Swiss Franc |

EUR/CHF - Euro Swiss Franc, April 25(see more posts on EUR/CHF, ) |

GBP/CHFWe have seen small gains made by the Euro against the Swiss Franc since the result of the first round of the Presidential elections in France, and indeed the Swiss Franc has generally weakened against most major currencies over the course of this week. The SNB (Swiss National Bank) have recently commented that they do have room to cut interest rates should they decide that they need to, which are currently sat at -0.75%. A lot now really depends on the next round of the French elections and should Marine Le Pen start to perform well and the Swiss Franc start to make gains once again then a move would not be out of the question. Although we do not have another interest rate decision due from the SNB for another 51 days (the next one is due on Thursday 15th June) I would not rule out the possibility of an earlier movement as the SNB have done this before and would not be afraid to do it once again. Those who have been following the Swiss Franc for a number of years will remember when the SNB removed the peg for CHF/EUR leading to movements of over 25% in a day for Swiss Franc exchange rates, certainly one of the strangest days I have had on this trading floor in the ten years I have been here. If you live in Switzerland and send money to the U.K or Europe, or should you be looking to buy a property in Switzerland and you have Swiss Francs to buy with either Euros or Pounds then I can help you with this. |

GBP-CHF - British Pound Swiss Franc, April 25(see more posts on GBP/CHF, ) |

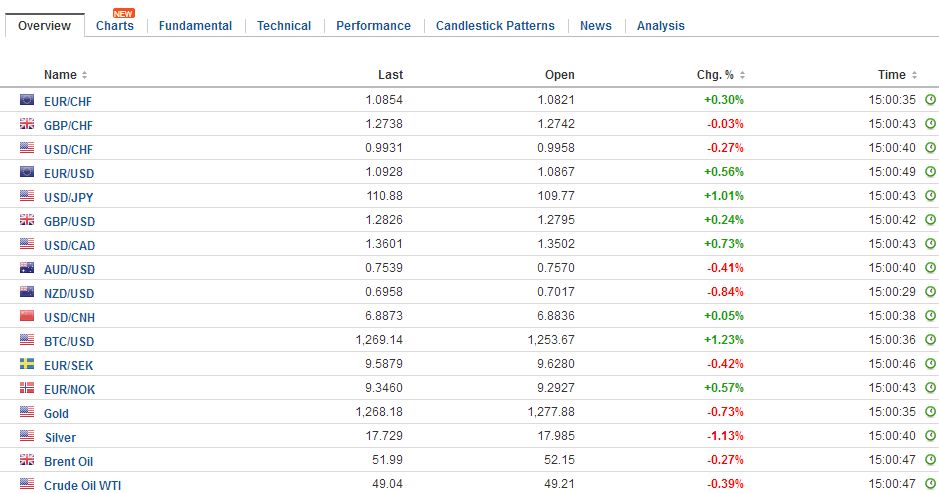

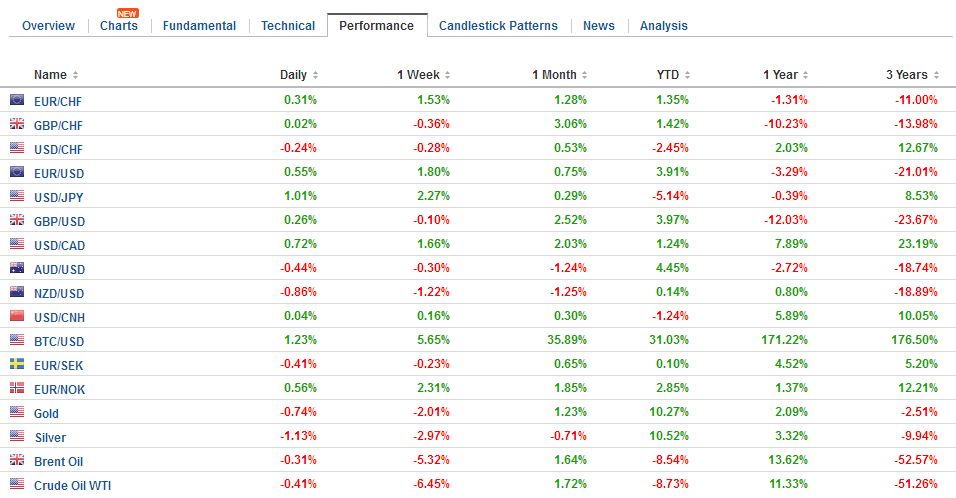

FX RatesThe US dollar is again at the fulcrum of the foreign exchange market. The dollar-bloc currencies are under pressure, along with the Japanese yen, while the European complex is posting modest gains. The euro is consolidating in the half cent below $1.09. Yesterday’s marked up in early Asia saw the euro complete the 61.8% retracement of the losses since the US election, which was found near $1.0935. Recall that the euro was trading around $1.1075 early last November. The $1.0980 area corresponds with a 50% retracement of the euro’s decline from last year’s high (in May near $1.1615). The 100-week moving average is a little below $1.10. |

FX Daily Rates, April 25 |

| Sterling has carved out a shelf in the $1.2770 area. It had briefly slipped through there before the weekend but quickly recovered. Yesterday’s high of $1.2870 may have been the retest on last week’s $1.29 high. A lower high is being recorded today ($1.2830).

The US dollar is trading at new highs for the year against the Canadian dollar and is approaching the Q4 16 high near CAD1.3600. Recall that the CAD1.3575 area corresponds to the 50% retracement objective of the US dollar’s decline from January 2016 high near CAD1.4700. The 61.8% retracement is found around CAD1.3840. In contrast, we note that previously Mexico seemed to draw the ire of the Trump Administration. Since a couple of days before Trump’s inauguration, the Mexican peso has been the strongest currency in the world, appreciating 16% against the dollar. Among the majors, sterling has been the strongest over that period, rising 6.4%. Among emerging markets, the Russian ruble is second best, up almost 7%. Also, for the first time in a couple of years, speculators in the futures market are net long pesos. |

FX Performance, April 25 |

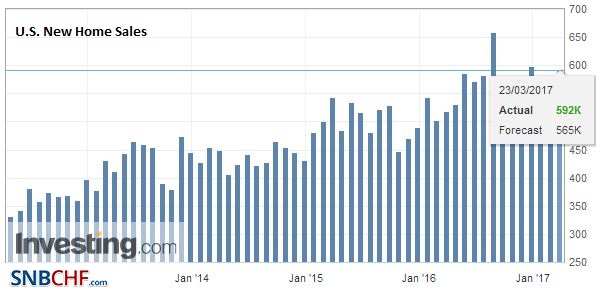

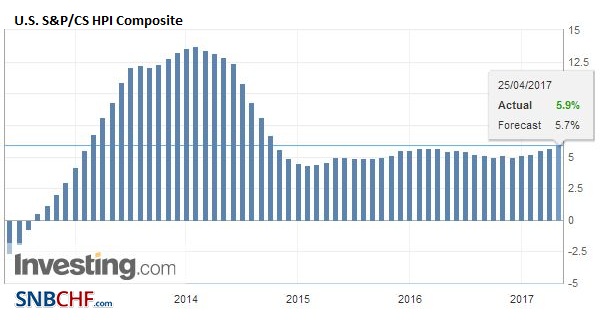

United StatesThe economic calendar in Asia and Europe is light, and it only picks up a little in the US. New homes sales and |

U.S. New Home Sales, March 2017(see more posts on U.S. New Home Sales, ) Source: Investing.com - Click to enlarge |

| the S&P CoreLogic house price index (the old CaseShiller), |

U.S. S&P/CS House Price Index Composite, March 2017(see more posts on U.S. Case Shiller Home Price Index, ) Source: Investing.com - Click to enlarge |

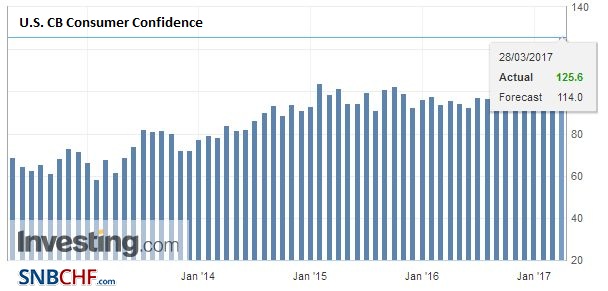

| the Conference Board’s consumer confidence measure, and the Richmond Fed manufacturing survey will be reported. However, with Q1 GDP due at the end of the week, the second tier data is unlikely to have much impact. |

U.S. CB Consumer Confidence, March 2017(see more posts on U.S. Consumer Confidence, ) Source: Investing.com - Click to enlarge |

The Commerce Department’s decision is preliminary. A final decision requires the US International Trade Commission to find that US industry suffered. Meanwhile, the action will likely have a cooling effect. The other potential trade friction involves the dairy industry.

The focus is on US tax policy and the need to renew the federal government’s spending authorization of face a government shutdown that would begin on Trump’s 100th day in office. Trump is expected to make some broad comments on his tax stance, but some aspects have already been picked up by the media. These include a 15% corporate tax rate from the current 35% schedule. The controversial border adjustment tax has lost favor and does not appear to be supported by the White House. The signals from Administration officials suggest the emphasis is on stimulating growth more than addressing the deficit.

Treasury Secretary Mnuchin already hinted at this course. The Administration wants to use a dynamic scoring which will allow it to forecast stronger growth and therefore a smaller deficit as a percentage of GDP. Ultimately for Congressional purposes, the key is the assessment by the Joint Committee on Taxation.

The controversial wall on the Mexican border reportedly is an important obstacle to an agreement on extending spending authorization. Some reports suggest that the White House may compromise and take up the fight in later in the year as the FY18 budget is negotiated. The wall was ostensibly to be paid by Mexico, which always rejected the idea. US taxpayers are being asked to foot the bill, with the Mulvaney, heading up the Office of Management and Budget, offering to fund the Affordable Care Act if the Democrats would support the wall.

Bond yields are firm. European yields are two-four basis points higher, while the US 10-year yield is back testing the 2.30% level. The dollar barely entered the gap created by yesterday’s sharply higher opening against the yen, but support was found at near JPY109.60 (and the gap extends to almost JPY109.40). Yesterday’s high near JPY110.65 may hold unless US Treasury yields continue to recover. The Us 10-year yield is rising for the fifth consecutive session and sixth in last seven.

Lastly, we note that the June light sweet crude oil futures contract has fallen for the past six consecutive sessions. It is essentially flat today, holding above yesterday’s low a little above $49. US oil inventories are expected to have slipped last week, but if the oil surplus is turning into a gasoline surplus, many investors will not be impressed.

Eurozone

The French premium over Germany is narrowing a little more today. The 10-year spread narrowed by 18 bp yesterday to 50 bp and today it is near 48 bp, a little above the year’s low of 45 bp. A year ago it was around 33 bp. The polls show Macron winning the second round, but many recognize that the key to policies going forward is the outcome of the parliamentary elections in June. So while the odds of what some journalists have dubbed Frexit have fallen, there can be no visibility of French policy going forward.

Given the recent CFTC positioning data, which according to Bloomberg showed that a week ago, speculators had a record large long euro futures position, had expected some pullback ahead of the ECB meeting on Thursday. It is unreasonable to expect a change in rates, but Draghi seems set to push against efforts by some creditor nations to push for an early rate hike. At the end of last week, he was clear that rates would stay at current levels of lower (thus maintaining an easier bias) and that risks to growth were on the downside.

Canada

On the other hand, our technical work warned of the vulnerability of the Canadian dollar. The US Commerce Department has slapped 20% tariffs on imports of Canadian softwood lumber (used to build homes) retroactively. The issue has been simmering since 2015 when the previous agreement expired. The issue is that some producers get access to cheap lumber from government lands. The tariff, which was used to compensate expired in 2015. Last year, Canadian producers were able to export lumber to the US duty-free and exports rose by nearly a quarter.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$CAD,$EUR,$JPY,EUR/CHF,FX Daily,gbp-chf,MXN,newslettersent,U.S. Case Shiller Home Price Index,U.S. Consumer Confidence,U.S. New Home Sales