Home › 1) SNB and CHF › 1.) SNB Press Releases › SNB reports a profit of CHF 1.2 billion for the first half of 2017

Previous post

Next post

SNB reports a profit of CHF 1.2 billion for the first half of 2017

(Several calculation mistake were corrected)

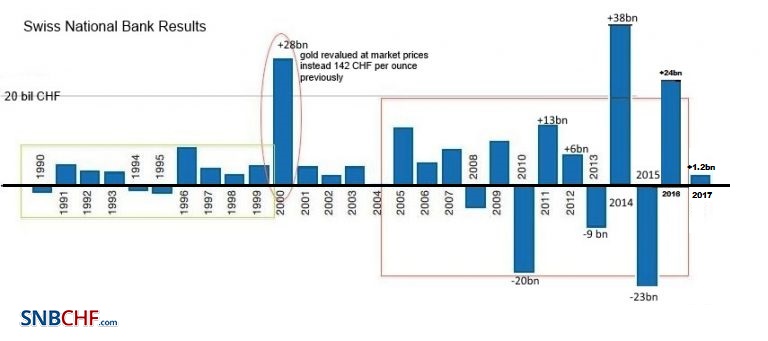

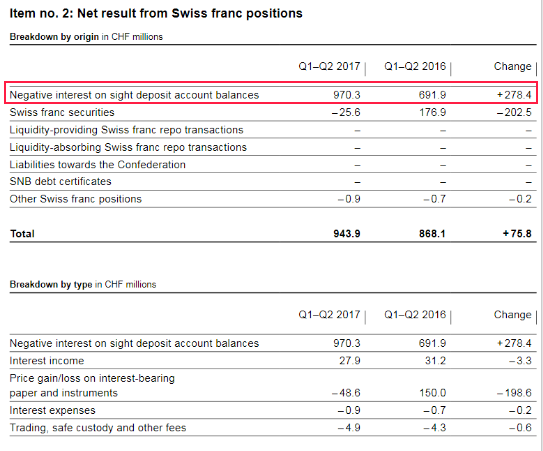

The increasing volatility of SNB Earnings

Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings.

But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse |

SNB Results Longterm H1 2017 - Click to enlarge |

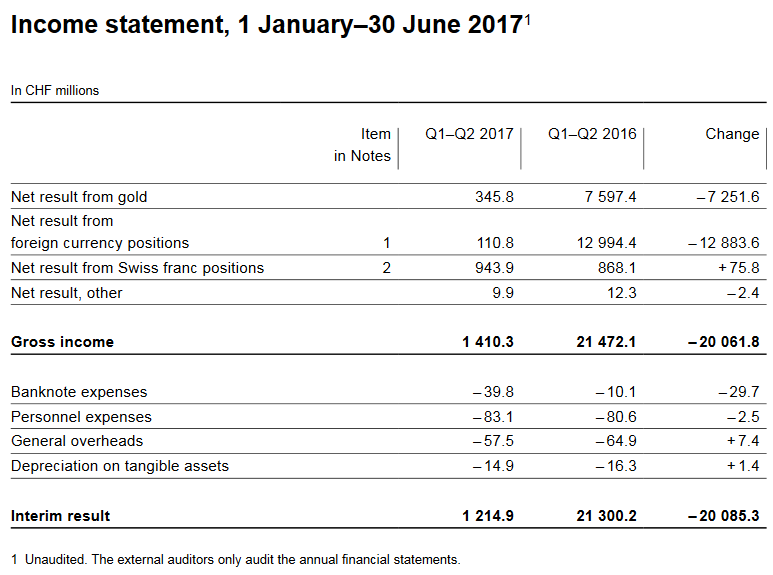

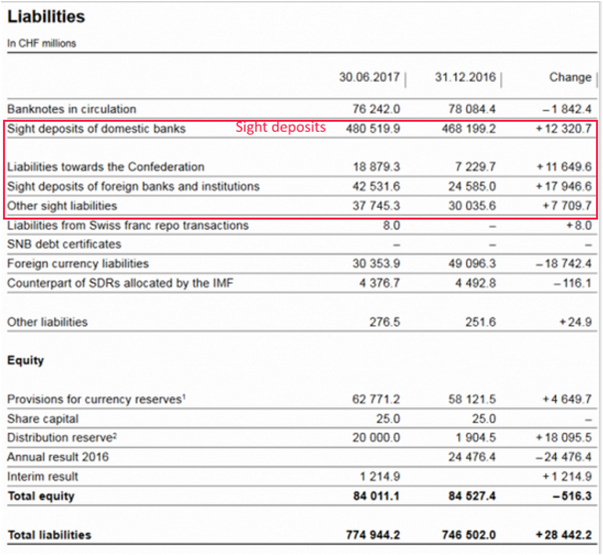

Interim results of the Swiss National Bank as at 30 June 2017

The Swiss National Bank (SNB) reports a profit of CHF 1.2 billion for the first half of 2017.

A valuation gain of CHF 0.3 billion was recorded on gold holdings. The profit on foreign currency positions amounted to CHF 0.1 billion and the profit on Swiss franc positions stood at CHF 0.9 billion.

The SNB’s financial result depends largely on developments in the gold, foreign exchange and capital markets. Strong fluctuations are therefore to be expected, and only provisional conclusions are possible as regards the annual result.

|

Income statement, 1 January–30 June 2017 Source: snb.ch - Click to enlarge |

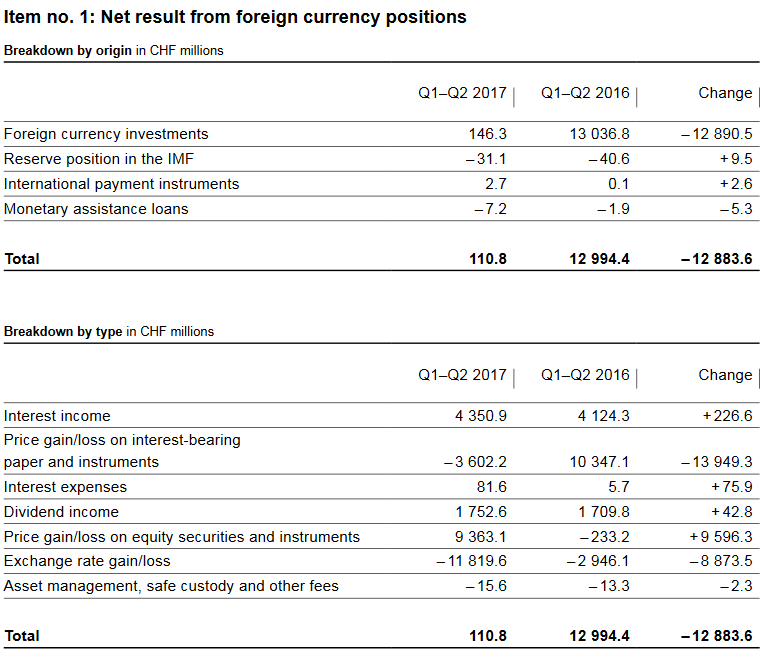

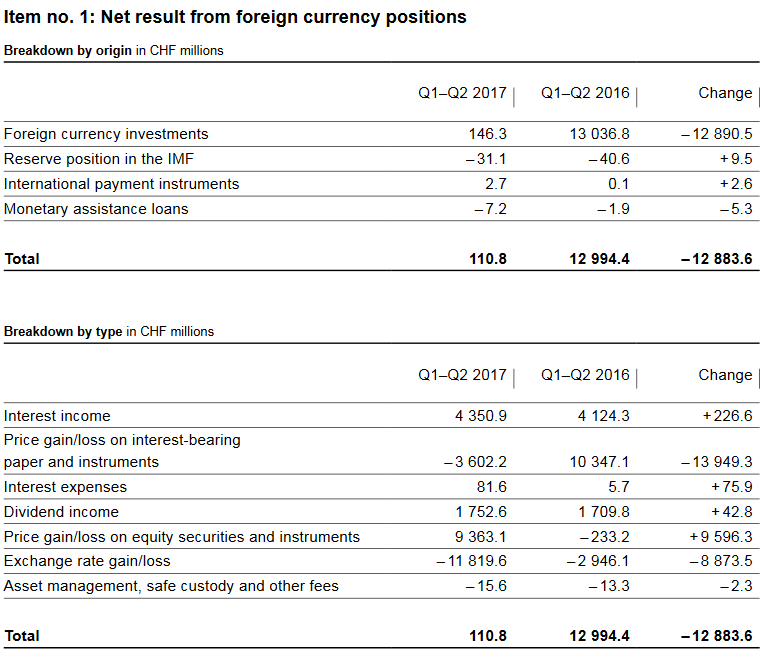

Profit on foreign currency positions

The net result on foreign currency positions was CHF 0.1 billion.

Interest income accounted for CHF 4.4 billion and dividends for CHF 1.8 billion. Movements in bond prices differed from those in share prices. A loss of CHF 3.6 billion was recorded on interest-bearing paper and instruments. By contrast, equity securities and instruments benefited from the favourable stock market environment and contributed CHF 9.4 billion to the net result.

Exchange rate-related losses totalled CHF 11.8 billion. Exchange rate gains on the euro did not offset losses recorded on other investment currencies, particularly the US dollar.

SNB results H1 2017

(in bn CHF) |

Profit |

BalanceSheet |

Profit in % |

| Total Profit on foreign currencies |

0.1 |

775 |

0.01% |

| Interest income(coupons) |

4.4 |

775 |

0.57% |

| Dividend income |

1.8 |

775 |

0.23% |

| Price changes in bonds |

-3.6 |

775 |

-0.46% |

| Price changes in equities |

9.4 |

775 |

1.21% |

| Exchange Rate Losses |

-11.8 |

775 |

-1.52% |

|

SNB Profit on Foreign Currencies Source: snb.ch - Click to enlarge |

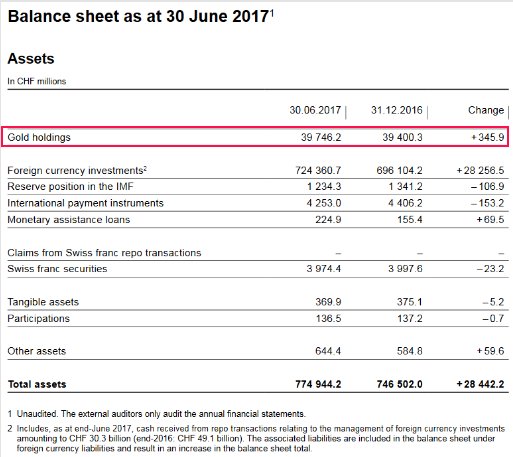

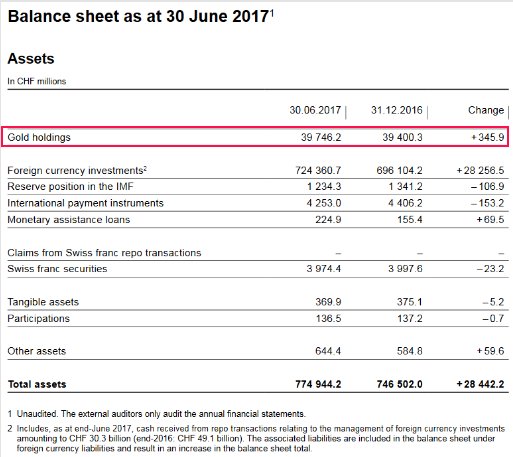

Valuation gain on gold holdings

A valuation gain of CHF 0.3 billion was achieved on gold holdings, which remained unchanged in volume terms. Gold was trading at CHF 38,217 per kilogram at end-June 2017 (end-2016: CHF 37,885).

SNB Results H1/2017

(in bn CHF) |

Profit |

Balance Sheet |

Profit in % |

| Total Profit on Gold………………………….. |

0.3 |

775 |

0.04% |

Percentage of gold to balance sheet

The percentage of gold compared to the total balance sheet is falling.

SNB Balance Sheet items

(in bn CHF) |

H1/2017 |

2016 |

2015 |

2014 |

| Gold……………………………………… |

39.7 |

39.4 |

35.5 |

39.60 |

| Total Balance Sheet |

775 |

746 |

640 |

561 |

| Gold in % of Balance Sheet |

5.12% |

5.28% |

5.55% |

7.06% |

Balance Sheet

The balance sheet has expanded by over 28.5 bn. francs by 3.82%.

|

H1/2017 |

2016 |

Increase in % |

| SNB balance sheet in CHF………………. |

775 |

746.5 |

3.82% |

| Swiss GDP in CHF |

656 |

650 |

0.92% |

| % of GDP |

118.14% |

114,85% |

|

|

SNB Balance Sheet for Gold Holdings, H1 2017 - Click to enlarge |

While the SNB supports foreign stock markets and foreign companies, it does not invest in Swiss stocks.

|

H1/2017 |

2016 |

| Swiss Franc Securities |

-25,6 |

45,5 |

| Total Balance Sheet |

774994 |

746502 |

| %CHF securities |

-0,0033% |

0,0061% |

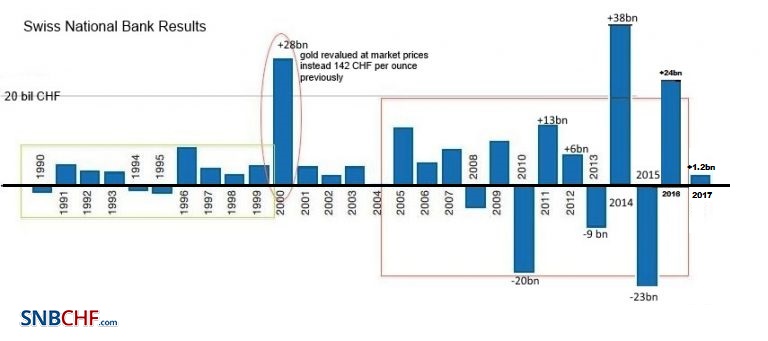

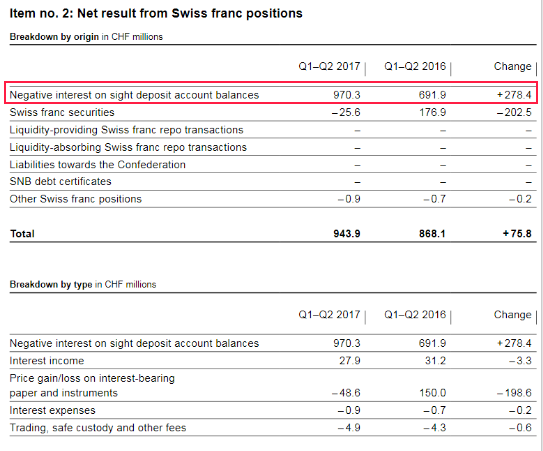

Profit on Swiss franc positions

The SNB maintains its profitability, last but not least, thanks to the reduction of the profitability of banks. When too many funds arrive on their accounts, they must deposit them on their sight deposit account at the SNB.

The net result on Swiss franc positions, which stood at CHF 0.9 billion, was largely comprised of negative interest charged on sight deposit account balances.

Negative Interest rates

Furthermore, the SNB harms the Swiss economy, when it reduces the profits of Swiss banks by negative interest rates. But with this measure she maintains her own profitability.

|

2017 |

2016 |

Change in % |

| Income through negative interest rates |

0.97 |

0.69 |

40.5% |

| SNB balance sheet |

775 |

746.5 |

3.82% |

| in % of balance sheet |

0.13% |

0.09% |

|

|

SNB Result for Swiss Franc Positions, H1 2017 - Click to enlarge |

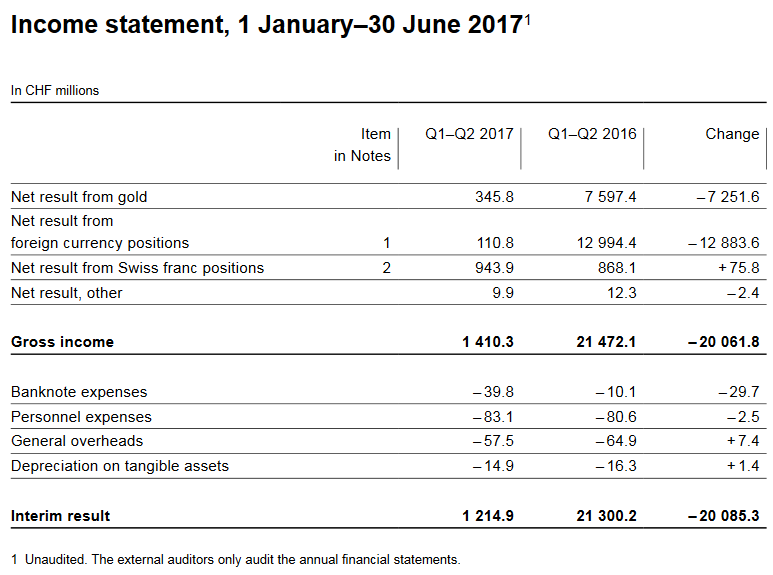

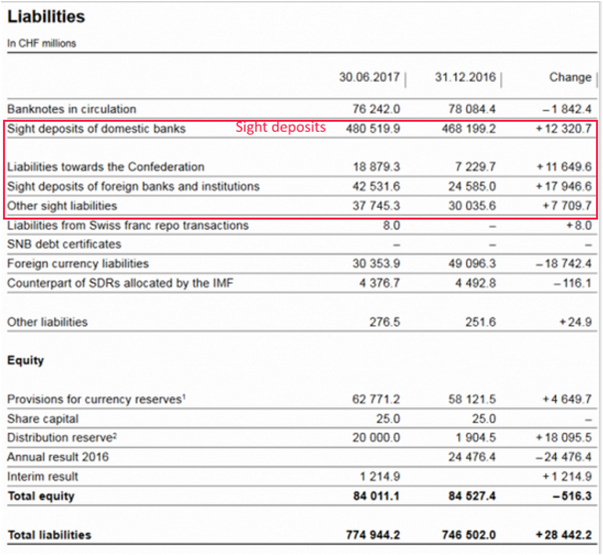

SNB Liabilities

Electronic Money Printing: Sight Deposits

Sight deposits is the biggest part of SNB interventions.

|

2017 |

2016 |

Change in% |

| Total Sight Deposits |

579 |

530 |

5.36% |

| Balance Sheet |

775 |

746.5 |

3.80% |

| % of balance sheet |

69.92% |

66.98% |

|

Paper Printing

Banknotes in circulation: -1.9 bn francs to 76 bn. CHF

The old form of a printing press, today a less important form of central bank interventions.

Provisions for currency reserves

As at end-June 2017, the SNB recorded a profit of CHF 1.2 billion, before allocation to the provisions for currency reserves.

In accordance with art. 30 para. 1 of the National Bank Act (NBA), the SNB is required to set aside provisions permitting it to maintain the currency reserves at the level necessary for monetary policy. The allocation for 2017 will be determined at the end of the year.

|

SNB Liabilities and Sight Deposits, H1 2017 - Click to enlarge |

Full story here

Are you the author?

George Dorgan (penname) predicted the end of the EUR/CHF peg at the CFA Society and at many occasions on SeekingAlpha.com and on this blog. Several Swiss and international financial advisors support the site. These firms aim to deliver independent advice from the often misleading mainstream of banks and asset managers.

George is FinTech entrepreneur, financial author and alternative economist. He speak seven languages fluently.

Previous post

See more for 1.) SNB Press Releases

Next post

Tags:

newslettersent,

SNB balance sheet,

SNB equity holdings,

SNB Gold Holdings,

SNB profit,

SNB results,

SNB sight deposits,

Swiss National Bank

Permanent link to this article: https://snbchf.com/2017/07/snb-interim-results-q2/