Princeton University economist Alan Krueger recently published and presented his paper for Brookings on the opioid crisis and its genesis. Having been declared a national emergency, there are as many economic as well as health issues related to the tragedy. Economists especially those at the Federal Reserve are keen to see this drug abuse as socio-demographic in nature so as to be absolved from failing in their primary task should it be found instead a macro concern. Tortured souls all around.

Dr. Krueger, an economist well-known for his work on minimum wage effects, reports that he had received partial funding for his study from the Federal Reserve Bank of Boston. It shouldn’t really matter but in this case it really seems as if it might.

The paper is itself quite comprehensive and sympathetic. It reports that almost half of men who are of prime working age but not officially part of the labor force take pain medication on a daily basis. This is an outright astonishing finding, though, unfortunately, not at all surprising. The issue of opioid abuse is clearly more than government noise.

But as to causation? In other words, is the opioid epidemic to blame for depressed labor participation, or is it the depressed economy that depresses labor participation leaving far, far too many especially males to seek escape?

Prime age men who are out of the labor force report that they experience notably low levels of emotional well-being throughout their days and that they derive relatively little meaning from their daily activities.

Though it starts out in this fashion, the paper and its 81 pages of text and statistics trends predictably the other way.

Labor force participation has fallen more in areas where relatively more opioid pain medication is prescribed, causing the problem of depressed labor force participation and the opioid crisis to become intertwined.

Dr. Krueger uses something of a statistical jog to make the case that the problem is structural and long predates the monetary events from 2007 forward. Decompressing data by county, he finds that the often vast differences in prescribing tendencies within the medical profession are a prime candidate. Don’t blame the Fed, the doctors have done this.

There is a clear regional pattern to opioid prescription rates and drug overdoses. The average quantity of opioids prescribed per capita varies by a factor of 31 to one in the top 10 percent of counties relative to the bottom ten percent of counties, according to CDC data. Across states, per capita prescription rates vary by a factor of three to one. The CDC argues that, “Health issues that cause people pain do not vary much from place to place, and do not explain this variability in prescribing.”

| All of that may be true, and very likely is. Prescription abuse is one of the most striking aspects of the crisis. But it is also misleading to focus on only that part, especially in the context of the post-crisis era. The clear spike in opioid overdose deaths since 2010 has little or nothing to do with prescriptions directly. |

US Overdose Deaths Involving Opioids, 2000 - 2015 |

On its website, a significant section of it dedicated to just opioids, the Centers for Disease Control and Prevention (CDC) show clearly that it is heroin and fentanyl that have been ravaging communities during the “recovery.” These are not prescribed medications, as a December 2016 CDC report spells out:

There is as yet no consensus as to why heroin and fentanyl use has skyrocketed, as have deaths from their abuse. Some believe it is tied to stricter supply of prescription opioids, as the medical profession has sought to reform its ways. Thus, this thinking goes, the doctors got the men hooked on pain killers and then started to restrict and remove the legal options for them, leaving the afflicted to illegal substitutes. It’s entirely possible, of course, but not even Dr. Krueger is as convinced as it may seem reading the whole of his argument. In conclusion he writes:

Even if prescribing rates were the primary medical pathology for the crisis, it still isn’t settled as to whether there are legitimate macro issues which pushed primarily unemployed males to seek out doctors in the first place. Their continued use in illegal substitutes thereafter, however, is not on its own a compelling argument for the hypothesis. |

US Overdose Deaths Involving Opioids, 2000 - 2015 |

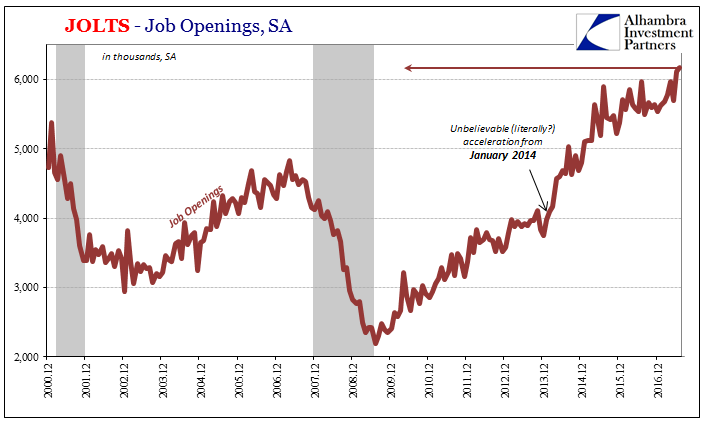

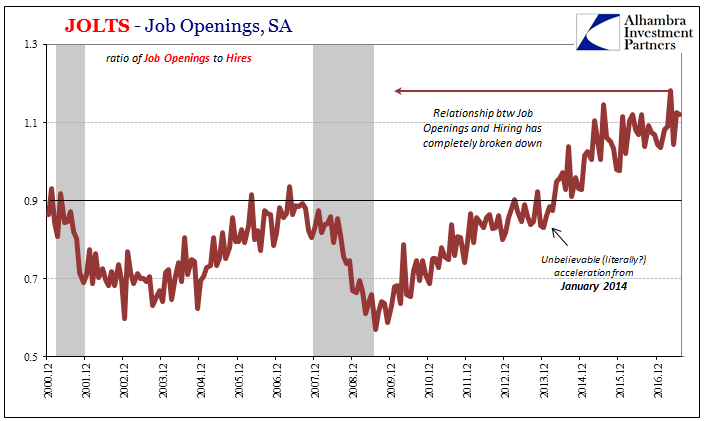

| What is becoming consensus is that the sharp spike in opioid problems coincides with the labor problem one side or the other. It may be, and in my view surely is, that final proof rests with other labor statistics.Regardless of cause, if a shortage exists the price of labor would be skyrocketing. That is more than Economics, it is basic economics that requires no special training in regressions or funding from branch central banks. If the demand for labor is robust but the supply of it impaired significantly, there can be no other result. |

US Job Openings, Dec 2000 - 2016 |

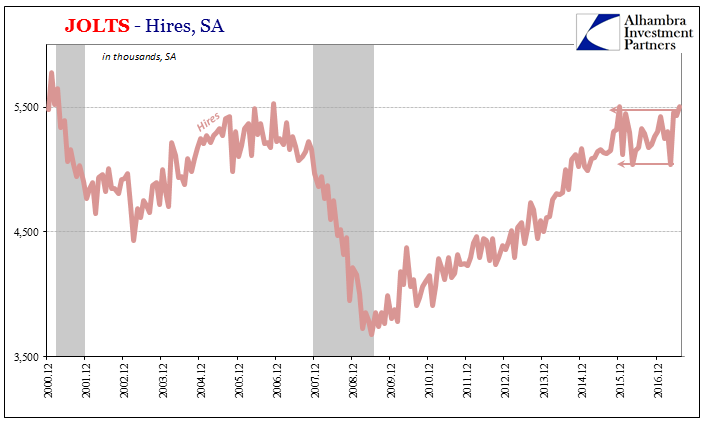

| The Bureau of Labor Statistics reports today that the level of Job Openings being advertised in July 2017 was at a new record high. At a seasonally-adjusted rate of 6.17 million, it does appear as if there is robust and rising demand for workers consistent with an economy that wants to be good or even great. The rate of Hires, on the other hand, continues instead to be quite subdued. Though up for the month of July, at 5.5 million that level hasn’t really moved much since 2015. |

US Hires, Dec 2000 - 2016 |

| It doesn’t really fit the prescription angle for the opioid crisis, does it? The rate of Hires in particular didn’t truly break from the level of Job Openings until 2014. Why would the labor shortage, at least as presented here in JOLTS, seem more related to the “rising dollar?” |

US Job Openings, Dec 2000 - 2016 |

| The answer is almost certainly how a sluggish recovery became even more sluggish as a result of a global monetary problem. The slowdown in Hires is perfectly consistent (in timing, intensity, and direction) with the slowdown in labor and income as a result. Estimates for Job Openings are entirely uncorroborated by anything else. |

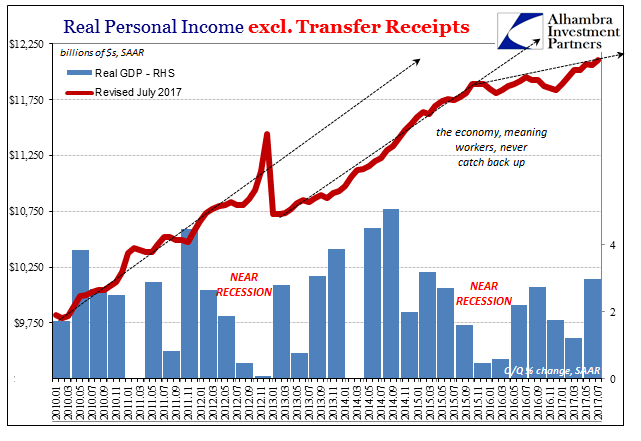

US Real Personal Income, Jan 2010 - Jul 2017(see more posts on U.S. Personal Income, ) |

| The catalog of evidence against the labor shortage, of course, includes every other piece of labor market data available (including several competing estimates of Job Openings). |

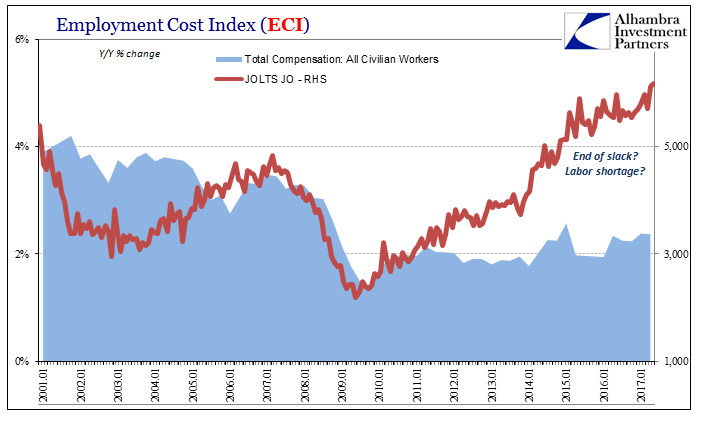

US Employment Cost Index, Jan 2001 - 2017(see more posts on U.S. Employment Change, ) |

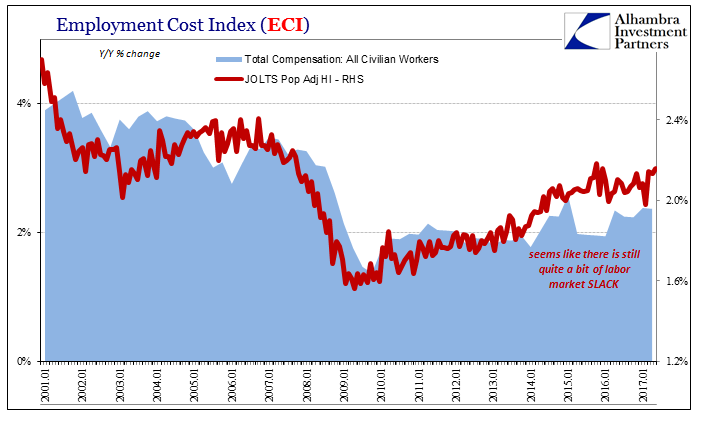

| There is no acceleration in wages or income that would suggest the start of a shortage let alone one several years in the extreme. |

US Employment Cost Index, Jan 2001 - 2017(see more posts on U.S. Employment Change, ) |

| If your view is that the economy would be robust if not for prescription abuse, and the primary evidence for it being these few data points suggesting there is robust but unmet demand for labor, then it can only be the wrong case. In other words, there isn’t the slightest hint apart from Job Openings that labor demand is even that good. The level of wage and income growth is instead consistent with reduced supply!

That would further suggest that the economy shrunk and has remained that way ever since 2008. The drug problem cannot be the cause but the effect. |

Corporate Cash Flow/Monetary Noose, Jan 1985 - 2017, US Two Labor Stories, Jan 1985 - 2017, US Retail Sales, Jan 1992 - 2017(see more posts on U.S. Retail Sales, ) |

Whatever structural economic issues may have predated the crisis, they were almost surely amplified immensely by it, most especially the lack of recovery. Whether prescription or not, the opioid crisis bears all the hallmarks of escapism from an economy that doesn’t work, stripped of its natural opportunities that were once taken for granted (I could insert market interpretations of things like eurodollar futures, German bunds, or the oddly close relationship between the UST curve and its JGB counterpart; all signifying similarly that money-related markets believe as these unfortunate Americans outside of the official labor force there is little to no economic opportunity available for money or workers).If monetary issues caused the crisis, and they clearly did, and monetary issues strangled the recovery, of the two more (so far) that followed, then monetary officials would have a lot to answer for in more than failed QE’s and ZIRP, maybe also heroin and fentanyl. A labor shortage would be convenient for that effort, but it just isn’t true.

Tags: currencies,economy,EuroDollar,Federal Reserve,Federal Reserve/Monetary Policy,hires,income,job openings,jolts,labor shortage,Markets,newslettersent,secular stagnation,U.S. Employment Change,U.S. Personal Income,U.S. Retail Sales,wages