| The University of Michigan reports that consumer confidence in September slipped a little from August. Their Index of Consumer Sentiment registered 95.3 in the latest month, down from 96.8 in the prior one. Both of those readings are in line with confidence estimates going back to early 2014 when consumer sentiment supposedly surged. |

University of Michigan Consumer Confidence, Jan 1997 - 2017(see more posts on University Of Michigan, ) |

| During that same period, however, consumer spending has been noticeably weak instead. Not long after confidence was believed to have jumped during that year, the “rising dollar” economy began to take its toll on consumers. As noted earlier today, retail sales have not really been at a strong level in more than five years, with all signs pointing to another weak year still. |

US Retail Sales, Jun 2011 - Aug 2017(see more posts on U.S. Retail Sales, ) |

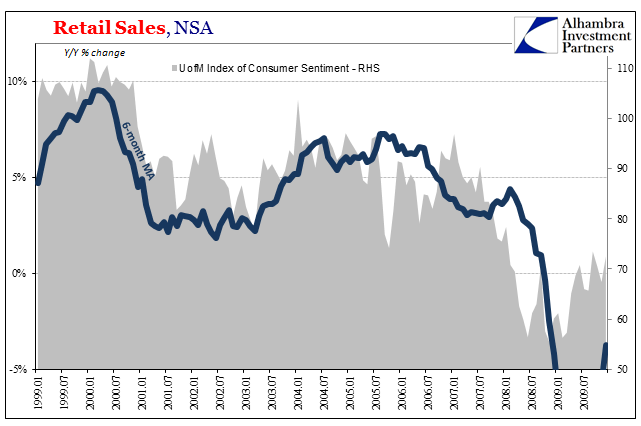

| Economists closely watch sentiment for what used to be strong correlation with spending. This disparity is relatively new, not that any of the sentiment indices fit perfectly with data like retail sales. In the prior business cycle, which was actually a business cycle, there was at least a very similar outline in timing and trend between measured spending and confidence. |

US Retail Sales, Jan 1999 - Jul 2007(see more posts on U.S. Retail Sales, ) |

| You can really appreciate the correlation much better taking out the individual monthly retail sales estimates, leaving their 6-month average to be quite consistent with U of M’s consumer sentiment index. |

US Retail Sales, Jan 1999 - Jul 2009(see more posts on U.S. Retail Sales, ) |

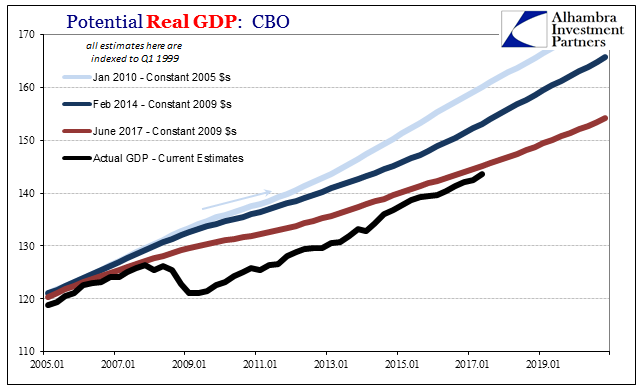

| Why are Americans spending less but feeling better, relatively, about it? The answer to that question may have a lot to do with economic potential as it really may be. |

US Confidence & Potential, Feb 2007 - Jun 2017 |

| Retail sales have been weak for five years and more now, but again confidence has come up despite that. Instead, the track of consumer sentiment matches pretty closely the significantly downgraded level of economic potential. |

US Gross Domestic Product, Jan 2005 - 2019(see more posts on U.S. Gross Domestic Product, ) |

I don’t mean to suggest that consumers are incessantly watching for GDP numbers and figuring their relationship to whatever counts as potential. Instead, it suggests something like normalization and acceptance of all that is wrong. Americans may simply be getting used to this economy as it is, low, uneven growth and all. They are being conditioned for this pathetic state as “potential”, maybe coming to view it like economists as good as it gets.

If this is actually the case, it would represent a serious structural problem. It’s not quite like a self-fulfilling prophecy where if you expect and are happy with low growth that is what you’ll get, but there are possible spillover effects from something like that – liquidity preferences and risk perceptions, for example, that might, too, normalize to a world without growth and therefore make it that much harder to actually get out of this mess should the monetary system ever be properly addressed. If you believe the economy can only be bad, you might find it very hard to believe (not without good reason, of course, given the last ten years) when conditions are actually right for it to start being good.

We can’t quite draw solid if sordid conclusions from this yet, but the suggestion is there especially in the disparity between spending and sentiment. There are other factors involved, too, as I don’t want to make it sound as if this could be the only explanation, or the one that is most comprehensive. Still, it should be kept in mind when thinking about why the economy can’t seem to grow anymore, and how, ultimately, to get it to do so down the road.

Tags: cbo,Consumer Sentiment,consumer spending,currencies,economic potential,economy,Federal Reserve/Monetary Policy,Markets,newslettersent,Output Gap,Retail sales,U.S. Gross Domestic Product,U.S. Retail Sales,University Of Michigan