The end of the Greek assistance program that allowed them to keep their primarily official creditors whole, and the broad expansion in the eurozone, was supposed to usher in a new period of convergence. Monetary union was once again feted as a success, and some observers were forecasting a substantial increase in the euro as a reserve asset. Instead, the economy lost momentum, core inflation returned to its trough, and new political crises have surfaced.

It has become a cottage industry to attribute negative developments while the US is raising interest rates to the Federal Reserve. However, it seems clear that the political challenges in both Spain and Italy are homegrown.

Rajoy heads a minority government and has been plagued by corruption allegations. These come to a head last week, with a previous treasury of the Popular Party, sentenced to more than 30-years in jail and the court levied a fine against the party. The opposition Socialist and Podemos parties called for a vote of no-confidence. This in itself may not have mattered much, but Ciudadanos, the centrist party that supported the minority government has also threatened to abandon Rajoy.

Ciudadanos is reluctant to support the motion of the Socialists and Podemos who too soft on Catalonia’s separatist efforts for it tastes. Also, the Socialists and Podemos solution, if successful, would result in a new government. Ciudadanos wants new elections and is pressing Rajoy on this point. The minority government just passed this year’s budget, which clears the legislative agenda, but Rajoy is resisting, and for good reason: Polls suggest that Ciudadanos is the only party that may benefit from early elections.

Ciudadanos is a centrist party and aside from the lack of experience, which apparently the Popular Party has too much of, a government headed by it may not be problematic for investors. However, Italy is a different kettle of fish. The elections that were held in early March under a new electoral law failed to do what it had been designed to do, and that was to help facilitate more stable governments. To the contrary, it has led to a strange government between the populist Five Star Movement, which eschewed coalitions of any kind, and the (Northern) League, an old nationalistic, nativist right-wing party, that campaigned quite vehemently against M5S.

Investors did not appear particularly concerned, but they have become increasingly so over the past couple of weeks. It is not just the fiscal plans, but it is also the suggestion of monetizing the government’s arrears, which have squeezed the many small businesses that provide goods and services to the government, and banks that lent them money. And it is not just the implicit threat of a parallel currency, that has similarities with a plan Greece drafted, it is also the suggestion that Savona, a critic of EMU, should be the new finance minister.

Moody’s was the first rating agency to weigh-in. It put Italy’s Baa rating review on for a possible downgrade after the European markets closed last week. The other three main rating agencies have Italy at the equivalent (BBB), but unlike the others, Moody’s had a negative outlook.

Moody’s cited the risk of a significant weakening of Italy’s fiscal position. It also saw risk that the structural reforms would stall and even reverse. Some of these reforms, for example, made it easier for banks to sell foreclosed property, which in turn, helped address the non-performing loan problem. Italy has a little breathing space. Only a rating below BBB- matters, because would mean Italy would have lost its investment-grade rating. While private sector investment managers typically don’t like split ratings, the ECB follows the lead of the most optimistic one, which is often DBRS.

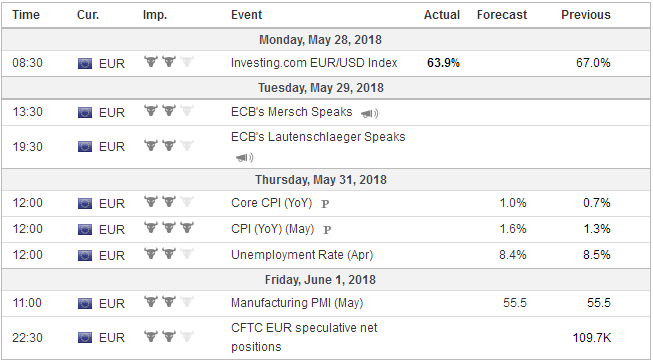

EurozoneSeemingly well within his authority, Italian President Mattarella has rejected the candidacy of Savona. The League has not backed down, though Savona himself seemed to recognize that may be inevitable. League leader Salvini appears to have much invested in Savona’s candidacy, but others say that he is wily and may be quick to take any pretense of offense and seek new elections. Polls suggest his hand may be strengthened. On the other hand, Mattarella is seen as representing the old guard and elites while resisting the popular will. The political backdrop makes for a poor setting for what under other circumstances could be positive for the euro. The flash May CPI is expected to confirm that the drop in April was a statistical quirk having to do with Easter. The rise in oil prices and the depreciation of the euro is expected to have lifted both headline and core CPI. The headline rate is likely to rise from 1.2% to 1.6%-1.7%. The ECB’s target is close to but below 2%. The core rate is expected to rise to 1.0% from 0.7%. This will likely help reassure investors that the ECB is on track to complete its asset purchases this year. That would, in turn, imply an evolution of its forward guidance at the late July meeting, with the June staff forecasts paving the ground. With the PMIs suggesting that the economic downshift in Q1 continued in Q2, and money supply slowing to its slowest pace since late 2014, the market is responding by pushing out the anticipated ECB rate hikes. The implied yield of the December 2019 Euribor futures contract has fallen from 23 bp in late January to minus 8.5 bp before the weekend, the lowest since December 2016. During the same time (late January through the end of last week), the December 2019 Eurodollar futures contract’s implied yield rose from 2.72% to 2.915%. It briefly traded above 3% around mid-May. The market remains confident that the Fed will hike rates two more times this year. There is a full slate of economic data in the coming days that will provide the economic backdrop for the FOMC meeting that concludes on June 13. |

Economic Events: Eurozone, Week May 28 |

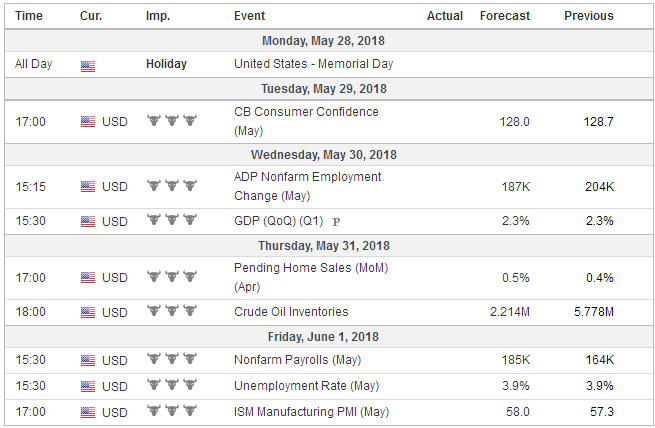

United StatesFed officials, like investors, probably won’t react much to a potential downward revision in Q1 GDP to 2.1% from 2.3%. The May manufacturing PMI and April household consumption figures will boost confidence that the economy is already reaccelerating. The Atlanta Fed’s GDPNow puts Q2 growth at 4.0%, the NY Fed model is at 3.0%, and the St. Louis Newscast model estimate is 3.6%. The US jobs report will continue to draw attention, even though the focus has shifted from job growth per se, barring a significant surprise, to earnings growth. Hourly earnings growth is incredibly steady. There have been three distinct phases in this recovery and expansion period. In the 2010-2012 period, average hourly earnings growth averaged about 2%. In the 2013-2015 phase, the pace increased to about 2.3%. Since 2015, it has hovered around 2.5%-2.6%. A 0.2% increase in May is needed to keep the year-over-year pace at 2.6%. US jobs growth is gradually slowing. It does not mean there cannot be some occasional acceleration. Non-farm payroll growth average 182k in 2017, which includes a 221k average in the fourth quarter. Job growth averaged 212k in Q1 18. April’s 168k was below expectations, and May is expected to bounce back. The Bloomberg median forecast is for 190k, but we suspect that the risk is on the downside. The Federal Reserve operationalized its mandate for price stability by targeting the core PCE deflator for 2% annual growth. It was 1.9% in April. It increased by a monthly average of 0.13% last year and 0.15% in 2016. In Q4 17, it accelerated to a 0.17% averaged and in Q1 18 it averaged 0.21%. We conclude by noting several unresolved issues. Those countries that got temporary exemptions for the US steel and aluminum tariffs may see them come to an end on June 1. Also, Mexico made a compromise offer on the domestic content/wage trade-off offered by the US. It is not clear that this is sufficient to break the logjam. The US Congress may challenge the Administration’s compromise over ZTE. Lastly, the inclusion of over 200 mainland Chinese companies in the MSCI Emerging Markets Index starts June 1. |

Economic Events: United States, Week May 28 |

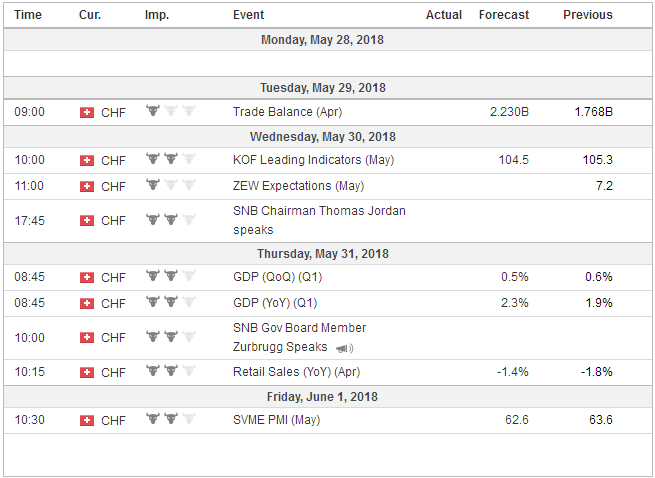

Switzerland |

Economic Events: Switzerland, Week May 28 |

Full story here Are you the author? Previous post See more for Next post

Tags: #USD,$CNY,$EUR,Federal Reserve,newslettersent