A Piece of Paper Alone Cannot Secure LibertyThe idea of a constitution and/or written legislation to secure individual rights so beloved by conservatives and among many libertarians has proven to be a myth. The US Constitution and all those that have been written and ratified in its wake throughout the world have done little to protect individual liberties or keep a check on State largesse. |

|

| Instead, in the American case, the Constitution created a powerful central government which eliminated much of the sovereignty and independence that the individual states possessed under the Articles of Confederation.

While the US Constitution contains a “Bill of Rights,” the interpreter of those rights and the protections thereof is the very entity which has enumerated them. It is only natural that decisions on whether, or if such rights have been violated will be in favor of the State. Moreover, nearly every amendment which has come in the wake of the Bill of Rights, has augmented federal power at the expense of the individual states and that of property owners. History has shown the steady erosion of individual rights and the creation of “new rights” and entitlements (education, health care, employment, etc.) which have occurred under constitutional rule. Instead of being a limitation on government power, constitutions have given cover for a vast expansion of taxation, regulation, debt, and money creation. |

As Murray Rothbard notes in Anatomy of the State: “All Americans are familiar with the process by which the construction of limits in the Constitution has been inexorably broadened over the last century. But few have been as keen as Professor Charles Black to see that the State has, in the process, largely transformed judicial review itself from a limiting device to yet another instrument for furnishing ideological legitimacy to the government’s actions. For if a judicial decree of “unconstitutional” is a mighty check to government power, an implicit or explicit verdict of “constitutional” is a mighty weapon for fostering public acceptance of ever-greater government power.” Rothbard quotes Professor Black in several footnotes; one of them states: “Where the questions concern governmental power in a sovereign nation, it is not possible to select an umpire who is outside government. Every national government, so long as it is a government, must have the final say on its own power.” [PT] |

Elimination of the Gold Standard as a Check on Government PowerWhile taxation has always been a facet of constitutional governments, it has been the advent of central banking and with it the elimination of the gold standard which has provided the means for the state to become such an omnipresent force in everyday life. Irredeemable fiat paper money issued by central banks has also led to the entrenchment of political parties which has allowed these elites to create and subsidize dependency groups which, in turn, repeatedly vote to keep the political class in office. Without the ability to create money and credit, the many bureaucracies, regulations, and laws could neither be created or enforced. This would mean that the vast and powerful security and surveillance agencies could not exist or would be far less intrusive than they currently are. With commodity money, debt creation would have to be repaid in gold, not monetized as it is currently done through the issuance of paper currency. Just as important, it would have been next to impossible for the two world wars to have been fought and carried to their unimaginable destructive ends. None of the populations involved would have put up with the level of taxation necessary to wage such costly undertakings. Few of the wars which followed (most of which have been instigated by the US) could have taken place without central banking. Nor could the level of “defense” spending – currently at a whopping $717 billion for fiscal year 2018 – be financed if the US was on a commodity standard.* |

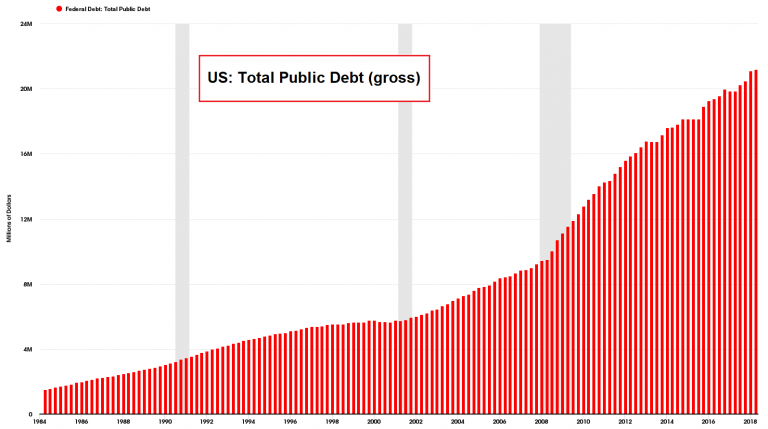

Total US federal debt streaks above USD 21 trillion. |

| Under a gold standard, governments would have to rely on taxation alone. Since citizens directly feel the effects of taxation, there is a “natural level” that it can be raised. Punitive tax rates usually lead to a backlash and potential social insurrection which strike fear in the hearts of political elites.

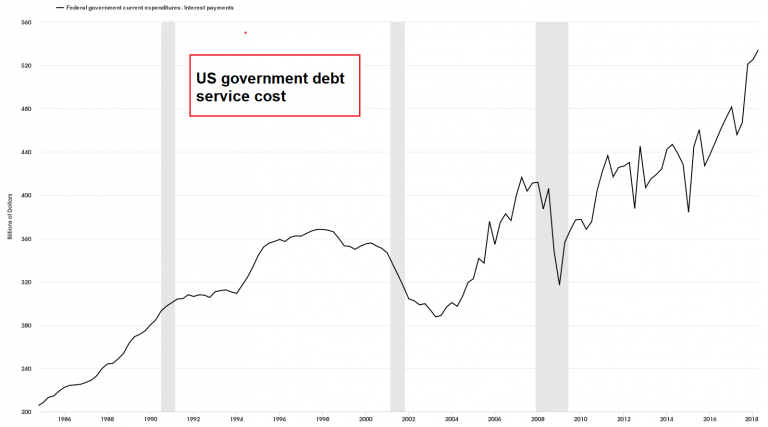

Recent projections by the Congressional Budget Office again demonstrate that constitutional government provides little restraint on spending. If present trends continue, the federal government will spend more on its interest serving its debt than it spends on the military, Medicare, or children’s programs. It is also expected that next year’s interest on the debt will be some $390 billion, up an astonishing 50 percent from 2017.** And, for the entire fiscal year of 2018, the gross national debt surged by $1.271 trillion, to a mind-boggling $21.52 trillion.*** At one time, economists used to speak of the pernicious effects that “crowding out” had on the economy. Since the onset of the “bubble era,” talk about deficits has almost dropped out of financial discussions. Yet, the reality remains the same: public spending and borrowing divert scarce resources away from private capital markets to unproductive wasteful government projects and endeavors. |

US government debt 1986-2018 |

Conclusion: Sound Money is the Solution

For those who seek a reduction in State power, defense of individual rights, and economic prosperity, the re-establishment of a monetary order based on the precious metals is the most efficacious path to take. Such a social system would not require elaborate legislation or fancy proclamations of man’s inalienable rights, but simply a return to honest money – gold!

References:

*Amanda Macias, “Trump Gives $717 Billion Defense Bill a Green Light. Here’s What the Pentagon is Poised to Get.” CNBC.com 14 August 2018.

**Nelson D. Schwartz, “As Debt Rises, the Government Will Soon Spend More on Interest Than on the Military.” The New York Times. 25 September 2018

***Tyler Durden, “US Gross National Debt Soars $1.27 Trillion in Fiscal 2018, Hits $21.5 Trillion.” Zero Hedge. 2 October 2018.

Charts by St. Louis Fed

Chart and image captions by PT

Full story here Are you the author? Previous post See more for Next post

Tags: central-banks,newsletter,Precious Metals