| The latest headline Swiss GDP figures were impressive. According to the State Secretariat for Economic Affairs’ (SECO) quarterly estimates, Swiss real GDP grew by 0.7% q-o-q in Q2 (2.9% q-o-q annualised, 3.4% y-o-y), slightly above our 0.6% projection and consensus (0.5% q-o-q). This was the fifth consecutive quarter with an above average rate. Q1 GDP growth was significantly revised up to 1.0% q-o-q (from 0.6%). Thus, average growth in the first half of 2018 was the strongest since 2010.

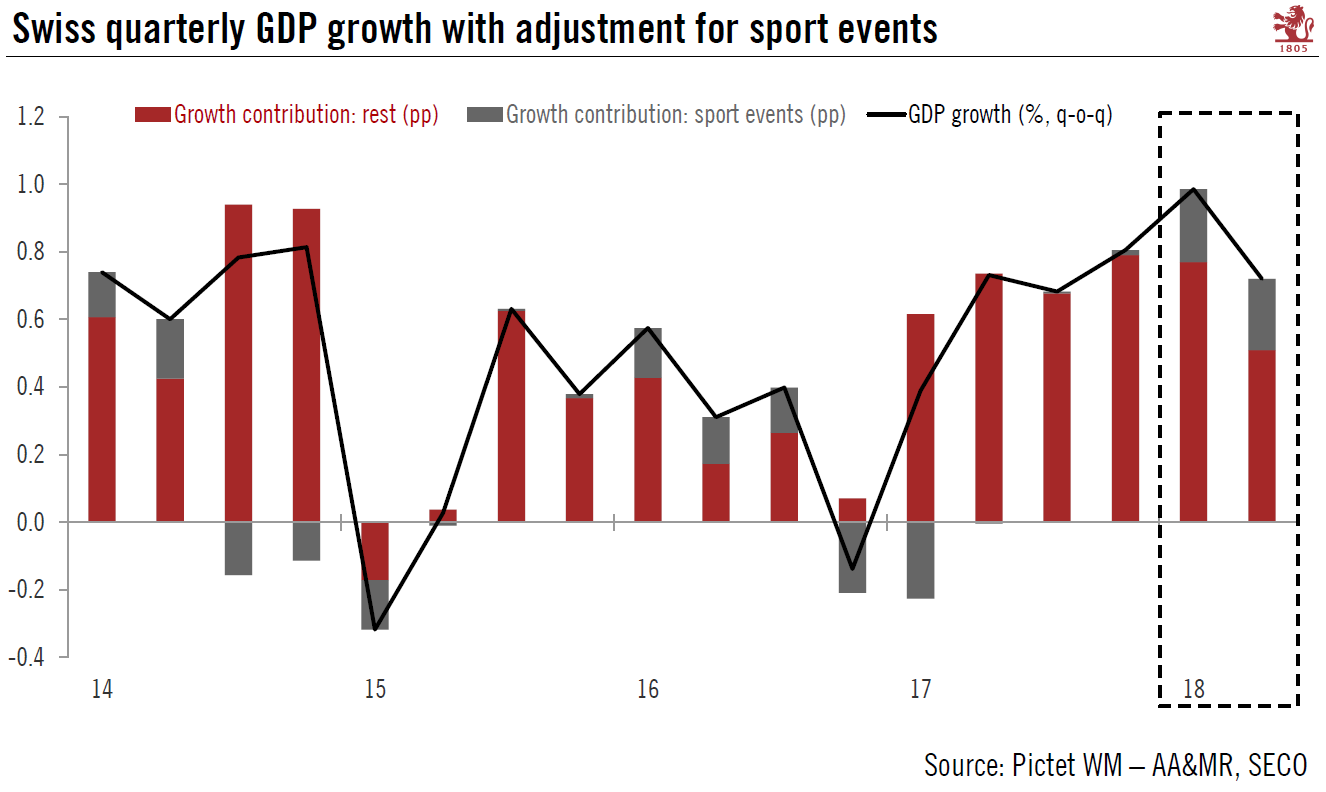

Nevertheless, the devil is in the details. First, GDP was again boosted by special factors, namely sports events, which added 0.2 percentage points (pp) to quarterly growth in both Q1 and Q2 (see Chart 1). Second, domestic demand, in particular private consumption, and imports were on the weak side in Q2. On the positive, global trade tensions have had hardly any impact. Of note, SECO’s report showed significant revision of past data.In particular, 2017 annual GDP growth was revised up from 1.1% to 1.7%. Looking ahead, our scenario remains unchanged. We expect the Swiss economy to grow at a solid albeit slower pace in H2 2018, as the effect of some factors is likely to fade. Moreover, the recent strengthening of the franc, somewhat weaker euro area growth and uncertainty regarding global trade suggest slower growth momentum ahead. Nevertheless , given the significant upward revisions in Q1 and 2017 data, our GDP growth forecast is mechanically pushed up to 2.9% in 2018 (from 2.0% previously). |

Swiss quarterly GDP growth with adjustment for sport events 2014-2018 |

Disappointing domestic demand

The breakdown by expenditure components should be taken with a pinch of salt, as they are particularly volatile in Switzerland. Nevertheless, several observations can be made. First, domestic demand ran somewhat out of steam in Q2. Private consumption growth slowed down (from +0.3% to 0.4% q-o-q), hindered in particular by low energy consumption. Investment in equipment contracted (-0.3%) after multiple quarters of above-average growth. By contrast, investment in construction accelerated (0.8% q-o-q from 0.2% in Q1). Turning to trade, exports (+2.2% q-o-q) enjoyed a robust growth, while imports contracted (-1.1% q-o-q).

On the production side of GDP, manufacturing sectors provided the most substantial boost to growth in Q2 (+1.5% q-o-q), underpinned by global demand and favourable exchange rate movements compared to recent years. The entertainment sector (+10.1% q-o-q, after +10.8% q-o-q in Q1) again provided a sharp boost to growth, due to the impact of sports events (winter Olympics and the World Cup) in this aggregate. Sport events added 0.2pp to quarterly growth in both Q1 and Q2 (see Chart 1).

Swiss national accounts particularities

In Switzerland, two institutions are responsible for national accounts calculation: the Federal Statistical Office (FSO), which is responsible for the annual results, and SECO, which produces the quarterly national accounts.

Every summer, the FSO publish es its first results for the previous year and the revised results for the two years prior to that. It also revises the historical time series of other key economic statistics. When the SECO publishes data for Q2 GDP growth (generally in September ), it incorporates the annual results of the FSO into its own calculations and thus ensures consistency between annual and quarterly figures. This is why every September; quarterly Swiss GDP figures published by the SECO might face significant revisions.

This year, the revisions were mainly due to employment and industrial turnover statistics, which impacted manufacturing and investment in construction aggregates (see SECO’s press release for further info, link here). Consequently, GDP growth figures for 2015 (to 1.3% from 1.2%), 2016 (to 1.6% from 1.4%) and 2017 (to 1.7% from 1.1%) were revised up.

H2 2018 GDP growth likely to be softerLooking ahead, our scenario remains unchanged. We expect the Swiss economy to grow at a robust, although slower pace in H2 2018 as the effect of some factors (namely sports events), is likely to fade. Indeed, the experience of prior years with major sports events (such as in 2014 where a World Cup and winter Olympics took place) suggests that growth will be much weaker in Q3 and Q4 (see Chart 1). Moreover, the recent strengthening of the franc, somewhat weaker euro area growth and uncertainty regarding global trade tensions suggest slower growth momentum ahead. Nonetheless, given the significant upward revisions in Q1 and 2017 data, our GDP growth forecast is mechanically pushed up to 2.9% in 2018 (from 2.0% previously). If our projections regarding GDP growth materialise for 2018, Switzerland will grow at a faster pace than the euro area for the first time since 2014. |

Swiss versus euro area real GDP growth (+2018 forecasts) |

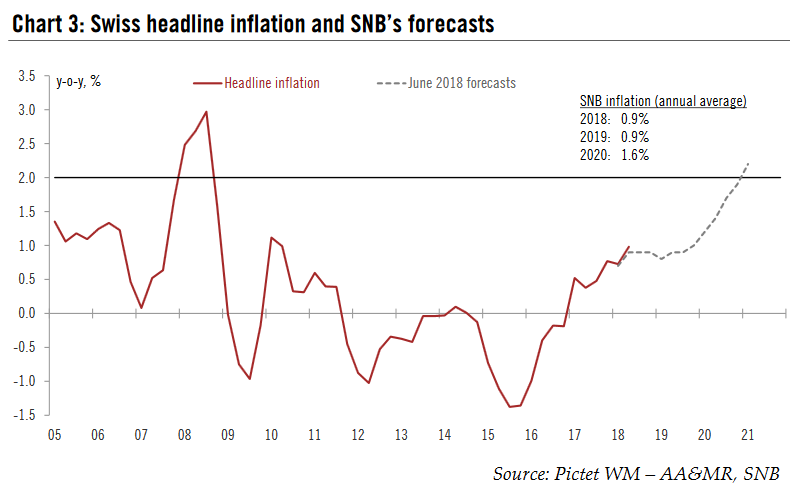

No change in SNB’s stanceAverage headline inflation in Q2 was 0.1pp above the Swiss National Bank (SNB) June projections. In addition, inflation pick-up in July and August (1.2% y-o-y) suggests that the Q3 average is also likely to be above the SNB’s Q3 forecast of 0.9%. This could push the SNB to marginally revise up its 2018 CPI forecast at its next meeting in September 20. Nevertheless, despite a strong economy and a pick-up in inflation, the SNB is unlikely shift its stance, even more so given appreciation of the Swiss franc in recent months and domestically generated inflation remaining subdued. As a result, we expect the SNB to maintain its accommodative monetary policy and we foresee the first SNB policy rate hike (+25 bp increase) in September 2019, after the first ECB depo rate hike the same month. |

Swiss headline inflation and SNB’s forecasts |

Tags: Macroview,manufacturing,newsletter,Swiss National Bank