See the introduction and the video for the terms gold basis, co-basis, backwardation and contango.

A Force Like GravityThis was a holiday-shorted week, due to Good Friday, and we are posting this Monday evening due to today being a holiday in much of the world. Gold and silver went up the dollar went down, +$33 and +$0.53 -64mg gold and -.05g silver. The prices of the metals in dollar terms are readily available, and the price of the dollar in terms of honest money can be easily calculated. The point of this Report is to look into the market to understand the fundamentals of supply and demand. This can’t necessarily tell you what the price will do tomorrow. However, it tells you where the price should be, if physical metal were to clear based on supply and demand. Of course, two factors make this very interesting. One is that the speculators use leverage, and they can move the price around. At least for a while. The other is that the fundamentals change. There is no guarantee that the prices of the metals will reach the fundamental price of a given day. Think of the fundamentals as gravity, not the strongest force in the system but inexorable, tugging every day. |

|

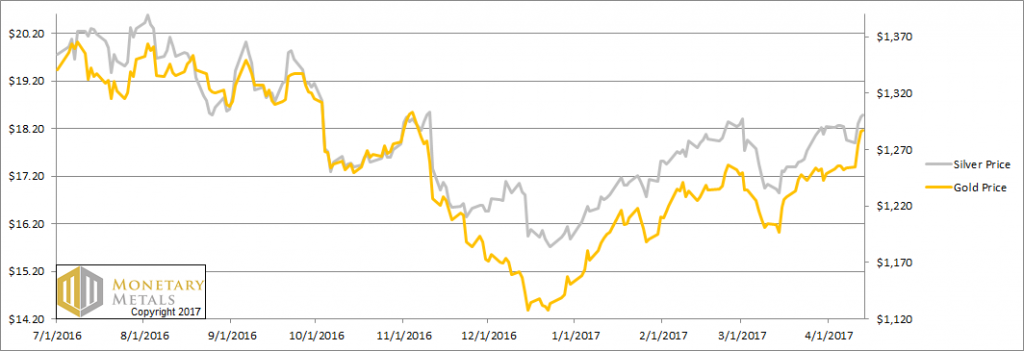

Fundamental DevelopmentsThis week, the fundamentals of both metals moved, though not together. We will take a look at that below, but first, the price and ratio charts. |

Gold and Silver Price(see more posts on gold price, silver price, ) |

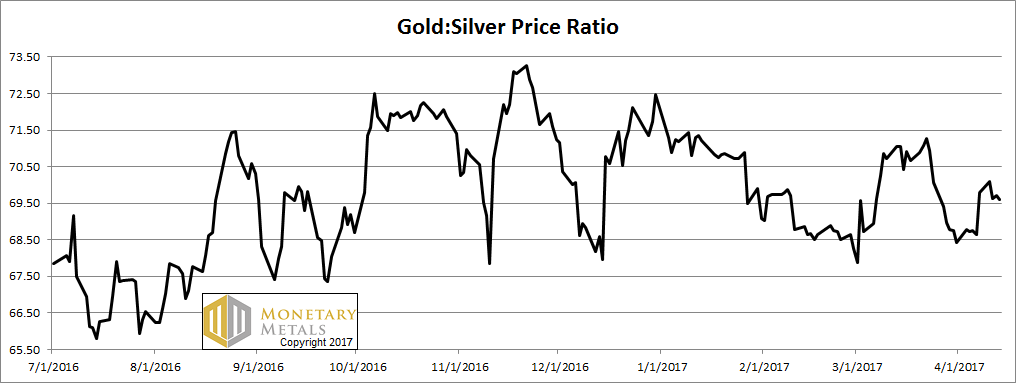

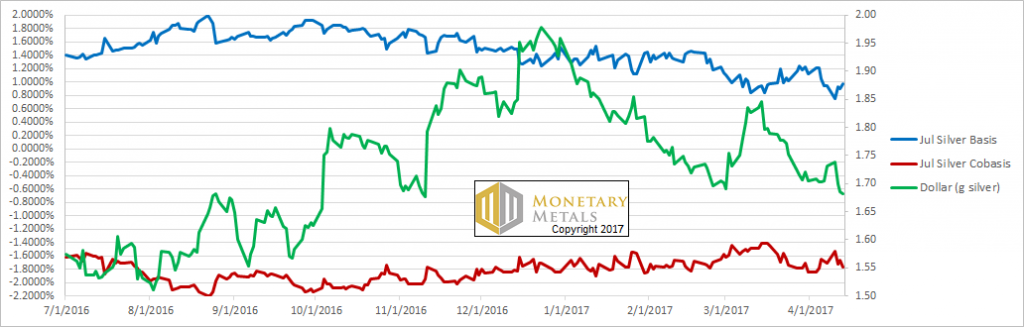

Gold:Silver RatioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It didn’t move much this week. For each metal, we will look at a graph of the basis and co-basis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and co-basis in red. |

Gold:Silver Ratio(see more posts on gold silver ratio, ) |

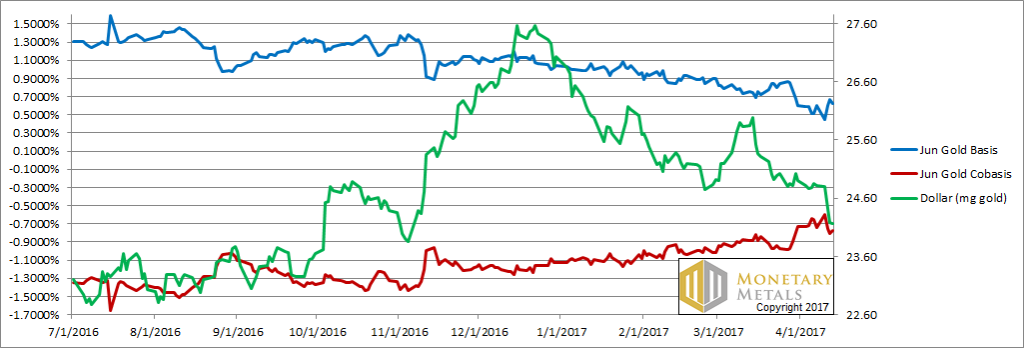

Gold Basis and Co-basis and the Dollar PriceHere is the gold graph. The scarcity (i.e. the co-basis, the red line) is in a gentle rising trend for about six months. This week, the co-basis was down slightly. Not a surprise given the (relatively) big price move of +$33. Nor does it appear to break the trend. Our calculated fundamental price of gold is at $1,301, just above the market price. |

Gold Basis and Co-basis and the Dollar Price(see more posts on dollar price, gold basis, Gold co-basis, ) |

Silver Basis and Co-basis and the Dollar PriceNow let’s look at silver. In silver, it’s much harder to say that there is an uptrend in the co-basis. Our indicator of scarcity is at the same level it was in October. Back then, the price of silver was $17.60 and on Thursday it was just about 90 cents higher. The fundamental price back then was just under $15. Now it’s just under $16.50. This happens to be down about 40 cents this week. With the fundamental price of gold rising, and that of silver falling, it’s not surprising that the fundamental gold-silver ratio is up to a bit over 79. |

Silver Basis and Co-basis and the Dollar Price(see more posts on dollar price, silver basis, Silver co-basis, ) |

Full story here Are you the author? Previous post See more for Next post

Tags: dollar price,gold basis,Gold co-basis,gold price,gold silver ratio,newslettersent,Precious Metals,silver basis,Silver co-basis,silver price