| I believe 2018 will be the year inflation arrives.

The reason, as I’ve noted throughout mid-2017, is that multiple Central Banks, particularly the European Central Bank (ECB), Bank of Japan (BoJ) and Swiss National Bank (SNB) have maintained emergency levels of QE and money printing, despite the fact that globally the economy is performing relatively well. All told, in 2017 alone, these Central Banks will printed over a $1.5 trillion in new money and funneled it into the financial system. This is an all-time record, representing even more money printing than what took place in 2008 when the whole world was in the grips of the worst crisis in 80 years! And it has finally unleashed the much sought after inflation. Around the world, inflationary data are breaking out to the upside. Producer prices are soaring in the EU, Japan, China and the US. |

Producer Price Indexes, Dec 2000 - 2017(see more posts on China Producer Price Index, Eurozone Producer Price Index, Japan Producer Price Index, U.S. Producer Price Index, ) |

| H/T Jeroen Blokland

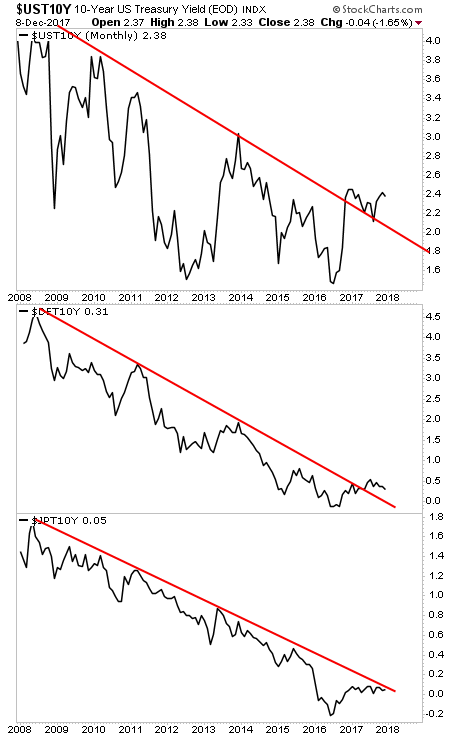

Why does this matter? Because the $199 TRILLION Bond Bubble trades based on inflation. When inflation rises, so do bond yields to compensate. When bond yields rise, bond prices FALL.. And when bond prices fall, this massive bubble, which I call The Everything Bubble bursts. This process has already begun. Around the world, bond yields are spiking to the upside as the bond market adjusts to the threat of future inflation. |

10 Year US Treasury Yield, 2008 - 2017(see more posts on U.S. Treasuries, ) |

Full story here Are you the author? Previous post See more for Next post

Tags: Bank of Japan,Bond,Business,central banks,China,China Producer Price Index,Economic bubble,economy,European central bank,European Union,Eurozone Producer Price Index,inflation,Japan,Japan Producer Price Index,Macroeconomics,money,newslettersent,Quantitative Easing,Swiss National Bank,U.S. Producer Price Index,U.S. Treasuries