- Gold set to shine as Washington stumbles

- “Bet on gold’s diversifying properties rather than political stability”

- World’s largest asset manager believes Trump and political drama in the U.S. means gold likely to rise

- Real rates flattening out and rising political instability – Blackrock’s Koesterich

- “For now my bias would be to stick with gold” – Blackrock

- U.S. debt ceiling issue to be fractious as bankrupt U.S. hits $20 trillion debt

- Investors will again turn to gold in coming political strife

|

- Click to enlarge |

“For now I would prefer to bet on gold’s diversifying properties rather than political stability” – Russ Koesterich, Blackrock.

Not for the first time this year, Blackrock’s Koesterich has spoken about his faith in gold during times of both financial and political instability.

Those times are now, the world’s largest money manager believes. Since the beginning of the year Koestrich has been adding to the gold position of the $39bn Global Allocation Fund. Gold is now the fund’s second-largest position.

Gold’s performance, up 12% year-to-date, is particularly interesting. A hard-to-define asset, gold is often thought to perform best when either inflation and/or volatility is rising. This year has been notable for both falling inflation and record low volatility, raising the question: What is powering gold’s ascent and can it continue? Two trends stand out:

Real rates have flattened out

Political uncertainty has risen

|

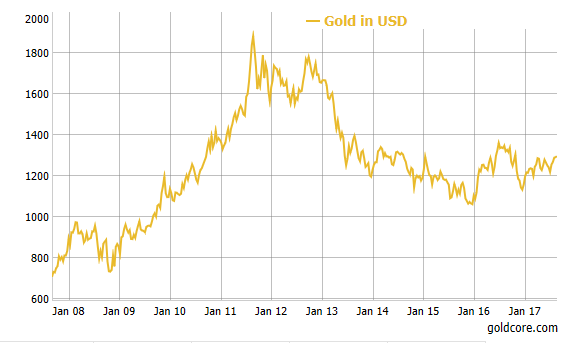

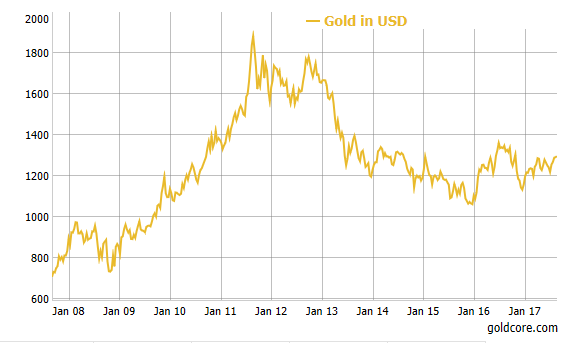

Gold Price in USD, Jan 2008-2017(see more posts on gold price, ) - Click to enlarge |

Real rates – plateauing and boosting gold

Gold is most correlated with real interest rates (in other words, the interest rate after inflation), not nominal rates or inflation. While real rates rose sharply during the back half of 2016, the trend came to an abrupt halt in early 2017. U.S.10-year real rates ended July exactly where they began the year, at 0.47%. The plateauing in real yields has taken pressure off of gold, which struggled in the post-election euphoria.

Heightened political uncertainty

Koesterich said earlier this month that

“There has been a Pavlovian response by investors to disregard any piece of bad news or any spike in volatility, and that has been a very profitable strategy but we do think that there are risks in the world that are not being priced in.”

Currently there is heightened geopolitical risk across the world, with a focus on how the US will manage. Investors will no doubt be looking to reduce their risk exposure as events unfold between the US and North Korea as well as Venezuela’s chaos which shows no sign of dissipating.

The VIX index is often referred to as the ‘Fear Index’. Many believe this is a misnomer and does not portray what is really going on. The index has been trading at historically low levels. Apparently investors continue to bet that the index will remain low if money keeps pouring into markets and the global economy carries on improving.

Koesterich doesn’t think this will be the case. For him political risk has not yet been reflected in the markets. |

Index Level, Jan 2014-Jul 2017 - Click to enlarge |

Although market volatility has remained muted, albeit less so the past week, policy uncertainty has risen post-election (see the accompanying chart, above). This is important. Using the past 20 years of monthly data, policy uncertainty, as measured by the U.S. Economic Policy Uncertainty Index, has had a more statistically significant relationship with gold prices than financial market volatility. In fact, even after accounting for market volatility, policy uncertainty tends to drive gold prices.

To a large extent, both trends are related. Investors came into 2017 expecting a boost from Washington in the form of tax cuts and potentially infrastructure spending—resulting in the so-called “reflation” trade. Thus far neither has materialized. While economists can reasonably debate whether either is actually needed, lower odds for tax reform and stimulus have resulted in a modest drop in economic expectations. This, in turn, has caused a reversal in many reflation trades, a development that has allowed gold to rebound.

Going forward, gold’s performance may be most closely linked with what happens in D.C. Absent fiscal stimulus, the U.S. economy appears to be in a state of equilibrium: modest but stable growth. In this environment, gold should continue to be supported by historically low real rates and continued political uncertainty. Alternatively, if Congress does manage to enact a tax cut or other stimulus, we are likely to see some, albeit temporary, reassessment of growth and a corresponding backup in real rates, a scenario almost certainly negative for gold.

|

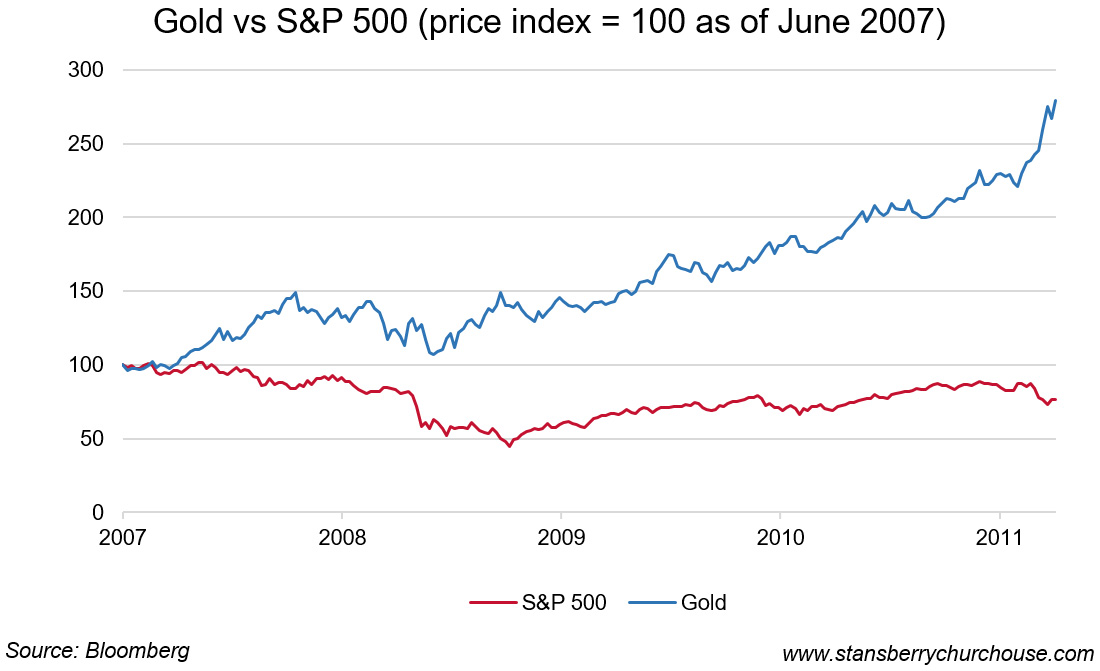

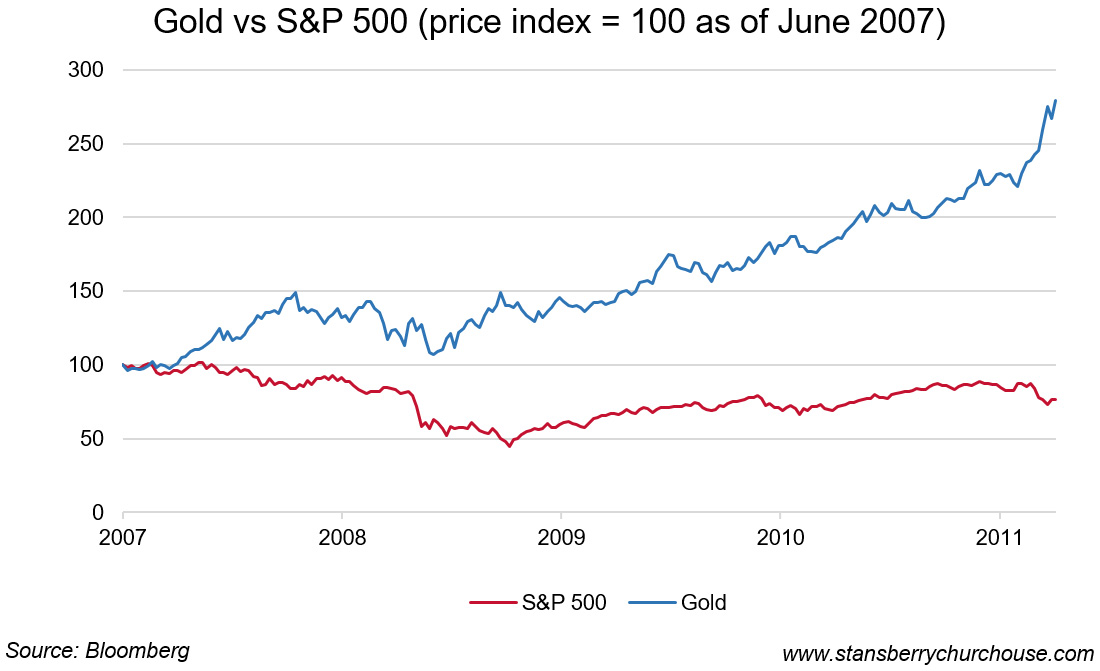

Gold vs S&P 500 Price index, 2007-2011 - Click to enlarge |

Conclusion – No crystal ball but stick with gold

Koesterich does not claim to ‘have any special insight into the Greek drama that is modern day Washington.’ But he is clear in his conviction that a ‘bet on gold’s diversifying properties rather than political stability’ is the way to trade right now.

Whilst Koesterich’s blog has made headlines and been featured on a range of sites, there should really be no surprise over his comments. All he is saying is that gold will continue to perform well thanks to a series of unknowns in the political and economic sphere.

It will act as a form of financial insurance and safe haven. This is no real news given history has demonstrated this as has the performance of gold in the last 10 years and as a hedge in the long term.

Most importantly the money manager is saying that he has little faith in the performance and abilities of the US government. In turn this means he is concerned for the strength of their currency and economy.

Individual savers and investors should take note – gold’s safe haven properties will be coming into their own as Washington continues to bicker and stumble.

Full story here

Are you the author?

I founded GoldCore more than 10 years ago and it has been my passion and a huge part of my life ever since. I strongly believe that due to the significant macroeconomic and geopolitical risks of today, saving and investing a portion of one’s wealth in gold bullion is both wise and prudent.

Previous post

See more for 6a.) GoldCore

Next post

Tags:

Daily Market Update,

Donald Trump,

gold price,

newslettersent