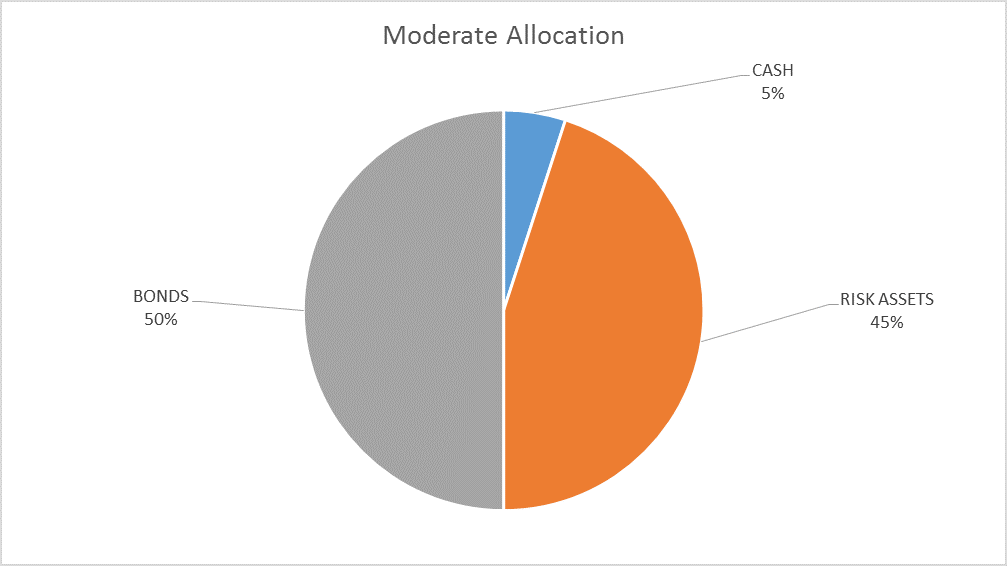

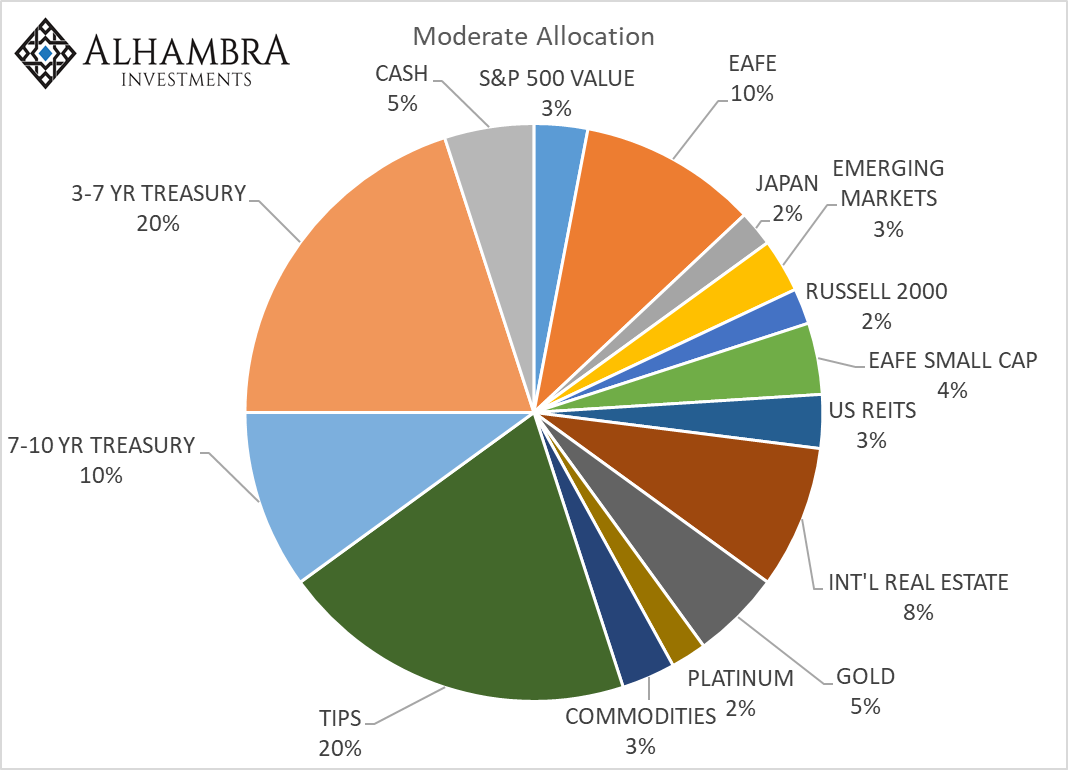

| There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. The extreme overbought condition of the US stock market persists so I will continue to hold a modest amount of cash. There are some minor changes within the portfolios but the overall allocation is unchanged. | |

| There have been two major developments since our last asset allocation update. First, the Fed raised rates at its December meeting and the Fed funds rate target is now 1.25 – 1.5%. Second, Republicans finally managed to pass the tax reform package, cutting both corporate and personal income taxes. The effect of both events on markets was…not much. Of course, both events were well anticipated so it may be that the impact was already factored into market prices but considering the market action before the two events, one wonders if the real reason markets didn’t move is that neither action really accomplishes all that much.

The Fed rate hike was, as all Fed actions are these days, well telegraphed. I do not agree with the Fed’s communication policies, least of all the modern method of preparing markets in advance for policy changes. Call me old fashioned but I think we were better off when we had to watch the Dow Jones newswire after an FOMC meeting to see if the open market desk entered the market, signaling a change in policy. The idea that central banks shouldn’t surprise markets is based on a false premise, namely that market volatility should be avoided. It is ironic indeed that Janet Yellen once said Hyman Minsky’s writings should be required reading and she now oversees a policy regime almost perfectly suited to creating a Minsky moment. Tamping down volatility for this extended period of time gives speculators the confidence to engage in, well, speculation. And there is no doubt that speculation is rampant in the global economy. Everyone knows about the recent purchase of an alleged Da Vinci painting for nearly a cool half billion dollars. But that is merely the latest example from the art world. The previous record for a painting sold at auction was in 2015 for one of the 15 versions of Picasso’s “Les Femmes d’Alger”, the gavel falling at $180 million. Let’s see 15 times 180…. Frankly, I was more shocked by the sale of a Twombly for $46 million at the same auction that produced the Da Vinci sale. Seriously? At a youthful 12 years old the paint is barely dry on Cy’s squiggles. Bitcoin is a product of the same speculative tilt to the global economy, a token that entitles you to exactly nothing of value. Yeah, yeah, I’ve heard about the revolutionary (how does one sneer in print?) blockchain technology that underlies Bitcoin and other cryptocurrencies. In fact, I’ve spent numerous hours reading detailed research on the topic and have yet to find a problem for which it is the ideal solution. Indeed, I haven’t come up with anything for which it is a better solution than what currently exists. But the price moves and speculators can dance to it so I give it a 10 Mr. Clark. There are other examples of speculation such as some European junk bonds trading at yields so low that no company should ever have to suffer the indignity of bankruptcy but for pure entertainment value you can’t beat Jesus coin. From the ICO:

Okay, it hasn’t raised a lot of money (a couple hundred thousand dollars if their website can be believed) and maybe it is just coincidence that there’s a movie out right now about P.T. Barnum, but the fact that it has raised even one nickel is enough to convince me that people have completely lost their frigging minds. And it isn’t the only joke coin ICO this year to attract real money. With this as context does anyone believe that the Fed raising the Fed funds rate – a market that basically doesn’t exist anymore – to 1.5% will do anything to deter this Those same liberal economists have nothing good to say about the more traditional trickle down tax reform bill passed by the Republican Congress. While it too attempts to address the growth issue by putting more money in wealthy people’s pockets at least it does so in an honest, open way. I don’t think it will have a lot of impact on the economy and I worry about the harm of larger deficits – evidence says that if it pays for itself it won’t be while this Congress is around – but it does try to go more directly at the problem. Our economic issues are myriad but a big one is the lack of productivity growth that is a result of reduced investment over the last decade and half. The reform of corporate taxes attempts to address this by putting cash in the hands of companies to make those investments and providing them with incentives to do so. Unfortunately, I don’t think it was a lack of cash holding back investment and so have my doubts as to whether it will solve the problem. And as long as the Fed is ready to ride to the rescue of speculators everywhere, it will be hard to get people to stop doing easy things like speculating on Jesus coin and doing hard things like building companies. Having said that, I don’t really try to figure these things out in advance. There are way too many moving parts to the modern global economy to even begin to figure out how this legislation will impact growth or inflation. All you supposedly free market types out there who think you know – or Kevin Hasset knows – this will raise growth to 3 or 4% need to take a break and go re-read Hayek’s Nobel Prize acceptance speech, The Pretence of Knowledge. Tax reform may indeed “cultivate a growth by providing the appropriate environment” but it is hardly assured and certainly can’t be calculated in advance. So far, the market impact of both these policy changes, as I said above, has been minimal. Yes, stocks continue to make new highs but Tesla has a lot more in common these days with that Twombly painting than anything Ben Graham would have bought. Same goes for Facebook, Alphabet, Amazon and so many others where beauty and stock price are in the eye of the beholder, completely subjective. Bond and currency markets have not embraced tax reform to nearly the same degree and in the case of the dollar, apparently not at all. Let’s take a look at our market indicators and see if we need to make any changes to our portfolio. Yield CurveThe yield curve continued to flatten since the last update a month ago, down another 8 basis points. We monitor the yield curve in hopes of identifying the onset of recession and while the current flattening points to lower growth – yes, even after tax reform passed – it doesn’t point to recession yet. Assuming of course that the curve actually does get to completely flat before recession something not assured but based on the Fed’s timid quarter point steps toward that Minsky moment is still likely. |

US Treasury Constant Maturity, 2002 - 2017 |

Credit SpreadsCredit spreads confirm the speculative nature of this market with spreads narrowing 12 basis points over the last month. Spreads are still above the narrowest of the cycle though and may be tracing out a rounding bottom. Spreads are like the canary in the coal mine for the stock market, widening associated with almost every correction and bear market. But right now? No indication of anything other than a healthy appetite for risk. |

US BofA Merrill Lynch High Yield Option, Jan 2004 - 2018 |

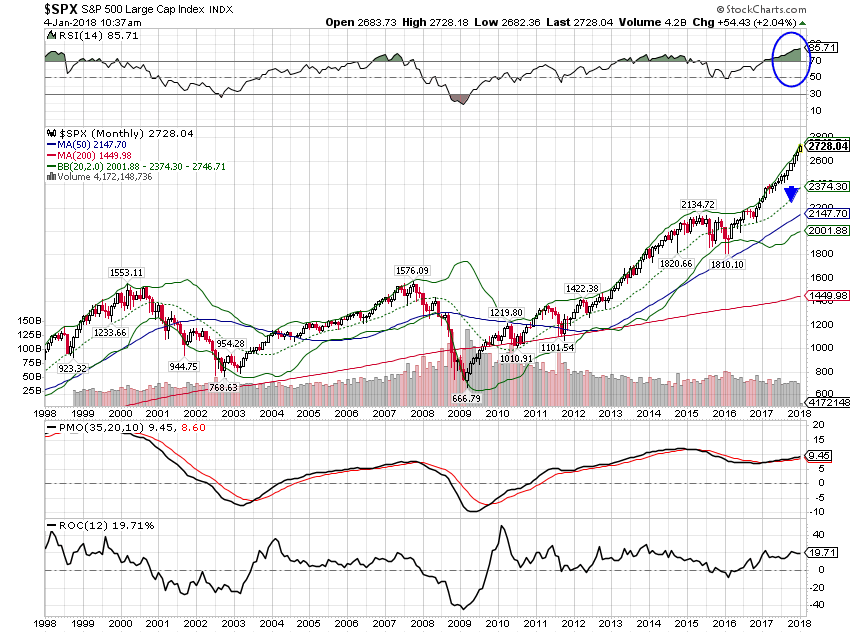

ValuationsOne is tempted to assume that valuations just improved with tax reform. After all, companies will be keeping more of their hard earned earnings, right? That’s harder to answer than it seems. Have you heard about all the companies offering their workers those one time, headline grabbing $1000 bonuses in thanks for tax reform? How much will that cost them? What about rising minimum wages that kicked in with the new year? How much will that raise wage costs? What about companies that were paying a lower effective rate because of some loophole that just got closed? The effective rate on the S&P 500 was only a couple of percent higher than the new statutory rate anyway. So, the effect of corporate tax reform, at least on the big averages, is probably a small positive but mostly distributional. Valuations were already so high it will make little difference unless much higher growth emerges. It is still true that foreign stocks are cheaper than their US counterparts. Emerging markets are cheapest and Japan is still cheap. Europe, though is getting rather pricey and growth expectations seem a tad optimistic. Nothing in Europe gets done quickly and that certainly includes economic reform. But the more important factor for these markets is the dollar. As long as the dollar falls, foreign markets will likely outperform. More on that below. MomentumThe S&P 500 remains extremely overbought with RSI readings higher than anytime since the great dot com bubble of the late 90s. As I pointed out a couple of months ago, that isn’t necessarily bad. The last time we had a reading this high was actually in 1996 so it obviously isn’t an impediment to further gains. But valuations today are actually higher than they were then so I’m not sure the two periods are comparable. Could this stock market just keep going up with no corrections for another couple of years as it did back then? I find that hard to believe but I won’t rule it out either. I had thought that we would get some kind of pullback after the passage of tax reform but obviously I was wrong. The question now is what should we do about it? Do we chase the market higher? I don’t think that is prudent so I’ll wait another month and see where we are. Our cash position is just 5% so it isn’t much of a drag and we don’t have any exposure to the full S&P 500 anyway. |

S&P 500 Large Cap Index, 1998 - 2018(see more posts on S&P 500 Large Cap Index, ) |

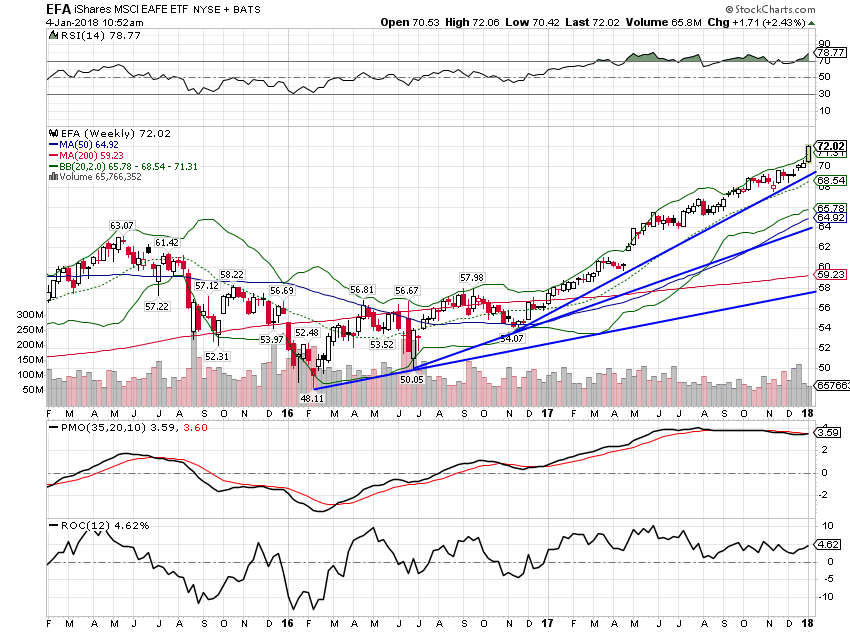

| More important for our portfolios is the trend of foreign stocks. EFA is our largest stock position and is trending very steadily higher. it has been accelerating to the upside since mid-2016 and especially since the dollar started to fall. |

EFA Weekly, Feb 2015 - Dec 2017 |

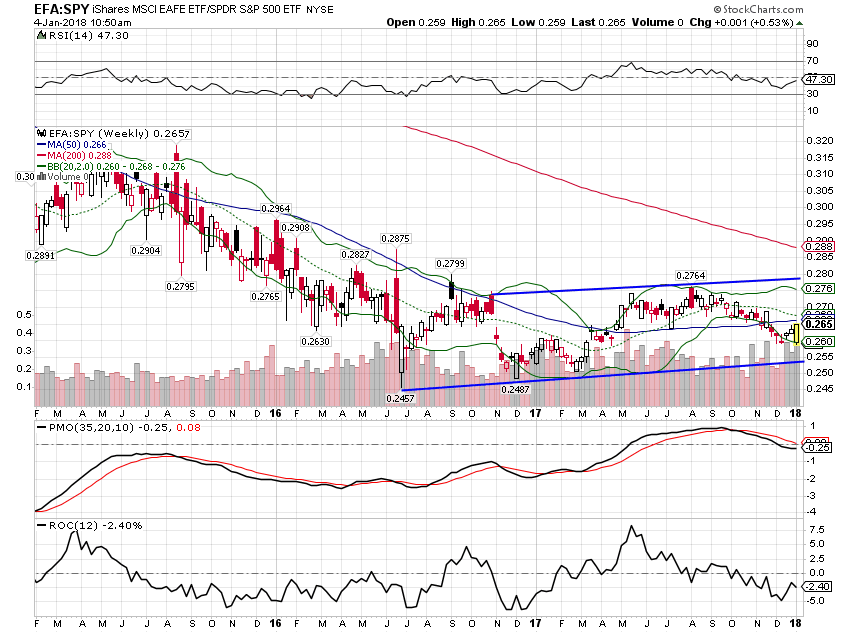

| EFA has also been trending higher – at a much slower rate – versus the S&P 500 since mid-2016. After lagging the second half of 2017, the trend is reasserting itself as the dollar resumes its downtrend in the new year. |

EFA:SPY Weekly, Feb 2015 - Dec 2017 |

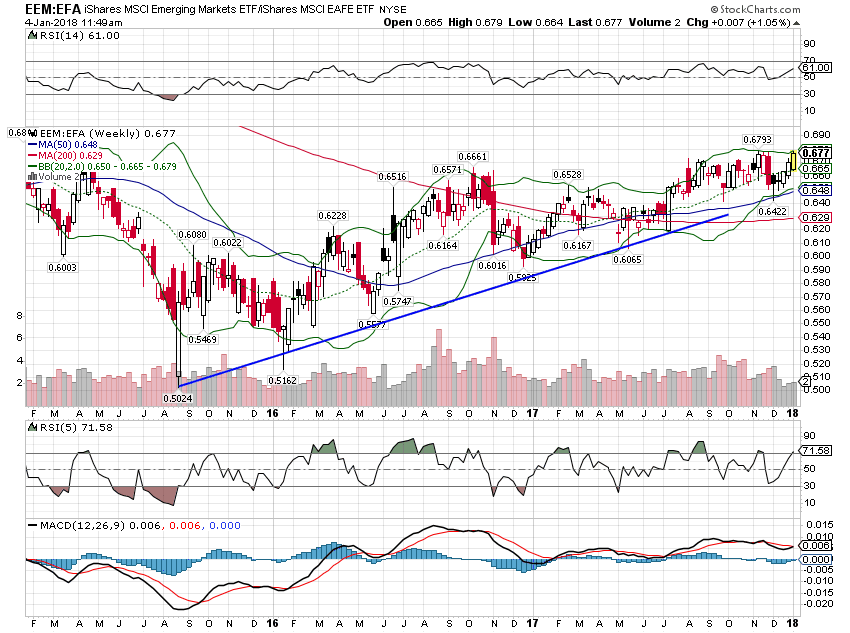

| Emerging market stocks (EEM) are maintaining their momentum versus EFA as well. |

EEM:EFA, Feb 2015 - Dec 2017 |

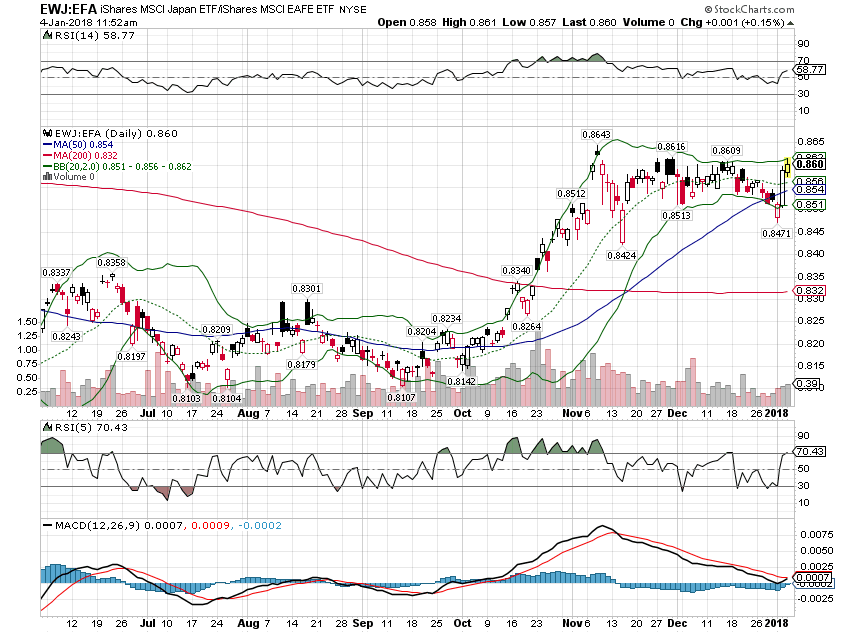

| Japan is resuming its outperformance of EFA: |

EWJ:EFA Daily, Jul - Dec 2017 |

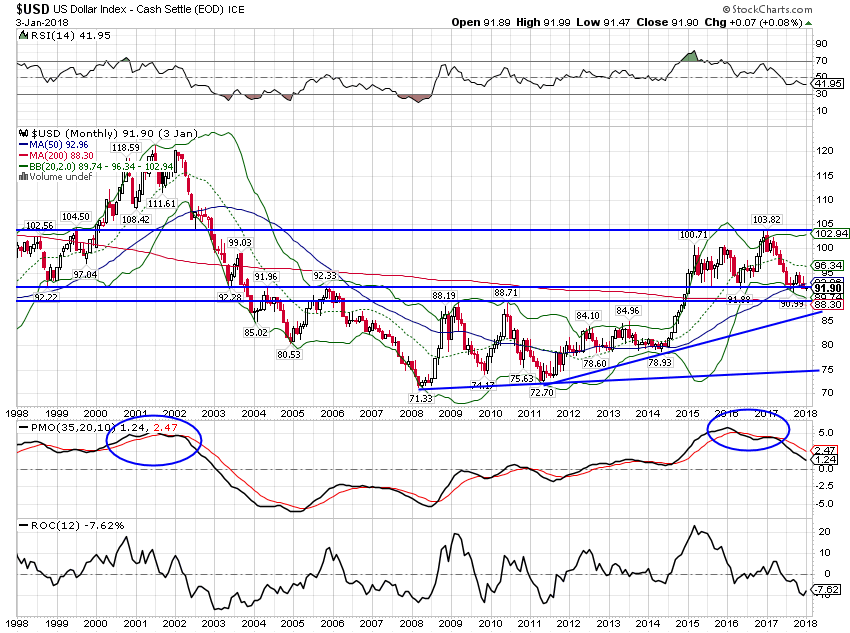

| The foreign market outperformance is being driven by the falling dollar. The dollar in turn is being driven by the changing perceptions of growth between the US and the rest of the world. Europe’s economy in particular is perceived as accelerating at a rate faster than the US. The Trump administration’s desire for a weak dollar is also well known and their rhetoric on trade certainly doesn’t help the greenback. A weak dollar is one of the main reasons I see little impact from the tax bill. Tax cuts and a weak dollar are not a good combination as we found out in the Bush administration. The US needs to attract capital and a weak dollar policy just makes that more difficult.

The dollar trend has resumed in earnest since the beginning of the new year but sentiment is not nearly as lopsided as it was a year ago. Dollar bulls are much scarcer now while everyone seems to like the Euro. The Yen is still disliked but economic performance there has definitely improved so we’ll see if that lasts. For now, I think the weak dollar is likely to continue with that uptrend line in the mid to high 80s a likely bounce point. |

US Dollar Index, 1998 - 2018(see more posts on U.S. Dollar Index, ) |

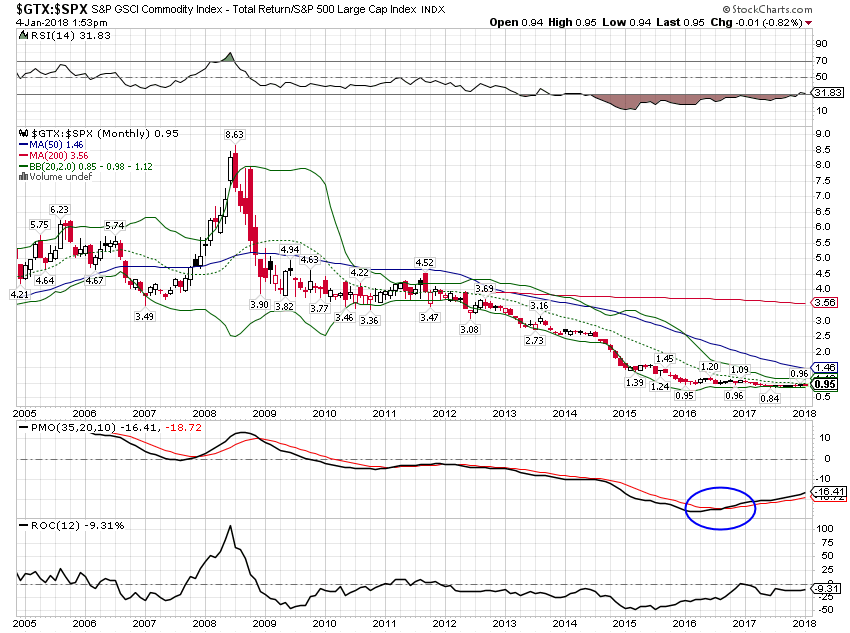

| The weak dollar has also supported commodity prices and momentum continues to shift slowly from stocks to commodities. |

GTX:SPY Monthly, 2005 - 2018 |

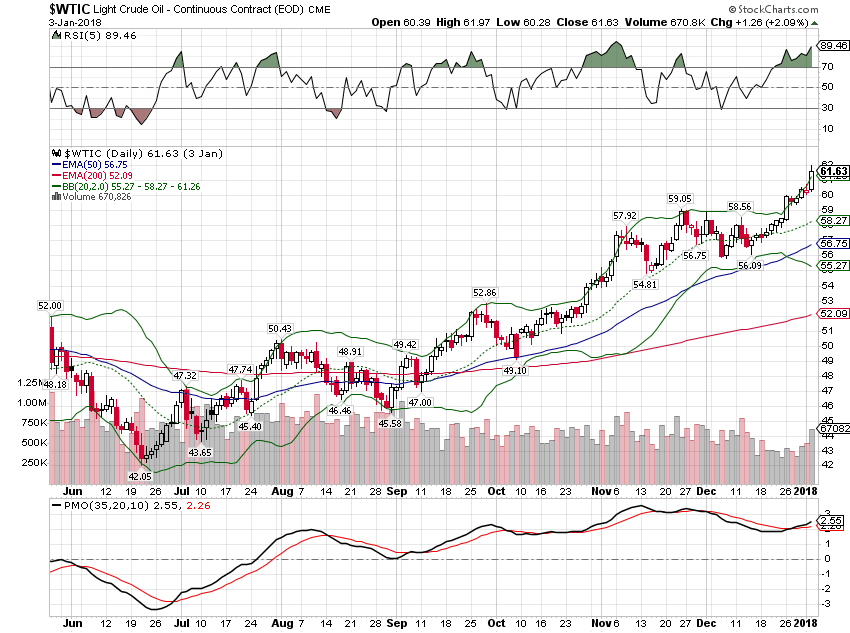

| Commodities outperformed the S&P 500 in the second half of 2017, mostly a product of rising oil prices: |

Light Crude Oil Daily, Jun - Dec 2017 |

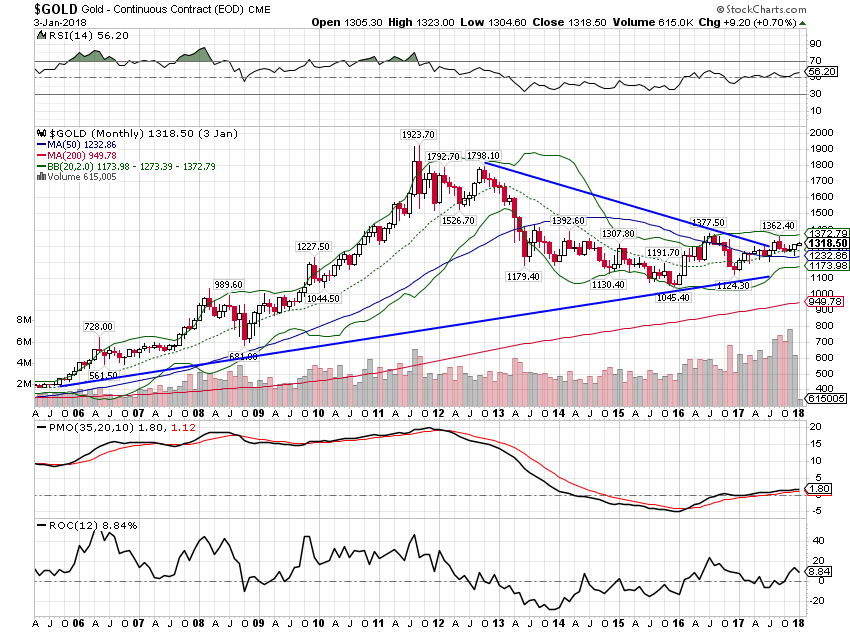

| Gold has also performed well in the weak dollar environment and long term momentum is still positive: |

Gold Monthly, Aug 2005 - Jan 2018 |

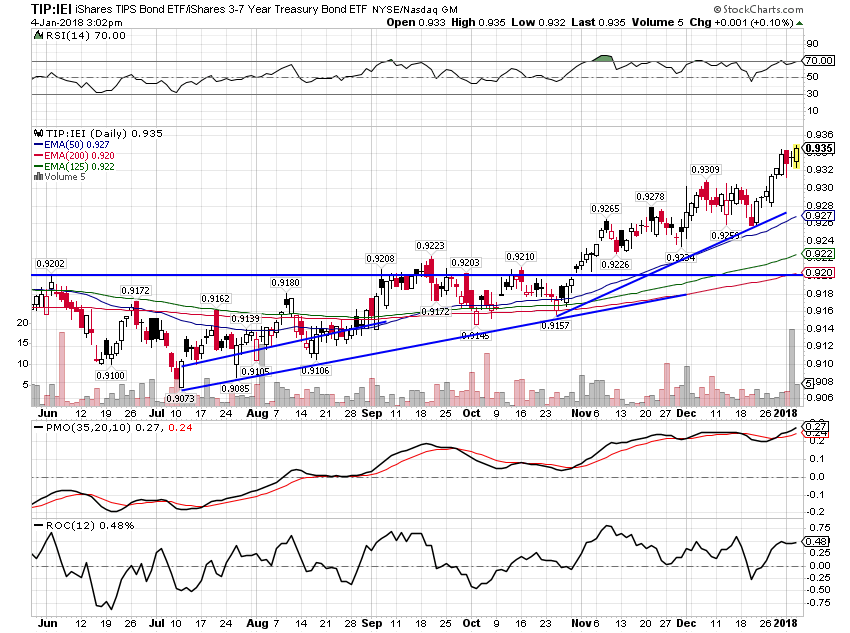

| In bonds, TIP continues to outperform intermediate Treasuries (IEI): |

TIP:IEI, Jun - Dec 2018 |

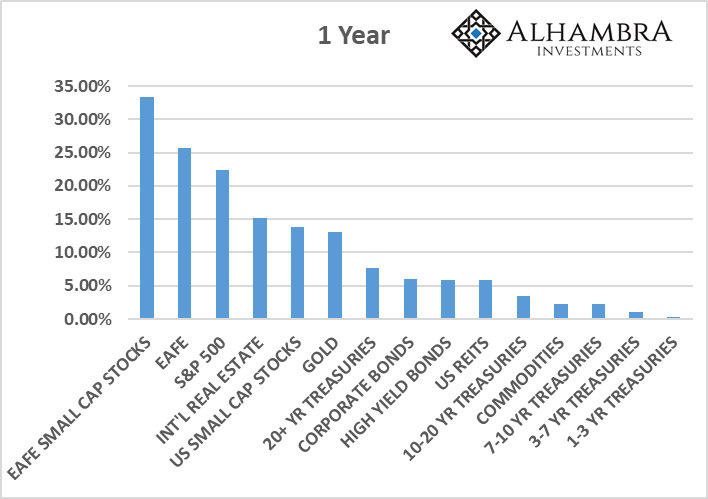

| In broad market brush strokes, the last year saw the largest gains in foreign stocks, followed by US stocks, International Real Estate and gold. The best performing part of the bond market were long term Treasuries contrary to all expectations at the beginning of last year. | |

Portfolio ChangesThe changes this month are minor and do not affect the overall allocation.

The new allocation: |

Tags: Alhambra Research,Bitcoin,commodities,credit spreads,Crude Oil,Cryptocurrencies,eafe,Emerging Markets,Global Asset Allocation Update,Gold,Interest rates,Markets,momentum,Monetary Policy,newslettersent,S&P 500,S&P 500 Large Cap Index,tax reform,TIPS,U.S. Dollar Index,US dollar,valuations,Yield Curve