Swiss Franc |

EUR/CHF - Euro Swiss Franc, May 09(see more posts on EUR/CHF, ) |

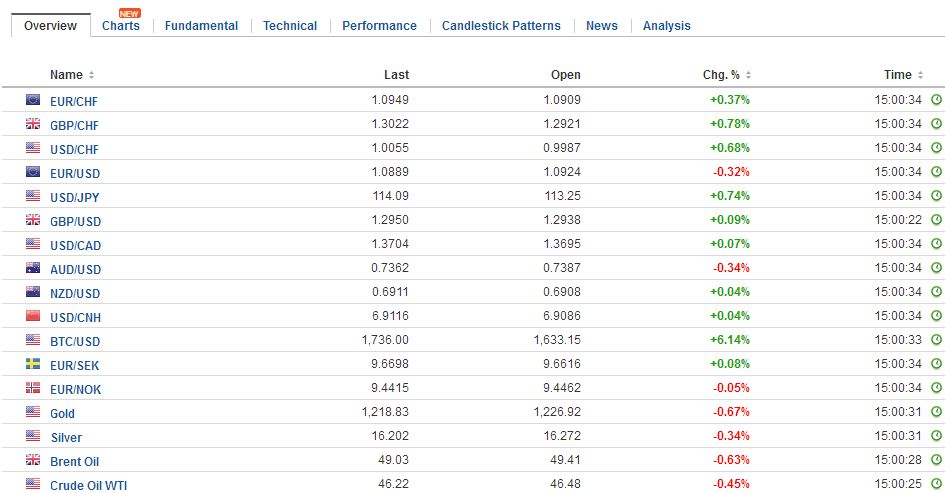

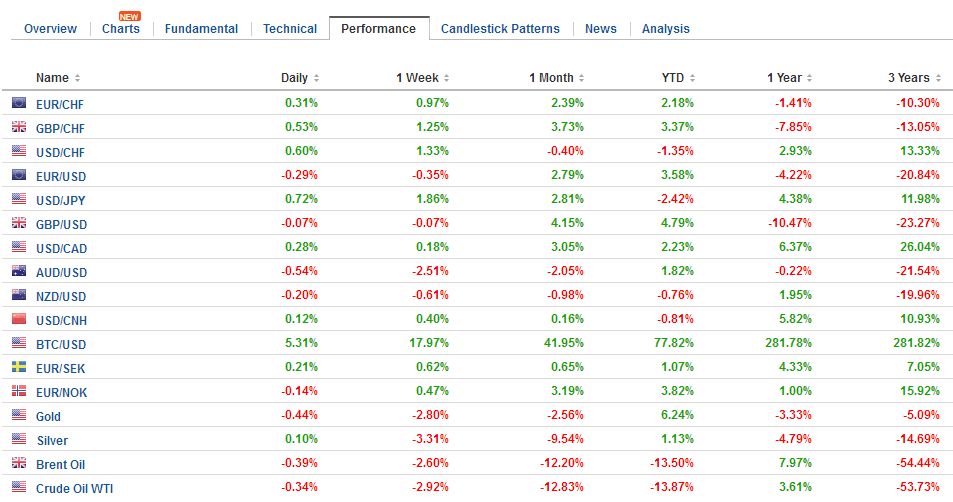

FX RatesThe election of Macron as French President has set off a bout of position adjustment that has seen the euro push back into the $1.0850-$1.0950 range that had confined activity for the two weeks between the first and second rounds of the French presidential election. The euro fell a cent yesterday after briefly poking through $1.1020. Marginal new lows were scored in the European morning, Support is seen in the $1.0850-$1.0875 area. There are chunky option strikes that roll off today at $1.0900-$1.0910 (665 mln euros) and $1.0950 (657 mln euros). Sterling is pulling back after nearing $1.30 in the past two sessions. Initial support is seen in the $!.2880-$1.2920 area. Modest options (~GBP180 mln) struck at $1.2900 and $1.2920 expire today. At this juncture, only a break of the $1.2750-$1.2800 would suggest a top is in place. The Australian dollar is the weakest of the major currencies. It is off about 0.7% to near $0.7320, new lows since the first half of January. It was initially sold in response to disappointing retail sales. March retail sales fell 0.1%. The median guesstimate in the Bloomberg survey was for a 0.3% increase after a 0.2% decline in February (revised from -0.1%). It is the third decline in the past four months. In Q1, adjusted for inflation, retail sales rose 0.1%, which represents a dramatic slowing from the 0.7% (initially 0.9%) rise in Q4 16. |

FX Daily Rates, May 09 |

| The government’s budget news may have helped spur fresh sales. The government projects a larger than expected deficit. The stimulus is understood to take some pressure off the central bank’s monetary efforts. However, investors were already uneasy about the levy on banks that had been tipped. The government will introduce a tax of six basis points on banks with liabilities greater than A$10 bln. This is expected to raise A$6.2 bln in revenue. The UK, Sweden, and Germany have similar levies.

Meanwhile, the dollar continues to recover against the Japanese yen. There is a $800 mln option struck at JPY114 that will be cut today. The dollar is up for the third day against the yen and in the past 17 sessions, has only fallen four times. Over this period, the US 10-year premium has risen by about 20 bp to 2.35%. Adjustment on the crosses also seems to be playing an important role in the yen’s weakness against the dollar. Since April 17, the euro has gained nearly 8.5% against the yen. The JPY125 area is of technical significance for the cross. Above there, and the euro can rise toward JPY130. The minor gains eked out by the Dow and NASDAQ failed to carry over to Asia. The MSCI Asia Pacific Index was off 0.5% after reaching its best level since mid-2015 yesterday. Note that Korean markets are closed as the nation votes for president today. European equities are doing better. The 0.5% gain by the Dow Jones Stoxx 600 is being led by materials, energy, and real estate. Only utilities are lower. Italian bank shares are up 1.4%. It is a sixth gain in the past seven sessions, and an index of Italian bank shares are at its highest level since last April. Lastly, we note that the VIX fell to its lowest level since 1993 yesterday and will begin today’s session below 10%. |

FX Performance, May 09 |

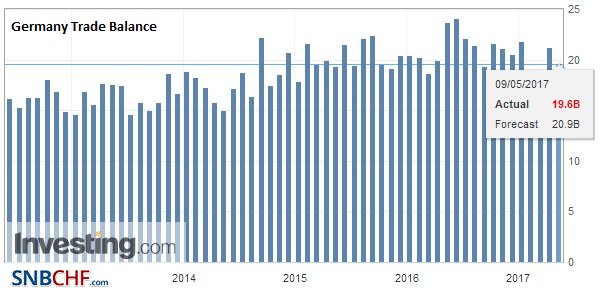

GermanyGermany reported trade and industrial production figures for March and Italy reported retail sales. German industrial output fell 0.4% in March, which is nearly half the decline that many economists expected after a sharp 2.2% increase in February, which was subsequently revised to 1.8%. Net-net, the year-over-year figure was nearly steady at 1.9% rather than the revised 2.0% pace posted in February. Germany reports the first estimate of Q1 GDP at the end of the week. The economy appears to have accelerated in Q1 to 0.6% from 0.4% in Q4 16. Over the past four, eight, and 12 quarters, the Germany economy has averaged 0.4% growth. |

Germany Trade Balance, March 2017(see more posts on Germany Trade Balance, ) Source: Investing.com - Click to enlarge |

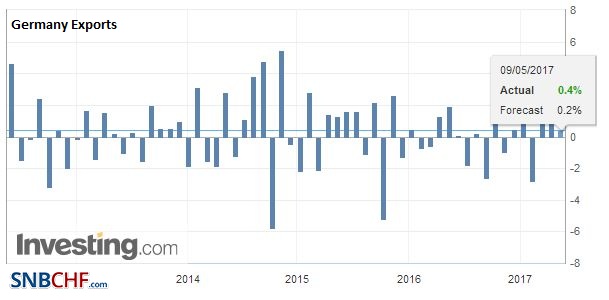

| The German trade surplus, as a source of widespread criticism (EU, ECB, US) jumped by a quarter in March to 25.4 bln euros from 20.0 in February. Export growth slowed to 0.4% after a revised 0.9%. |

Germany Exports, March 2017(see more posts on Germany Exports, ) Source: Investing.com - Click to enlarge |

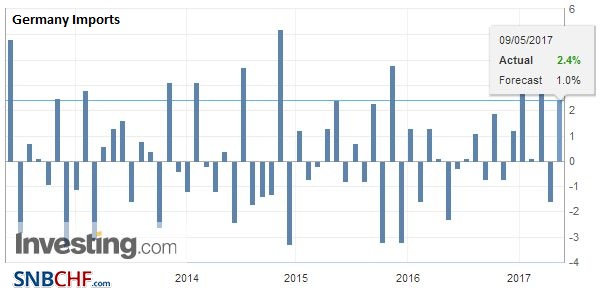

| Imports, which had fallen 1.6% in February rose 2.4% in March, which was more than expected. The German current account jumped to a new record high of 30.2 bln euros (from 20.7 bln). The current account was flattered by what seems to be a seasonal increase in primary income (investment income) and a small deficit on secondary income (aid). |

Germany Imports, March 2017(see more posts on Germany Imports, ) Source: Investing.com - Click to enlarge |

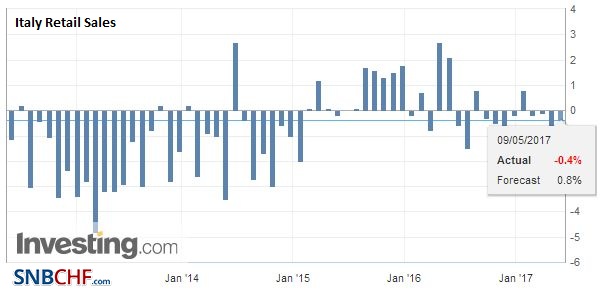

ItalyItaly’s retail sales disappointed. They were flat in March rather than increase by 0.2% as economists expected. The contraction in February was shaved from 0.3% to 0.2%. Year-over-year, retail sales have fallen by 0.4%. Italy reports industrial output tomorrow and Q1 GDP early next week. With the French presidential election over, and Merkel’s CDU finding better footing in state elections and national polls, the focus of angst in Europe turns to Italy, where parliamentary elections are due next year. The Five-Star Movement is polling well, and is, for all practical purposes running neck and neck with the PD, which recently saw Renzi re-elected leader. |

Italy Retail Sales YoY, March 2017 Source: Investing.com - Click to enlarge |

Eurozone

Separately, we note that Axel Weber, formerly of the Bundesbank, and the favorite to replace Trichet at the helm of the ECB, until he quit over unorthodox monetary measures, articulated an outlook that many expect. There will likely be some modification of the ECB’s risk assessment and forward guidance as early as next month. A decision to taper the asset purchase program may be announced in September.

United Kingdom

The UK reported strong BRC like-for-like retail sales. The 5.6% year-over-year increase is the strongest since 2006 when Easter again distorted the figures. The Easter holiday likely distorted the report. However, below the surface, the divergence between increased food sales (2.4% like-for-like) and non-food retail sales (0.3%) may be a warning sign of problems brewing.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$EUR,$JPY,$TLT,EUR/CHF,FX Daily,Germany Exports,Germany Imports,Germany Trade Balance,newslettersent