In 1830, France was once more swept up in revolution, only this time at the end of it was installed one king to replace another. Louis-Phillipe became, in fact, France’s last king as a result of that July Revolution. The country was trying to make sense of its imperial past with the growing democratic sentiments of the 19th century. Despite being one of the richest men in all Europe and aligned with the Bourbons, he was Duke of Orleans and married to a Neapolitan princess, the reign of Louis-Phillipe I was supposed to be a milder form of dominion, the so-called citizen king or bourgeois monarch.

Caught up in the upheaval of 1830 were many who had been aligned with the deposed Charles X. Because the citizen king was viewed as a usurper throughout much of France, his time on the throne tended to be more repressive, particularly toward those who had at least been in the Charles court and government. Among them was a Versailles lawyer named Gustave de Beaumont, who, sensing that the political winds had shifted despite the grand upheaval toward (outwardly, at least) more liberal sentiments, gained permission to get out of the country.

Beaumont would travel to the United States ostensibly to study in grand and comprehensive detail its penal system. He set out in April 1831 taking with him a young 25-year old friend, a former magistrate who had similarly found himself of disfavor under the bourgeois monarch. The two landed in Rhode Island and traveled all over the country doing quite a bit more investigation than strictly prison life in the United States. It was, in fact, an examination of this country’s political soul.

The pair returned to France in 1832 to the stark contrast of what must have been near constant unsettled dynamics, from political to economic life (though in those days there was no difference between politics and economics). Beaumont was largely responsible for the authoring the official work derived from their journey, On the Penitentiary System in the United States and Its Application In France. His partner, Alexis de Tocqueville, was more interested in America as an ideal, completing in 1835 the first part of what would be one of the most influential books of the whole 19th century, Democracy In America.

Because of the age in which they landed, there was at the time really no single America. It was still a collection of states but grouped in binary arrangement by the economic ends of its politics. There was the slavery South of agriculture and plantations set against the industrial North with its factories. These two vastly different systems collided at several points, but most especially along the Ohio River. It struck de Tocqueville as one of the most rigorous juxtapositions in all of his journeys:

On the north bank of the Ohio, everything is activity, industry; labor is honored; there are no slaves. Pass to the south bank and the scene changes so suddenly that you think yourself on the other side of the world; the enterprising spirit is gone.

He further described Kentucky as a place where “society has gone to sleep…it is nature that seems active and alive, whereas man is idle.” The South had accumulated a vast wealth, to be sure, but it was of a static sort that was more in keeping with the 18th century than the modernizing world of the 19th.

The economic issue, as always, is labor. The difference North to South in those terms was not really plantation versus factory, but specialization versus sameness. Capitalism is what sets the creative minds of industry free by allowing people to do what they do best. Slavery, quite obviously, by treating most as interchangeable blunt instruments is forever limited in its capacities.

There are those who even today argue that there is no difference between those two labor dynamics. The Socialist Party, the real hardcore capital “S” Socialists who continue to contest unequivocally that socialism has never been tried (don’t you dare bring up Venezuela or Stalin), makes no meaningful distinction between the chattel slavery like that of the antebellum American South and the wage slaves of the North and of contemporary arrangement. Their view is quite clear, so long as workers are divorced from the exact fruits of their labor they are slaves in any case.

The Socialists in Britain tell us:

Thus, the wage-slave has some scope for self-development and self-realisation that is denied the chattel slave. Limited scope, to be sure, for the wage-slave must regularly return to the cramped world of wage labour, which spread its influence over the rest of life like a pestilential mist.

For an economic doctrine it is surprisingly (not really) devoid of economic literacy. I don’t quite know how to fashion my own cell tower, nor do I have the ability to make the components for the computer I use to type this out, or the capacity to make my own electricity by which all of it would run. The only way those things are even possible is if, as de Tocqueville observed almost two centuries ago, “labor is honored.” That means nothing other than specialization.

The fracture which the Socialists and others have always sought to exploit is money. Labor is very well honored in the barter system, but it is not an efficient one that can exploit (I use that particularly word with purpose) all the capitalist means of advance. The introduction of money as a unit of account is, as Adam Smith observed, one of humanities most precious advances:

The man who wanted to buy salt, for example, and had nothing but cattle to give in exchange for it, must have been obliged to buy salt to the value of a whole ox, or a whole sheep, at a time. He could seldom buy less than this, because what he was to give for it could seldom be divided without loss . . . If, on the contrary, instead of sheep or oxen, he had metals to give in exchange for it, he could easily proportion the quantity of the metal to the precise quantity of the commodity which he had immediate occasion for.

Thus, for honest trade there must be honest money. The regular business cycle, however, meant that there were times when money (liquidity) would be valued more than labor, and so the entire discipline of economics especially after the Great Depression has been dedicated to expropriating money so that liquidity would never again become at the expense of honest labor. It is a timeless quest, and indeed a good and worthy ideal, one that has been given voice on innumerable occasions. William Jennings Bryan in 1896 within his “cross of gold” speech here again in America masterly thundered:

The man who is employed for wages is as much a businessman as his employer. The attorney in a country town is as much a businessman as the corporation counsel in a great metropolis. The merchant at the crossroads store is as much a businessman as the merchant of New York. The farmer who goes forth in the morning and toils all day, begins in the spring and toils all summer, and by the application of brain and muscle to the natural resources of this country creates wealth, is as much a businessman as the man who goes upon the Board of Trade and bets upon the price of grain. The miners who go 1,000 feet into the earth or climb 2,000 feet upon the cliffs and bring forth from their hiding places the precious metals to be poured in the channels of trade are as much businessmen as the few financial magnates who in a backroom corner the money of the world.

| There is a great truth in what Bryan says, though, I believe, in service of the exact wrong direction. What he, like de Tocqueville, had noticed is balance; a simple and yet altogether insanely complex ideal. There must be money and there must be rules governing that money, but those must be stable as well as faithful to the balance to labor. We cannot swing too far in any one direction, as Bryan proposed with his further silver agitation, for that is the place where all economics becomes the pure politics of dissatisfaction and revolution; from the contradictions of early America to the constant upheaval of 19th century France and Europe.

This can, at times, seem like all ancient stuff. Surely the modern 21st century has left long ago the criticisms of the 1800’s like those of Karl Marx (who was no fool). But Marxism has undergone resurgence, and a big one that should not be underestimated, and all because of the bastard lie of the Great “Moderation.” Economists tells us that it was the golden age where technocratic prowess of perfect ideals was put best to work in fashioning stable growth – and then leave us with no answers, none, to the asset bubbles as well as what really happened ten years ago. |

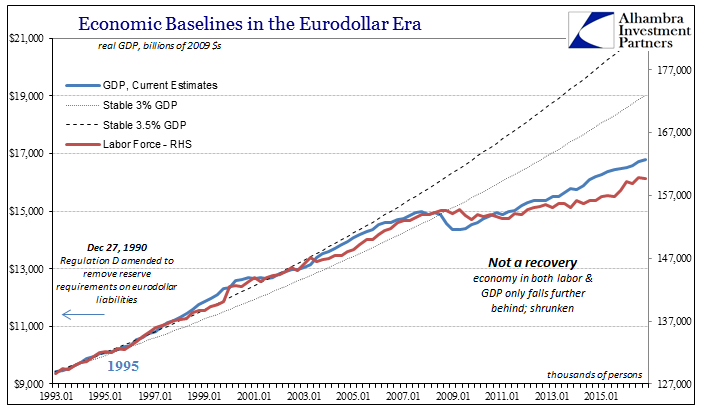

Economic Baselines in the Eurodollar Era, January 1993 - 2016 |

| They have done this under the banner of capitalism and free markets. And so the grave dissatisfaction over this lost decade everywhere in the world has taken on those proportions for a sizable minority (feel the Bern). The longer this is allowed to continue, the closer to the tipping point we might get.

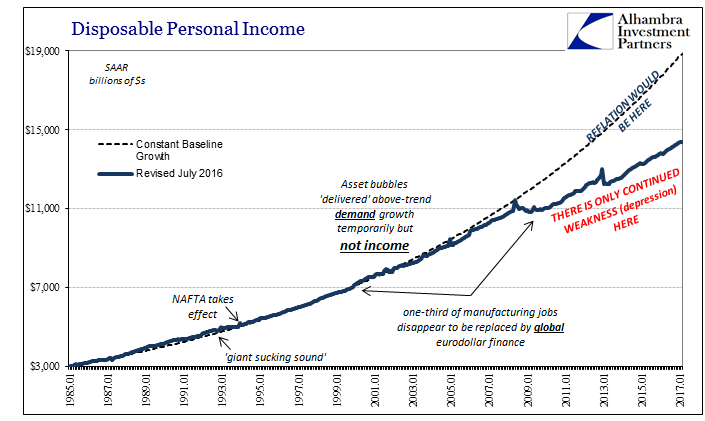

The irony of classifying the Great “Moderation” as one age of ideal capitalism is its utter lack of capital. Money has become so fungible as to be purely undefinable. If money is such, there cannot be balance of capital to money, nor of most importantly money to labor. That hidden imbalance of the last few decades in that regard is everything about the stagnant world left in its wake; the economists of the 1980’s forward have allowed the US and global economy to transverse the Ohio River to the Southern side. By that I don’t mean the socialists are right and that we all are slaves regardless; rather, I mean simply that by allowing money growth to go so far out of control (in both directions now) labor is no longer honored as it needed to be, and still does. |

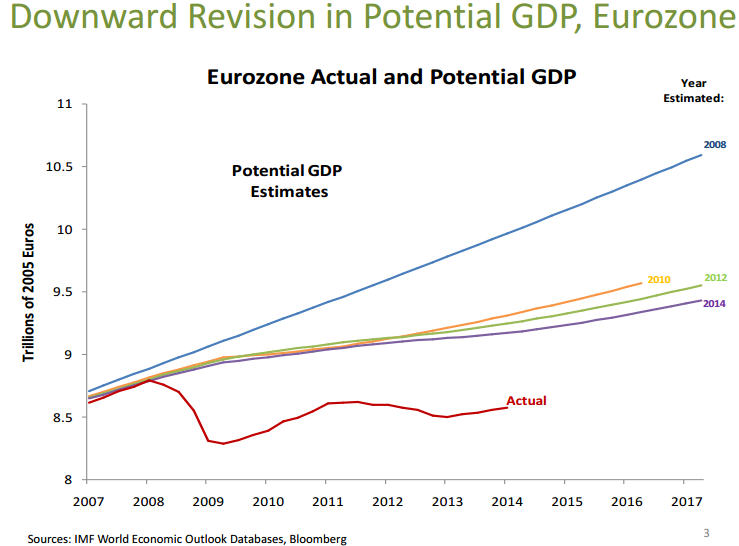

Eurozone Actual and Potential GDP, 2007 - 2017(see more posts on Eurozone Gross Domestic Product, ) |

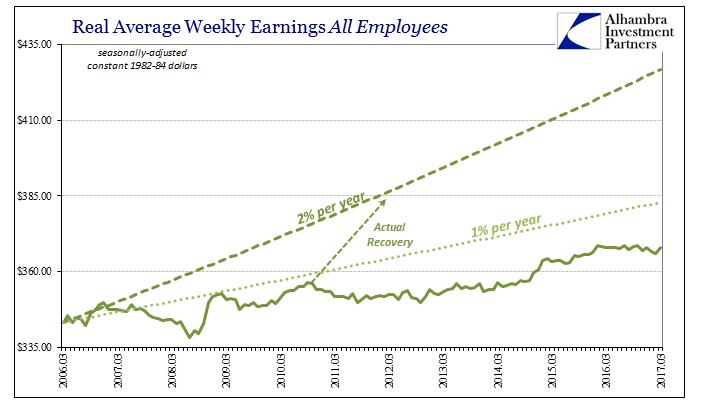

| The affliction of wage reduction, in aggregate terms, is not at all about drug addicted, lazy Americans and their retiring grandparents; it is the lack of restored balance in money. It is, again, just that simple as well as insanely, incomprehensibly complicated. |

US Disposable Personal Income, Jan 1985 - 2017(see more posts on U.S. Disposable Personal Income, ) |

US Average Weekly Earnings, March 2006 - 2017(see more posts on U.S. Average Earnings, ) |

|

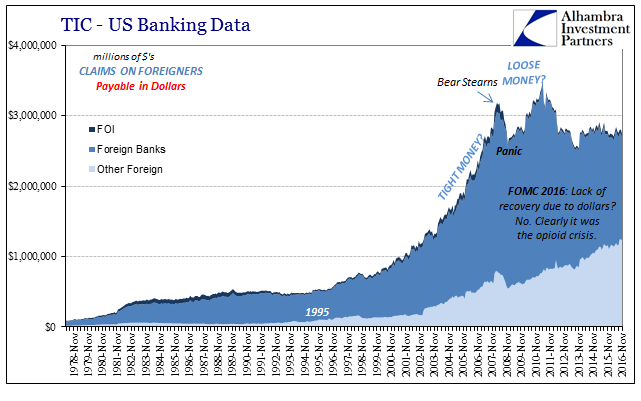

TIC - US Banking Data, Nov 1978 - 2016 |

|

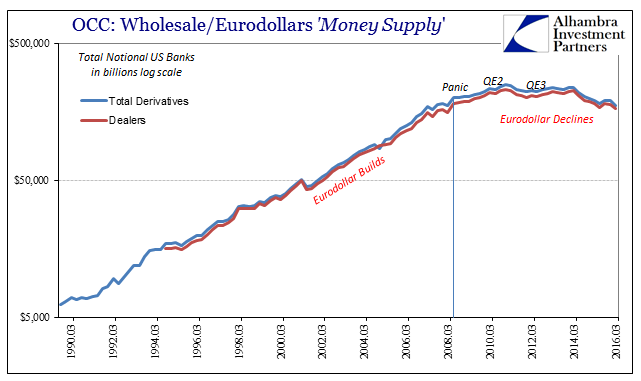

US Money Supply, Mar 1990 - 2016(see more posts on U.S. Money Supply, ) |

|

Ratio of Total Loans, Q1 1952 - Q1 2012 |

Tags: currencies,dollar,economy,Eurozone Gross Domestic Product,Federal Reserve/Monetary Policy,Markets,newslettersent,U.S. Average Earnings,U.S. Disposable Personal Income,U.S. Money Supply