Swiss Franc |

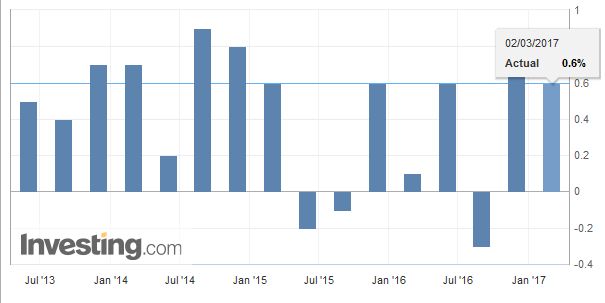

EUR/CHF - Euro Swiss Franc, March 02(see more posts on EUR/CHF, ) Source: Investing.com - Click to enlarge |

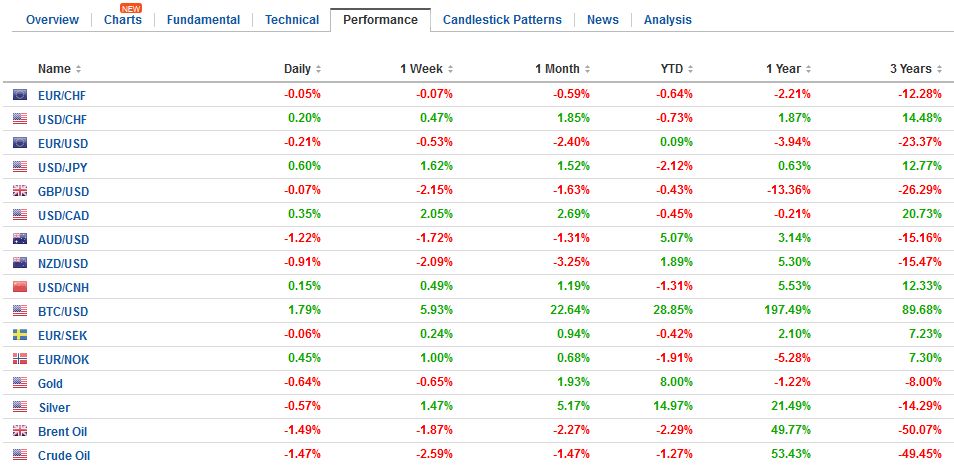

FX RatesThe US dollar is bid against the major currencies as the combination the increased expectation of a Fed rate hike and the President’s commitment to fiscal stimulus buoys sentiment. The dollar-bloc, where speculators in the futures market, have grown a net long position, are leading the move. The Australian dollar is the best performer this year, but is the worst today, giving back 0.75%. It has repeatedly tested the $0.77000 area, and today’s disappointing trade figures and ideas that iron ore prices may have peaked (after a 70% rally over the past eight months) has helped spur the pullback toward the lower end of the range (~$0.7600). The January trade balance was a third of the A$3.8 bln expected. |

FX Daily Rates, March 02 |

| The dollar is extended its gains against the yen for the fourth consecutive session. It is the longest advancing streak since around the US election last November. The greenback is now at two-week highs to approach the upper end of its range since the middle of January seen in the JPY115.00-JPY115.60 area. The drivers seem clear. Rising US rates (and spread over Japanese rates) and rising equities. The US 10-year yield is also rising for its fourth consecutive session.

The S&P 500 has risen in four of the last five sessions. Its 7% gain, year-to-date coming into today’s session, is easily the most within the G7. Japan’s Topix has a three-day streak in tow. A note of caution is in order. The Topix gapped higher to its best level since late 2015, but the initial upside momentum could not be maintained and the close was on the lows. Wednesday’s high, about 0.6% lower than the close (~1554) will be important in tomorrow’s price action. The euro is consolidating in the lower half of yesterday’s range. Participants seem reluctant to sell it near $1.05. It has not closed below there since January 4. On the upside, there may be scope to $1.0560-$1.0580. With the Fed’s Brainard comments late yesterday, also endorsing a rate hike soon, the market, according to Bloomberg’s calculations has it nearly fully discounted (86%). Last Thursday, the calculation showed only a 38% probability was discounted. Fischer and Yellen speak tomorrow, and some participants may be reluctant to lighten up on dollar exposure ahead of them. |

FX Performance, March 02 |

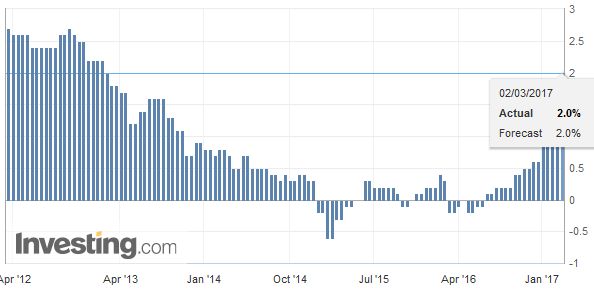

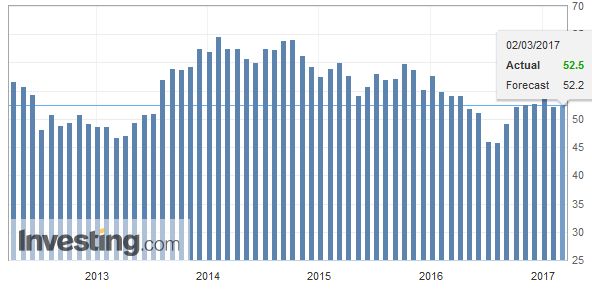

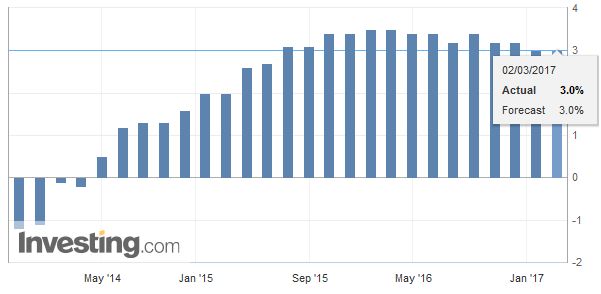

EurozoneEuropean bourses are struggling. Minor losses are being recorded. The Dow Jones Stoxx 600 is off marginally, led by real estate, consumer discretionary and stable. Utilities are the strongest (+0.8%) followed by materials (+0.4%). The economic news from the eurozone has been in line with expectations. The initial estimate for February CPI was 2.0%, up from 1.8% in January. |

Eurozone Consumer Price Index (CPI) YoY, February 2017(see more posts on Eurozone Consumer Price Index, ) Source: Investing.com - Click to enlarge |

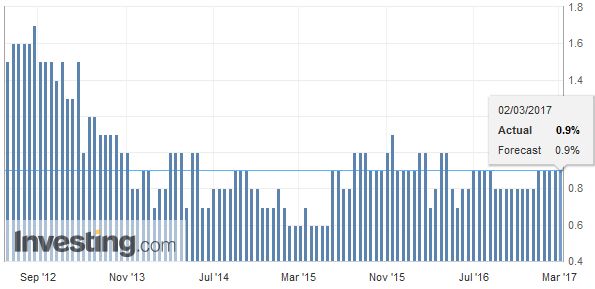

| However, the core rate was steady at 0.9%, around where it has been for months despite the rise in the headline. |

Eurozone Core Consumer Price Index (CPI) YoY, February 2017(see more posts on Eurozone Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

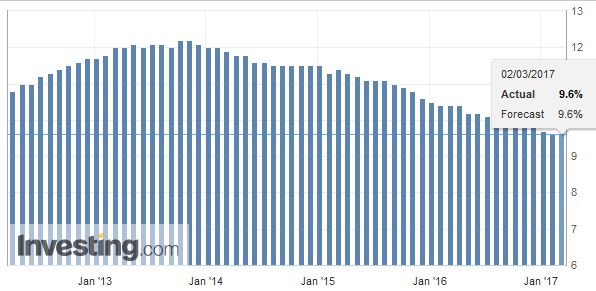

| The January unemployment rate was unchanged at 9.6%. In January 2016, it stood at 10.4%. |

Eurozone Unemployment Rate, February 2017(see more posts on Eurozone Unemployment Rate, ) Source: Investing.com - Click to enlarge |

Eurozone Producer Price Index (PPI) YoY, February 2017(see more posts on Eurozone Producer Price Index, ) Source: Investing.com - Click to enlarge |

|

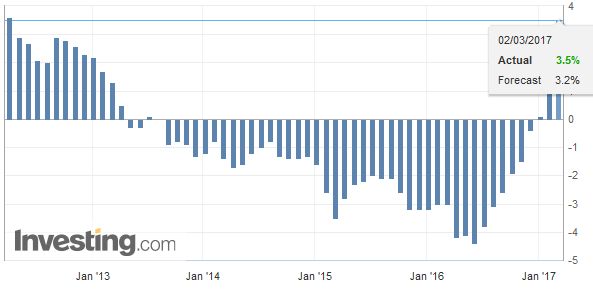

United KingdomSterling is extending its losses today. The uptick in the construction PMI (52.5 from 52.2) was prompted ignored. Sterling had found support, especially on a closing basis near $1.24. It finally closed below it on the last day of February and had not looked back. In fact, it now struggles to resurface above $1.23. The proximate cause of the latest losses was news that the House of Lords added an amendment to the bill that authorizes Prime Minister May to trigger Article 50. The details of the amendment, protecting the rights of EU citizens in the UK, are no so controversial. Cabinet Ministers like Johnson and Gove have expressed a similar sentiment. The issue is two-fold. The defying of the Prime Minister and the delay as the bill goes back to the House of Commons (called ping-pong). This means at least another week delay it seems, making the formal triggering of Article 50 closer to the Ides of March. Separately, note that Northern Ireland votes for a new assembly today. |

U.K. Construction Purchasing Managers Index (PMI), February 2017(see more posts on U.K. Construction PMI, ) Source: Investing.com - Click to enlarge |

Spain |

Spain Gross Domestic Product (GDP) YoY, Q4 2016(see more posts on Spain Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

United StatesThe Dollar Index is testing the 102.00 area. It has not traded above there since January 11. A successful move above there would undermine some ideas that a top (head and shoulders) was being carved. That area also corresponds with a 61.8% retracement objective of the down move since the January 3 high near 103.80.

|

U.S. Initial Jobless Claims, February 2017(see more posts on U.S. Initial Jobless Claims, ) Source: Investing.com - Click to enlarge |

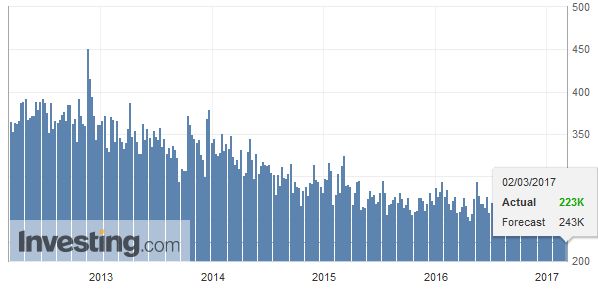

CanadaAfter a flurry of economic reports in recent days, the US calendar is light with weekly jobless claims the only release. Next week’s national report overshadows today’s report. The four-week average stands at new cyclical lows of 241k. The Fed’s Mester speaks, but her views are known. Canada reports December and Q4 16 GDP. A 0.3% expansion in December would translate into 2.0% Q4 growth, down from 3.5% in Q3. The Bank of Canada Poloz saw a half empty glass in his remarks yesterday. The US dollar blew threw CAD1.32 resistance on Tuesday and is pushing near CAD1.34 now. |

Canada Gross Domestic Product (GDP) QoQ, Q4 2016(see more posts on Canada Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,Canada Gross Domestic Product,EUR/CHF,Eurozone Consumer Price Index,Eurozone Core Consumer Price Index,Eurozone Producer Price Index,Eurozone Unemployment Rate,newslettersent,Spain Gross Domestic Product,U.K. Construction PMI,U.S. Initial Jobless Claims