There are three areas that we suspect that many investors are vulnerable to disappointment. NAFTA, trade talks with China, and Powell speech at Jackson Hole on Friday.

With problems elsewhere, the Trump Administration has been playing up the likelihood of an agreement as early as today with Mexico, which would be used, apparently to deliver a fait accompli to Canada. It is not clear what a “handshake agreement” really entails, but the optics suggest someone in a hurry to claim a victory. Several critical issues reportedly have not been addressed, including the sunset clause, which could alone be a deal-buster, government procurement, and a conflict resolution mechanism.

The press an agreement comes from both Mexico and the US. Mexico’s new president (AMLO) takes office on December 1 and would seem to prefer an agreement is struck by the outgoing government. Part of the challenge here is that the new Congress is seated September 1.

The procedural requirement in the US is protracted. The President is required to give a 90-day notice to Congress of his intention to sign the new agreement. Pressure comes from the November midterm election. Historically the party that does not control the White House picks up seats in the midterm elections, and polls confirm the likelihood that this historical pattern remains intact this year.

It seems unlikely that an agreement can be struck by all three parties, even with the threat of auto tariffs hanging over the talks like the Sword of Damocles, in sufficient time to beat AMLO into office and under the existing US Congress.

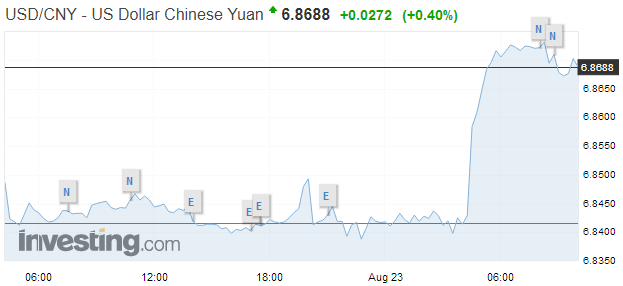

| Press reports suggest there is some optimism that the first US-China trade talks in nearly two-months are actually substantive and could result in a de-escalation of trade tensions. This optimism is misplaced. In fact, within hours of the low-level meetings that take place in Washington today and tomorrow, which an Under-Secretary of the Treasury leads the US team, who has not trade authority, the US will implement the previously announced 25% tariff on $16 bln of Chinese goods.

This is part of the 25% on $34 bln of Chinese goods, that was imposed due to claims of intellectual property rights violations. China has indicated it will retaliate in full. Intentionally or not, the US plays “good cop bad cop” with China. The Treasury Department is seen to be more supportive of the global liberal trading system as it has evolved and plays the good cop. However, it has struggled to drive the administration’s policies to the dismay of Chinese officials. The bad cop is represented by the Commerce Department that appears to be pushing for more tariffs until Chinese (and others) change their behavior. Public hearings on the next round of tariffs on $200 began on Monday and may run into the start of next week. More than 350 companies and trade associations are scheduled to testify. This set of tariffs were in retaliation for China’s retaliation, and hence the sense of a downward spiral. While these could be implemented in late September or early October, the possibility of a Trump-Xi summit in November could forestall them, though, given the modus operandi of the Trump Administration and the “maximum pressure” doctrine, it seems unlikely. |

USD/CNY, August 23(see more posts on USD/CNY, ) |

The third potential source of disappointment is with Fed Chair Powell’s speech at Jackson Hole on Friday. Before reports of the President’s criticism of Fed policy, many observers had played up the possibility of a less hawkish tone. Some argue that for technical reasons and in reaction to the risk of blowback from the volatility in the emerging market economies that Powell could suggest a willingness to consider slowing the balance sheet adjustment. Others suggest that he could hint at when the Fed would pause in its hiking cycle that began at the end of 2015. A few contacts thought that Powell could modify his language to appease Trump while not altering the Fed’s course.

We did not think a dovish read of Powell was likey before Trump’s comments, and even more so now. The Fed cannot be seen to be capitulating to the pressure. By criticizing the Fed, Trump did not erode the central bank’s independence. The independence would be violated if it reacted positively to the pressure. We expect Powell to stick to the main thrust of last month’s Congressional testimony.

Powell noted that the strength of the US economy and rising price pressures that are best addressed be a continuation of the gradual rate increases. The Fed wants to put the unwinding of the balance sheet practically on autopilot and not using it as a policy tool. We seem to recognize a higher bar to changing its pre-set pace that has not yet reached its terminal pace. Powell has identified economic headwinds emanating from trade tensions, and such tensions do not appear to have eased since he last addressed the topic.

The CME’s model shows a 93% chance of a September hike has been discounted by the fed funds futures market. Bloomberg’s model put the odds at 90%. The CME shows about a 61% chance of a December hike, while the Bloomberg model put its closer to 55%. However, due to seasonal distortions at the end of the year, we have been focusing more on the January 2019 contract. The models show almost 64% and 57.5% for the CME and Bloomberg respectively.

Full story here Are you the author? Previous post See more for Next postTags: #USD,China,Federal Reserve,NAFTA,newsletter,Trade,USD-CNY