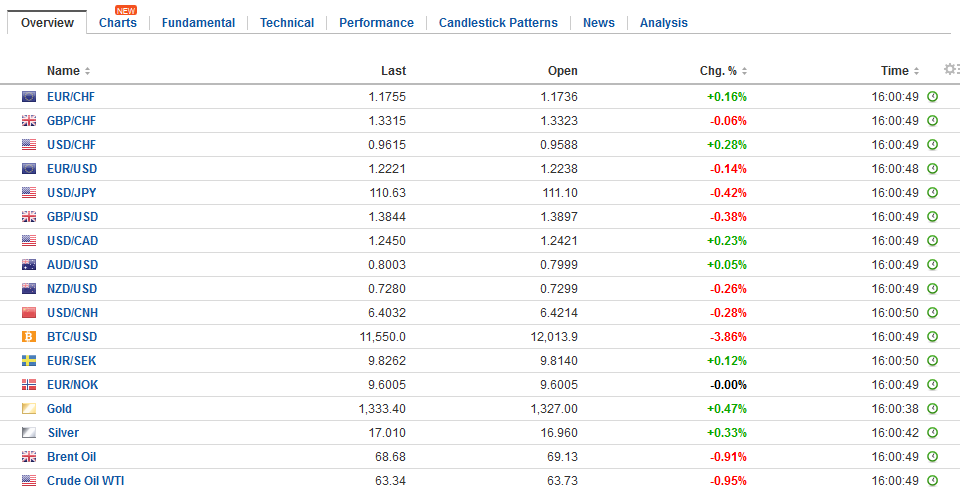

Swiss FrancThe Euro has risen by 0.23% to 1.1759 CHF. |

EUR/CHF and USD/CHF, January 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe US dollar is broadly lower as the momentum feeds on itself. Asia is leading the way. The Japanese yen, Taiwanese dollar, Malaysian Ringgit, and South Korean won are all around 0.45% higher. Asian shares also managed to shrug off the weakness seen in the US yesterday. The MSCI Asia Pacific Index advanced 0.7%. It is the sixth consecutive weekly gain. The dollar’s drop comes as US yields reach levels now seen in year. The 10-year yield is at its highest level seen 2014, while yields from bills to three-year paper are at their highest level since 2008. The risk of a US government shutdown beginning tomorrow may be providing the latest fodder for the dollar’s sell-off. The Dollar Index is set to post its fifth consecutive weekly loss, the longest drop since April-May 2015. The House of Representatives voted to extend the spending authorization for a month (Feb 16), but the Senate is balking. The Democrats in the Senate, whose votes are needed, unlike tax cuts, Many Democrats in the Senate want a deal on the adults that were brought by their families illegally as children. |

FX Daily Rates, January 19 |

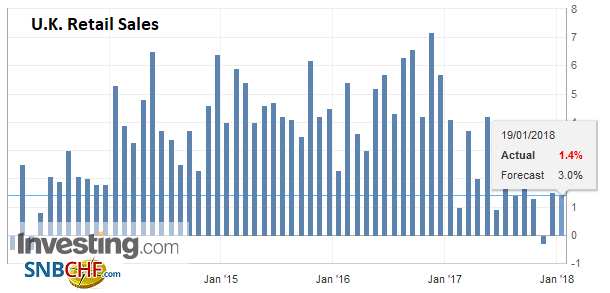

| The dollar bears have not only pushed aside the rise in US interest rates but also economic data that suggests the US economy accelerated in Q4 17 (initial estimate will be reported next week). In addition, even disappointment, like the UK’s retail sales report today, has failed to stem the greenback’s slide. December retail sales fell a sharp 1.5%, the latest drop since mid-2016, and 1.6% excluding gasoline. The median expectation was for a 1.0% decline after a strong 1.1% and 1.2% rise respectively. Those November gains were revised lower by 0.1%. Household goods purchases fell 5.3%, while clothing was off 1%. The average monthly change in Q4 was zero, after 0.2% in Q3 and 0.4% in Q2.

Sterling softened on the news, but only after it made a new high since the UK referendum (~$1.3945) and it remained above $1.39. It has not had a losing session against the dollar since January 1. This is the third week it is rising on a trade-weighted basis as well. The euro is knocking on $1.24 after having fallen to $1.2165 yesterday. The high from the middle of the week was nearly $1.2325. European assets markets are firm. The Dow Jones Stoxx 600 is up 0.45%, showing resilience in the face of yesterday’s losses in North American. It is up in each of the three weeks of the new year. European bonds are mixed, but the peripheral yields are two-three basis points lower. Italy is lagging a bit, as the March election deters some investors. |

FX Performance, January 19 |

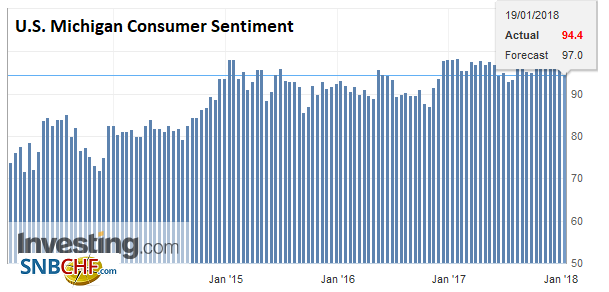

United StatesThe North American session features the University of Michigan’s consumer sentiment survey. Given the rising market-based measures of inflation expectations are rising, it is of some interest if the survey detects the same development. The two-year breakeven is a little more than 1.8%, while the 10-year breakeven is near 2.10%. The Fed’s speech calendar includes Bostic on the economy in US morning, while Quarles speaks on bank regulation early afternoon. Separately, San Francisco President Williams is a candidate for Vice Chair, joining Lindsey and El-Erian among the candidates cited in the press. Canada reports manufacturing sales, and international security transactions. |

U.S. Michigan Consumer Sentiment, Jan 2018(see more posts on U.S. Michigan Consumer Sentiment, ) Source: Investing.com - Click to enlarge |

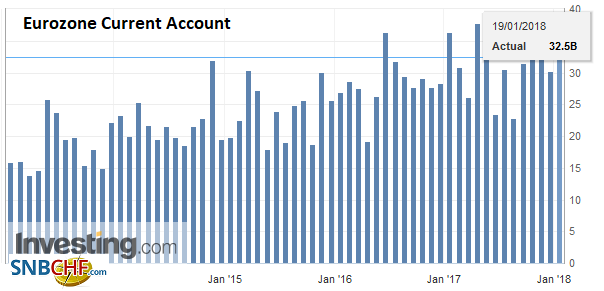

Eurozone |

Eurozone Current Account, Nov 2017(see more posts on Eurozone Current Account, ) Source: Investing.com - Click to enlarge |

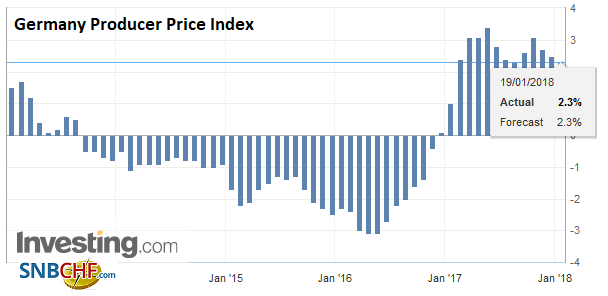

Germany |

Germany Producer Price Index (PPI) YoY, Dec 2017(see more posts on Germany Producer Price Index, ) Source: Investing.com - Click to enlarge |

United Kingdom |

U.K. Retail Sales YoY, Dec 2017(see more posts on U.K. Retail Sales, ) Source: Investing.com - Click to enlarge |

Meanwhile, the hunt for yield, and the prospects that Fitch upgrades Spain today (currently BBB+) has encouraged the narrowing of the Spanish premium over Germany. The 10-year premium is moving below 90 bp for the first time since 2010. The outperformance of Spain is taking place despite the still unresolved Catalan-Madrid tensions.

The dollar rose to a five-day high against the yen yesterday near JPY111.50 but has been sold today to JPY110.50. The low seen earlier this week (~JPY110.25) represented a four-month low, and a 61.8% retracement of the greenback’s rally from early September through early November (~JPY110.25). The yen is the weakest of the majors this week, rising about 0.35%.

Sterling is the strongest of the majors this week, rallying 1.3%, but the Australian dollar is a close second with a 1.25% gain. The Aussie finished the North American session yesterday just above $0.8000 and is extending those gains today. The Canadian dollar, in contrast, is up about a third of one percent, despite the Bank of Canada’s rate hike. Typically, we find that in a move against the US dollar, the Canadian dollar often underperforms on the crosses.

The MSCI Emerging Market Index is advancing another 0.4% after a similar rise in both last two sessions. It is rising for the sixth consecutive session and the sixth consecutive week. Firm world growth and subdued inflation appears to be helping to sustain the appetite for risk.

Graphs and additional information on Swiss Franc by the snbchf team.

Are you the author? Previous post See more for Next postTags: #GBP,$AUD,$CAD,$EUR,$JPY,$TLT,EUR/CHF,Eurozone Current Account,Germany Producer Price Index,newslettersent,U.K. Retail Sales,U.S. Michigan Consumer Sentiment,USD/CHF