|

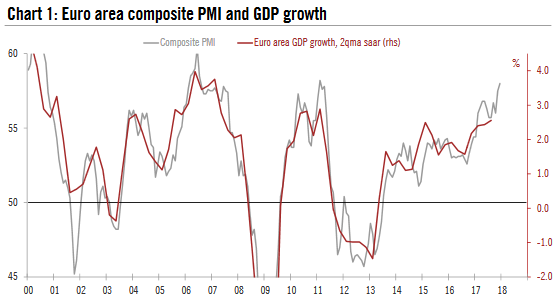

Momentum in the euro area picked up further at the end of the year. The flash composite purchasing managers’ index (PMI) increased to 58.0 in December, from 57.5 in November, above consensus expectations (57.2). The improvement was once again broad-based across sectors. Both the manufacturing (+0.5 to 60.6) and services (+0.3 to 56.5) indices improved in December, with the former reaching its highest level since the series began in 1997. The breakdown by sub-indices was pretty strong, with new orders and output rising strongly across both sectors. Job creation stayed at the highest for just over 17 years. However,there were continued reports of capacity constraints. Average delivery times lengthened to an extent not seen since May 2000 and backlogs rose especially sharply. Overall, today’s PMIs point to further acceleration in euro area growth at the end of the year (see Chart 1). Q4 (57.2) average composite PMI was higher than Q3 (56.0) and the highest since Q1 2011(57.6). As a result, Markit noted that the PMIs were now consistent with real GDP growth of 0.8% q-o-q in Q4 (up from 0.6% in Q3). We maintain our euro area GDP growth forecast unchanged at 2.3% in 2017 and 2.3% in 2018. We continue to see a very gradual slowdown in the sequence of quarterly GDP growth rates, to around 2% by end-2018, as the result of less favourable tailwinds (global growth) as well as some modest headwinds (tighter financial conditions). |

PMI Headline Indices |

|

Regarding price dynamics, price pressures abated somewhat in December. Markit noted that “although price pressures abated, the robust growth of demand and tightening labour market hint at rising core inflationary pressure as we move through 2018”.

|

Eurozone Composite PMI and GDP, 2000 - 2017(see more posts on Eurozone Composite PMI, Eurozone Gross Domestic Product, ) |

In Germany, the flash composite PMI index rose to 58.7 in December, from 57.3 in November, above consensus expectations (57.2) and reaching its highest level since April 2011. The increase was driven by both services (+ 1.5 to 55.8) and manufacturing (+ 0.8 to 63.3) , with the latter reaching a record high. “This was partly thanks to another steep rise in the level of goods export orders, with firms reporting higher intakes from Asia, the US and elsewhere in Europe”, according to Markit.

All in all, surveys suggest that the German economy is currently witnessing one of its strongest cyclical recoveries on record. Composite PMI is now consistent with a GDP growth of 1.0% q-o-q in Q4 (up from 0.8% in Q3).

In France, although the flash composite PMI decreased to 60.0 in December from 60.3 in November, this was above consensus expectations (59.6). The marginal dip was led by the services sector (-1.0 to 59.4), while the manufacturing index rebounded (+1.5 to 59.3), hitting its highest level since September 2000. The breakdown by sub-indices showed particularly encouraging numbers for the manufacturing sector.

All in all, PMIs continued to signal strong growth in the private sector. French composite PMI is now consistent with a GDP growth of 0.7-0.8% q-o-q in Q4 (up from 0.5% in Q3).

Outside the two largest euro area countries, Markit noted that “growth lagged behind France and Germany on average, though it continued to run at one of the fastest rates seen since the global financial crisis.”

Full story here Are you the author? Previous post See more for Next postTags: euro area growth,Eurozone Composite PMI,Eurozone Gross Domestic Product,Macroview,newslettersent