The German Social Democrats have endorsed the Grand Coalition, ending the period of political uncertainty and paralysis in Germany since the last September’s election. The polls have suggested nearly 60% of the SPD would support joining the government and the actual outcome looks to be closer to 66%. In 2013, when the SPD had a similar vote, three-quarters favored a Grand Coalition. Among the differences is that the SPD public support has waned, and now, according to some polls, is at risk of slipping into third place behind the AfD.

Another difference is that the CDU is more desperate as well. Merkel’s first choice was a coalition with the FDP and the Greens, but negotiations failed. The SPD has secured two key portfolios: the foreign and finance ministries. Previously, there was some thinking that responsibility for Europe could shift from the finance ministry to the economics ministry, and it is something investors will want to monitor for insight into Germany’s European policy. At the same time, it appears that that differences between the two major parties are not as great as the rhetoric sometimes suggests.

Italy holds the only G7 national election this year. The first exit polls will be available around 5:00 EST/22:00 GMT. In 2013, these exit polls were not very helpful. The first hard numbers are likely a two-three hours later. If the election is as close as the polls before the blackout suggested, it may take longer to get decisive results. Suffice it is here to say that although there is keen interest, the uncertainty did not weigh on the euro, which finished at near the week’s highs and Italian assets have more than held their own in the run-up to the elections.

After a couple week recovery from the swoon into the middle of February, equities moved lower last week. Although the US tariffs and threat of a trade war riled investors, the equities were already falling, and the US stocks staged a late rally before the weekend. The S&P 500 and NASDAQ closed higher after recording new lows for the week. The Dow Industrials failed to do so and will start the new week carrying a four-day losing streak in tow.

Conventional wisdom holds that protectionism is not good for the dollar or the stock market, but most of the evidence seems to be selectively picked. For example, the great free-trade president Reagan used “voluntary export restrictions” and “orderly market agreements” to limit import penetration, and the dollar rallied until 1985 when the G7 coordinated intervention to knock it down.

Also, much of the work coming from Wall Street and the financial press offer narrow and subjective definitions of protectionism and only find a few examples. A more robust approach could look at the cases brought against the US to the WTO which the US lost. In addition, in the accounts, little attention is paid to the direction of stocks and the dollar before the protectionist measures were implemented. For example, US stocks and the dollar were falling before Bush’s steel tariffs in 2002 and fell after they were lifted in 2003. To attribute causation or even correlation would seem to require more work.

In the week ahead, there are four major central bank meetings. Also, the US releases the February employment report, one of the most impactful of the high-frequency data.

First, let’s turn to the Reserve Bank of Australia (March 5) and the Bank of Canada (March 7). Neither central bank will change policy. The Bank of Canada delivered its third hike in the cycle in January and is in no hurry to do so again. The market is pricing in a 63% in May. Investors also see a good chance of a hike in H2 as well.

The Reserve Bank of Australia is reluctant to hike rates. The market appears to be pricing in around a one-in-three chance of a hike this year. The economy is still struggling with the transition from mining and mineral, as the recent disappointing Q4 capex report showed.

Both the Australian and Canadian dollars have depreciated on a trade-weighted basis since the end of January. The Aussie is off a little more than 4%, while the Canadian dollar has fallen by nearly 4.5%. The RBA may welcome the depreciation more than Canadian officials. The OECD sees the Australian dollar as almost 15% over-valued against the US dollar, while the Canadian dollar is understood to be about 2.2% undervalued. Both countries face risks from the policies of large neighbors, who are also their biggest trading partners.

JapanThe Bank of Japan’s meeting at the end of next week had taken on greater importance after Governor Kuroda’s comments before the weekend that spurred yen gains. Investors have been particularly sensitive to changes in Japan’s monetary policy. By and large, they appear too ready to think the BOJ is already or is about to pull back on the monetary throttle. The Yield Curve Control strategy announced in 2016 requires the BOJ to buy few bonds than under the Quality and Quantitative Easing that Kuroda introduced quickly on succeeding Shirakawa at the helm. In addition, Kuroda argues that given that the float is less, it does not need to buy the same yen amount to have the same impact. Buying fewer bonds then is the continuation of the course, not a deviation or tapering as is often claimed. Until the end of the week, Kuroda has simply dismissed talk of an exit as premature. However, he said before the weekend that a discussion of an exit may be appropriate at the start of the FY19. In April next year. The yen strengthened as if this were really new news. The dollar was sold to its lowest level (~JPY105.25) since November 2016. We struggle to see the news here. The BOJ currently projects that inflation will reach its target around the FY19. Surely it follows from this that sometime around then the BOJ will more formally discuss how to exit from this prolonged aggressive monetary easing. Indeed, we read Kuroda’s comments to suggest there is little chance of exiting this year, and that is to say, we have not seen peak divergence. When trying to think through the outlook for BOJ policy, our views are shaped the planned October 2019 hike in the retail sale tax. Given the importance of it in last year’s election and the expansion of Japanese economy, we suspect it will be particularly difficult to postpone again. It will boost inflation, which the BOJ will look through, as it did before, and pose a headwind to the economy. Headline CPI of 1.4% in January is largely a function of fresh food and energy. When these are stripped out, measured inflation falls to around 0.4%. The yen has appreciated by about 4.5% on a trade-weighted basis since early February. This coupled with the 4.7% slide in oil prices in February is warns of downside risks. |

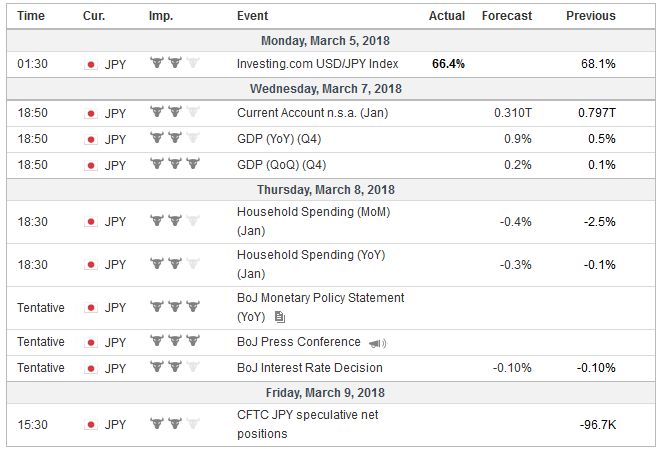

Economic Events: Japan, Week March 05 |

EurozoneThe outlook for the ECB meeting has moved in the opposite direction of the BOJ. The market previously was keenly focused on the ECB meeting, expecting an important shift in forward guidance. So while the BOJ’s meeting has become more important for investors, the ECB meeting has become less so as little change is now expected. Whatever changes are delivered will be subtle. The broad course of policy is understood. The ECB is buying 30 bln euros a month in assets, mostly government bonds. It will do so at least through September. We suspect that some time, probably July, the ECB may signal that it will further taper its purchases in Q4 when they are complete. Until then, the ECB’s assessment and forward guidance will gradually evolve. Its risk assessment much change. The ECB may soon feel more comfortable in modifying or dropping its pledge to increase its asset purchases if needed. This seems implicit, in any event. With the eurozone enjoying the broadest economic expansion in a decade, Draghi’s call for patience and persistence may seem out of sync. Yet here is the difficulty. The ECB’s single mandate it for stable prices, which has been operationally defined as near but lower than 2%. The advanced reading for February’s CPI was 1.2%. In February 2017 it stood at 2.0%. That was mostly energy. Core rate now stands at 1.0%. It was at 0.9% in February 2017. There does seem to be some upward pressure on service prices, though the fall in oil prices may drag the headline lower. The OECD model has the euro the most undervalued currencies (~8.6%). On a trade-weighted basis, the euro is largely flat. It had appreciated a little more than 1% through early February, but since then it has eased. It is now virtually unchanged on the year and about 0.5.% above its 100-day moving average, to put it in perspective. Draghi often cites surveys, and he may recognize that there has been some loss of momentum, though the levels are still elevated. He may also mention the improved lending to businesses that were contained in last week’s money supply report. He may be asked about the nomination of Spain’s finance minister to succeed Constancio as his deputy. The ECB is reportedly going to make a formal statement at some juncture. Draghi has noted that the ECB is an independent entity and it will remain so. |

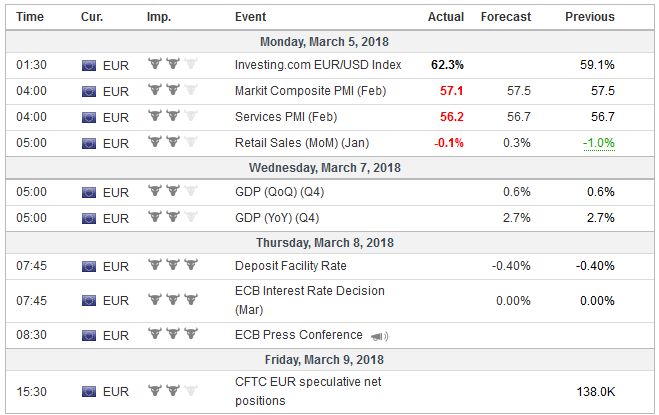

Economic Events: Eurozone, Week March 05 |

United StatesMeanwhile, the market is as confident as it can get about a 25 bp rate hike by the Federal Reserve later this month. The US employment data set the general tone for the monthly cycle of high-frequency real sector data. The labor market is robust. Weekly jobless claims and the four-week moving average are at new cyclical lows. The consensus calls for a little more than a net 200k increase in non-farm payrolls, little changed from the January increase. The US grew an average of 181k jobs a month in 2017. The 12-month average peaked in the cycle three years ago near 260k. In January the 12-month average stood at 176k. The recent averages are above the longer averages, meaning that there has been an acceleration in hiring lately. On the other hand, the average hourly earnings are watched as a key measure of wage pressure, which is understood to drive core inflation. The 0.3% in January for a year-over-year rate of 2.9%, the most since 2009, became part of the fuel that lifted inflation expectations and encouraged the closing of the gap between the three hikes the Fed envisions and what the market had been discounting. The issue for households, investors, and policymakers is whether wage growth has accelerated. We agree with Fed Chair Powell’s assessment that they probably haven’t, which seem consistent with other data on labor compensation. There is much month-to-month volatility, but long-run moving averages are considerably more stable, and both the 12- and 24-month averages are for monthly gains of around 0.2%. A 0.2% print for February would bring the year-over-year rate to 2.8%. The average workweek unexpectedly fell to 34.3 hours in January from 34.5 in December. We dismiss this as a bit of a statistical quirk and expect it to return to its longer-run average of 34.4 hours. At least three regional Federal Reserve banks publish GDP trackers. The Atlanta and the St. Louis Fed models have Q1 growth at 3.5% and 3.4% respectively. The NY Fed’s model is a bit lower at 3.0%. All three see an acceleration in Q1, bucking the recent curse of disappointing starts to the year. |

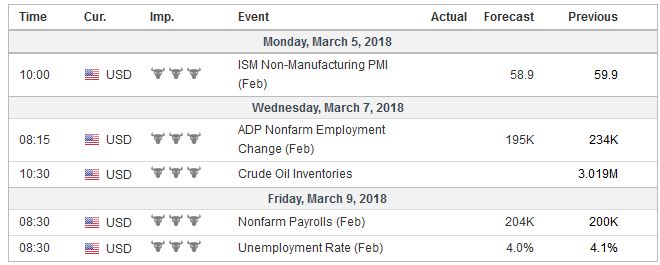

Economic Events: United States, Week March 05 |

Switzerland |

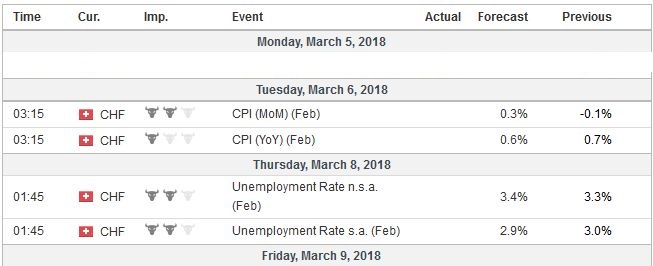

Economic Events: Switzerland, Week March 05 |

Full story here Are you the author? Previous post See more for Next post

Tags: Bank of Canada,Bank of Japan,ECB,jobs,newslettersent,RBA,Trade