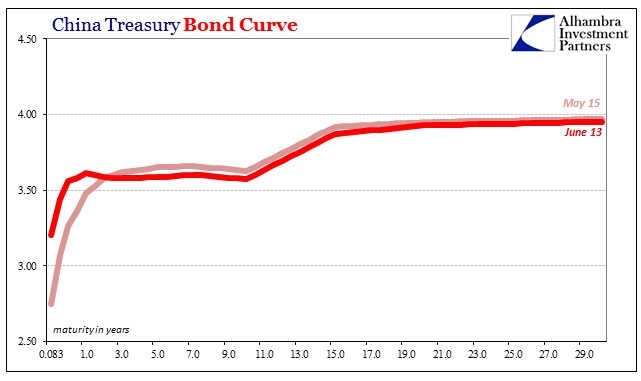

Some economic and financial conditions leave a yield curve as a more complex affair. Then there are others that are incredibly simple. The UST yield curve is the former, while right now the Chinese Treasury curve is the latter. Even still, the media manages to make it something it isn’t because the world from its perspective is surely improving, and Chinese money is tight for prudent reasons of intentional policy.

RMB markets are indeed “tightening”, so longer-dated government paper continues to reflect the consequences of that condition, even now to more extreme levels. For an economy already precariously positioned given the events of the last few years, it’s not a trivial concern. |

China Treasury Bond Curve(see more posts on china treasury bond, ) |

| It is not so much inverted as heavily malformed, though in truth that is more pedant semantics than analysis. There is no question as to the first part, just as there isn’t for the second. What seems to be misunderstood is the reasoning for what is taking place at the short end. |

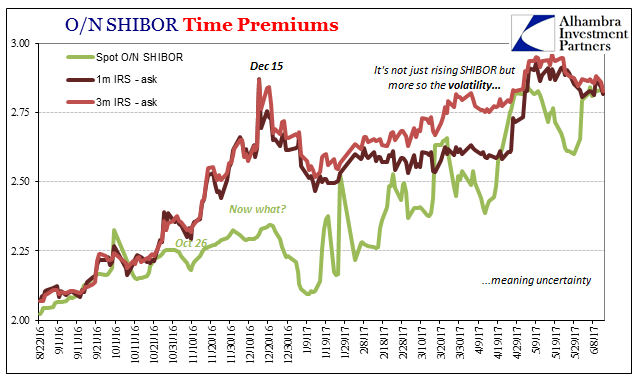

China RMB SHIBOR, January 2016 - June 2017 |

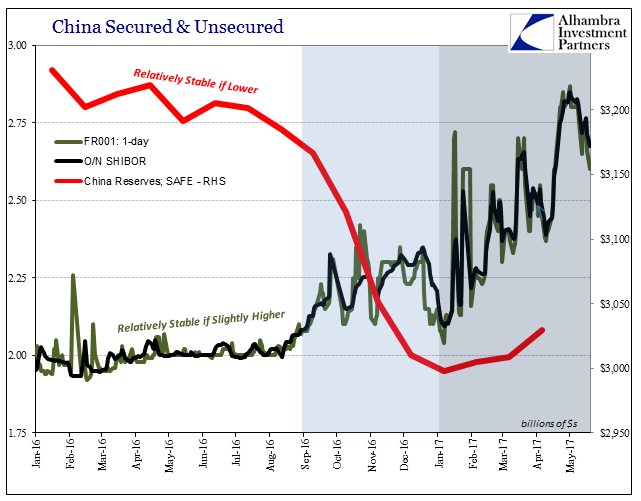

| What is going on here is nothing short of disorder. There is simply no way to characterize it as a product of intentional monetary policy. To begin with, the PBOC doesn’t operate (ever) with such messy design. China’s central bank has in its history operated with a much more conditioned approach, even when their method and intent have been misguided or mistaken. The appearance of almost open chaos in 2017 brings to mind RMB conditions in the middle of 2013 – the last time the treasury curve inverted. |

O/N SHIBOR Time Premiums, August 2016 - June 2017 |

| After having experienced that degree of illiquidity four years ago, Chinese authorities instituted rather quickly additional liquidity channels so as to avoid ever again those circumstances. It’s not as if the PBOC has sat out this last year, either. They have been heavily, hugely engaged using just those means, but to no further avail.

|

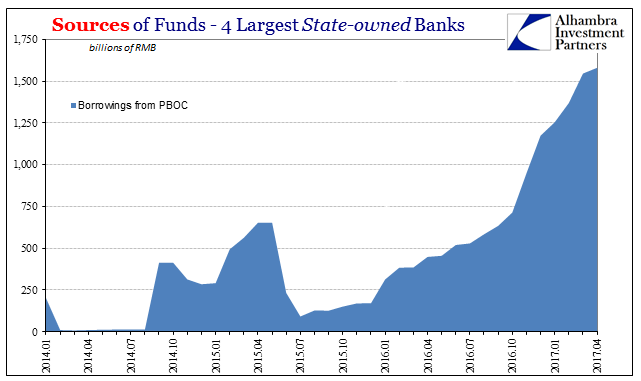

Sources Of Funds, January 2014 - April 2017 |

We can argue the intent of policy, but what is unambiguous is why and where. The Big 4 state-owned banks have been left with little spare monetary capacity. It is a topic I have written about before (more than a few times), but still bears repeating.

|

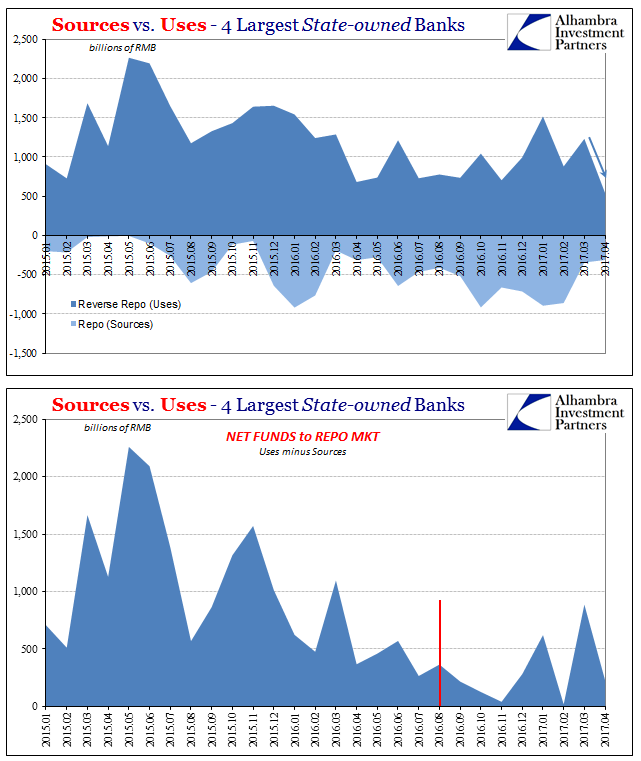

Sources vs. Uses, January 2015 - June 2017 |

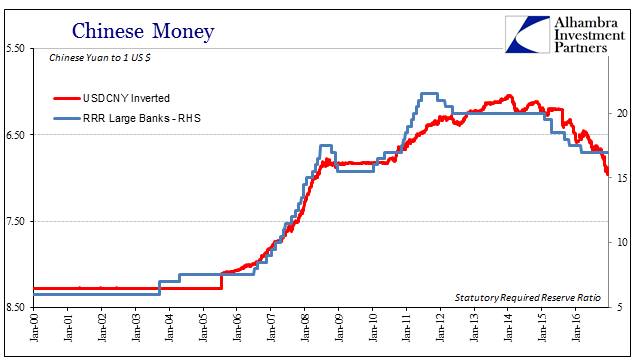

| Judging by a lot more in June, they still haven’t. The overriding deficiency remains, as always, the “dollar” system and China’s ill-suited connection to it. They can wish for “inflows” and claim to be ready to buy all the UST’s in the world, but eurodollar erosion is still the constant baseline, if intermittently applied. There is as yet no spare RMB because there continues to be a (“dollar”) lid on reserve balances at the PBOC. It really is that simple, and fully accounted for right on the central bank balance sheet. |

China Secured And Unsecured, January 2016 - June 2017 |

|

The long end of China’s treasury curve is merely the expected response to prolonged serious tightening, the further predictable intermediate term consequences that we have witnessed all over the world for just about a decade now. The only difference was that for years it was thought the Chinese were immune to such Western pressures, when all along their deal with the “dollar” devil was just waiting to be cashed in.

|

Chinese Money, January 2000 - June 2017 |

Full story here Are you the author? Previous post See more for Next post

Tags: Bonds,China,china treasury bond,currencies,dollar,dollar short,economy,eurodollar system,Federal Reserve/Monetary Policy,inversion,Liquidity,Markets,newslettersent,PBOC,RMB,shibor,Yield Curve,yuan