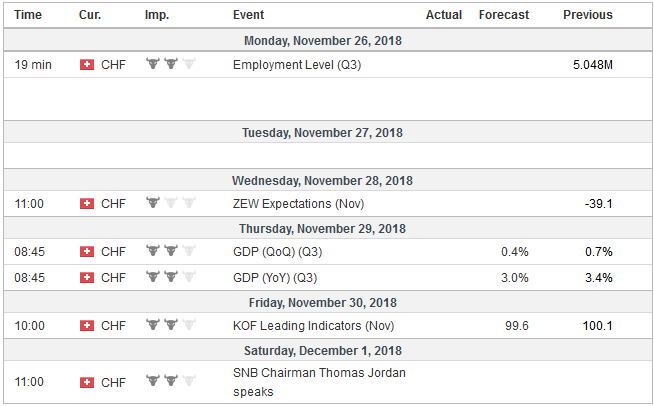

Economic Events: Switzerland, Week November 26 |

Observers add to the difficulty for investors to separate the noise from the signal by treating all Fed speakers equally. None of the regional presidents, except the head of the NY Fed get to vote every year. Some simply express views that are outliers and do not represent the majority of the Fed. Kashkari and Bostic have opposed nearly every hike in the cycle, so when they now say the Fed should pause, investors can discount it. The Fed officials that will consistently be on message are Powell the Chair, Clarida, the Vice-Chair of the Federal Reserve Board, and Williams, the New York Fed President and Vice-Chair of the FOMC.

All three speak next week. They will not deviate from the message that they have been delivering. The monetary cycle is not over, and additional gradual hikes will be delivered. The Fed’s risk assessment is balanced. In recent speeches, some of the potential headwinds have been specified. These include slowing world growth, the cumulative effect of past hikes, and fading fiscal stimulus. Some observers suggest that the sell-off in stocks can give the Fed cover to pause, but this is to mistake the Fed’s intentions. The Fed is not looking for cover or excuses not to hike rates. It wants to raise rates because it has achieved its mandate. For all practical purposes, full employment is at hand, and the inflation target has been reached.

Some observers suggest the dramatic drop in oil prices will keep inflation in check and this is another reason the Fed does not need to raise rates. This is mistaken. The Fed targets core inflation, which excludes food and energy. This is because the Fed has found that over time headline inflation converges to the core rather than the other way around. Another way to say this is the core rate is the signal while headline inflation is noisy. Remember in July 2008 ECB hiked interest rates because of the thought-to-be inflationary implications of rising oil price, a policy blunder of epic proportions or so it seemed as the eurozone economy had already begun contracting before the collapse of Lehman a couple of months later.

Modern central bankers take financial conditions into account when setting monetary policy. The performance of equities is part of the financial conditions. However, that does not mean that every technical correction (10% decline) or bear market (20% decline) requires a policy response. Many Fed officials understood that the stock market was rich compared with historical measures of valuation. The narrowness of the advance seemed to conceal the weakness below, such as the number companies trading below the 100 or 200-day moving averages. At some level of decline in some time frame would likely elicit a response from the Fed but that level is probably well below what we have seen so far.

III

The much anticipated G20 meeting takes place November 30-December 1. Trump-Xi meeting is the main focus as the meeting has been long seen as the last chance to ease the trade tension. The well was poisoned by Vice President Pence’s speech at APEC and Lighthizer’s report last week claiming that even in the run-up to APEC, China is continuing to steal intellectual property.

Trump and Xi may agree to some framework for talks. Recent administrations had some framework for trade and economic discussions, which Trump eschewed. However, in and of themselves, they mean little to investors. The most pressing issue is whether Trump makes good his threat of slap a 10% tariff on the remain in roughly $265 bln of goods that it has not enacted a new levy, and will Trump go forward with plans to hike the 10% tariff to 25% on $200 bln of Chinese goods.

One argument against intervention in the foreign exchange market is that it would undermine the effort to persuade China that exchange rates are best set in the market. Similar, the US pushing into uncharted waters of national security to justify its protectionism undermines arguments that China is somehow unique in gaming the rules for its advantage. And to be sure, it is not just Trump. Consider Obama’s tire tariffs and Bush’s steel tariffs.

It seems quite clear that the US views China as more than a trade problem. Senior US officials have pressed their case in recent speeches that China. The projection of China’s power is a threat to the US, and its vision is antithetical to US values. This is radically different than how the US views its other economic competitors like Canada, Mexico the UK, Germany, and Japan. Bill Kristol, a neo-conservative and editor of the Weekly Standard, mused in the social media whether regime change should be the US objective in China.

At the G20 meeting, the US, Canada, and Mexico are expected to sign what Canada and Mexico call the new NAFTA agreement. In that agreement, which US officials, have suggested will be the template for future deals is a clause that essentially says that in exchange for special access to the US markets, countries have to agree not to enter free-trade deals with non-market economies (which is a euphemism for China). The US is laying the groundwork a new world order.

US rhetoric and actions strengthen the camp in China that favor reducing its trade ties with the US. Some Americans have suggested there is a basis for a trade agreement such as soy and LNG for rare earths. While there is a logic to it, China does not experience the US to be a reliable trade partner. China may be better served by securing alternative sources for inputs and markets for its goods.

Many, including Trump, argue that the fact that China has a large trade surplus with the US means that it (China) will be more impacted by the trade tensions. This lends itself to minimize the potential disruption to American consumers. The disparity of wealth in America means that many households depend on cheap consumer goods. America seems ill-prepared for an import-substitution strategy. Despite the corporate tax cuts, capital investment in the US has been weaker than the Trump Administration projected. The retaliatory tariffs also discourage expanding onshore capacity.

Full story here Are you the author? Previous post See more for Next postTags: China,ECB,Federal Reserve,newsletter