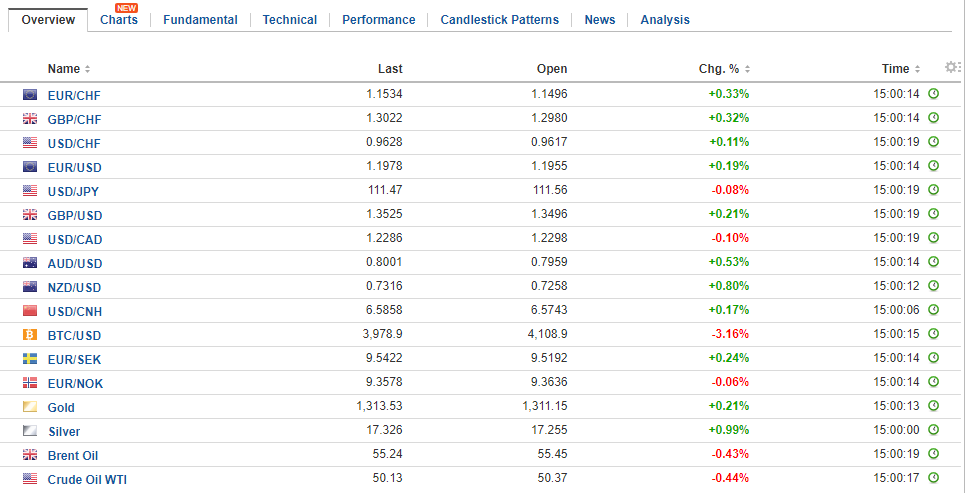

Swiss FrancThe Euro has risen by 0.36% to 1.153 CHF. |

EUR/CHF and USD/CHF, September 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesPolitics seems to dominate the talking points today. Boris Johnson’s weekend op-ed has been rejected by May, and there is talk that Johnson may resign or fired. Sterling is consolidating after pulling back yesterday. Carney said that if the UK does hike it will be gradual and limited. The markets did respond dramatically to the BOE minutes and suggestions by even some of the doves that rates may need to be lifted, but there is still a good reason to be a little skeptical. Carney has intimated the same thing several times during his tenure, and the base rate is lower now. It is possible that buying a few more months can see price pressures peak. There are some notable option expires today. The euro has options struck at $1.1950 (648 mln) and $1.20 (500 mln). There are options struck at 111.50 ($382 mln) and the New Zealand dollar at $0.7295 (378 mln). |

FX Daily Rates, September 19 |

| Japanese politics is also front and center. Abe says he will decide whether to call a snap election when he returns from the US, where is headed soon for the UN. The yen’s weakness looks more a function of the rise in US yields. The 10-year yield had reached almost 2% before rebounding and now is a little above 2.2%. The Nikkei’s nearly 2% rally may have also been partly a little catch up after being on holiday on Monday.

The increase perceived likelihood has not done the dollar much good against the euro, where the single currency traded above $1.20 today for the first time since September 11. The euro recorded the recent high on September 8 near $1.2090. The next key retracement target is near $1.2165, which is 50% of the single currency’s drop from mid-2014. The dollar’s gains against the yen were extended toward JPY111.85. The next level of resistance is seen near JPY112.00-JPY112.20. |

FX Performance, September 19 |

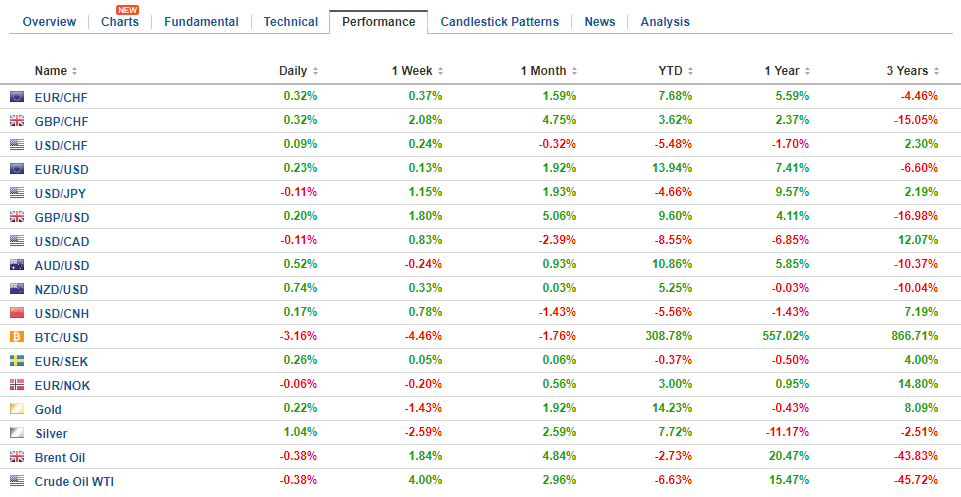

United StatesThe FOMC meeting gets underway today with the outcome announced tomorrow. Ahead of that, today the US reports August housing starts, which should recover a bit from July’s unexpectedly large 4.8% decline. The impact of the hurricanes will likely distort the time series starting in Q4. The Fed’s challenge setting the appropriate monetary policy for the economy is all the more difficult if the economic data becomes distorted. |

U.S. Housing Starts, Aug 2017(see more posts on U.S. Housing Starts, ) Source: Investing.com - Click to enlarge |

| Still, over the past week or so, the market has moved to recognize a somewhat greater chance of another Fed hike by the end of the year, which effectively means the December meeting. The CME’s calculation puts the odds at 55.8%, interpolating from the Fed funds futures strip. This is up from around 37.5% a month ago and 41.3% a week ago. Bloomberg’s calculation puts the odds at 49.1% up from 35.2% a week ago. |

U.S. Current Account, Q2 2017(see more posts on U.S. Current Account, ) Source: Investing.com - Click to enlarge |

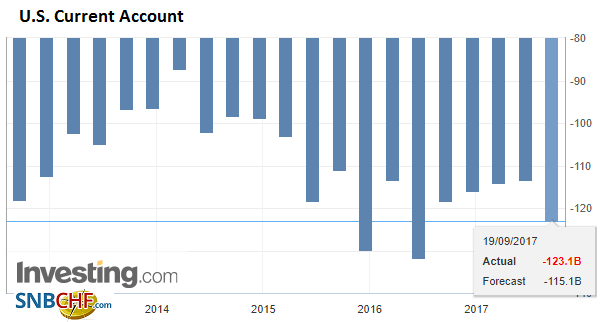

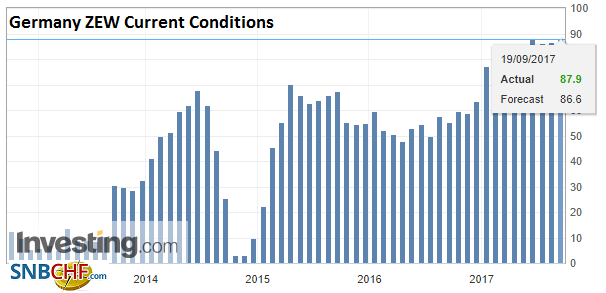

Germany |

Germany ZEW Current Conditions, Sep 2017(see more posts on Germany ZEW Current Conditions, ) Source: Investing.com - Click to enlarge |

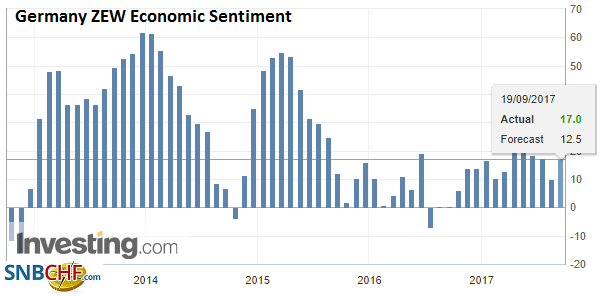

Germany ZEW Economic Sentiment, Sep 2017(see more posts on Germany ZEW Economic Sentiment, ) Source: Investing.com - Click to enlarge |

|

Eurozone |

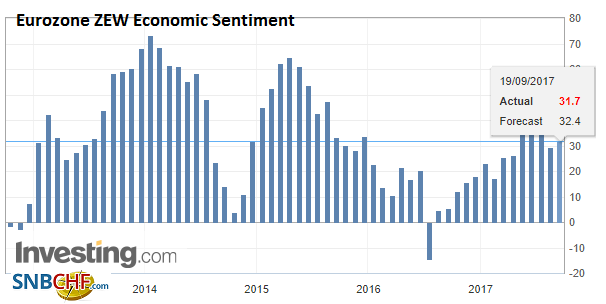

Eurozone ZEW Economic Sentiment, 2013 - 2017(see more posts on Eurozone ZEW Economic Sentiment, ) Source: Investing.com - Click to enlarge |

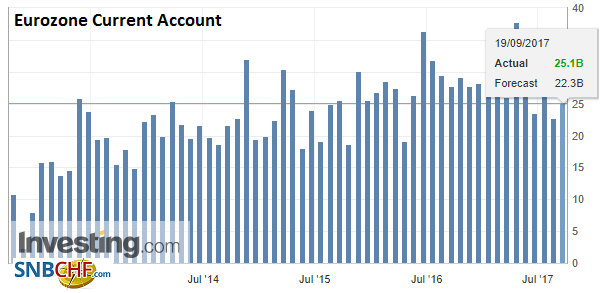

Eurozone Current Account, Jul 2017(see more posts on Eurozone Current Account, ) Source: Investing.com - Click to enlarge |

|

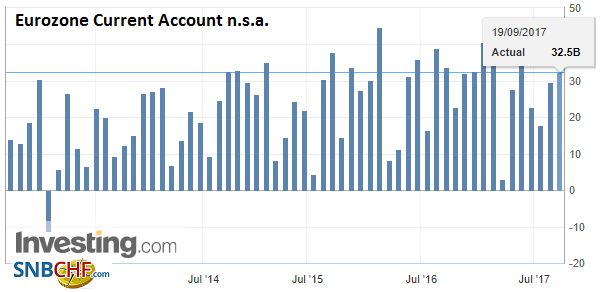

Eurozone Current Account n.s.a., Jul 2017(see more posts on Eurozone Current Account n.s.a., ) Source: Investing.com - Click to enlarge |

The New Zealand dollar is recouping yesterday’s losses. The election on September 23 is still seen as too close to call. It could very well turn on the performance of smaller parties as a coalition government looks necessary. New Zealand reports Q2 GDP figures. Some are suggesting that it could be the key to the election. The economy expanded 0.5% in Q1 and is expected to have grown a bit faster in Q2, though the year-over-year rate may not improve from the 2.5% year-over-year pace.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,$EUR,$JPY,$TLT,Boris Johnson,EUR/CHF,Eurozone Current Account,Eurozone Current Account n.s.a.,Eurozone ZEW Economic Sentiment,Germany ZEW Current Conditions,Germany ZEW Economic Sentiment,newslettersent,U.S. Current Account,U.S. Housing Starts,USD/CHF