Exterminating AngelLOVINGSTON, VIRGINIA – Amid all the sound and fury of the Trump news cycle, hardly anyone noticed. There is a specter haunting this economy. It is the specter of inflation… Bloomberg has the report:

French investment bank Natixis makes a related observation:

Wait – inflation is what the Fed has been looking for. And the latest numbers reveal it may have already reached the Fed’s target of 2%. If you’ll recall, the Fed set itself two targets: Unemployment would have to fall below 5%. And inflation would have to rise above 2%. Reaching those two targets would prove that the economy was healthy enough to allow the Fed to raise rates. |

|

| Higher rates of inflation – higher prices – signal more consumer demand. And more labor demand, too. It suggests there are more people with more money ready to spend it. How could that ever be a bad thing? And now, with the Fed’s key targets hit, we’re ready to return to the good ol’ days, right? Oh, dear, dear reader – if it were only that simple!

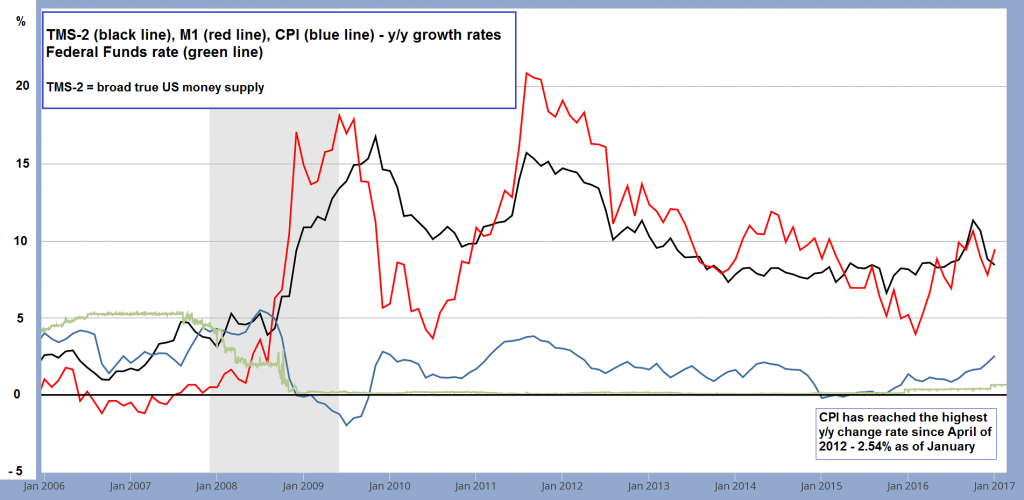

Year-on-year change rates of TMS-2 (broad true US money supply, black line), M1 (red line), CPI (blue line) vs. the FF rate (green line). Keep in mind that large increases in the money supply will initially mainly lead to shifts in relative prices. CPI doesn’t reflect that the prices of stocks, bonds, real estate and other long-lived assets have increased massively. There are as a rule very long time lags between these initial effects of monetary inflation and a rise in all prices. As long as the public remains unaware that the inflationary policy is deliberate and will never end, there is still time to nip the worst in the bud. Once the public becomes convinced that the inflationary policy won’t be reversed, it is too late. At that point the genie is out of the bottle and prices will adjust upward rapidly, as people will try to get rid of cash balances as quickly as possible. That hasn’t happened in a long time, but it would be quite erroneous to think that therefore, it can no longer happen. The typical U.S. household’s income is below the level of 1999. Higher consumer prices will make it harder to keep up living standards. But the bigger problem is debt. Real money – backed by gold – is limited. This limits the amount of debt, because there’s only a limited amount of money to lend. The post-1971 fake-money system, on the other hand, allowed debt to creep up and then gallop away. Now, there’s more than $200 trillion of it worldwide – about three times the global economic output. And here’s the thing: As debt rises, inflation becomes an exterminating angel. Welcome at first – then deadly. Rising prices signal to lenders that the amounts they are owed are losing buying power. They will demand higher rates of interest to protect themselves. |

Money supply CPI and FF rate |

Great ExtinctionBut this is a world whose major institutions – banks, pension funds, governments, large corporations, all the major players in the Deep State system – have flourished on extremely low interest rates. Now, like dinosaurs that have adapted to the tropics, they’ll shiver, die, and go extinct when the chilly winds blow. And they could blow hard. Even an increase of just 1% in the cost of servicing debt – if applied to the world’s debt load – would cost more than $2 trillion a year in interest. Everyone who had to borrow – those aforementioned major players – would suddenly find themselves unable to continue living in the style in which they’d become accustomed. Ordinary households would be in trouble, too. Mortgage rates would go up. House prices would fall. Credit markets would “seize up,” making it difficult to refinance old loans. They would have to cut back, laying off workers and canceling expansion projects – or go broke. Your stocks could easily drop to half of today’s prices… and stay there. Your pension might have to be trimmed. Even the government, if forced to pay more to service its debt, would have to reduce spending. But don’t worry. The central banks have the matter in hand, right? Now that inflation and unemployment are in line, they can let rates rise, right? This will tamp down inflation, right? |

We sometimes wonder if the Deep State is worried that people have a name for it these days. The Kabuki theater of partisan bickering still works as a distraction, but not as well as it once used to, not by a long shot. Many propaganda efforts are failing nowadays, because they are so obviously at odds with reality and because the internet has broken the Deep State’s information monopoly. - Click to enlarge |

Recession WarningIt won’t happen. As we’ve been warning, the Fed can never voluntarily return to a normal interest rate policy because it has created a world that depends on an abnormal one. Here’s what will happen: The Fed will talk about raising rates. It may even raise them another quarter point or more. |

|

| But a recession and a bear market are coming, probably before the end of this year. If President Trump were smart, he’d be trying to get them to start soon so he could blame them on Obama. The longer they take to arrive, the more they have his brand on them.

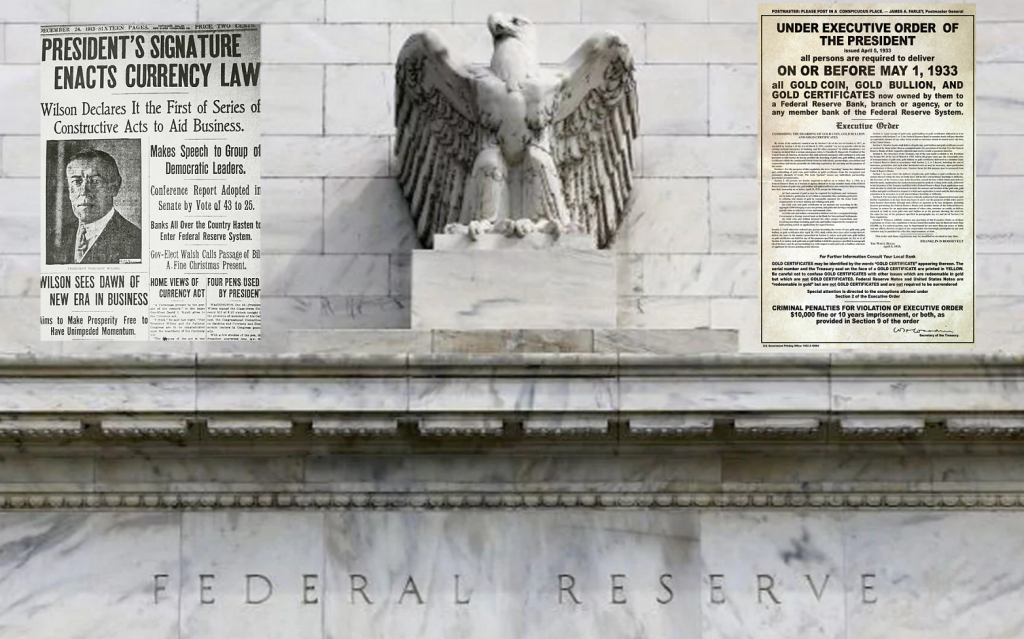

Markets and economies are part of the natural world. They have to breathe in and breathe out. Their lungs fill with ambition and optimism. Then, they must exhale, blowing out the mistakes and disappointments. But when the “correction” comes, the giant raptors in Northern Virginia and the mega-fauna of Manhattan will howl for succor. The Fed will immediately abandon its pretense of returning to normal. Instead, it will buy stocks and bonds. Once upon a time, people were told that what used to be warehouse receipts for actual money would henceforth be their money. Their actual money would be kept safe by the wise men issuing the scrip that could no longer be redeemed. And what could they do? There was a law that said it was going to be so. Besides, there was an emergency, and it would be unpatriotic and small-minded to complain. The next logical step in this progression will be the ban of the irredeemable scrip. After all, who needs it, when digits in a computer are just as acceptable for payment? Only criminals would complain about their property being locked up in the fractionally reserved banking system forever. And why would anyone mind that every movement of their money could now be subject to surveillance by the State – unless they had something to hide? As the wise political philosopher and former German information minister Joseph Goebbels once said: “If you have nothing to hide, you have nothing to fear.” Modern-day politicians and their advisors frequently had occasion to remind us of this maxim in recent years. Obviously, they recognize wisdom when they see it! And it may ban cash… impose negative interest rates… rain down money from helicopters…. and come up with novel new ways of distorting, delaying, and defrauding the economy. |

Chart by St. Louis Federal Reserve Research

Chart and image captions by PT

Full story here Are you the author? Previous post See more for Next post

Tags: newslettersent,On Economy,On Politics