Swiss Franc |

EUR/CHF - Euro Swiss Franc, April 24(see more posts on EUR/CHF, ) |

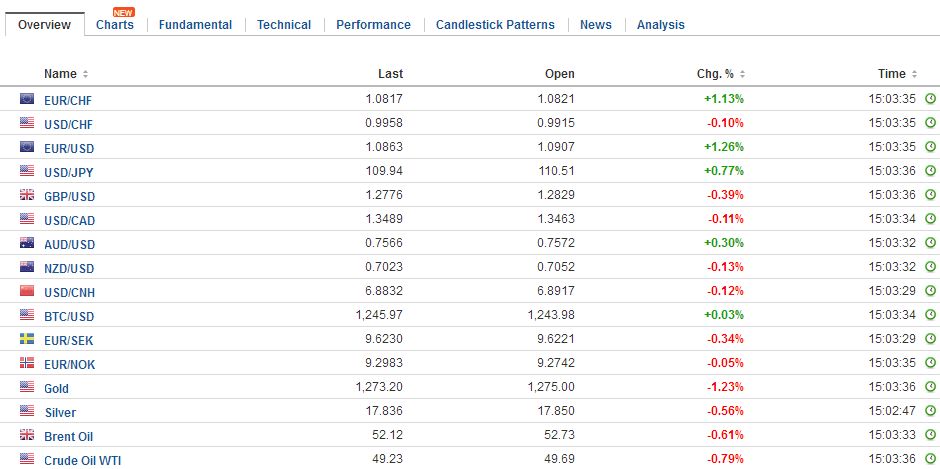

FX RatesThe results of the first round of the French election spurred a dramatic response in the capital markets. Our thesisthat there is no populist-nationalist wave sweeping the world is supported by the previous results in Austria, the Netherlands, and now France. The AfD in Germany is wilting in the polls, and there too the center will hold. The populist-nationalist wave seems a result of the Anglo-American two-party system in which the center-right party adopted part of the populist-nationalist platform. The euro gapped higher in pre-Pacific trading. It had finished the week in North America a little below $1.0730 and jumped to almost $1.0860 on its way to nearly $1.0940. However, it drifted lower in Asia and steadied in Europe around $1.0850. The gap is found between $1.0738 (Friday’s high) and $1.0821 (today’s low). The immediate issue is what kind of gap it is? The longer it is unfilled, the more bullish are the implications. |

FX Daily Rates, April 24 |

|

As the euro gapped higher against the dollar, the dollar gapped higher against the yen. It reached almost JPY110.65 before settling back down around JPY110. The gap is found from the pre-weekend high (~JPY109.42) to today’s low (~JPY109.82). However, we continue to warn that the safe haven status of the yen is misunderstood. The real safe haven is US Treasuries, and the yen moves inversely. US Treasury yields jumped in from below 2.25% in late pre-weekend North American dealings to 2.31%-2.32% in Asia. It has largely held above, 2.30%, the old floor. The euro-yen cross, which has been a key axis, exploded higher. Before the weekend, it reached a high near JPY117.30. It opened around JPY119.55 and reached almost JPY121 before steadying, and like the euro has pulled back toward its opening level. The gap is found between JPY117.30 and JPY119.00. |

FX Performance, April 24 |

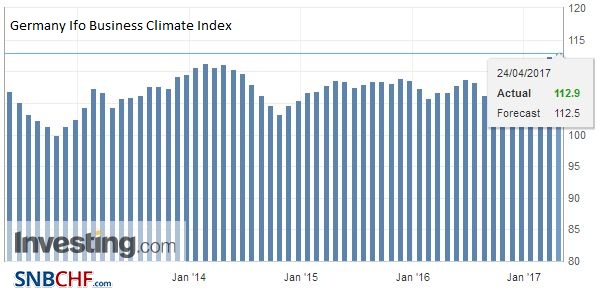

GermanyGermany’s IFO survey was better than expected. The measure of the business climate rose to112.9 from 112.4. |

Germany Ifo Business Climate Index, April 2017(see more posts on Germany IFO Business Climate Index, ) Source: Investing.com - Click to enlarge |

| The market expected a flat number. |

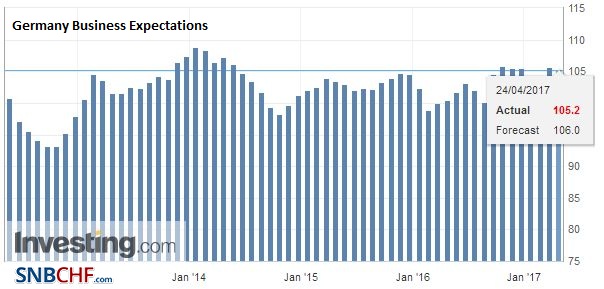

Germany Business Expectations, April 2017(see more posts on Germany IFO Business Expectations, ) Source: Investing.com - Click to enlarge |

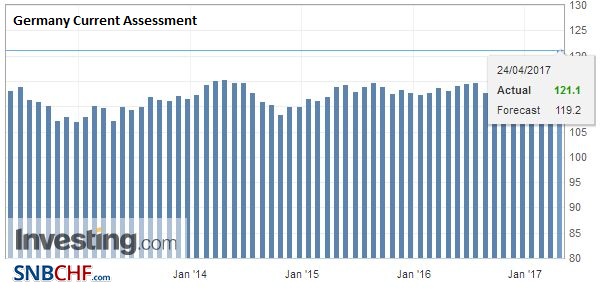

| It reflected an upbeat assessment of current conditions (121.1 vs. 119.5), while the expectations component slipped a little (105.2 from 105.7). |

Germany Current Assessment, April 2017(see more posts on Germany Current Assessment, ) Source: Investing.com - Click to enlarge |

United Kingdom

There have been three economic reports that have largely been lost in the shuffle. In the UK, Rightmove house price index rose 1.1% in April. It is the second month of slower gains, but well above the six and 12-month averages. Still, the year-over-year pace continued to decelerate. At 2.2%, it is the slowest pace in four years. The CBI reported softer business optimism and weaker orders while selling prices remained elevated. Sterling continues to trade at the upper end of the range set on May’s unexpected election call last week.

Eurozone

There are some events that are the week that could challenge it. The ECB meeting stands out as a risk. The March meeting was seen as hawkish, and this does not seem to be Draghi’s intent. Draghi’s comments before the weekend reiterated the line about rates being this low or lower. The ECB’s Nowotny explained that policy for 2017 has already been set, and a decision about 2018 will be made in the second half.

Investors’ sight of relief at the results of the French election is the main driver today. It is sufficient to overwhelm the decision by Fitch before the weekend to downgrade Italy’s sovereign rating to BBB from BBB+. Italian 10-year bond yield is off six basis points, while the German 10-year yield is up nearly 10 bp. Spain’s 10-year yield is down five basis points. France is off 10 bp.

In recent weeks, the fund trackers have reported strong demand for European stocks. European bourses are sharply higher today. The CAC leads the way with a 4.4% advance that has lifted the benchmark to its best level since 2008. The DAX’s nearly 3% gain lifts it to a new record high. While sterling itself is marginally firmer, the FTSE 250 is up nearly 1% to a new record high. The Dow Jones Stoxx 600 is up almost 2%, led by the financials, industrials, and telecom. None of the major industry groups is up by less than 1%.

China

Asia-Pacific interest rates and equity markets rose. The MSCI Asia Pacific Index rose 0.4%, for a third consecutive advancing sessions. The Nikkei advanced more than 1% for the second consecutive session, something not seen since January. Chinese shares were not invited to the party. The Shanghai Composite lows 1.4% amid reports of a regulatory crackdown. It was the largest decline of the year. It is off nearly 5% since the 15-month high was set two weeks ago.

United States

The North American session features the April Chicago Fed’s National Activity survey for March and the Dallas Fed manufacturing survey for April. The highlight of the week is the first estimate of Q1 GDP, which, as we have noted, has underperformed the other quarters on average since the end of the financial crisis. The pullback in consumption after a strong Q4 16 will likely prove temporary. Meanwhile, the drag from the energy sector has been lifted. US oil output has risen by nearly 500k barrels a day over the past five-six months, and rig count and related activity have improved. The Fed’s Kashkari, the lone dissent against the March rate hike, speaks at two functions in California today.

Meanwhile, as President Trump’s 100-day in office approaches, there seems to be a push to make something happen, but this could be a dangerous game if the inflated expectations are not satisfied. In particular, there has been the suggestion that a vote on health care reform could be held this week, but it does not look ready. Trump reportedly will make an announcement on tax reform (Wednesday), but this is likely more of a wish list that detailed proposals. Reports suggest that it will not include the controversial border adjustment tax.

Also, some measure must be passed before the end of the week on the spending authorization of the federal government. Some sort of short-term extension rather than a real solution is likely. It is what has happened to the debt ceiling as well. The Treasury Department has already begun taking extraordinary measures, including reducing its cash balances at the NY Fed, which some have linked to reducing the cost of dollar funding in the cross currency swaps.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,$EUR,$JPY,$TLT,equities,EUR/CHF,EUR/GBP,France,Germany Current Assessment,Germany IFO Business Climate Index,Germany IFO Business Expectations,newslettersent