See the introduction and the video for the terms gold basis, co-basis, backwardation and contango.

Frexit Threat MacronizedThe dollar moved strongly, and is now over 25mg gold and 1.9g silver. This was a holiday-shortened week, due to the Early May bank holiday in the UK. The big news as we write this, Macron beat Le Pen in the French election. We suppose this means markets can continue to do what they wanted to do before the threat of Frexit, shutting off trade between France and the rest of Europe, and who knows what else Le Pen was plotting to do to the French people. This will be a short Report this week, as Keith has been working hard on a paper to address the question of which metal will have the higher interest rate. Look for that tomorrow. |

|

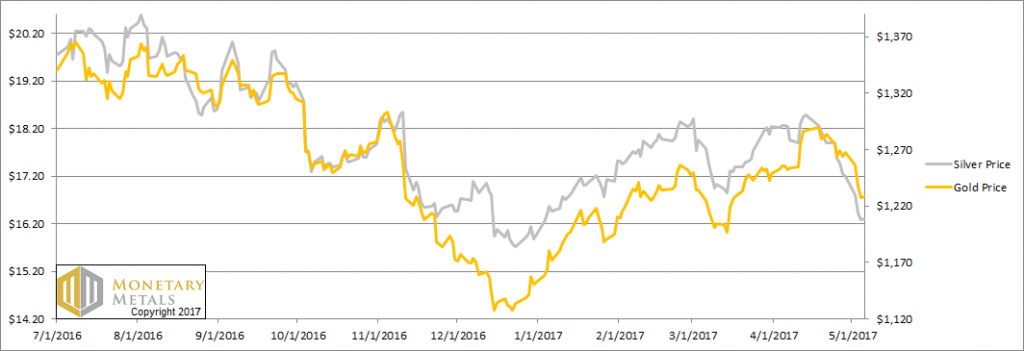

Prices of gold and silver

|

Prices Of Gold And Silver, July 2016 - May 2017(see more posts on Gold and silver prices, ) |

Gold-silver price ratioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It had another major move up this week, after a major move up last week and one the week before. It now sits at the same level it was a year ago. If it breaks above 76, then the next resistance looks to be 80. |

Gold And Silver Price Ratio, July 2016 - May 2017(see more posts on gold silver ratio, ) |

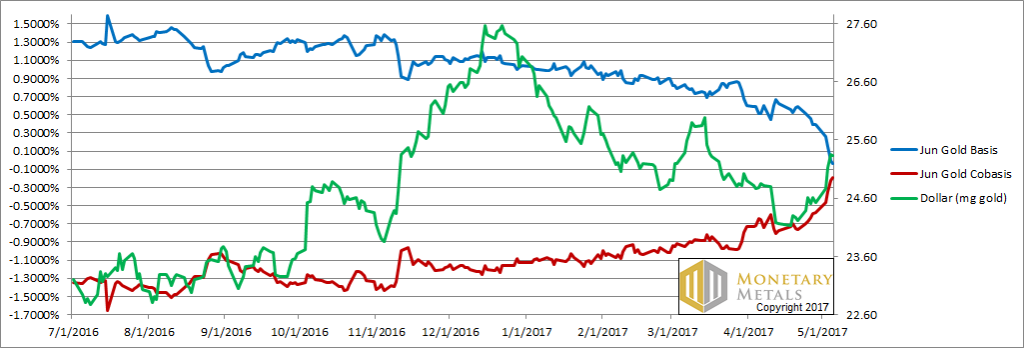

Gold basis and co-basis and the dollar priceHere is the gold graph. |

Gold Basis And Co-Basis And The Dollar Price, July 2016 - May 2017(see more posts on dollar price, gold basis, Gold co-basis, ) |

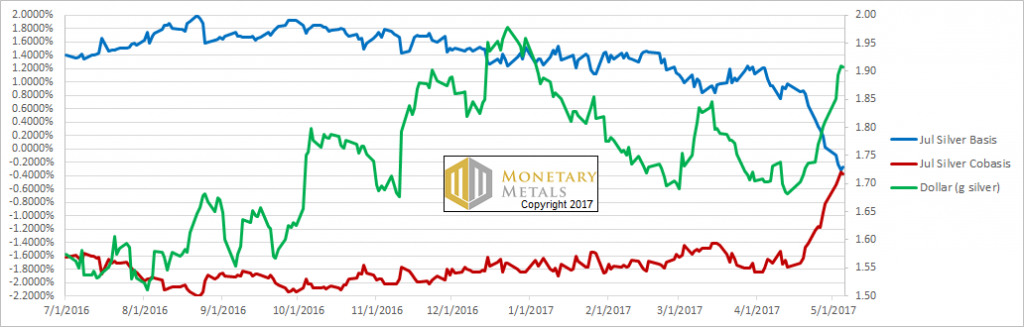

Silver basis and co-basis and the dollar priceIf we didn’t know better, we would say that as fast as the co-basis (i.e. scarcity, the red line) ran up, the price of the dollar (which is the inverse of the conventional view of the price of gold) ran up faster. Actually, that is accurate. And consequently, our calculated fundamental price of gold fell over twenty bucks (though it’s still more than twenty bucks over the market price). Now let’s look at silver. In silver, the same phenomenon occurred though to an exaggerated degree. Last week and the week before, we asked:

Then we said:

It happened to more of them this week. That’s what a rising co-basis with falling price of silver means. A sell-off of futures. A flush of the leveraged speculators. Unfortunately for them, owners of metal were also selling. Our calculated fundamental price of silver fell almost penny for penny with the market price. It remains about a buck twenty under the market price. We saw a technical analysis trader write a note this weekend. He said he plans to short silver on Monday. When the technicals and the fundamentals align, that can make for an interesting week.

|

Silver Basis And Co-Basis And The Dollar Price, July 2016 - May 2017(see more posts on dollar price, silver basis, Silver co-basis, ) |

Tags: dollar price,Gold and silver prices,gold basis,Gold co-basis,gold silver ratio,newslettersent,Precious Metals,silver basis,Silver co-basis