| At its December meeting, the Swiss National Bank (SNB) left its accommodative monetary policy unchanged. More specifically, the SNB maintained the target range for the three-month Libor at between – 1.25% and-0.25% and the interest rate on sight deposits at a record low of – 0.75%. The SNB also reiterated its commitment to intervene in the foreign exchange market if needed, taking into account the “overall currency situation”. The central bank’s assessment of the Swiss franc remained unchanged from its previous meeting in September, stating that it continued to see the Swiss Franc as “highly valued” and the situation on foreign exchange markets as still fragile.

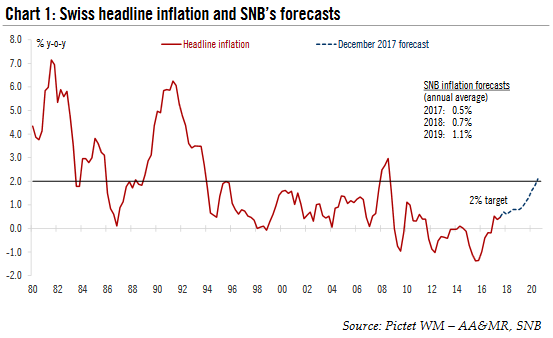

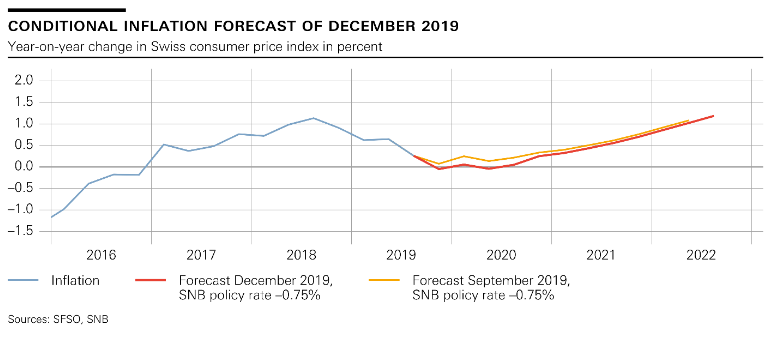

The SNB published an update of its forecasts for inflation and GDP growth.The conditional inflation forecast for 2017 has been raised to 0.5%, up from 0.4%. For 2018, the SNB anticipates inflation of 0.7%, up from its forecast of 0.4% in September. For 2019, the SNB continues to expect an average inflation of 1.1% (Pictet PWM’s own forecast is for +0.5% headline inflation in 2017, +1.0% in 2018). Importantly, the last data point (Q3 2020) was fixed at 2.1%, above SNB’s definition of price stability of “a rise in the CPI of less than 2% per annum”. This represents a first cautious step to prepare markets for policy normalisation.The SNB maintained its forecast for the Swiss economy to grow by close 1.0% in 2017 and now sees Swiss economy growing at around 2.0% in 2018 (Pictet PWM’s forecast is for 1.0% GDP growth in 2017 and 2.0% in 2018). |

Swiss Headline Inflation and SNB's Forecast, 1980 - 2017 |

|

Overall, the SNB’s monetary policy assessment reflected an improvement in the outlook since its September meeting. Domestic activity is recovering after disappointing in H1 2017 and Swiss exporters will continue to benefit from good global demand. More importantly, growth is broadening across sectors, with the machinery, electronics, metal and watch-making industries starting to grab a greater share of export growth. On the more negative side, the SNB again pointed out financial stability risks, in particular in residential property segment.

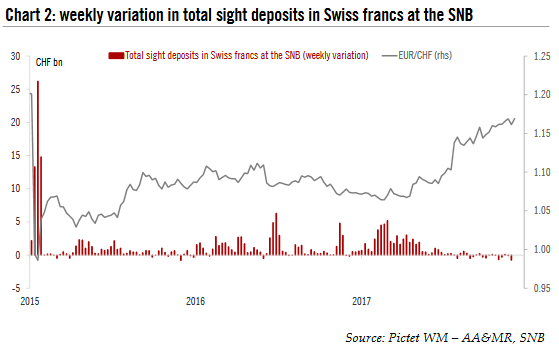

A window of opportunity to hike once in 2018The SNB is likely to remain cautious and true to its current ‘two -pillar’ strategy (negative interest rates and a commitment to intervene in the FX market if needed). The franc’s decline this summer gave some relief to the SNB. Variations in total sight deposits at the SNB (a proxy used to gauge the central bank’s interventions) suggest that it has not intervened in the FX market since July (see Chart 2). Thanks to currency depreciation and the good performance of financial markets, the central bank posted record profits in Q3 2017.

|

Total Sight Deposits in Swiss Francs at the SNB, 2015 - 2017 |

Tags: Macroview,newslettersent,SNB monetary policy,Swiss monetary policy