Equities

Global equities have sold off hard. The magnitude of the recent loss is similar to what happened earlier this year. The MSCI World Index of developed countries fell 10.5% in January-February carnage and are now off about 11% this month. The MSCI Emerging Markets Index has matched the 11% loss back at the start of the year, but never truly recovering in between. The Dow Jones Stoxx 600 fell around 9% initially but did not bottom until the following month, by which time it was off closer to 10.4% from the peak. This leg down has seen it shed roughly 9.8%. The S&P 500 fell about 11.8% in January-February’s downdraft and has slid 10.8% now.

Most narratives seem to attribute the sell-off to the fear of a policy mistake from the Federal Reserve in raising rates too much (Trump) or suggesting it will go beyond what investors think reasonable, though some like the Fed’s own Kashkari (Minneapolis Fed President) opposed the rate hikes in the first place. Recently he penned an op-ed piece in the Wall Street Journal putting forth his argument that the Fed should pause but appears not to have persuaded his colleagues. Some see the backing up of long-term rates, which is also influenced by the increase in supply, and the deterioration in the US fiscal condition, as more significant than the rise in fed funds rate, which has been well telegraphed. Others fear a peak in earnings, which is often tied with the coming end of the economic expansion.

We suspect the S&P 500 will bottom before these macro considerations change. Our read of the technical condition warns that while indicators are stretched, there is nothing to indicate a low is in place. A reversal pattern or at least a close above the previous day’s high is needed to begin pointing to a bottom.

United Kingdom

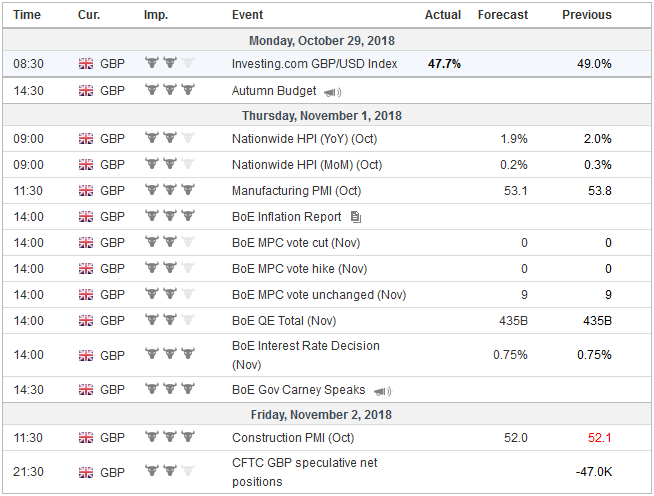

|

Economic Events: United Kingdom, Week October 29 |

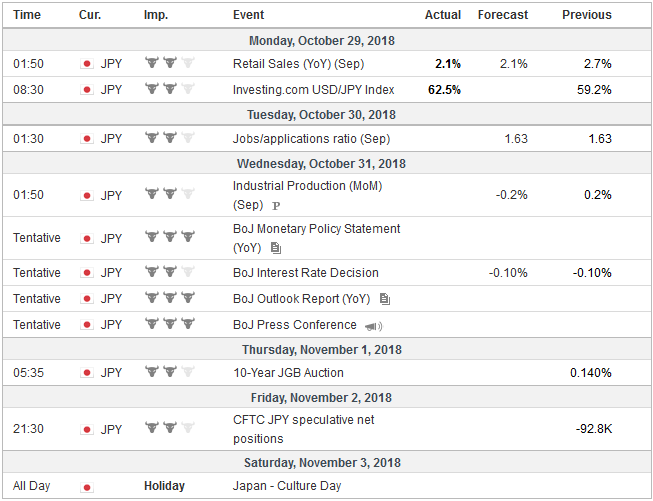

JapanThe Bank of Japan cannot be too dissatisfied with the direction of the macroeconomic readings, though the situation, especially prices, is evolving frustratingly slow. The economy appears to have lost some momentum at the end of Q3 but may be picking up again here in October. The unexpected weakness in September exports reported last week, was the first contraction in two years. Even though Japan’s exports are modest in proportion of GDP, is around the same for the US in the mid-teens), foreign demand helps drive some key manufacturing sectors and gives Japan the economies of scale that its shrinking population may no longer support. |

Economic Events: Japan, Week October 29 |

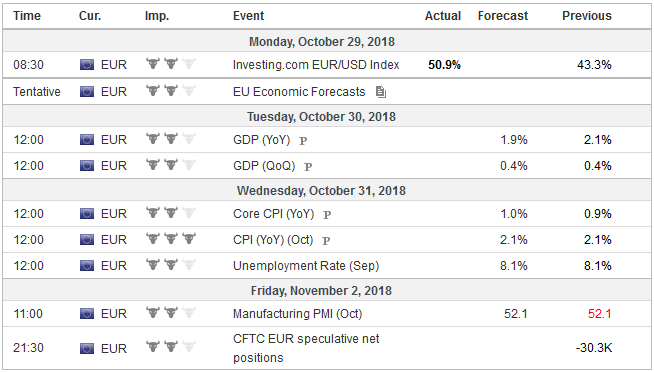

EurozoneEconomists expect that the eurozone economy slowed in Q3, but the risk is on the downside. Recall that after peaking at a 0.8% quarterly pace in Q4 16, the growth was steady last year at a heady 0.7% a quarter. In the first half growth moderated to 0.4%. Economists mostly project a 0.3% expansion, but they have consistently forecast stronger data than has actually been delivered. It offers a stark contrast with the US GDP that was reported at the end of last week. Growth was stronger than expected at 3.5% annualized, after a heady 4.2% pace in Q2. Peak divergence still lies ahead, both on interest rates and relative size of the central bank’s balance sheet. The flash October eurozone PMI gives little hope that the slowdown in Europe has ended. However, with the ECB’s forward guidance assuring investors that there will not be a rate increase until at least Q3 19, the loss of economic momentum is not too pressing, as Draghi seemed to recognize. The ECB President has put much weight on the labor market, and the pace of improvement is moderating as one would expect. The September reading will be published next week, and the unemployment rate and likely remained at the cyclical low of 8.1%. |

Economic Events: Eurozone, Week October 29 |

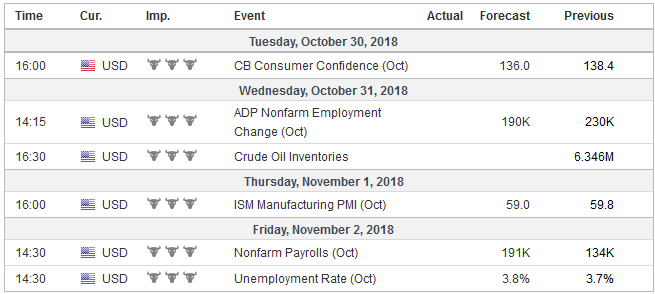

United States

|

Economic Events: United States, Week October 29 |

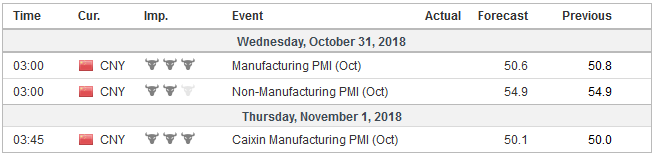

ChinaChina reports the October PMIs and Caixin publishes its manufacturing figures in the week ahead. Any weakness, however, will likely be shrugged off. It has been superseded by new policy initiatives and in particular tax cuts. A former Chinese central bank official was quoted in the press estimating that the tax cuts and other measures could be worth 1% of GDP. Tax cuts, which appear to include a change in the brackets, alone could be worth around 0.5% of GDP. Тhis is a more promising path than the traditional easy money, local government spending, and debt stimulus. One consequence of the trade tension with the US may not be a change in China’s external behavior as internal. It is commonplace for many Americans to bemoan how China refuses to make adjustments. Yet in two big ways adjustments have made that will likely be reinforced by the US tariffs. First, the current account surplus has been more than halved and was in deficit in the H1 18. Even if China ran a current account deficit, which is a reasonable projection in the coming years, it would be unlikely to appease many critics. The second adjustment is the increased importance of domestic consumption. It appears to have accounted for around 80% of Chinese growth up from less than 50% at the start of the decade. This is more than most high-income countries, including the US. By recognizing partial successes instead of damning the failure, American negotiators may achieve greater progress and investors may recognize new opportunities. Foreign production in China will increasingly be for domestic consumption, which is a trend already appears in place. |

Economic Events: China, Week October 29 |

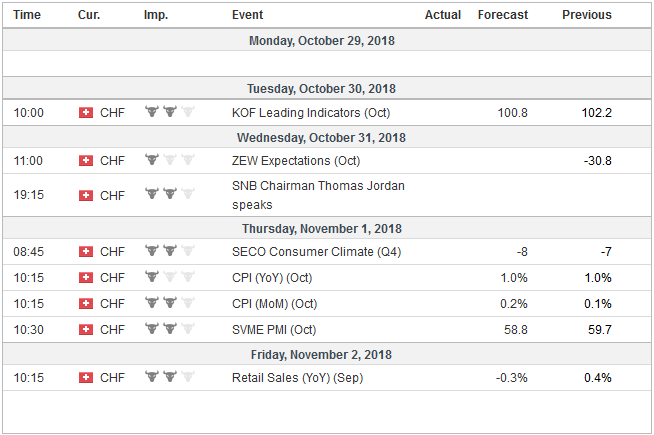

Switzerland |

Economic Events: Switzerland, Week October 29 |

European Politics

Neither the economy, the setting of monetary policy, nor the euro’s exchange rate is particularly problematic at the momentum. The biggest immediate threat is not from trade either. The most urgent risks come from politics.

Brexit without an agreement would be disruptive for parts of EMU, even if more disruptive for the UK. This is underscored by the WTO informing the UK that many countries, including the US and China, objected to its plan to simply copy and paste EU’s international trade commitment as its own. The UK will need to negotiate its own schedule. Trump may have encouraged the UK to leave the EU, but he is not prepared to make it easy.

Italy and the EC’s talks have begun, and there does seem to be an attempt on the part of European officials to avoid language that could be inflammatory. Still, the political drama will take weeks and months to play out, and any sanctions cannot be imposed until next year when the elections will change the composition of the EC itself. However, investors are more impatient but seem satisfied at the moment with the rise in yields in the first half of the month. The generic 10-year yield has risen 30 bp this month but has consolidated over the past two weeks and ahead of the weekend, closed at its lowest level since October 5.

S&P kept its BBB rating for Italy unchanged, where it had lifted it a year ago. However, it did change the outlook to negative from stable. Private sector investors typically do not like mixed ratings (investment grade and non-), so even if one of the main agencies took away Italy’s investment-grade status, which is not imminent, it would impact portfolio managers. However, for ECB purposes, as long as one of the top four agencies recognize Italy as an investment grade credit, it is good enough for it.

Investors are ill-prepared for low probability but high impact event in Germany. The weekend election in the state of Hesse is a local event to be sure. The CDU and Greens currently govern in a coalition. The CDU is set to lose more voters than the Greens gain, forcing them to invite another party, probably the Free Democrats, into the coalition. However, the risk comes from the SPD. Recall in the election in Bavaria earlier this month it garnered less than 10% of the vote. Another drubbing like that would likely embolden the left-wing of the party that wants to quit the national coalition. No one is thinking or prepared for a collapse of the German government, and the risk may be greater than it seems.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$CNY,$EUR,$JPY,newsletter,SPX