Geopolitical issues will continue to bubble below the surface for the capital markets. The fallout from the reimposition of US sanctions on Iran has apparently helped lift oil prices in the face of the rising dollar, which often acts as a drag. In the coming days, the US will take the symbolic step of moving its embassy to Jerusalem. The conflict between Israel and Iranian forces in Syria is escalating. Meanwhile, US reportedly is offering North Korea economic assistance in exchange for giving up its nuclear weapons, which seems very much like the deal with Iran from which it is withdrawing.

Trade issues are also near the surface. As we have noted, the US legislative process after a NAFTA agreement is reached is quite protracted. For the current Congress to fulfill its obligations, a final agreement is needed by May 17. The failure to reach an agreement by the end of the week could see renewed threats of leaving NAFTA, which would have some bipartisan domestic support.

High-level talks with China resume in Washington this week. On Tuesday, China’s Vice Premier, and top economic adviser to President Xi, Liu He, will lead the delegation. It is his second trip in three months. China does not seem opposed in principle to some quantitative bilateral trade target. What is being negotiated is the size and the price.

These geopolitical developments often have little perceptible impact on broad market forces. Instead, it has been the reemergence of divergence, or rather the continued divergence is blunting other considerations and is becoming too expensive to ignore. The cost here is measured in terms of money–interest rate differentials.

The US premium has never been greater over Germany. The two-year differential of 3.10% is more than the yield of a 10-year US Treasury. The 10-year differential is about 2.40%. Medium and long-term investors appreciate that the differential has averaged a little more than 85 bp over the past decade.

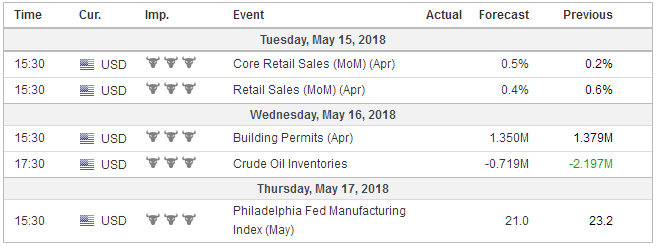

United StatesPerhaps the starkest contrast comes from the Q1 corporate earnings. According to Reuters, it appears that the S&P 500 companies are on track for Q1 earnings that will be more than 25% above year-ago levels. The benchmark rose about 11.5% and adding a 2% dividend would have generated a return of about 13.5%. The Dow Jones Stoxx 600 earnings growth may be north of 4% on a stretch. The index posted a loss of about 2.6% over the four quarters to the end of March 18, which was offset by a roughly 3.2% dividend yield, for a net return of 0.6%. The large fiscal stimulus being provided to an economy growing above trend and near the targets (full employment, price stability, and financial stability), encourages the Federal Reserve to look past practically any near-term weakness in economic reports. It is not clear how much of the fiscal largess will fuel economic activity and how much will translate into inflation. The market remains confident of two more Fed hikes this year and is unsure about a third one (~33% chance discounted). The recent hourly earnings data and CPI means that there is no need to accelerate the current gradual pace of rate increases. The actual impact of the fiscal stimulus is a different matter. So far, it is still hard to detect on investment or consumption. Retail sales are about 40% of personal consumption expenditures. It rose an by an average of 0.4% a month last year and 0.3% a month in 2016. The pace accelerated in H2 17 to 0.65% a month. Retail sales slowed to an average gain of 0.1% in Q1 18. The median forecast for April is 0.3%. The components used for GDP calculations fell in three months through February and rose in 0.4% in March. A similar rise in April will not prevent the year-over-year rate from slowing. The H2 18 monthly average was a little above 0.5%. Tax cuts may boost residential investment, not just consumption. Housing starts are one area to look. US housing starts have returned to about half the level that was prevailing before the Great Financial Crisis. Housing starts jumped over 10% in January eased in February and rose in March. Keeping the alternating pattern intact, the median forecasts call for a small decline in April. Permits rose by an average of 2.1% a month in both Q4 17 and Q1 18. Here even a 2.1% decline, which is the median forecast would allow the year-over-year rate to increase. Last April, permits fell 2.5% and another 4.9% in May. |

Economic Events: United States, Week May 14 |

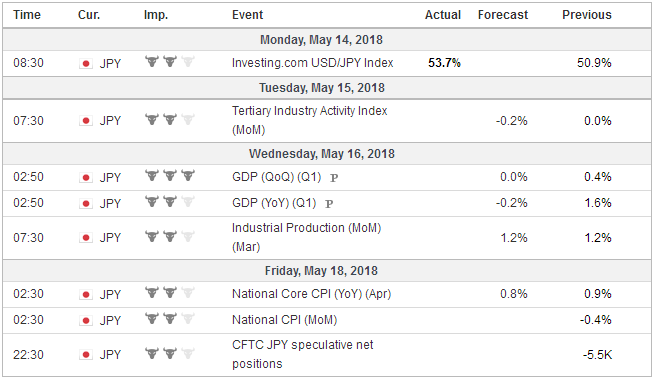

JapanJapanese data will illustrate why Fed policy is still diverging from BOJ policy. It is possible that the eight quarter expansions, the longest in at least a quarter of a century, ended in Q1 18. At an annualized pace the economy may have contracted by 0.1%. The GDP deflator is expected to have risen to a 0.3% pace from 0.1% in Q4 18. This would match last year’s average. The poor price news will be reiterated by the April CPI figures that will be released at the end of the week. Headline CPI is expected to have slowed to a 0.7% year-over-year pace, down from 1.1%. The core rate, which excludes fresh food is expected to have moderated to 0.8% from a year ago from 0.9% in March. The dollar has risen against the yen for seven consecutive weeks, covering the period since the start of Japan’s new fiscal year. The 10-year US Treasury yield has risen in five of the seven weeks. The 60-day correlation between the two on a value basis stands near 0.77, the highest since January. On the basis of returns (percent change), the correlation of 0.57 is also near the highest for this year. The correlation with the US two-year yield is a little stronger (0.87 at the level and 0.60 on percentage change). |

Economic Events: Japan, Week May 14 |

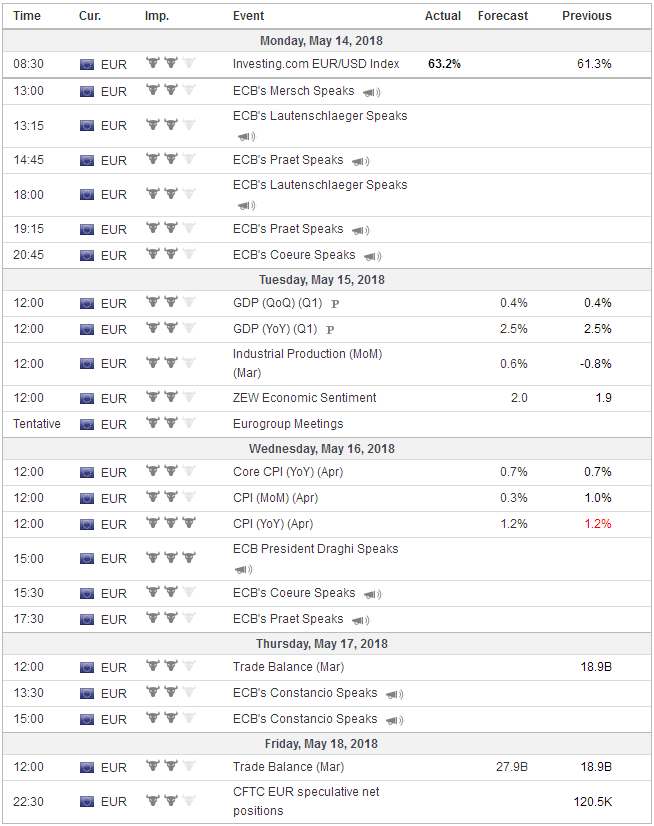

EurozoneInvestors will be reminded the source of the ECB’s caution with the confirmation of Q1 GDP at 0.4% and softer inflation. The preliminary report showed a decline in the core rate to 0.7% from 0.9%. The final report is expected to confirm this, but lower the headline figure from 1.3% to 1.2%. The core rate bottomed in three years ago and before trillions of bonds were purchased at 0.6%. A key question facing policymakers and investors is whether the loss of economic momentum, which Draghi acknowledged to have been broadly experienced, is a temporary phenomenon, related to some transitory factors, like weather, flu, labor action, or the end of the business cycle. If it is temporary, there should be an improvement in the next batch of data. This may give extra significance to Germany’s May ZEW survey. The German DAX has risen for seven consecutive weeks, and 11 of the past 13. Sentiment remains lofty even though the assessment of the current situation has fallen for three consecutive months, and is likely to have declined again in May. It averaged 84.1 last year and 90.3 in Q1 18. The expectations component fell into negative territory in April (-8.2) for the first time since July 2016, which itself was the first time since October 2014. The failure of the expectations component to improve may increase the challenge facing communicating the policy outlook to investors. Part of the dilemma facing the BOE will be evident with another robust jobs report, and base earnings (excluding bonuses) may tick up to 2.9% from 2.8%. Some easing of the squeeze on purchasing power is being offered by the fact weekly earnings are rising faster than prices. Meanwhile, Brexit risks have hardly subsided, and the EU chief negotiator warned before the weekend that talks could yet break down. With nearly ten months before Brexit, the UK government seems as divided as ever. |

Economic Events: Eurozone, Week May 14 |

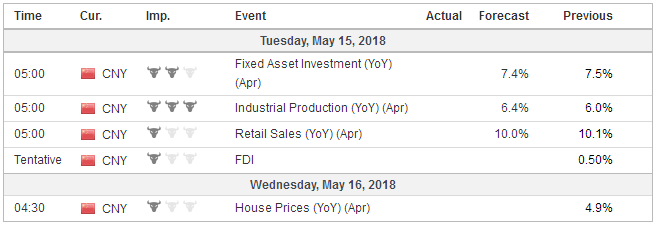

ChinaChina has the usual mid-month retail sales, industrial production, and fixed asset investment reports. The main takeaway is one of broadly stable activity. Before the weekend, the PBOC set the fixing for dollar lower by 0.38%, the most in six weeks. After reversing lower in the middle of last week, the US dollar fell to its lowest level since April 26 before the weekend. Chart support is now seen in the CNY6.30-CNY6.32 band. If one wanted to set the best context for the US-China trade talks, at the very least, it would be helpful for the yuan not to depreciate, if it can be avoided, and actually strengthen, if that could be arranged with minimal effort. |

Economic Events: China, Week May 14 |

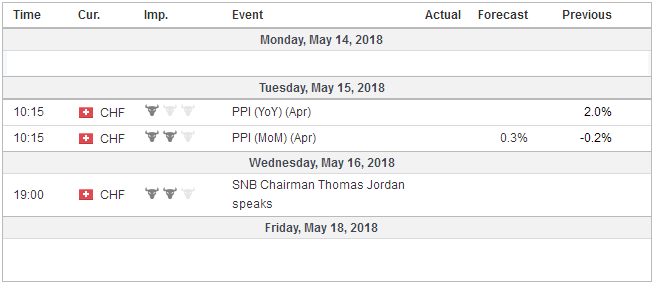

Switzerland |

Economic Events: Switzerland, Week May 14 |

Full story here Are you the author? Previous post See more for Next post

Tags: #USD,$CAD,$CNY,$EUR,$JPY,MXN,newslettersent