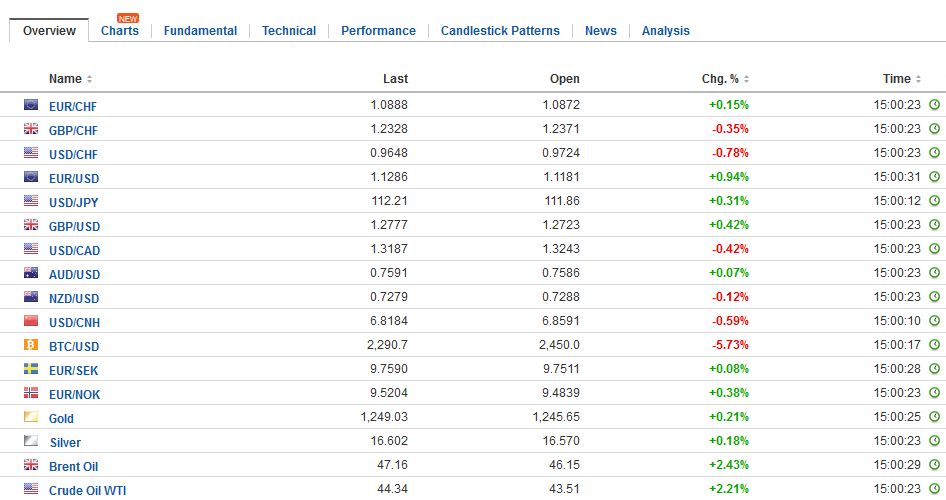

Swiss FrancThe euro is up by 0.17% to 1.0890 CHF. |

EUR/CHF - Euro Swiss Franc, June 27(see more posts on EUR/CHF, ) |

FX RatesECB President Draghi told the audience at the annual ECB Forum transitory factors were holding back inflation. This was quickly understood to be bullish for the euro, and it rallied from near the session lows below $1.12 to around $1.1260, a nine-day high. To be sure, Draghi still argued that a “considerable degree of monetary accommodation is still needed” because inflation is not yet “durable and self-sustaining.” Nevertheless, by providing a context for the low inflation, Draghi fanned expectations that the ECB is will likely announce tapering as it extends its asset purchases into next year. There is some concern that the scarcity of German paper may also hamper efforts to extend the asset purchases much beyond the middle of next year, without changing tactics. The dollar rose to its highest level since May 24 against the yen in Asia. However, after poking its head through JPY112.00, the dollar was whacked. It fell a little below JPY111.50 before finding a bid. Provided the JPY111.20 area holds, there may be another attempt higher. |

FX Daily Rates, June 27 |

| The $1.1285-$1.1300 area capped the euro in the first half of the month. The euro had fallen to $1.1120 a week ago and recovered before the weekend to $1.1200. The dollar, we had suggested, was vulnerable, before Draghi pushed the open door. Technically, it is important that the euro makes a new high above $1.1300. If it does not, the price action will give the appearance of a more complicated topping pattern in the euro is unfolding (head and shoulders top or some derivative of a triple top).

Draghi’s comments have also spurred a sell-off in European debt instruments. Two-year benchmark yields are 2-3 bp higher, while 10-year yields are 2-4 bp higher. Although US yields are firm, European rates are rising faster, spurring narrowing of the US premium. At the same time, the higher yields are corresponding to weaker equities, though the market was heavy before Draghi’s comments. The Dow Jones Stoxx 600 is off 0.6% near midday in London. The rise in materials and financials is not offsetting the declines elsewhere, led by consumer discretionary, information technology and telecom. The reintroduction of the capital buffer follows recent conflicting signals by the MPC. The vote earlier this month was a 5-3 decision to leave rates on hold. Within days, Governor Carney said that now was not the time to raise rates. This was quickly followed by the BOE’s chief economist revealing he was close to voting for a hike. This had already put the proverbial cat among the pigeons. The question now is whether the removal of accommodation by the FPC sufficient or will the MPC resist Carney’s suggestion. The June and December short sterling futures contracts are little changing, giving no hint, though some economists are bound to change their view and call for an August hike. Sterling rallied a little more than a quarter cent on the news but met strong sellers near $1.2770. The 20-dya moving average is near $1.2790, and last week’s high was $1.2815. |

FX Performance, June 27 |

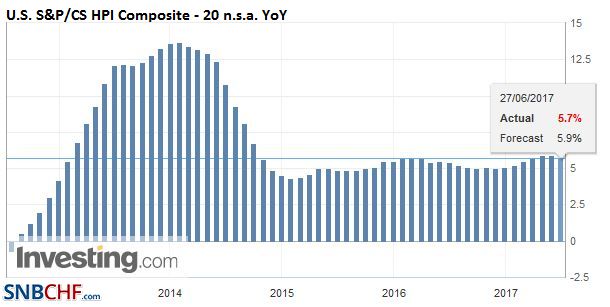

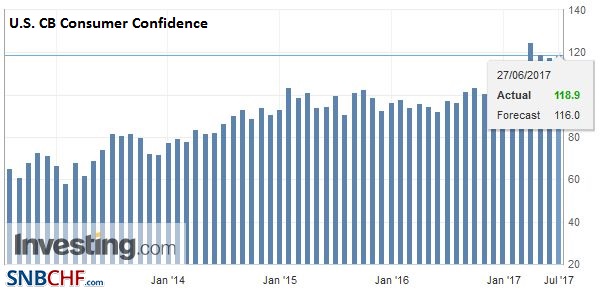

United StatesThe US reports home prices, consumer confidence and Richmond Fed Manufacturing Index (June). However, the interest may be on the slew of official speeches, including Yellen (1:00 pm ET from London), and the ongoing ECB Forum in Portugal. Dudley’s recent comments are very much in line with Yellen’s remarks after the FOMC meeting. The Fed’s leadership and several regional presidents continue to see the case to stay the course, while a few others officials and at least one Governor, is sounding more cautious. We expect the Fed to announce its balance sheet operations in September to begin in October and provided the labor market continues to improve, consider a rate hike in December. |

U.S. S&P/CS HPI Composite - 20 n.s.a. YoY, April 2017(see more posts on U.S. Case Shiller Home Price Index, ) Source: Investing.com - Click to enlarge |

U.S. CB Consumer Confidence, June 2017(see more posts on U.S. Consumer Confidence, ) Source: Investing.com - Click to enlarge |

China

In Asia, sharp move in the Chinese yuan punctuated its recent calm. The yuan has weakened for eight consecutive sessions coming into today and in 10 of the past 11 sessions. It appears, but because these kinds of things are indirect and lack transparency, it is difficult to know for sure, that the PBOC may have intervened by having its agent banks sell dollars for the yuan in Hong Kong (CNH) and drove the yuan higher. The 0.4% rise today is the largest move (absolute value) this month.

United Kingdom

The third important development of the day was the Bank of England’s announcement that it will raise the required capital buffer for UK banks from 0.5% now and to 1.0% in November. Banks will have a year to build the initial buffer (~GBP5.7 bln) and 18 months for the second part. Recall the counter-cyclical buffer was introduced in March 2016 but was lowered to zero following the referendum.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$CNY,$EUR,EUR/CHF,FX Daily,newslettersent,U.S. Case Shiller Home Price Index,U.S. Consumer Confidence