| – “Going off gold did the opposite of what many people think” – FT Alphaville – “Surprising” findings show benefits of Gold Standard – Study by former Obama advisor in 1999 and speech by Bank of England economist in 2017 make case for gold – UK economy was ‘much less prone to extremes’ under than the gold standard – research shows – ‘Gold standard seems to have produced fewer catastrophes for Britain’ – data shows – FT still wary of gold standard arguing ‘stability can be overrated and growth is worth having’ – Finding is not surprising and joins a wealth of evidence and research that shows gold’s importance as money, a store of value and safe haven asset |

300 years ago last week on the 21st September, 1717 Sir Isaac Newton, Master of the Royal Mint of Great Britain, accidentally invented the gold standard.

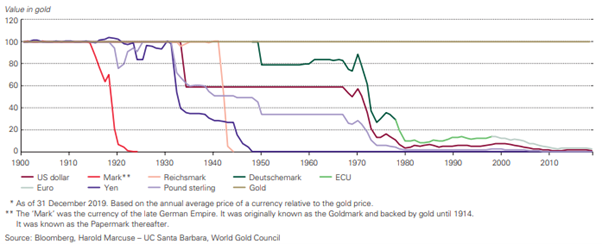

Last month it was the 46th anniversary of President Nixon ending the gold standard. Since then the world has existed on a system of fiat paper and digital currency. It works so badly that it has lead to the global financial crisis, unending debt issues and a dramatic devaluation in sovereign currencies.

Despite this, much of the media and central banking system remain supporters of the current financial and monetary status quo.

They are so convinced that the time before fiat money was a disaster that anyone who suggests otherwise is labelled a gold-bug and told to move along.

Last week, there was a glimmer of light when the Financial Times’ Matthew C. Klein uncovered some 18-year old research into the gold standard and a recent speech by a Bank of England economist.

Mr Klein although a young man has quite an impressive journalistic c.v. He writes for FT Alphaville and Bloomberg View about the economy and financial markets.

He previously wrote for the Economist magazine and before that, Klein was a research associate at the Council on Foreign Relations (CFR), where he spent more than two years studying the history of the Federal Reserve and the intellectual history of monetary economics.

Going off gold did the opposite of what many people think

Klein writing in FT Alphaville draws on research from former economics advisor to President Obama, Christina Romer:

Imagine you can choose between living in two kinds of societies:

- Dynamic world prone to wild swings and big crashes, but ultimately more growth in the long run

- Safe and stable world with greater consistency, less volatility, and much lower risk of catastrophe

You might think that Americans and Europeans effectively decided to move from option 1 to option 2 between the late 19th and mid-20th centuries. Depending on your politics, you might attribute this to the stultification of modernity, or the triumph of the enlightened welfare state.

Regardless, you would be wrong.

The growth of government as a service provider and guarantor of financial security — backed by fiat money — has actually coincided with faster trend growth and greatervariance around that trend line. Moreover, the likelihood of particularly bad events has increased since the escape from the “golden fetters”.

Klein refers to this and subsequent information from Romer as ‘surprising findings’. They are not likely suprising to Klein but would be too many FT readers given its generally negative stance towards gold in recent years.

| The gold standard: Reduced volatility

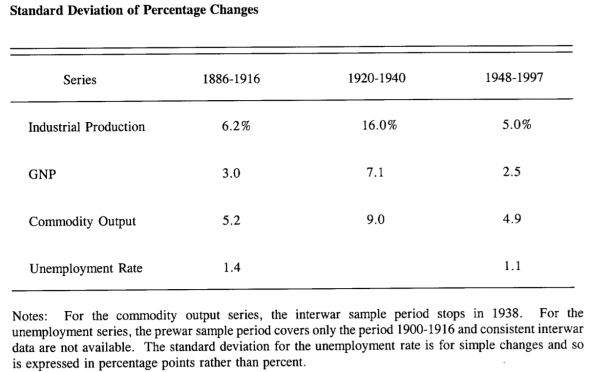

Klein reports that in 1999, Romer made some interesting findings regarding the stability and volatility of various business cycles in the 20h century. The findings initially suggest results that would make modern bankers rest on their laurels in terms of how they manage things today, but dig deeper and things don’t look so straight forward. He reports that Romer concluded:

|

Percentage Changes, 1886 - 1997 |

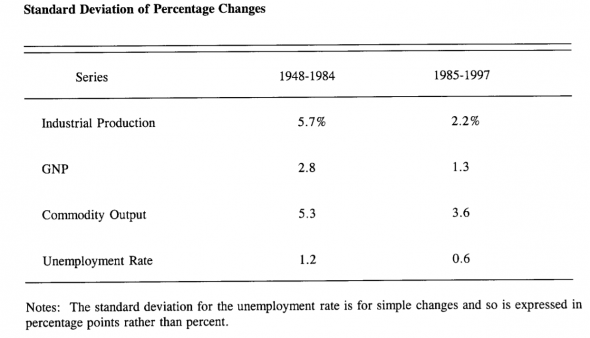

| But this was entirely attributable to the unusual calm of 1985-1997.

Given what’s happened since then, the pre-WWI period might look more stable than the era of the “countercylical” Federal Reserve. Romer measured the severity of a downturn by looking at how far industrial production fell from its peak and how long it took to return to its old level. Using her method, the financial crisis was about as painful as the depression of 1920 and the contraction of 1937 — and about 2.5 times as bad as any post-WWII downturn. |

Percentage Changes, 1948 -1997 |

| Bank of England’s economist makes case for gold

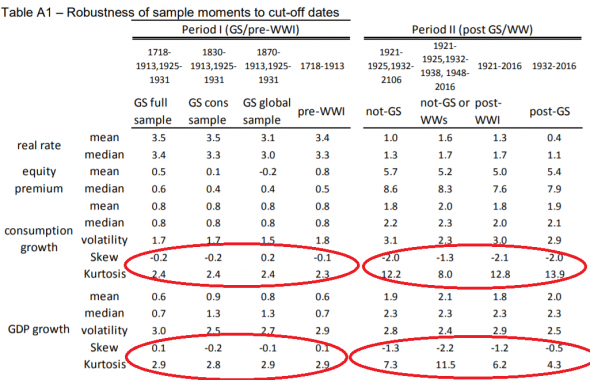

Gertjan Vlieghe, an economist and former economic assistant to Lord Mervyn King at the Bank of England, gave a speech last week entitled ‘Real Interest Rates and Risk’. The speech presented research on and linked the history of interest rates, economic volatility, and stock market returns. As Klein points out in the FT the most important part of the speech is most likely to the be most underreported. Vlieghe’s research finds that whilst the UK economy off the gold standard was better at allocating resources, the dangers it brought to the financial system made it “more fragile” and “lead to a financial crisis”. Vlieghe at the Bank of England says:

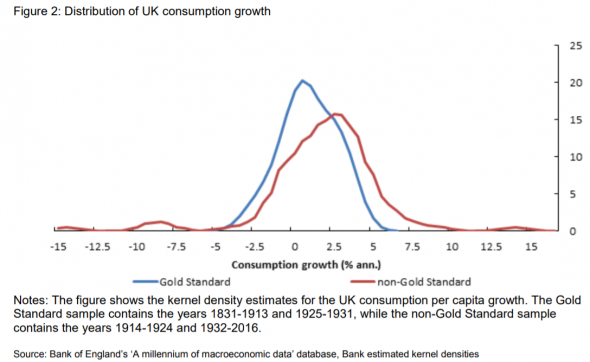

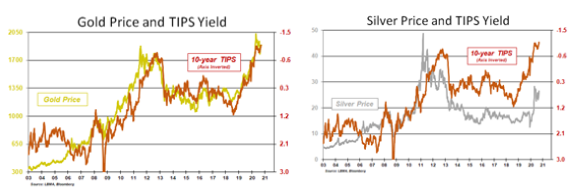

Klein draws our attention to an interesting chart presented as part of Vlieghe’s speech. |

Robustness of sample moments to cut-off dates |

Klein explains:

|

UK Consumption growth |

|

Klein clearly recognises that this shows the gold standard for what it is: a monetary system which brings far fewer disasters to an economy than one easily manipulated by central bankers and governments. This, says Klein, requires some serious consideration.

Very little desire for serious revision Throughout history, the majority of fiat currencies have met a miserable end, succumbing to hyperinflation after just a few decades. So far the current global fiat monetary system has survived just over 45 years. Few can seriously look at it and argue that it is healthy. It is increasingly unstable and is in terminal decline. It is not unfathomable to expect it to fail in the coming financial crisis. Unfortunately bankers and governments have not woken up to this thought yet. Ignorance is apparently bliss when it comes to believing a decade of money printing can be unwound without serious consequence. |

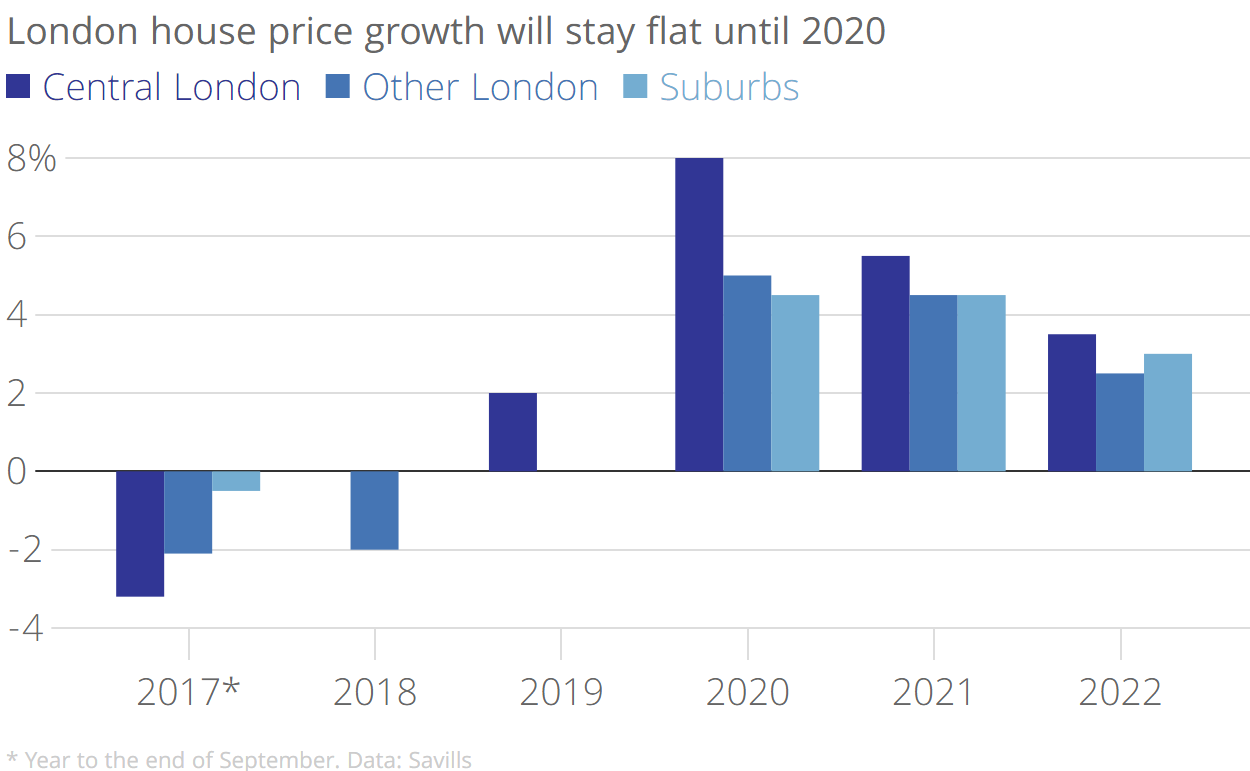

UK House Price Growth, 2017 - 2020 |

Whilst it is refreshing to see the Financial Times take a positive look at the gold standard, it is unfortunate that they have failed to recognise this simple fact from looking at monetary history and at the wealth of research out there which makes very similar arguments.

One of the world’s most famous bankers, Alan Greenspan, recognised the destructive nature of the fiat system:

‘In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value …’ (Greenspan, 1967)

In a study which used data from 15 countries from as early as 1820 to as late as 1994, Rolnick and Weber (1997) found ‘money growth and inflation are higher’ under fiat standards than those seen in gold and silver standards. They found during the fiat standard the average inflation rate was 9.17% per year compared to 1.75% per-cent found in gold standards.

The result of the FT’s approach is their readers (you, I, central bankers, finance ministers) are easily swayed into believing that a system of debt, volatility, high returns and high risk is preferable to the gold standard. We come to believe it is ‘the norm’.

But a system which repeatedly fails cannot be ‘the norm.’ Surely the one that we ultimately return to after each failure should be ‘the norm’?

Did we learn anything about money?

Following the financial crisis, a 2009 UN report concluded that the disaster was not a result of failures, instead the result of bad political choices:

‘…our multiple crises are not the result of a failure or failures of the system. Rather, the system itself – its organization and principles, and its distorted and flawed institutional mechanisms – is the cause of many these failures… our global economy is but one of many possible economies, and, unlike the laws of physics, we have a political choice to determine when, where, and to what degree the so- called laws of economic behaviour should be allowed to hold sway.’

Luckily gold’s role as a store of value and important monetary asset is being increasingly appreciated. This is happening both on the part of governments and individuals alike.

Major holders and buyers of gold include the world’s largest central banks, the largest global banks, the largest insurance companies in the world, the largest hedge funds in the world, the largest pension funds in the world and of course many wealthy and prudent investors.

The idea of returning gold to the monetary system is clearly not a crazy one – it is already slowly happening and the Chinese look set to take the lead in this regard.

The mainstream media should not be surprised by this. After all, the evidence shows gold’s ability to protect wealth, reduce volatility and protect us from the policies of central banks and increasingly populist governments.

Full story here Are you the author? Previous post See more for Next post

Tags: Daily Market Update,newslettersent