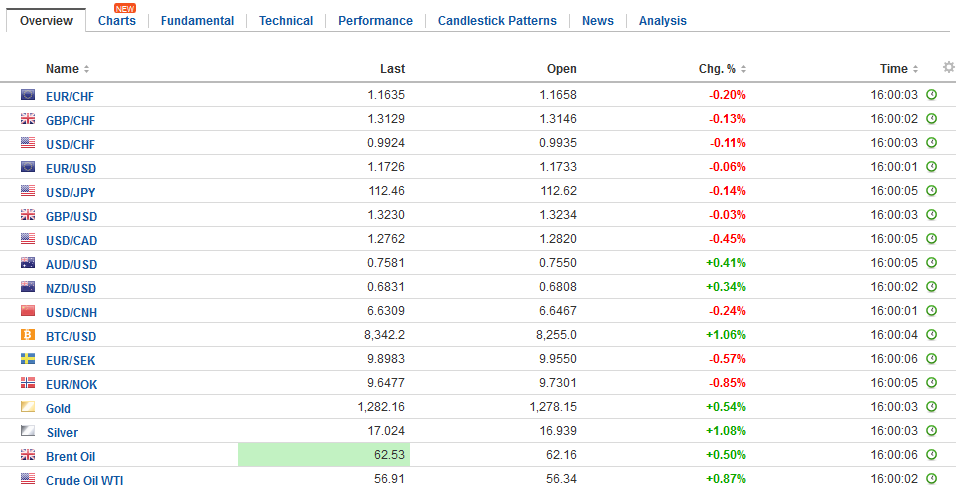

Swiss FrancThe Euro has fallen by 0.17% to 1.1635 CHF. |

EUR/CHF and USD/CHF, November 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

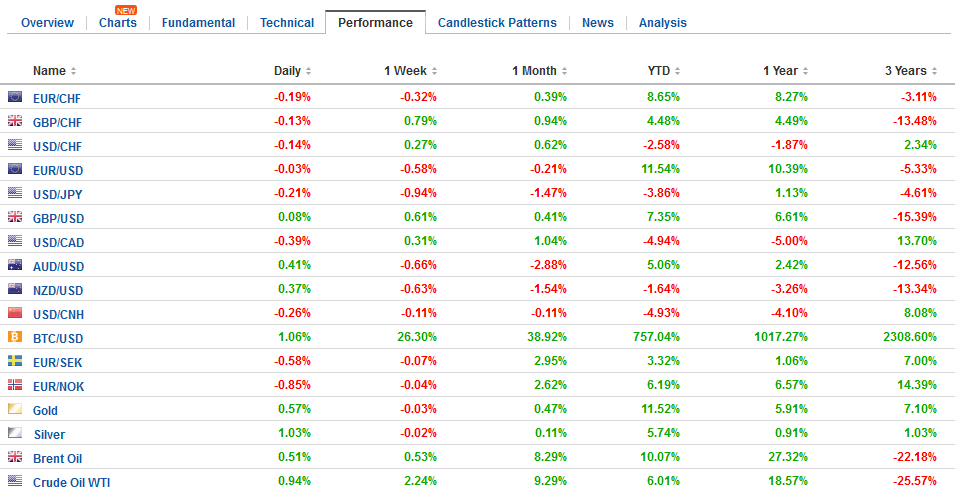

FX RatesThere are a couple of exceptions to the inside trading days. First, the dovish twist to the minutes from the Reserve Bank of Australia’s recent meeting saw the Australian dollar make a marginal new five-month low of almost $0.7530 before rebounding smartly to push above yesterday’s high. A close above $0.7575 would be constructive. Investors seemed to latch out to the RBA’s disappointment with the weak wage growth and increased competitive pressure in retailing as restraining prices. However, Governor Lowe’s comment that although there is no strong case for a near-term adjustment in policy, the next move is likely appeared to spark the recovery. With the daily technical indicators stretched, we had anticipated that a new low would not be sustained. The euro was sold in early Europe, and marginal new lows were recorded (~$1.1715). However, the single currency snapped back quickly. Initial resistance is seen near $1.1760. German politics remains the chief talking point. The German President is sounding out the different parties to see if there is a possibility of a coalition. Initial surveys suggest Merkel is in tune with the public in preferring new elections to a minority government. Both of these options are unusual for modern Germany. We suspect talk of the end of Merkel’s tenure is greater exaggerated. Survey suggest Merkel’s CDU will remain the largest party, and within the CDU, there does not appear to be a compelling alternative. At first, it seemed that a minority government would be preferable to new elections. The fear seemed to be that new elections would see the AfD bolstered, but the initial poll suggests this is not the case. The FDP is seen as a somewhat irresponsible and may suffer on its leader’s gamble. The Greens appear to have won a few new supporters. |

FX Daily Rates, November 21 |

| Investors do not seem to think that the unsettled political scene is a threat to the stability of economic performance of Germany. The DAX gapped lower yesterday and quickly filled the gap to close 0.5% higher. It is extending those gains today to trade at a five-day high. Technically, we see immediate scope for another 0.5-1.0% gain.

The euro may be helped by some cross rate gains. Concern about house prices and weak interbank rates continue to weigh on the Swedish krona. The euro surged above SEK10.0 for the first time since last November. We note that the three-month interbank rate Sweden fell to a record low yesterday. Ironically, while the Swedish krona is the weakest of the major currencies today, the Norwegian krone is battling the Aussie for the top position, and this is despite the fact that three-month interbank rates also fell to record lows yesterday. Sterling is in narrow ranges in the upper end of yesterday’s ranges. The government borrowing in October was a little more than expected, but this was offset by the downward revision to the September borrowing. The market is looking toward tomorrow’s autumn budget announcement by Hammond and tracking the latest developments over Brexit. Reports suggest the UK Cabinet supported Prime Minister May doubling its initial financial offer. Other reports suggest she will accept that after Brexit, EU citizens in the UK will be protected by the European Court of Justice. |

FX Performance, November 21 |

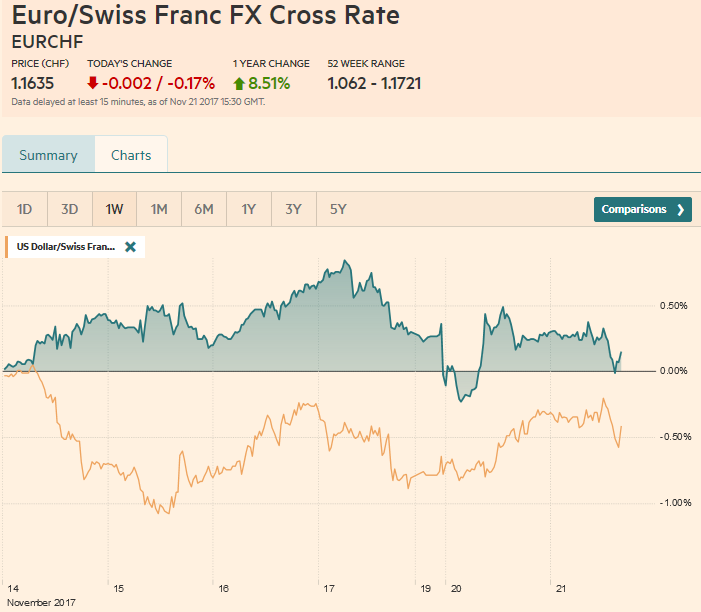

United StatesThe US dollar has largely been confined to yesterday’s trading ranges against the major currencies amid light news. The North American session does not hold much hope for fresh impetus. The US reports October existing home sales, which are not typically market moving in the best of times. Yellen does not speak until after the markets close, and even then is unlikely to sway expectations, which have priced in a rate hike next month. |

U.S. Existing Home Sales, Oct 2017(see more posts on U.S. Existing Home Sales, ) Source: Investing.com - Click to enlarge |

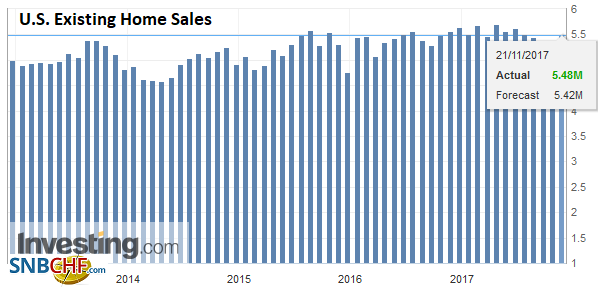

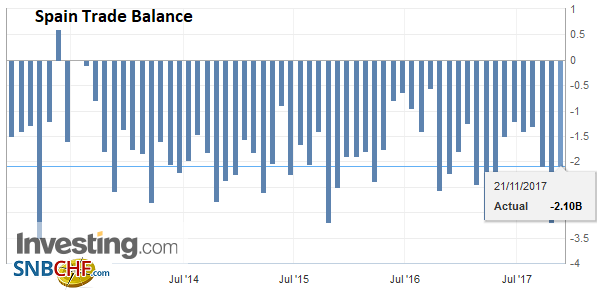

Spain |

Spain Trade Balance, Oct 2017(see more posts on Spain Trade Balance, ) Source: Investing.com - Click to enlarge |

There were no reports of fresh proposals about the Irish border. There is some thought that if the UK offers progress on the EU citizen’s rights and its financial obligation, the Irish border issue could be kicked down to be addressed within a new trade agreement. That seems to be a gamble, and such gambles based on looking for a room to “divide and conquer” have not been particularly successful in the Brexit negotiations. Initial support is pegged near $1.3220, and nearby resistance is near $1.3270.

The US dollar has toyed the CAD1.2820 area, which is important from a technical vantage point. It rose to almost CAD1.2840 in early European turnover. It ran into a wall of offers and reversed lower. There is a $1.5 bln option that expires today struck at CAD1.2750 than could come into play.

After slipping yesterday, the MSCI Asia Pacific Index recovered 0.9% today. Equity markets in Hong Kong, Taiwan, and Singapore advanced by more than 1%. Hong Kong’s Enterprise Index (H-shares) advanced nearly 3%, led by real estate and financials. European shares are also moving higher. The Dow Jones Stoxx 600 is up about 0.3%. Energy and information technology are leading the advance. Telecoms sector is the only one in the read and maybe a knock-on effect on the US Justice Department seeking to block the ATT-Time Warner merger.

Ten-year benchmark yields are softer by 2-4 bp in Europe. The 10-year US Treasury yield is paring yesterday’s increase, but at 2.35% is still a basis point above last week’s closing levels and sits on the five-day average. Oil prices are firm, helped perhaps by speculation that US oil stocks may have fallen for the first time in three weeks (EIA estimate tomorrow). Next week (November 30) OPEC is expected to agree to extend output cuts.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$CAD,$EUR,EUR/CHF,newslettersent,SEK,Spain Trade Balance,U.S. Existing Home Sales,USD/CHF