| As the UK triggered its formal departure from the European Union yesterday, gold demand from UK investors remained ongoing and robust with increased numbers of British investors diversifying into physical gold in order to hedge the considerable uncertainty and volatility that the coming months and years will bring.

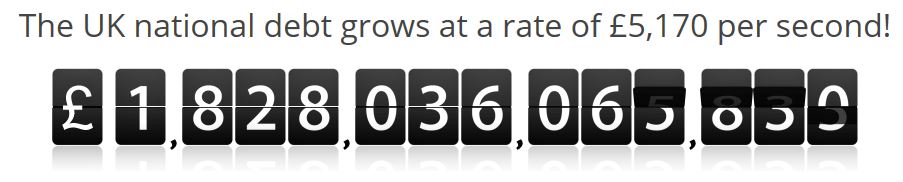

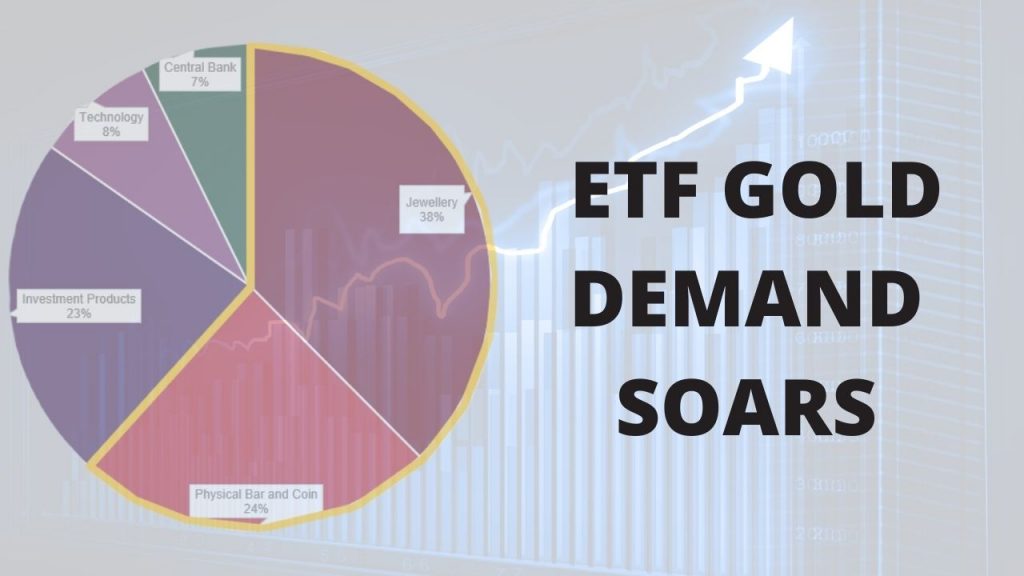

The U.K. government yesterday triggered Article 50–the legal mechanism which will start negotiations on how the UK will exit the EU – after the British voted to leave the EU last June. This is creating considerable uncertainty and concerns about the political and economic outlook – both for the UK and for the EU itself. Demand for gold bars by UK investors has surged 39% in 2016 according to GFMS as reported by the WSJ:

|

Gold Bars and UK GBP, Jan 2008 - 2017Gold in GBP – 10 Years |

| Given the scale of the uncertainty created by the UK decision to leave the EU, robust gold demand in the UK should continue.

Indeed, given the fact that cohesion of the European Union itself will be tested and there is the risk of contagion, gold demand in the EU should also remain robust. Ireland and the Irish economy is particularly vulnerable. Gold has edged up in recent days and appears to be consolidating at the $1,250 level. In sterling terms, the pound has fallen against gold and gold in sterling terms is back above the important psychological level of £1,000 per ounce. The pound fluctuated wildly yesterday against other currencies after the Prime Minister triggered Article 50. A period of intense uncertainty for financial markets, both UK and EU markets and for sterling and indeed the euro awaits. The negotiations are likely to be fractious and divisive and this uncertainty for UK companies, business in general and for the already indebted UK economy does not bode well for sterling. |

|

| It is not not just uncertainty about Brexit talks that will likely support gold. The French elections are now just three weeks away (April 23 and May 7) and the mess that is politics in the U.S. should lead to further safe-haven diversification in the coming weeks.

The ‘Trumpflation’ meme has run its course in markets and stocks and the dollar looks vulnerable to weakness which should support gold. The failure last week to overturn ‘Obamacare’ and the ‘Civil War’ style politics in the U.S. should also support and those seeking to allocate to gold should continue to do so on price weakness. |

Bullish on Bullion, 2012 - 2017 |

Full story here Are you the author? Previous post See more for Next post

Tags: Daily Market Update,newslettersent