Swiss Franc |

EUR/CHF - Euro Swiss Franc, February 28(see more posts on EUR/CHF, ) Source: Investing.com - Click to enlarge |

GBP/CHFGBH CHF continues to see a volatile period with the general global uncertainty which has seen investors favour the safe haven currency. GBP CHF currently sits at 1.25 for this pair and there is resistance at these levels which is preventing the pound from driving higher. Brexit is now upon us with Article 50 to be invoked by UK Prime Minister Theresa May in the month of March. Whilst there was an expectation that it would be invoked 09/01/2017, the Brexit secretary David Davis made clear that this was not a date he was familiar with so there is still much uncertainty as to when it will actually happen. Meanwhile events in the US and the political uncertainty as to future policies from the Trump administration are also having an impact on the Swiss Franc. In times of global uncertainty both the US dollar and Swiss Franc generally perform well as they are both safe haven currencies. Tomorrow sees UK mortgage approvals released which could give some new direction for sterling exchange rates. The housing market in Britain is under the spotlight at the moment with some concerns that the London housing market may have peaked. Manufacturing data as per the Purchasing Managers Index is released tomorrow which is an excellent barometer of how well the sector is performing. The construction and services sectors data are released this Thursday and Friday respectively. Political events in Britain, France and the Netherlands are going to have a huge impact on all of the currencies in these coming weeks and months and the Swiss Franc is also likely to react to any major developments. |

GBP/CHF - British Pound Swiss Franc, February 28(see more posts on GBP/CHF, ) Source: Investing.com - Click to enlarge |

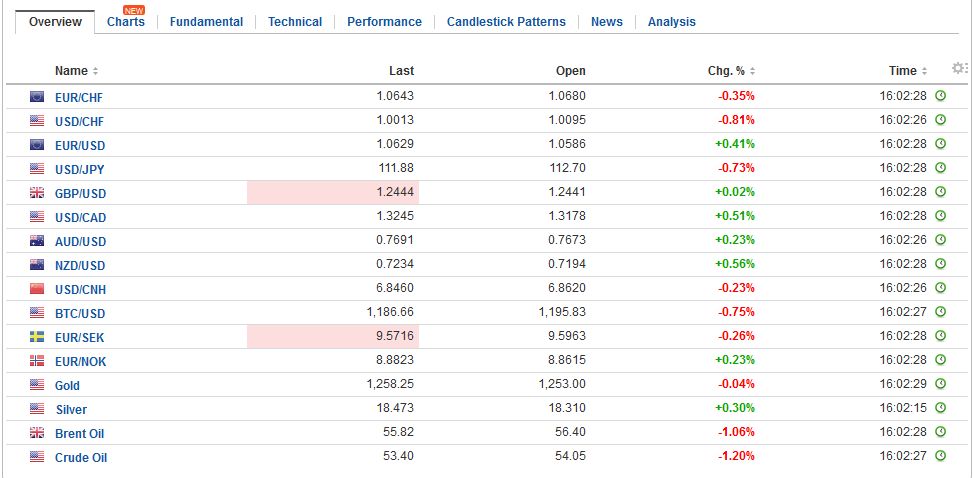

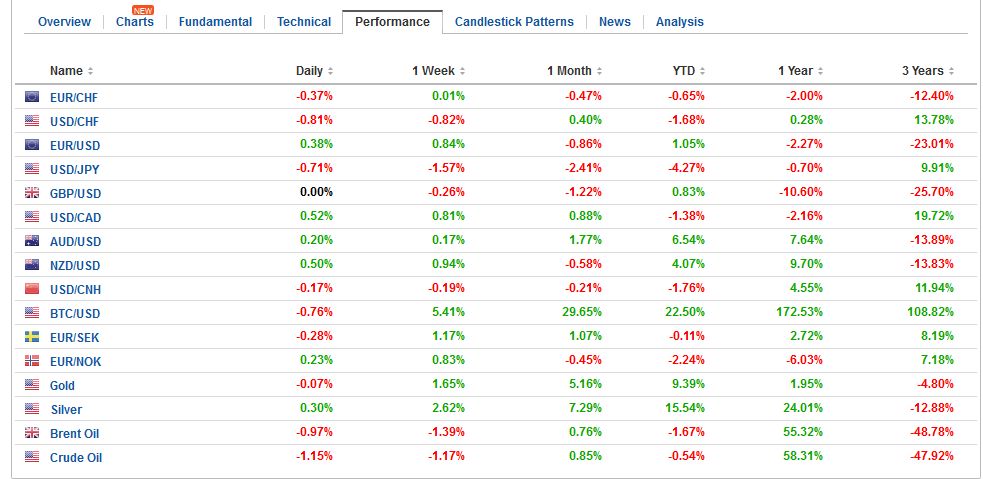

FX RatesThe capital markets are becalmed, and the US dollar is in narrow trading ranges. Month-end considerations are at work, but the key event is much-awaited speech US President Trump to a joint session of Congress this evening (early Wednesday in Asia). The hope is that he provides the policy signals that allow the dollar to break out of its recent ranges. The combination of fiscal stimulus and less accommodative monetary policy is thought to be dollar-friendly. At the same time, given the build-up, the mercurial temperament, and unorthodox style could set up investors for disappointment, after the Dow Jones Industrials have rallied for a dozen consecutive sessions, and the S&P 500 off only three sessions this month, coming into today. The speculative long dollar position has been reduced in the futures market, but it remains net short euros, sterling, and yen. However, speculators are also net long the dollar-bloc currencies. There seem to be several ways that expectations could be disappointed, but what they have in common is dampening of expectations for fiscal stimulus. Yesterday’s call for a substantial increase in defense spending, while cutting discretionary spending may run into some difficulties getting around rules designed to avoid precisely that. In any event, the Trump’s economic team appears committed to stronger US growth via trade adjustment, tax reform, deregulation, and infrastructure spending. |

FX Daily Rates, February 28 |

| Although the Republicans hold both houses of Congress and the White House, its slim majority in the Senate denies it carte blanche. Also, some Republicans in Congress and some Republicans in the White House do not see eye-to-eye on the full range of fiscal issues. The comprehensive tax reform efforts are predicated on raising sufficient revenue to avoid or minimize the impact on the deficit and debt.

There are two main sources of revenue, in this approach. Taxes that are currently being used to fund national health care, for which opinion surveys now suggest greater for as it is about to be fundamentally altered, and the proposed border adjustment tax on imports. Between the two there is more than $2.0 trillion that theoretically can be used to fund tax cuts that in the dynamic accounting and optimistic assumptions can actually increase revenue. Both sources are not as solid is it may have appeared even a few weeks ago. The repeal and replacing of the national health care is turning out to be more complicated that officials understood, and the border adjustment appears not to have the necessary support in the Senate. Trump speech is likely to be a broad wish list and then call upon Congress to deliver. He does not need to prioritize his programs. Treasury Secretary Mnuchin said last week that the infrastructure initiative is more a 2018 story, but yesterday Trump pressed this issue. Nevertheless, it does not seem that fiscal policy will be a major factor in the Fed’s decision in two weeks about raising interest rates. The market increased the odds of a March hike yesterday. According to Bloomberg, the Fed funds futures contract has discounted a 50% chance of a hike, while its calculation using the overnight index swaps (OIS) is 57.1%. The CME, where Fed funds futures trade estimates the probability of a March hike at 31%. |

FX Performance, February 28 |

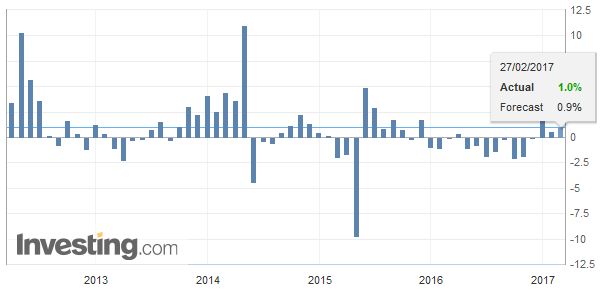

JapanThe news stream is light. Japanese industrial output unexpectedly fell in January, for the first time since last July. The 0.8% decline contrasts to expectations for a 0.4% increase. The January decline comes after rising of nearly the same magnitude in December (0.7%). Australia reported a smaller current account deficit in Q4 (A$4.0 bln from Q3 revised A$10.2 bln (which could have a small knock on effect on expectations for tomorrow’s GDP report. |

Japan Retail Sales YoY, January 2017(see more posts on Japan Retail Sales, ) Source: Investing.com - Click to enlarge |

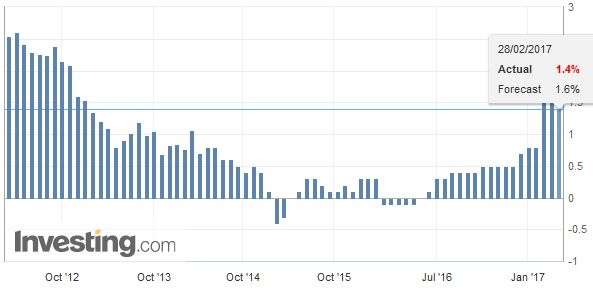

FrancePreliminary French and Italian inflation figures were reported, and they moved in opposite directions. France’s estimate rose 0.1% rather than the median estimate of 0.4%. The year-over-year rate slipped to 1.4% from 1.6%. |

France Harmonised Index of Consumer Prices (HICP) YoY, January 2017(see more posts on France Harmonised Index of Consumer Prices, ) Source: Investing.com - Click to enlarge |

ItalyItalian CPI rose 0.2% in February. The Bloomberg median estimate was for a 0.1% decline. The year-over-year rate rose to 1.6% from 1.0%. |

Italy Consumer Price Index (CPI) YoY, January 2017(see more posts on Italy Consumer Price Index, ) Source: Investing.com - Click to enlarge |

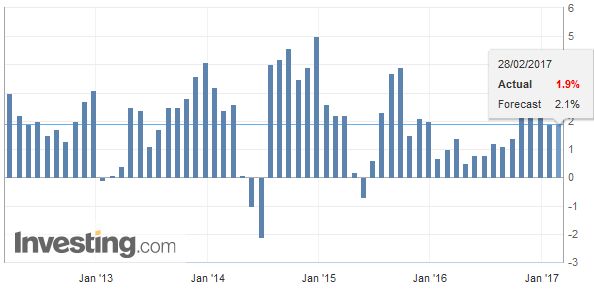

United StatesIn terms of economic data, the US session features a likely upward revision to Q4 growth to 2.1% from 1.9%, helped in part by better consumption. The preliminary merchandise trade balance for January will be reported at the same time. The wholesale and retail inventories will be reported too and may be overshadowed by the other data. |

U.S. Gross Domestic Product (GDP) QoQ, Q4 2016(see more posts on U.S. Gross Domestic Product QoQ, ) Source: Investing.com - Click to enlarge |

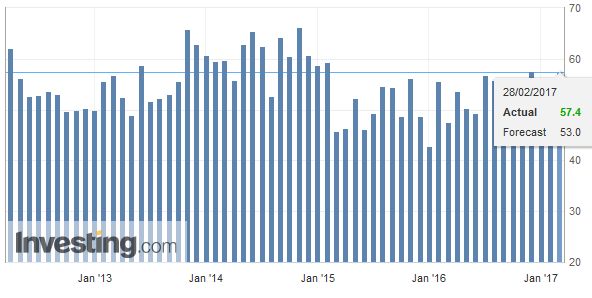

| Later will be house price, Chicago PMI and the Conference Board’s consumer confidence measure. The Fed’s Harker and Williams speak toward the end of the session, while Bullard speaks a couple of hours before the President. |

U.S. Chicago Purchasing Managers Index, February 2017(see more posts on U.S. Chicago PMI, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,EUR/CHF,Federal Reserve,Fiscal,France Gross Domestic Product,France Harmonised Index of Consumer Prices,gbp-chf,Italy Consumer Price Index,Japan Retail Sales,newslettersent,U.S. Chicago PMI,U.S. Gross Domestic Product QoQ