Incrementum Advisory Board Discussion Q3 2018 with Special Guest Kevin Duffy

“From a marketing perspective it pays to be overconfident, especially in the short term. The higher your conviction the easier it will be to market your investment ideas. I think the Austrian School is at a disadvantage here because it’s more difficult to be confident about your qualitative predictions and even in terms of investment advice it is particularly difficult to be confident in these times because we don’t really have any historical precedents we can analyze and draw conclusions from.

Rahim Taghizadegan

As always, the discussion at the Incrementum Q3 Advisory Board meeting covered a wide range of subjects, with a special focus on the disadvantages and advantages of an Austrian School approach to investing. We were joined by special guest Kevin Duffy of Bearing Asset Management, who shared his insights on the current market environment, as well as telling us about the investment process he has adopted in many years of experience as an investment professional who has lived through several full-scale boom-bust cycles.

Long term member Rahim Taghizadegan returned as well, and inter alia provided us with the quote cited above, which neatly summarizes one of the difficulties one faces as an “Austrian” in today’s markets (as an aside, we believe Rahim is one of the philosophical and intellectual leaders of the Austrian School in the land of its birth, and we are always delighted to hear what he has to say).

|

Kevin Duffy, co-founder of Bearing Asset Management was the special guest at the Q3 Incrementum Advisory Board discussion. - Click to enlarge |

| The lack of a historical precedent directly comparable to the post-GFC era makes it forecasts particularly difficult. Furthermore, monetary pumping on a grand scale naturally engenders caution, as it is inescapable that it creates distortions in relative prices and consequently leads to malinvestment of scarce capital. We believe that the biggest problem for those trying to predict a turning point is most likely that the lead-lag effects associated with monetary trends are even more drawn-out than they were prior to the GFC – but this is just guesswork at this point. |

SPX, Monthly S&P 500 Index, monthly: the “everything” bubble triggered by “unconventional” monetary policy on the part of the world’s largest central banks towers impressively over anything the world has seen before; obviously this applies not only to the relentless increase in nominal prices. - Click to enlarge |

Ivestment and speculation are mainly thymological quests – below are three brief excerpts from Human Action by Ludwig von Mises pertinent to this:

“The distinctive reasoning of the speculator is an understanding of the relevance of the various factors determining future events. And […] action necessarily always aims at future and therefore uncertain conditions and thus is always speculation. Acting man looks, as it were, with the eyes of a historian into the future.”

Elsewhere he notes:

“Those facts which can be established in an unquestionable way on the ground of the source material available must be established as the preliminary work of the historian. This is not a field for understanding. It is a task to be accomplished by the employment of the tools provided by all non-historical sciences.”

And lastly:

“In order to see his way in the unknown and uncertain future man has within his reach only two aids: experience of past events and his faculty of understanding. Knowledge about past prices is a part of this experience and at the same time the starting point of understanding the future.”

Ludwig von Mises, the dean of the Austrian School: all future-oriented action is essentially speculation and from a methodological perspective requires the application of the same techniques historians employ.

In these brief quotes Mises mentions all the tools which a speculator , whether he is an entrepreneur or an investor in financial markets – or putting it differently, a “historian of the future” – needs to perform his task:

Understanding – assigning the correct relevance to various data, this is to say the process of determining the unique and individual features of each investment case. This is a subjective procedure that cannot really be taught – it is a talent that some people have and others lack.

Conception – scientific knowledge, or in other words those features that are universally valid and apply to every case, which serve as a constraint to forecasts (in this case the laws of economics).

Statistics, or the data of past (particularly the history of prices), which serve as the starting point for the procedure of understanding. As Mises notes (see below), the very nature of this procedure implies that not everybody can be a successful entrepreneur or speculator.

Understanding in this sense cannot be systematized, rather it is based on a mixture of talent and experience (much of the “knowledge” it involves is likely tacit and cannot even be fully articulated by those who have it). Moreover, Mises writes that those most likely to succeed will usually hold opinions about the future that deviate from those “held by the crowd” – in other words, it is to be expected that contrarian and/or unconventional thinking are most likely to lead to success:

“Th[e] specific anticipative understanding of the conditions of the uncertain future defies any rules and systematization. It can be neither taught nor learned. If it were different, everybody could embark upon entrepreneurship with the same prospect of success. What distinguishes the successful entrepreneur and promoter from other people is precisely the fact that he does not let himself be guided by what was and is, but arranges his affairs on the ground of his opinion about the future. He sees the past and the present as other people do; but he judges the future in a different way. In his actions he is directed by an opinion about the future which deviates from that held by the crowd.”

The talent required for successful understanding of the factors influencing the future state of the market varies from individual to individual and is at least partly an inherited trait, but it is certainly the case that most “Austrians” are contrarians. With respect to conceptual knowledge, we would argue that Austrian praxeological theory provides the best and most useful forecasting constraints.

| In the discussion Kevin Duffy mentioned a potential pitfall of this approach in view of today’s “policy-driven” markets: it is often easy to overlook that the unceasing progress of the market economy continues despite the machinations and interventions of central banks and other regulatory agencies. As an example he inter alia cited the dramatic decline in bandwidth prices as a proxy for the enormous increase in productivity in recent decades – which of course applies to information technology generally, as well as the industries which were able to introduce much improved production methods by making use of such technology.

Mises incidentally also warned of what we might term a tendency toward adopting overly bearish views. He remarked that although the boom-bust cycle will produce “impoverishment”, this term should not be misunderstood as an assertion that the situation after the bust phase of a business cycle will be worse than that prevailing on the eve of the preceding boom; rather, it will be less satisfactory than it could have been had no expansion of money and credit ex nihilo occurred. |

Prices of IT equipment since the late 1950s Prices of IT equipment since the late 1950s. Official price indexes attempt to incorporate improvements in quality, which is not an entirely objective process. Nevertheless, it is certainly fair to say that enormous productivity increases have occurred, which charts such as this one reflect. - Click to enlarge |

|

Another point made by Kevin which we want to briefly highlight concerns a subject we have frequently mentioned in these pages as well: namely the expectation that the end of the Bernankean echo bubble will likely be different from the end of previous bubbles in certain respects. In other words, one should be very careful not to rely on the notion that specific events have to be replicated or have to occur in a similar sequence as previously.

Whatever mixture of early warning signals will eventually be identified (by most observers in hindsight) will be unexpected in some ways. Some of the signals we “always” used to get will be absent, others may be more pronounced or display different lead times than they have in the past. This just as a reminder that while there are probabilities, there are no sine qua non preconditions, expect those necessitated by economic laws.

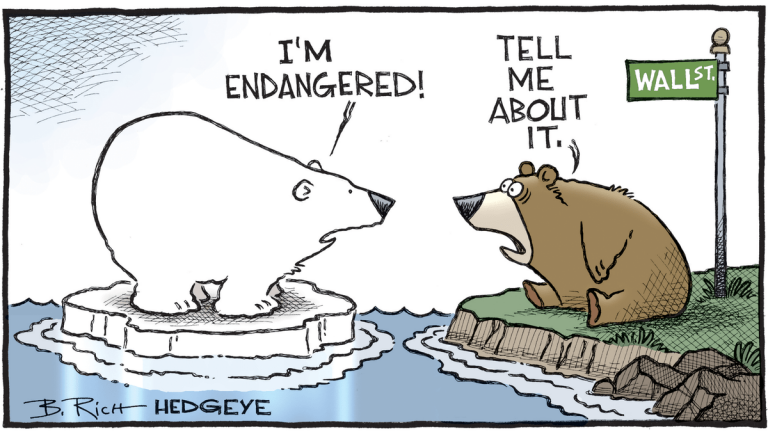

|

Endangered species meeting |

Download Link: An Inquiry into Austrian Investing: Profits, Protection and Pitfalls – Incrementum Advisory Board Discussion, Q3 2018 (PDF)

Charts by: StockCharts, St. Louis Fed

Full story here

Are you the author?

Pater Tenebrarum is an independent analyst and economist/social theorist. He has been involved with financial markets in various capacities for 39 years and currently writes economic and market analyses for independent research organizations and a European hedge fund consultancy as well as being the main author of the acting-man blog.

Previous post

See more for 6b.) Acting Man

Next post

Tags:

newslettersent,

On Economy,

On Politics