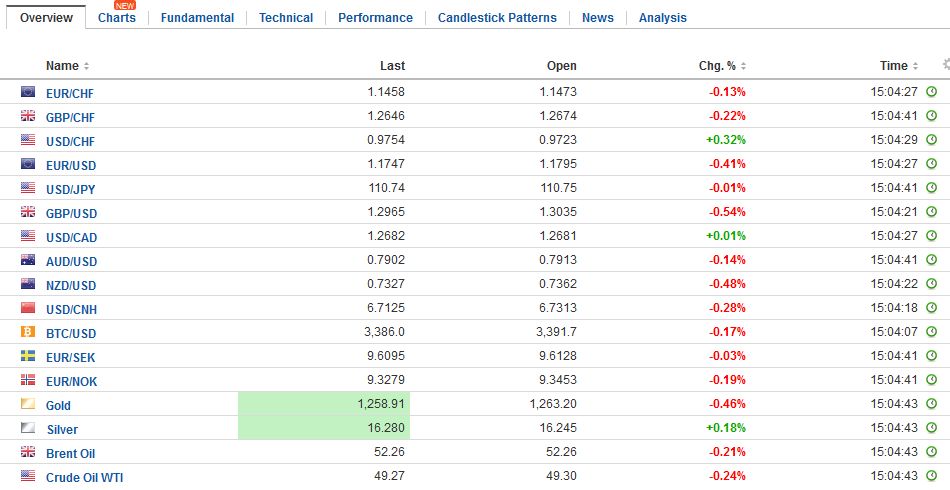

Swiss FrancThe euro has depreciated by 0.17% to 1.1451 CHF. |

EUR/CHF and USD/CHF, August 08(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

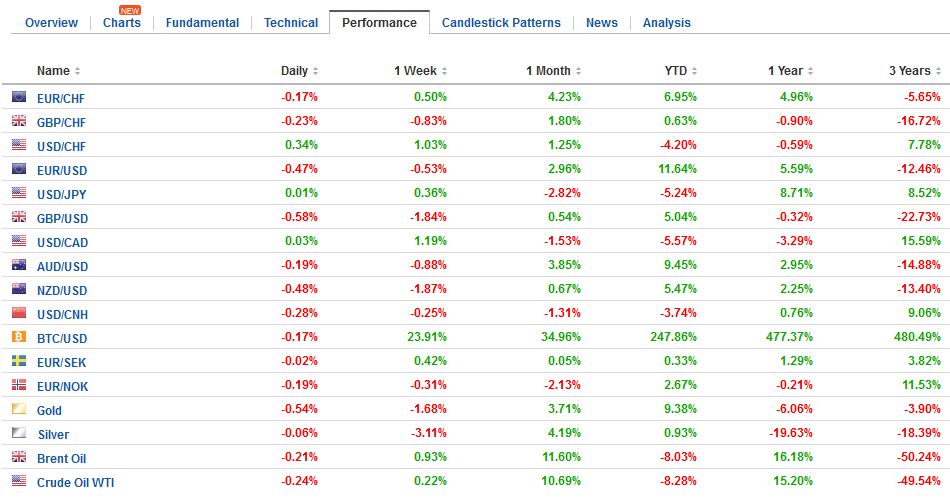

FX RatesThe US dollar has a slightly lower bias today, but the against most of the major currencies, it is consolidating within the range set at the end of last week. The main exceptions are sterling and the Canadian dollar. They had extended their pre-weekend losses yesterday, and are trading within yesterday’s range today. The news stream will be light in North America, with no market moving data on tap and no central bank speakers scheduled. Equity markets are firm. The MSCI Asia Pacific Index gained about 0.15% to post its second consecutive advance after losing a little more than 0.5% in two sessions before last weekend. The minor gain is impressive given that Japan, Taiwan, Korean and Indian equity prices eased. Stock markets are mostly higher in Europe, but gains are minor. The Dow Jones Stoxx 600 is slightly higher. Weakness in consumer names, materials, and real estate offsets gains in energy, utilities, industrials, and financials. |

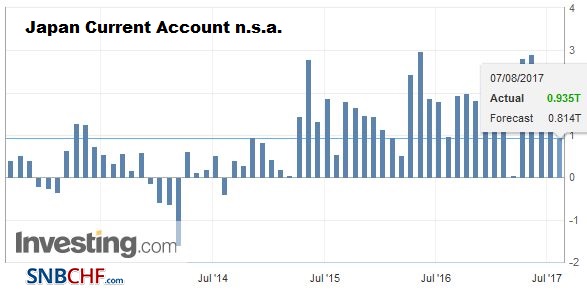

FX Daily Rates, August 08 |

| Bond markets are narrowly mixed. Australian and Japanese 10-year benchmarks changed by less than a basis point. New Zealand bonds remain strong. The 10-year yield fell another 6.5 bp to 2.83%. The yield has fallen by nearly 20 bp in the past week. The Reserve Bank of New Zealand meets on Thursday, and many appear to be positioning more dovish rhetoric. European bond yields are little changed, though we note that Italy and Portugal are faring better than Spain. Meanwhile, US Treasury and UK Gilt yields are slightly firmer.

There are few option strikes that may be in play today. The $1.18 strike inn is on the bubble. There is a large A$2.5 bln option struck at $0.7950 that may influence activity today. The data theme today is trading. Trade figures from Japan, China, and Germany have been reported. Japan and Germany reported June data, while China reported its balance for July. The Chinese yuan continued to strengthen today. The US dollar briefly dipped below CNY6.70 for the first time since last October. In addition to the broad US dollar weakness and news that China’s reserves increased in July helping the yuan, the PBOC appears to be stingy in its open market operations. It has simply rolled over seven and 14-day reverse repos today and has failed to inject fresh funds. This has led to a drain of around CNY100 bln from the banking system. |

FX Performance, August 08 |

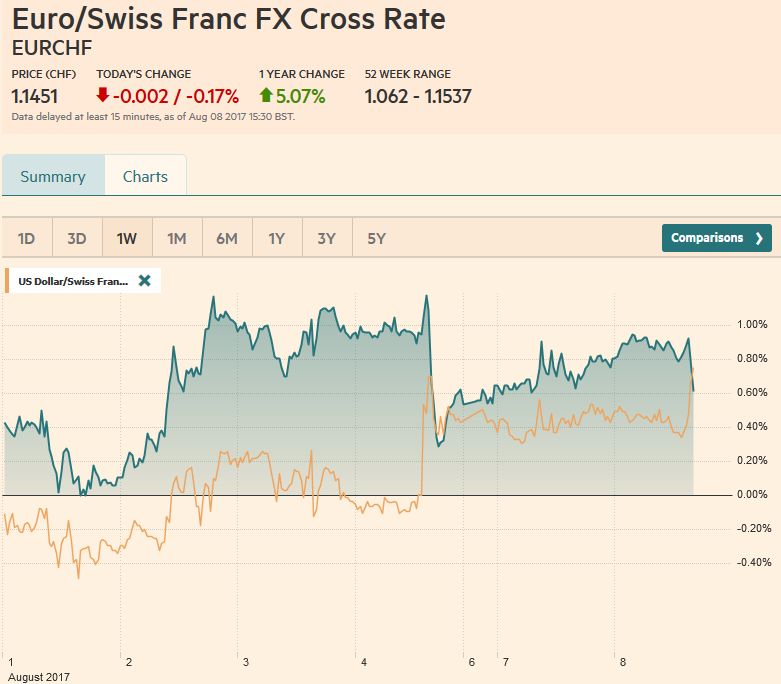

JapanJapan reported a JPY934.6 bln current account surplus. It was down from JPY1.653 trillion in May. There are strong seasonal influences in Japan’s balance and that current account surplus typically narrows in June from May. However, a key takeaway is that 12-month average is improved to JPY1.697 trillion from JPY1.544 average last June. One of the most important characteristics of Japan’s external surplus is that is not so much driven by trade, but by the primary income surplus (interest and dividends generated from overseas portfolio investment). With the current account, Japan also reports details of its capital account. The highlights include news that Japanese investors turned cool toward Australian debt and sold the most in four years. On there another hand, they continue to buy US Treasuries (JPY1.1 trillion after JPY1.3 trillion in May). Meanwhile, Chinese investors sold JPY2.77 trillion of short-term Japanese debt, which is most in over a decade. |

Japan Current Account n.s.a. June 2017(see more posts on Japan Current Account n.s.a., ) Source: investing.com - Click to enlarge |

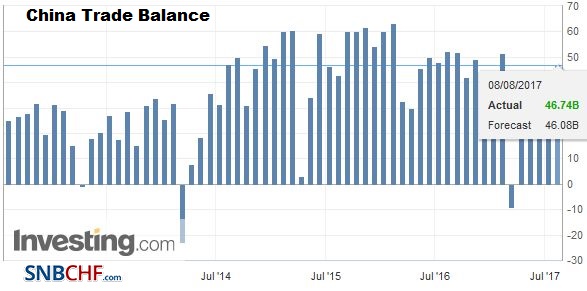

ChinaChina reported a $46.74 bln trade surplus for last month. This is down $1.6 bln from last July, but sequentially, it is the fifth wider surplus in a row. Both imports and exports slowed more than expected. Its 12-month average surplus stands at $37.76 bln vs. $48.54 bln for the same year ago period. |

China Trade Balance, July 2017(see more posts on China Trade Balance, ) Source: investing.com - Click to enlarge |

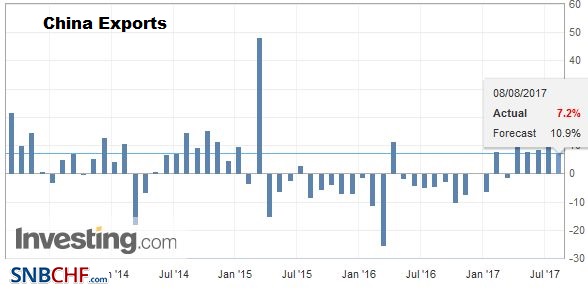

| Exports rose 7.2% year-over-year after an 11.3% rise in June. |

China Exports YoY, July 2017(see more posts on China Exports, ) Source: investing.com - Click to enlarge |

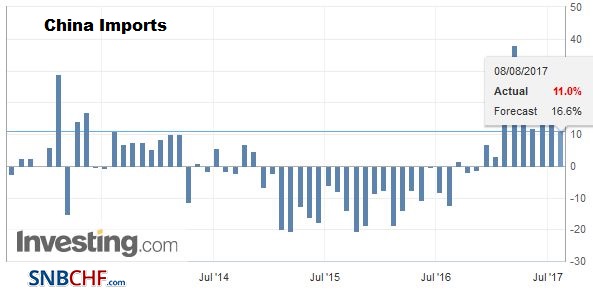

| Imports rose 11.0% after increasing 17.2% in June.

Some of the highlights include, oil imports falling to their lowest level in six months, while iron ore import rose 7.5% in the first seven months of the year. Natural gas imports rose by more than a fifth. Exports to the US rose 8.9% year-over-year compared with a 19.8% pace in June. Of particular interest, China’s steel exports fell by a third from a year ago, and are off nearly 30% in t he first seven months of the year. China appears to shuttered some capacity, while its domestic demand remains elevated due to efforts to upgrade its infrastructure. We note that the improved prices helped lift Nucor profits in H1 to its highest since the recession and US Steel earnings exceeded expectations. |

China Imports YoY, July 2017(see more posts on China Imports, ) Source: investing.com - Click to enlarge |

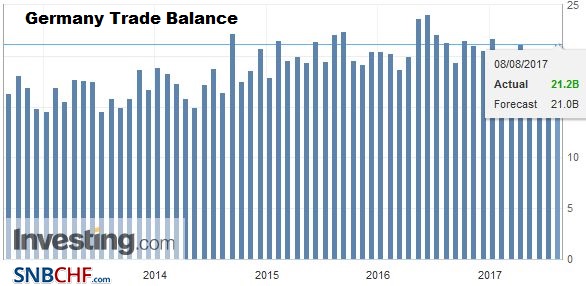

GermanyGerman trade figures round out today’s reports. German imports and exports were weaker than expected in June and this coupled with the softer PMI, and industrial output figures warn that European engine has lost some momentum around mid-year. Exports fell 2.8% in June. It is the first decline of 2017 and the most in two years. Imports fell 4.5%. It is the largest decline in eight years. However, despite the short-term vagaries, the trade balance is stable. The June surplus stood at 22.3 bln euro, up from 22.0 bln in May. Last June, the surplus stood at 24.5 bln euros. The 12-month moving average is 20.4 bln euros, little changed from the 21.0 bln euro average June 2016. The current account surplus, driven by the trade balance, is also remarkably steady. |

Germany Trade Balance, June 2017(see more posts on Germany Trade Balance, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next post

Tags: #GBP,#USD,$CAD,$EUR,$JPY,China Exports,China Imports,China Trade Balance,EUR/CHF,FX Daily,Germany Trade Balance,Japan Current Account n.s.a.,newslettersent,USD/CHF,yuan