Swiss National Bank leaves expansionary monetary policy unchanged

The Swiss National Bank is keeping the SNB policy rate and interest on sight deposits at the SNB at −0.75%. It remains willing to intervene in the foreign exchange market as necessary, while taking the overall currency situation into consideration. The expansionary monetary policy continues to be necessary given the inflation outlook in Switzerland.

The trade-weighted exchange rate of the Swiss franc is practically unchanged compared with September 2019. The franc thus remains highly valued, and the situation on the foreign exchange market is still fragile. Negative interest and the willingness to intervene counteract the attractiveness of Swiss franc investments and thus ease the upward pressure on the currency. In this way, the SNB stabilises price developments and supports economic activity.

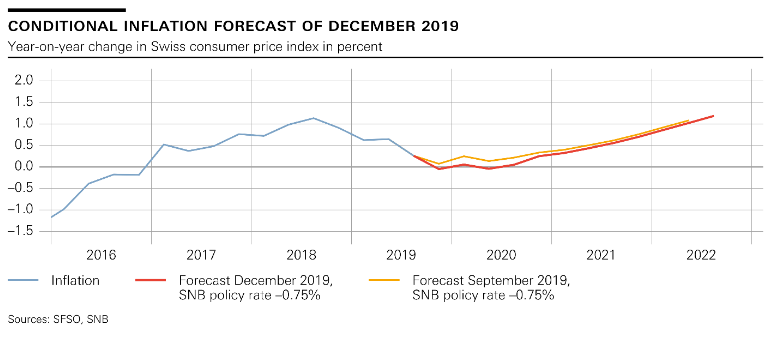

| The new conditional inflation forecast for the coming quarters is slightly lower than in September. The longer-term forecast is virtually unchanged. For 2019 the forecast stands at 0.4%, for 2020 at 0.1% and for 2021 at 0.5%. The conditional inflation forecast is based on the assumption that the SNB policy rate remains at –0.75% over the entire forecast horizon.

International trade tensions and political uncertainty have weighed on the global economy in recent months. Accordingly, economic growth around the world was again slightly below average in the third quarter. The increase in manufacturing output was modest in many countries, this being accompanied by subdued capital spending and lacklustre global trade in goods. Various central banks eased their monetary policy in the autumn in light of modest inflation and the economic risks. Moreover, they signalled that they would probably leave their policy rates at a low level for an extended period of time. The SNB is maintaining its existing baseline scenario for the global economy, and expects momentum to remain modest over the short term. The monetary policy easing is likely to contribute to the economy – and thus also inflation – picking up again over the medium term. Risks to the global economy remain tilted to the downside. Chief among them are still trade tensions and the possibility of the persisting weakness in manufacturing activity spreading to the economy as a whole. |

Conditional Inflation Forecast, December 2019 Source: snb.ch - Click to enlarge |

| According to the initial estimate, the Swiss economy grew by 1.6% in the third quarter. This growth was primarily driven by manufacturing, where value added increased significantly thanks to strong growth in the exports of pharmaceutical products. The other industries in the manufacturing sector recorded a more modest expansion, in line with the slowdown in manufacturing worldwide. The labour market continues to be a mainstay of the economy. Employment figures rose again slightly, and the unemployment rate persisted at a low level through to November.

GDP is likely to expand by around 1% in 2019, and the SNB expects growth of between 1.5% and 2% in 2020. The stronger expansion next year reflects the gradual firming expected in global economic activity as well as an exceptional effect. The latter stems from the fact that the forecast includes the revenue generated by major international sporting events, which is likely to increase growth by around half a percentage point. Imbalances persist on the mortgage and real estate markets. Both mortgage lending and prices for single-family homes and privately owned apartments continued to rise slightly in recent quarters, while prices in the residential investment property segment stagnated. Nevertheless, due to the strong price increases in recent years and growing vacancy rates there is the risk of a correction in this segment in particular. The SNB therefore welcomes the latest revision of the self-regulation guidelines for banks in the area of investment properties, which enters into force in January 2020. The SNB will continue to monitor developments on the mortgage and real estate markets closely, and will regularly reassess the need for an adjustment of the countercyclical capital buffer. |

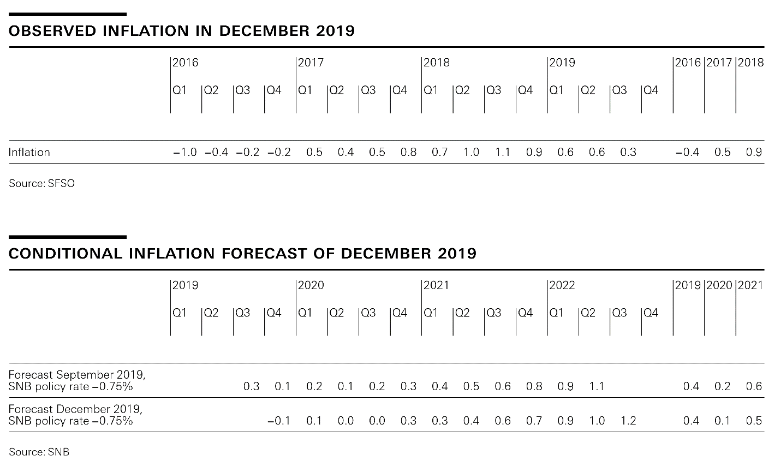

Observed Inflation, December 2019 Source: snb.ch - Click to enlarge |

Tags: newsletter,SNB monetary policy