There are several trends in the capital markets at a high-level. The euro and yen’s decline has coincided with sustained rallies in European and Japanese equity benchmarks. Emerging market equities and currencies have been trending lower.

There are two other trends that arguably are reinforcing if not causing the other trends. Both oil prices and U0S interest rates have been trending higher. It is unusual but not unprecedented for oil and the dollar to move in tandem. It seems premature to conclude a structural shift that some narratives that are linking with the launch of yuan-denominated oil futures contract and some reports suggesting the eurozone could pay for Iranian oil in euros instead of dollars.

And, in any event, we suspect the talk of petro-dollar and petro-yuan are exaggerated. In the world of fiat currencies, and the evolution of the capital markets, the size, depth, breadth, and transparency of the US Treasury market lies at the heart of the dollar’s role in the world economy, backed up, as it were, by the military might second to none. Capital, not goods and services, drives the modern political economy.

The persistence and magnitude of the trends, especially in the foreign exchange market, suggest several forces are work. We argue that the 72 bp rise in US 10-year rates so far can be largely explained by the shifting views of the trajectory of Fed policy and the actual increase in inflation. The expectation of for the effective Fed funds rate at the end of the year, using the January 2019 futures contract, has risen by 37 bp this year. Headline inflation (CPI) has accelerated to 2.5% from 2.1% at the end of last year. The yield on the 10-year TIP has more than doubled since the start of the year to 95 bp.

Actual inflation and anticipation of a more aggressive Fed can account for the rise in yields. There is no need to multiply entities and emphasize sentiment, supply, or the liquidation of $63 bln of foreign official holdings of marketable securities (Treasuries and MBS) held at the Federal Reserve on behalf of foreign central banks over the past month. Those issues get to the distribution of ownership not necessarily market direction.

The Federal Reserve is on the cusp of achieving its mandates, and its balance sheet is reduced with little sign of disruption. The large fiscal stimulus to an economy growing above-trend and near capacity can reasonably be expected to goose growth, prices, and given the US propensities to import and growth differentials with its major trading partners, the external deficit.

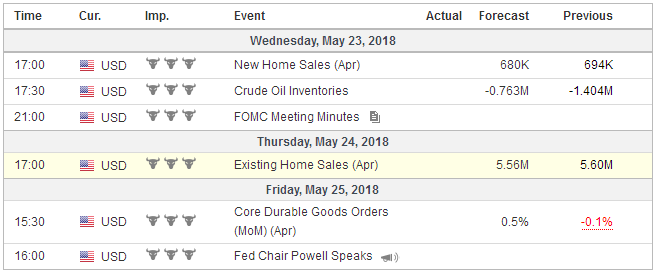

The market may look through weakness in home sales and volatile durable goods orders, confident of the Fed’s path. The FOMC minutes are themselves a tool of forward guidance. They are a tool of communication policy more than a verbatim record of a meeting. The minutes are more impressionism than realism. Two issues dominate investors’ interest given that a hiked next month is fully discounted: the tolerance for an overshoot of inflation and the risk and significance of a potential inversion of the yield curve.

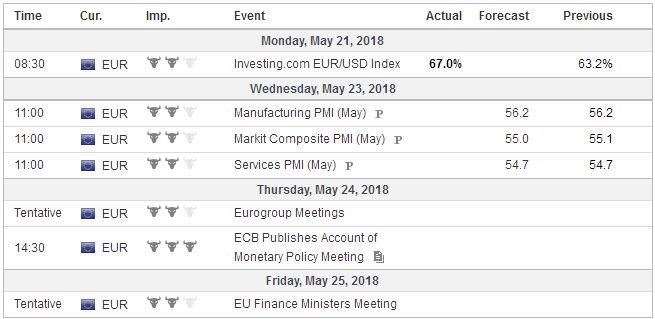

EurozoneSofter inflation in the eurozone has helped solidify expectation that the ECB asset purchases wind down further in Q4 and stop at the end of the year. The first rate hike is penciled for around the middle of next year. If the argument that the some of the slowing in Q1 was due to transitory or one-off factors is fair, then the data should be improving. We see both transitory influences, like the weather, flue, and industrial action, and cyclical factors, or the maturing of the business cycle, are at work. This is consistent with modest improvement in the high-frequency economic data, including this week’s flash May PMI. Although economists have revised down their expectations, which explains, at least in part, why the “surprises” have been less on the downside in recent weeks. The prospect for a new Greek-like crisis but on a larger scale in Italy as an inexperienced and malcontent government appears set to assume office poses a new potential threat to the euro even if the data improves. In the current environment, with strong downside momentum, and a large speculative long speculative, extrapolating from the futures market, the market hardly needs a fresh reason to sell the euro, which has been trending lower with few exceptions over the past 12 weeks. The dynamics of maturing debt (~20 bln euros still this month), new issuance, and ECB purchases (~4 bln a month until September) are not particularly adverse for Italy. Italy needs to issue around 125 bln of debt this year, and there is 150 bln euro maturing. The absolute rise in Italian yields and the premium over Spain and Germany, however, may have not reached levels that will attract investors, leaving aside the political uncertainty and the fact that no prime minister has been named. The premium over Spain is about 84 bp. It reached nearly 100 bp a few months ago and got up to almost 120 bp in 2012. The premium over German is near 165 bp, which is highest since last October. It was trading near 130 bp as recently as May 15. A year ago the Italian premium was closer to 200 bp. |

Economic Events: Eurozone, Week May 21 |

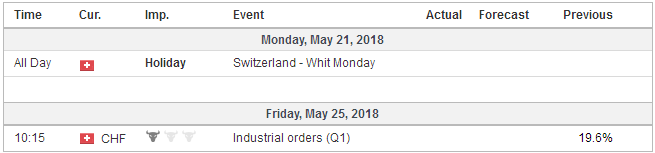

SwitzerlandThe Swiss franc appears to be beneficiary of the heightened political risk in Italy. The euro fell 1.7% against the Swiss franc last week, the biggest weekly loss in two years. The euro’s gains since the February lows, which carried the cross to the old euro cap/Swiss franc floor at CHF1.20, have been halved with last week’s drop. A break of CHF1.1720 now could see CHF1.1650. |

Economic Events: Switzerland, Week May 21 |

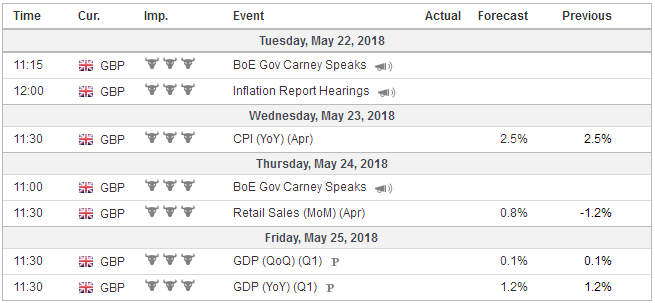

United KingdomThe UK reports April CPI and retail sales. Headline CPI and the core rate are expected to be steady at 2.5% and 2.3% respectively. Retail sales can snap back after a contraction in March, but the year-over-year rate is still likely to slow. The UK stock market has been trending higher. The FTSE 100, which is sensitive to sterling’s exchange rate, has rallied 13.5% in the eight-week advance, and the FTSE 250’s eight-week streak has lifted it nearly 10.5%. The 10-year Gilt has gone nowhere. The yield continues to chop around a range between around 1.35% and 1.55%. |

Economic Events: United Kingdom, Week May 21 |

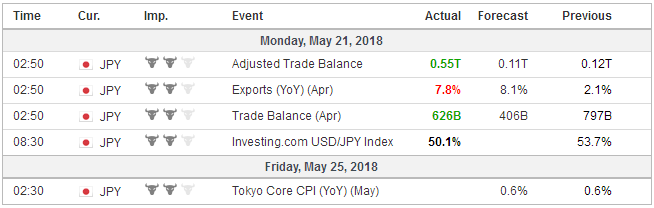

JapanNear-term high-frequency Japanese data will not have the heft to heal the blow dealt last week by the outright contraction in Q1 GDP and a second consecutive monthly decline in CPI. Japan reports April trade figures that are likely to see strong growth in both exports and imports in value terms. Japanese trade figures are very seasonal. April very often sees the balance deteriorate and in May it nearly always worsens from April. |

Economic Events: Japan, Week May 21 |

United StatesLastly, trade issues remain very much on the fore. An agreement in principle appears struck between the US and China. Ostensibly China will buy more US goods from the US. Details are lacking. The US may be successful in negotiating to lower China’s tariffs. As we have argued this may be very much consistent with President Xi’s reforms. However, it is possible that other countries’exports besides American’s will benefit. On the other hand, don’t discount the current pace. US exports to China have risen by about 85% over the past decade, while US exports to other destinations have increased by a quarter as much (21%). Meanwhile, the exemptions from US tariffs granted Europe expire at the end of the month. The recriminations with Europe over these tariffs, and also tensions over US sanctions on Iran are poised to increase. While NAFTA negotiation may continue, US trade officials seem to downplay the likelihood of a breakthrough. If a NAFTA deal is not struck, it is not clear what happens to the steel and aluminum tariffs for Canada and Mexico. If we treat the claim that US protectionism is dollar negative as a hypothesis, it looks as if under the current constellation of macroeconomic conditions, it is not. Alternatively, it may be that tailwinds are offsetting the headwind. One effect of tariffs and quota is to boost prices. It may simply reinforce the impulses in a Fed tightening cycle and extend the divergence theme. |

Economic Events: United States, Week May 21 |

Tags: #GBP,#USD,$CHF,$EUR,$JPY,$TLT,FOMC,newslettersent