Monthly Archive: March 2018

US Stock Market: Conspicuous Similarities with 1929, 1987 and Japan in 1990

There are good reasons to suspect that the bull market in US equities has been stretched to the limit. These include inter alia: high fundamental valuation levels, as e.g. illustrated by the Shiller P/E ratio (a.k.a. “CAPE”/ cyclically adjusted P/E); rising interest rates; and the maturity of the advance. Near the end of a bull market cycle there is always the question of when a decline will begin, and above all, how large will it be.

Read More »

Read More »

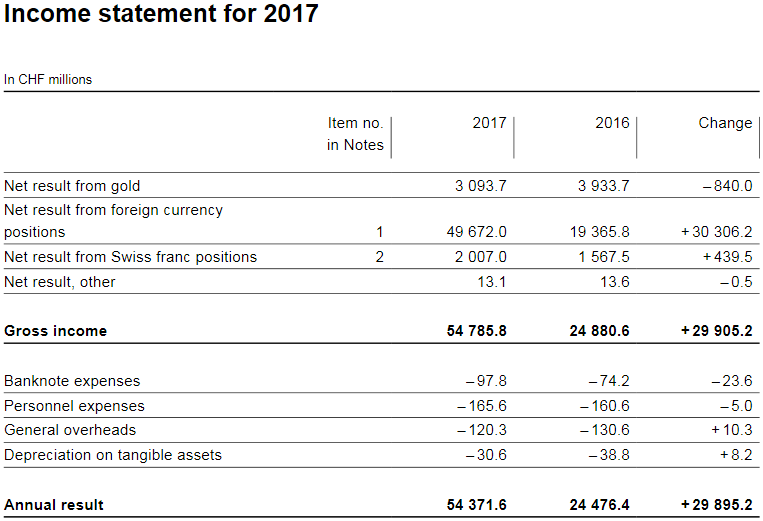

SNB reports a profit of CHF 54.4 billion for 2017

The Swiss National Bank (SNB) reports a profit of CHF 54.4 billion for the year 2017 (2016: CHF 24.5 billion). The profit on foreign currency positions amounted to CHF 49.7 billion. A valuation gain of CHF 3.1 billion was recorded on gold holdings. The profit on Swiss franc positions was CHF 2.0 billion.

Read More »

Read More »

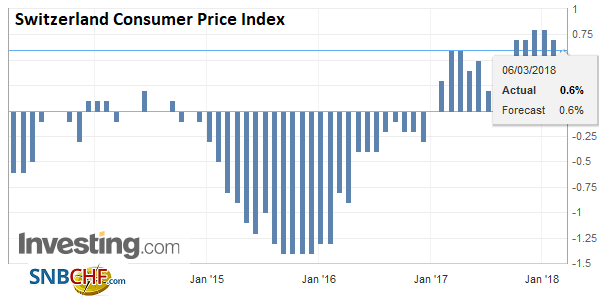

Swiss Consumer Price Index in February 2018: +0.6 percent YoY, +0.4 percent MoM

The consumer price index (CPI) increased by 0.4% in February 2018 compared with the previous month, reaching 101.1 points (December 2015=100). Inflation was 0.6% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO).

Read More »

Read More »

FX Daily, March 06: Resiliency Demonstrated

The resiliency of the status quo is again on display. After much chin wagging and finger pointing after the Italian elections and the modest decline in Italian assets, they have bounced back today. Italian bonds and stocks are participating in today's advance. Italian equities were off 0.5% yesterday and are up a 1.1% near midday in Milan. Italy's 10-year yield rose three basis points yesterday is off five today.

Read More »

Read More »

Weekly Technical Analysis: 05/03/2018 – USDJPY, EURUSD, GBPUSD, EURGBP, AUDUSD

The USDCHF pair shows sideways trading around the EMA50, noticing that the EMA50 shows clear negative signals on the four hours’ time frame, while the price settles below the intraday bullish channel’s support line that appears on the chart.

Read More »

Read More »

Great Graphic: Is the Canadian Dollar a Buy Soon against the Mexican Peso?

This Great Graphic composed on Bloomberg shows the Canadian dollar against the Mexican peso since the start of last year. There have been three big moves. The Canadian dollar trended lower against the peso as it corrected from the sharp sell-off induced in great measure to the candidate Trump's rhetoric against Mexico. However, shortly before the inauguration, the peso began recovering continued through H1 17.

Read More »

Read More »

Quarter of Swiss companies fail to pay bills on time

23.3% of businesses in Switzerland did not pay their bills on time in 2017, found the business information service Bisnode D&Bexternal link in a survey published on Wednesday. That’s 0.3% less late-payers compared to 2016. The average delay of payments was also shorter in 2017, averaging 14.4 days, compared to 15.7 in 2016.

Read More »

Read More »

FX Daily, March 05: Italian Election Weighs on Italian Assets, but Little Systemic Risk Seen

The US dollar is narrowly mixed. The Japanese yen remains firm. The dollar appears stuck in a narrow range. Near JPY105.20 the seems to be some short-covering pressure in front of JPY105. On the top side, the greenback is encountering offers in front of JPY105.80. Sterling is firm against the dollar as it recovers against the euro. Before the weekend, the euro reached GBP0.8950, its best levels since last November. The euro is testing GBP0.8900...

Read More »

Read More »

Rosier economy should boost Swiss housing market

The economic upturn should drive demand for Swiss property after a period of record construction and lower rental prices, a survey claims. The improved economic situation should “revive demand in all segments” of the Swiss housing market, according to Credit Suisse’s Swiss Real Estate Market 2018 reportexternal link, published on Tuesday.

Read More »

Read More »

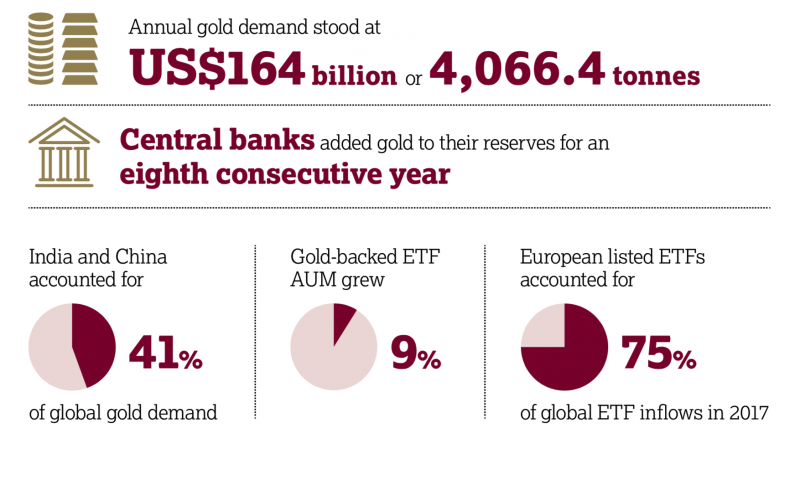

Four Key Themes To Drive Gold Prices In 2018 – World Gold Council

Four key themes to drive gold prices in 2018 – World Gold Council annual review. Monetary policies, frothy asset prices, global growth and demand and increasing market access important in 2018. Weak US dollar in 2017 saw gold price up 13.5%, largest gain since 2010. “Strong gold price performance was a positive for investors and producers, and was symptomatic of a more profound shift in sentiment: a growing recognition of gold’s role as a wealth...

Read More »

Read More »

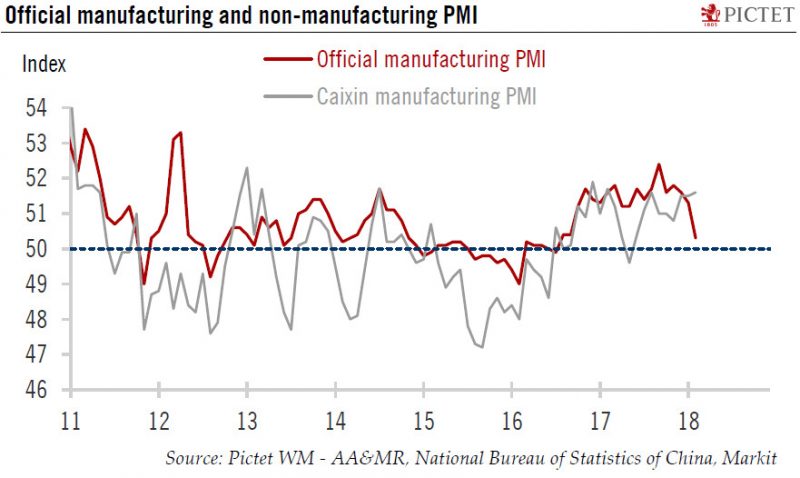

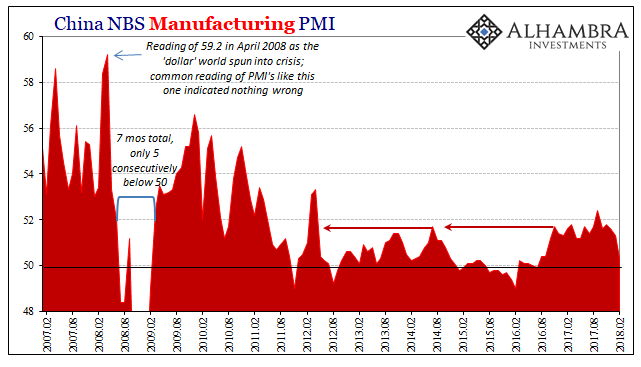

China: February PMIs point to deceleration in industrial activity

China’s official manufacturing Purchasing Manager Index (PMI) for February, compiled by the National Bureau of Statistics of China and the China Federation of Logistics and Purchasing, came in at 50.3, down from 51.3 in January and 51.6 in December 2017. This is the lowest reading of this gauge since October 2016. The Markit PMI (also known as the Caixin PMI), however, edged up slightly to 51.6 in February from 51.5 in the previous month

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended Friday on a mixed note, capping off a largely softer week. Best performers last week for MYR and TWD while the worst were ZAR and ARS. US stocks clawed back early losses and ended the week on a firmer note but we think further market turbulence is likely.

Read More »

Read More »

FX Weekly Preview: Thumbnail Sketch Four Central Bank Meetings and US Jobs Data

The German Social Democrats have endorsed the Grand Coalition, ending the period of political uncertainty and paralysis in Germany since the last September's election. The polls have suggested nearly 60% of the SPD would support joining the government and the actual outcome looks to be closer to 66%. In 2013, when the SPD had a similar vote, three-quarters favored a Grand Coalition. Among the differences is that the SPD public support has waned,...

Read More »

Read More »

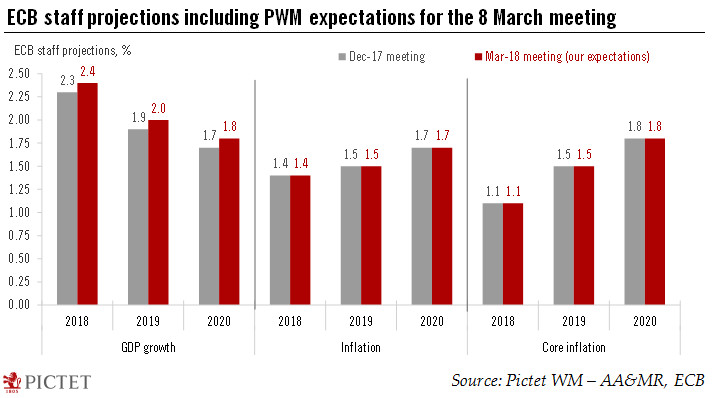

Europe – ECB preview

Market participants have enjoyed a protracted period of very low volatility, but it may well have come to an end in 2018. Central banks are often said to be responsible for the disappearance of volatility, for example through their large-scale asset purchases, which have compressed the term premium. But, now that the same central banks are heading for the exit from unconventional policies, they, too, need to relearn how to live with volatility.

Read More »

Read More »

Jobless in Switzerland after 55 – most end up longterm unemployed

Age discrimination in the Swiss job market appears to be getting worse. Between 2010 and 2016, the number of over 55s on welfare increased by 50.5%, something that cannot be fully explained by an aging population. The population aged between 56 and 64 only increased by 11.6% over the same period.

Read More »

Read More »

Average expat in Zurich earns more than $200,000

Zurich and Geneva are among the top cities in the world for expat salaries, according to this year’s HSBC expat salary survey. The average expat can look forward to a pay packet of $206,875 (CHF191,960) in third-place Zurich and $184,942 in fifth-place Geneva.

Read More »

Read More »

Data Distortions One Way Or Another

Back in October, we noted the likely coming of two important distortions in global economic data. The first was here at home in the form of Mother Nature. The other was over in China where Communist officials were gathering as they always do in their five-year intervals. That meant, potentially. In the US our economic data for a few months at least will be on shaky ground due to the lingering economic impacts of severe hurricanes.

Read More »

Read More »

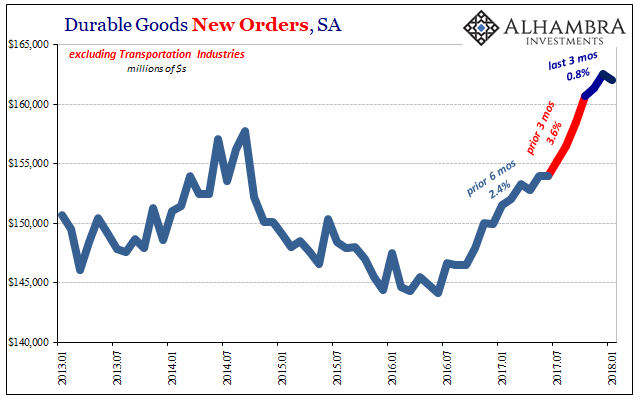

Durable and Capital Goods, Distortions Big And Small

New orders for durable goods, excluding transportation industries, rose 9.1% year-over-year (NSA) in January 2018. Shipments of the same were up 8.8%. These rates are in line with the acceleration that began in October 2017 coincident to the aftermath of hurricanes Harvey and Irma. In that way, they are somewhat misleading.

Read More »

Read More »

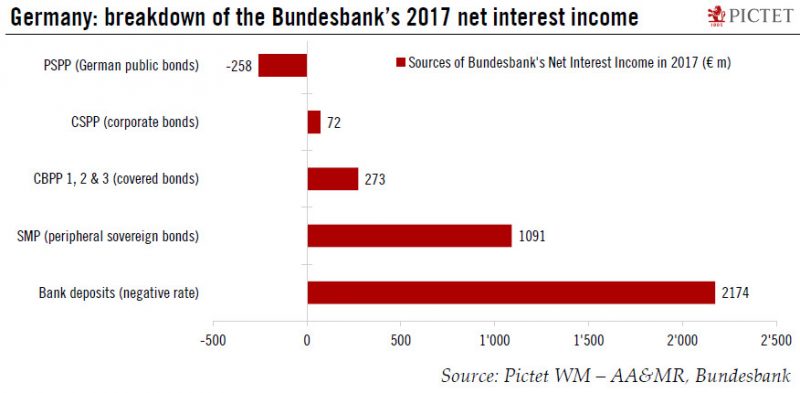

ECB policy is boosting the Bundesbank’s profits

This week the German Bundesbank published its 2017 annual report, which includes a number of interesting figures that are relevant to the broader (monetary) policy debate in the euro area. In particular, the Bundesbank provided details of the amount of securities held on its balance sheet for policy purposes, including QE, at the end of 2017, and the corresponding flows of income stemming from its asset purchases. Remember that QE is largely...

Read More »

Read More »

E-franc pipe dream fails to arouse Switzerland

Mounting calls for Switzerland to introduce a blockchain-based national cryptocurrency continue to fall on deaf ears at the Swiss National Bank (SNB). Romeo Lacher, chairman of the SIX Groupexternal link that runs the Swiss stock exchange, recently added his voice to the debate by advocating such a virtual currency.

Read More »

Read More »