Why is SHIBOR falling from an economic perspective? Simple again. China’s growth both on its own and as a reflection of actual global growth has stalled. And in a dynamic, non-linear world stalled equals trouble.

Going all the way back to early 2017, there’s been no acceleration (and more than a little deceleration). The reflation economy got started in 2016 but it never went anywhere. For most of last year, optimists were sure that it was just the first step toward recovery. The longer it goes without the more everyone realizes this is no different than 2014, or 2011, or 2007. There may not yet be fire but once more there is a whole lot of smoke.

| Chinese customs officials reported today that exports from China were up 12.2% year-over-year in July 2018. That is weirdly the fourth straight month of almost exactly the same growth rate (12.9%, 12.6%, and 11.3% April, May, and June, respectively). It sounds impressive but these are not good results. Four straight months of about 10% is about one-third of what a healthy Chinese economy would require especially after two years of extended contraction. |

China Exports, Jan 2008 - Jul 2018(see more posts on China Exports, ) |

| Instead, exports fell for that long and rather than accelerating to recovery have remained stuck at the same low growth level as before the recession. It’s now a year and a half like this, raising the chances that this is really how it is.

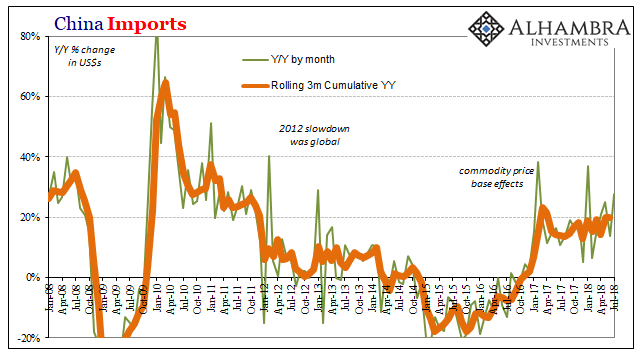

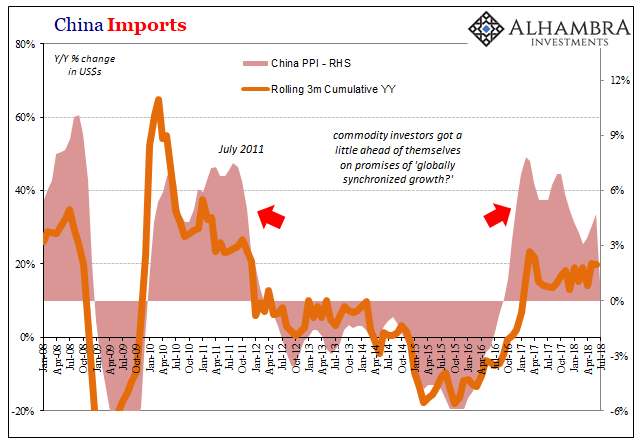

It’s even more prominent on the import side, if harder to believe there. Imports were up an impressive-sounding 27.3% in July, but again that is far short of what would indicate something consistent with the idea of globally synchronized growth. I understand completely how counterintuitive it might seem to classify 27% as “growth” instead of growth. |

China Imports, Jan 2008 - Jul 2018(see more posts on China Imports, ) |

| But here, too, China’s economy has stalled and for a very long time. In non-linear terms, this is the basis for renewed deflation. Commodity investors particularly those making bets in late 2016 were not expecting reflation to get no further than the first few months of 2017. |

China Imports, Jun 2008 - Jul 2018(see more posts on China Imports, ) |

| With monetary and financial indications starting to really slide in the wrong direction again, what has taken place in Chinese money markets of late makes sense. People may be mesmerized by 27% import growth and four months of 12% export gains, but some in China as well as those participating in global markets appear to understand the distinctions. |

China SHIBOR, Jan 2016 - Jul 2018 |

Tags: $CNY,China,China Exports,China Imports,currencies,dollar,economy,EuroDollar,eurodollar system,exports,Federal Reserve/Monetary Policy,global trade,globally synchronized growth,hkd,imports,Markets,newslettersent,PBOC,RMB,shibor