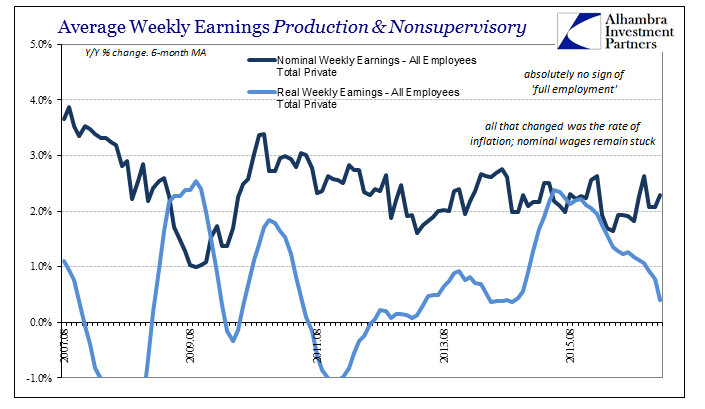

| Real average weekly earnings for the private sector fell 0.6% year-over-year in January. It was the first contraction since December 2013 and the sharpest since October 2012. The reason for it is very simple; nominal wages remain stubbornly stagnant but now a rising CPI subtracts even more from them. Consumers receive no significant boost to their incomes, but are starting to pay more (in comparative terms) for things like gasoline. Without income growth, this is the background for why the economy can only ever remain in variable forms of stagnant. |

Average Weekly Earnings Production and Nonsupervisory August 2007 - February 2017 |

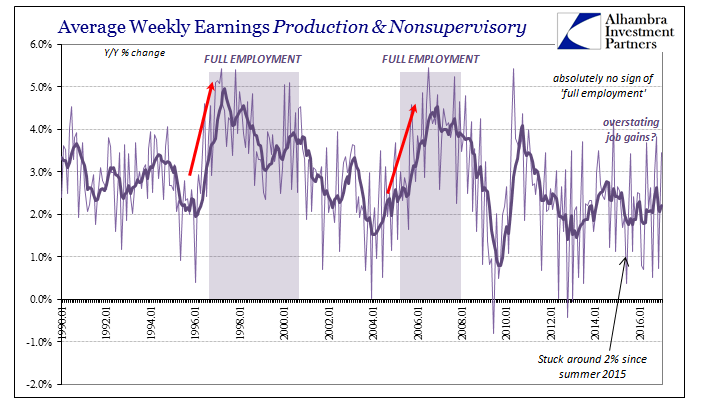

| If the output gap, to the extent there might actually be such a thing, has closed as officials now believe because of the “supply” side foiling all “stimulus” directed at aggregate demand, then the lack of wage growth nominally is its principle side effect. No matter what the unemployment rate says, the wage and income data is consistent in its denial of any indication about full employment. That would argue the output gap isn’t actually closed, but rather that the economy is woefully underperforming for other reasons. |

Average Weekly Earnings All Employees March 2007 - February 2017 |

| To reconcile this difference, policymakers have started to contemplate another labor market absurdity (on top of Baby Boomer retirement and the “skills mismatch” of lazy and drug addicted Americans) as to how wages might not actually accelerate at full employment. The end of “slack” has always meant rising wage growth, therefore the lack of wage acceleration would otherwise argue continued slack and therefore still a positive and serious output gap despite four QE’s and seven years of ZIRP. |

Average Weekly Earnings Production and Nonsupervisory, January 1990 - January 2017 |

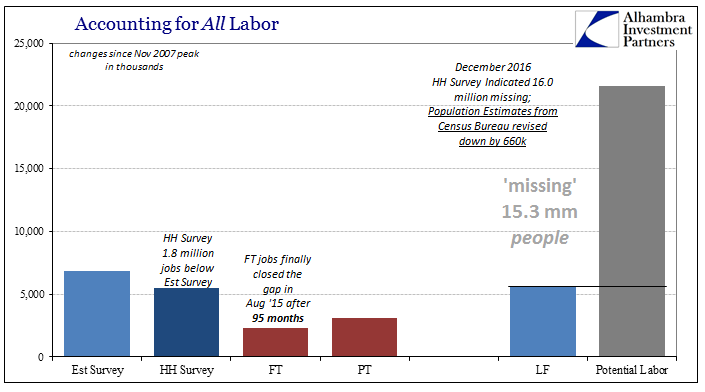

| To believe in full employment and a closed (or nearly closed) output gap is to believe that the shadow proportion of the participation problem is actually permanently withdrawn from the labor force – Baby Boomers actually retired in huge numbers and all at once in late 2008, 2009, and half of 2010, American students remain in college with no intent to ever leave it, and those actually addicted to opiates are so addicted so as to be forever unfit. |

Accounting for All Labor |

| The wage data, on the other hand, by continuing to be depressed despite the unemployment rate suggests that what may appear to be uninterested potential labor (unattached) actually remains very much interested despite various official classifications otherwise (out of the labor force). Like incongruent productivity estimates, it is yet another inconsistency highlighting the problems Economists and officials will continue to have in embracing these economic conditions as just the way it is.

It isn’t, and there is a recovery and sustained growth out there if someone would just embrace it rather than the continued farce. |

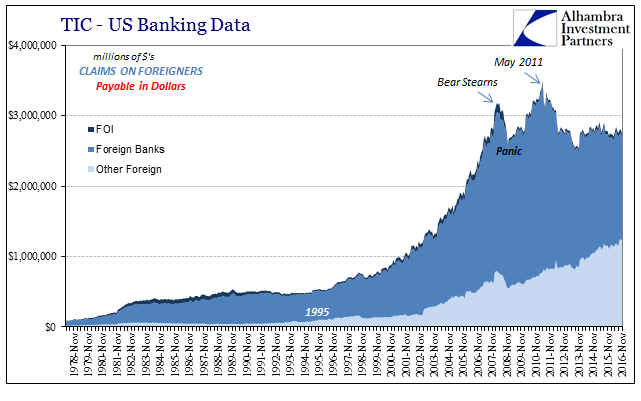

US Banking Data November 1978 - November 2016 |

Tags: currencies,earnings,economy,Federal Reserve/Monetary Policy,inflation,labor force,Markets,newslettersent,participation rate,QE,real wages,slack,stimulus,U.S. Average Earnings,unemployment rate,wages