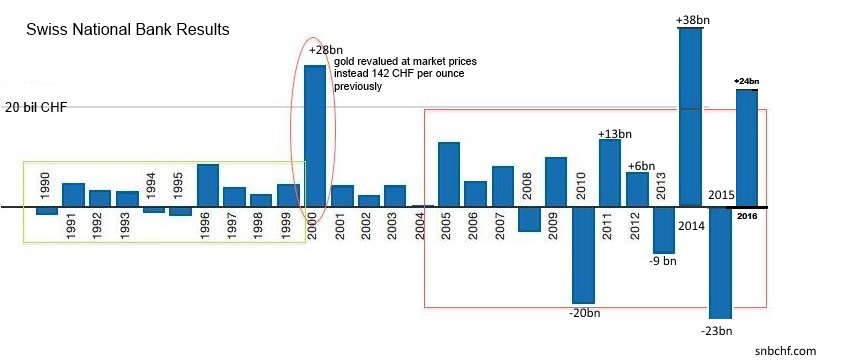

The increasing volatility of SNB EarningsAnnual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse |

SNB Results Longterm 2016 |

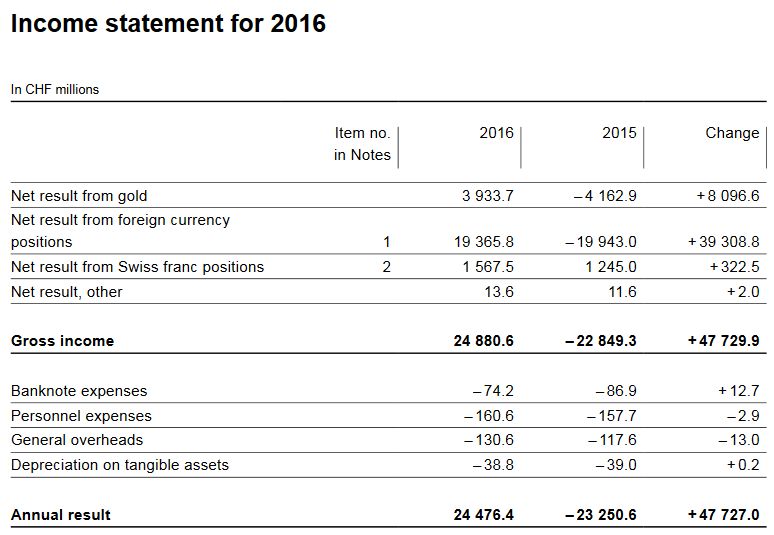

Interim results of the Swiss National Bank for 2016The Swiss National Bank (SNB) reports a profit of CHF 24.5 billion for the year 2016 (2015: loss of CHF 23.3 billion). The profit on foreign currency positions amounted to CHF 19.4 billion. A valuation gain of CHF 3.9 billion was recorded on gold holdings. The profit on Swiss franc positions was CHF 1.6 billion. For the financial year just ended, the SNB has set the allocation to the provisions for currency reserves at CHF 4.6 billion. After taking into account the distribution reserve of CHF 1.9 billion, net profit comes to CHF 21.7 billion. This will allow a dividend payment of CHF 15 per share, which corresponds to the legally stipulated maximum amount, as well as a profit distribution to the Confederation and the cantons of CHF 1 billion. The Confederation and the cantons are also entitled to a supplementary distribution of a maximum of CHF 1 billion if the distribution reserve after appropriation of profit exceeds CHF 20 billion. The net profit for 2016 allows a supplementary distribution of CHF 0.7 billion. One-third of the total distribution is allocated to the Confederation and two-thirds to the cantons. After these payments, the distribution reserve will amount to CHF 20 billion. |

SNB profit of 24.5 bn. CHF in 2016, after a 23.3 bn. loss in 2015 Source: snb.ch - Click to enlarge |

||||||||||||||||||||||||||||||||||||

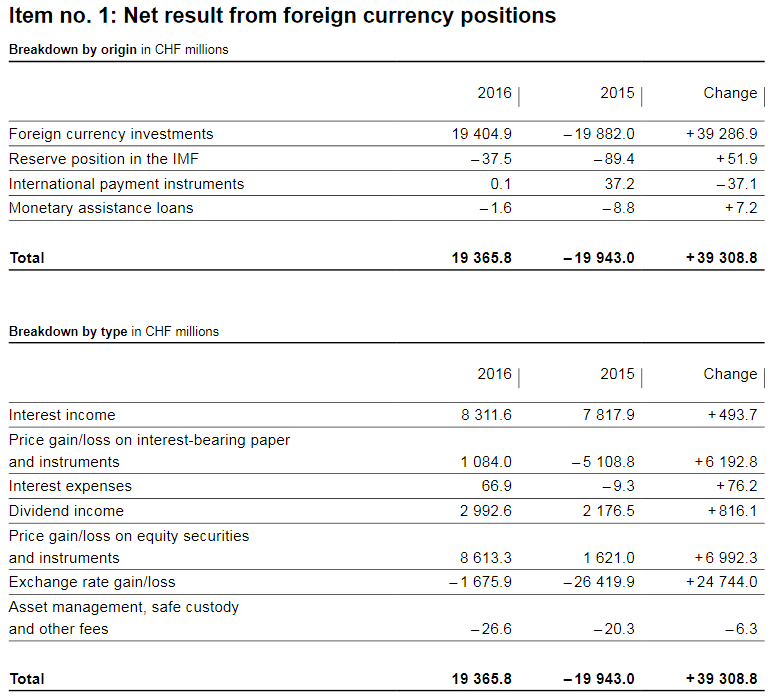

Profit on foreign currency positions

|

SNB Result for Swiss Franc Positions, 2016 Source: snb.ch - Click to enlarge |

||||||||||||||||||||||||||||||||||||

Valuation gain on gold holdings

Percentage of gold to balance sheetEven if the gold price is rising, its parts of the balance sheets is falling.

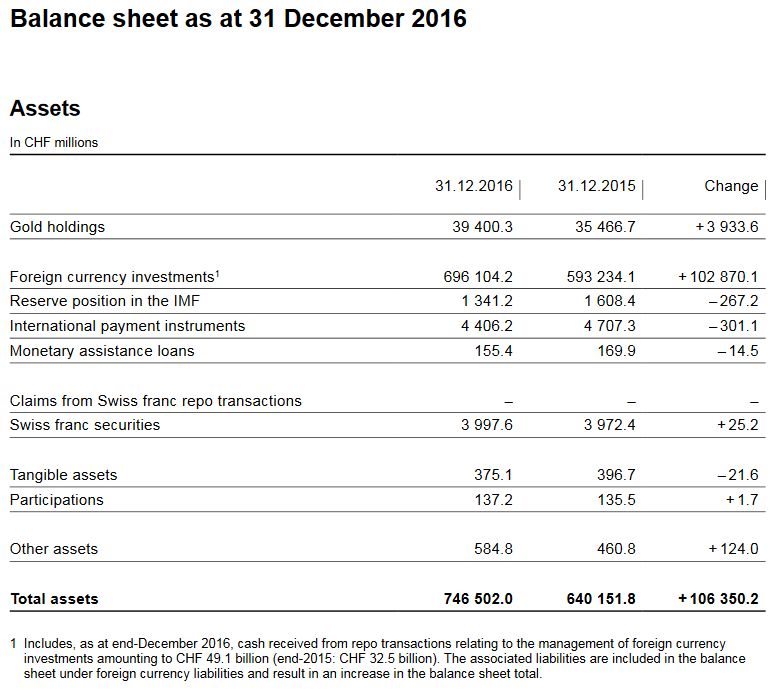

Balance Sheet The balance sheet has expanded by over 106 bn. francs by 16.62%

|

Balance sheet as at 31 December 2016 Source: snb.ch - Click to enlarge |

||||||||||||||||||||||||||||||||||||

|

While the SNB supports foreign stock markets and foreign companies, it does not invest in Swiss stocks.

Profit on Swiss franc positions

Negative Interest ratesFurthermore, the SNB harms the Swiss economy, when it reduces the profits of Swiss banks by negative interest rates. But with this measure she maintains her own profitability.

|

SNB Results for Swiss Franc Positions, 2016 Source: snb.ch - Click to enlarge |

||||||||||||||||||||||||||||||||||||

SNB LiabilitiesSight deposits is the biggest part of SNB interventions

Banknotes in circulation: +5.2 bn francs to 78 bn. CHF |

SNB Liabilities and Sight Deposits, 2016 Source: snb.ch - Click to enlarge |

Provisions for currency reserves

In its annual review, the SNB decided to amend the rule governing the allocation to the provisions for currency reserves, given the high market risks present in its balance sheet. This amendment will be applied for the first time in the 2016 financial year. The percentage increase in provisions will continue to be calculated on the basis of double the average nominal GDP growth rate for the previous five years. However, a minimum annual allocation of 8% of the provisions at the end of the previous year will now also apply. This is aimed at ensuring that sufficient allocations are made to the provisions and the balance sheet is further strengthened even in periods of low nominal GDP growth.

Since nominal GDP growth over the last five years has averaged just 1.9%, the minimum rate of 8% will be applied for the 2016 financial year. This corresponds to an allocation of CHF 4.6 billion (2015: CHF 1.4 billion). As a result, the provisions for currency reserves will grow from CHF 58.1 billion to CHF 62.8 billion.

Full story here Are you the author? Previous post See more for Next post

Tags: newslettersent,SNB balance sheet,SNB equity holdings,SNB Gold Holdings,SNB profit,SNB results,SNB sight deposits,Swiss National Bank