Swiss Franc |

EUR/CHF - Euro Swiss Franc, February 16(see more posts on EUR/CHF, ) |

GBP/CHFAt the time of writing the pound is trading much closer to it’s annual low against the Swiss Franc than it’s annual high, and for reason for this can simply be put down to last years Brexit vote. We are now just weeks from the formal initiation of the Brexit process and interestingly the Pound is trading around it’s year-to-date highs against many currency pairs. Personally I think that markets have now accepted that the UK will be carrying out a ‘Hard Brexit’ after the UK PM, Theresa May made clear the UK government’s plans for the Brexit moving forward. With this in mind references to a harder Brexit are no longer weighing on the Pound’s value in the way they were prior to May’s speech, as there is now clarity as to what’s likely to happen as the UK begins Brexit negotiations. I think that those with a currency requirement involving the Pound and the Swiss Franc should keep a close eye on trade deal negotiations between the UK and the international community as talks of broken down talks are likely to weigh on the Pounds value in my opinion. Trade negotiations have historically taken a long time and if the UK is unable to buck this trend during this crucial time I think further Sterling falls will be on the cards. |

GBP/CHF - British Pound Swiss Franc, February 16(see more posts on GBP/CHF, ) |

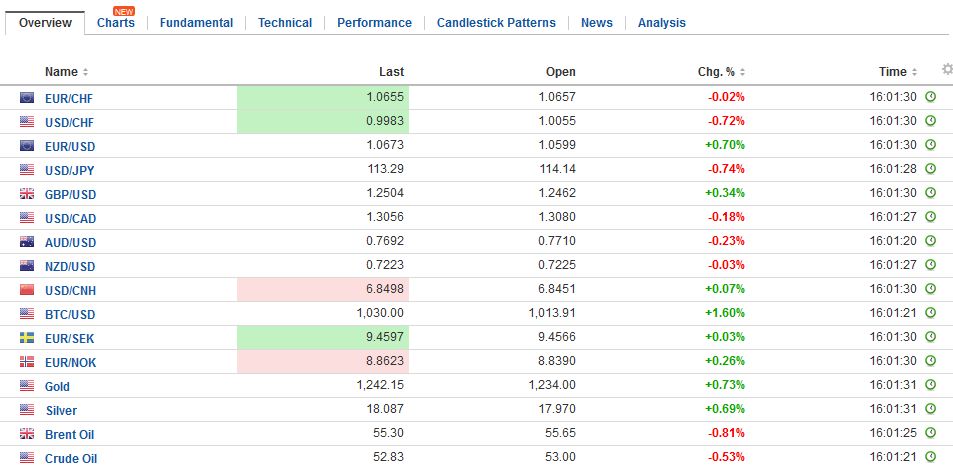

FX RatesThe Dollar Index had moved higher for ten consecutive sessions before reversing yesterday’s gains to close lower. Yesterday and today’s losses have seen the Dollar Index retrace 38.2% of the advance since February 2. That retracement objective was near 100.80. The 50% retracement is found near 100.50 and the 61.8% retracement by 100.20. The euro recorded a reversal pattern yesterday–a hammer candlestick–, and there has been following through euro gains today. It had been sold to almost $1.0520 yesterday before the short-covering bounce lifted it to new session highs in late turnover, and managed to finish the North American session at $1.06. Short covering today lifted the single currency to $1.0640, which is the 38.2% retracement objective, but it does not appear over. The 50% retracement is seen near $1.0675 and the 61.8% retracement is $1.0710. |

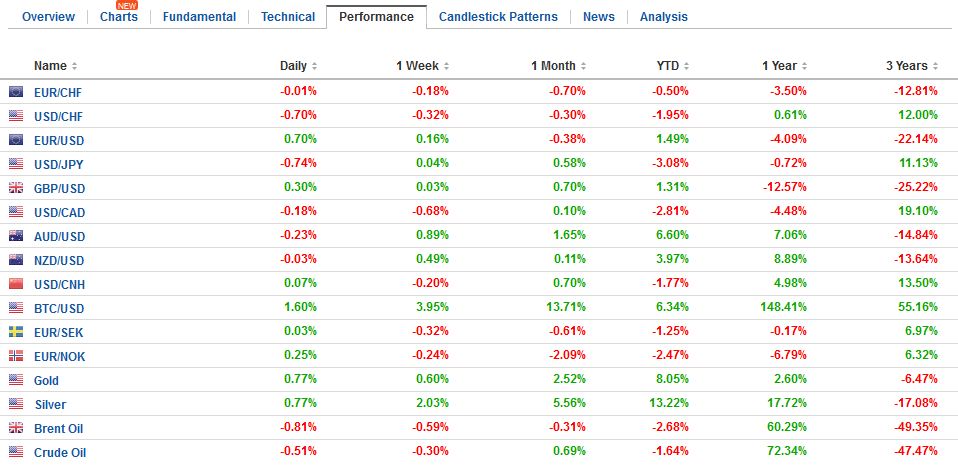

FX Performance, February 16 2017 Movers and Shakers Source: Dukascopy.com - Click to enlarge |

| Softer US yields, weaker Japanese stocks, and the corrective pressures have seen the dollar back away from yesterday’s test on JPY115 to return to JPY113.50. At JPY113.80, the greenback surrenders 38.2% of its recent gains. The 50% mark is at JPY113.30, and the 61.8% retracement objective is found near JPY112.90.

Sterling is firmer, but cable appears to be being held back by the unwinding of long sterling cross positions. It had dipped below $1.24 yesterday for the second time this month, and demand once again emerged. Sterling is testing resistance in the $1.2530-$1.2540 area, and a move through there would set up a more important technical test in the $1.2570-$1.2585 band. The Canadian dollar, in contrast, seems largely sidelined. It is up about 0.25% today with the US dollar near CAD1.3050. The technical indicators suggest the potential for the US dollar to move higher, perhaps back toward CAD1.3100. Yesterday’s high (~CAD1.3120) and the 20-day moving average (~CAD1.3110) offer nearby resistance. |

FX Daily Rates, February 16 |

| The main US equity indices closed at new record highs yesterday. Although the MSCI Asia Pacific Index closed higher (~0.45%), it struggled. Japanese, Korean, and Taiwanese markets fell. China, Australia, and India rose. In Europe, the Dow Jones Stoxx 600 is set to end its longest advancing streak in 18 months (seven sessions) that had carried the benchmark to its best level since late 2015. Today’s modest loss (~0.3%) is being led by energy, consumer staples, industrial, materials, and financials/real estate sectors. Information technology, telecom, and healthcare sectors are gaining today.

The Australian dollar rallied from $0.7165 on January 2 to a little through $0.7730 today. The nearly 8% advance is led the major currencies. The Aussie fared well even during the US dollar’s recent streak. As corrective forces unfold, the Australian dollar looks vulnerable. A move back toward $0.7600 seems likely, but only a convincing break of that area would be of technical significance. |

FX Performance, February 16 |

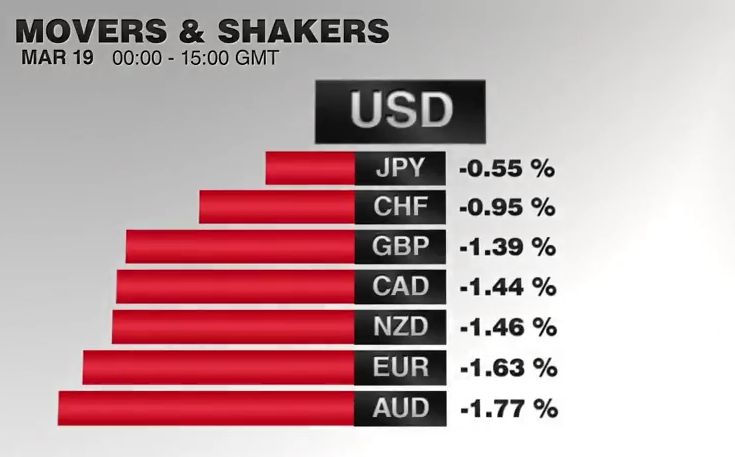

AustraliaThe Australian dollar had pushed above the $0.7700 cap yesterday but is struggling to sustain the potential breakout after disappointing jobs data, despite the corrective forces weighing on the greenback. Australia created 13.5k new jobs, but they were all part-time positions, and the participation rate eased to 64.6% from 64.7%, which accounts for the decline in the unemployment rate to 5.7% from 5.8%. |

Australia Participation Rate, January 2017(see more posts on Australia Participation Rate, ) Source: Investing.com - Click to enlarge |

| Australia created an average of 31k full-time jobs a month in Q4 2016. This was too good to be true. In Q3 it lost an average of 38k jobs a month. In January, it shed 44.8k full-time jobs and grew 58.3k part-time positions. |

Australia Unemployment Rate, January 2017(see more posts on Australia Unemployment Rate, ) Source: Investing.com - Click to enlarge |

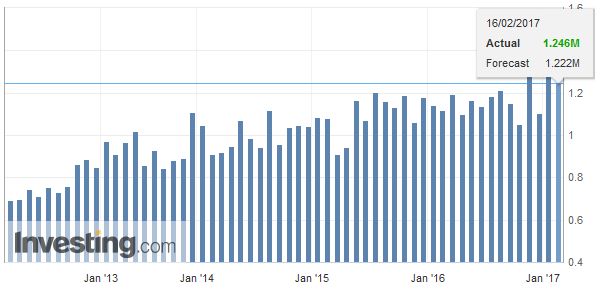

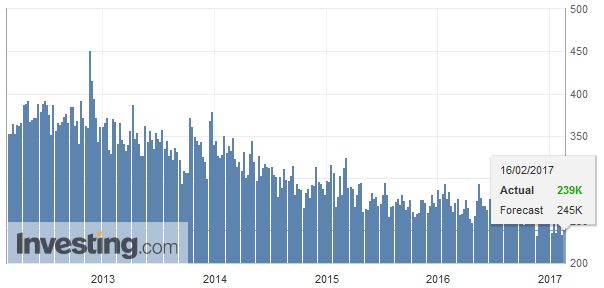

United StatesThe US economic calendar does not have the heft to arrest the corrective pressures. The US reports January housing starts and permits, the February Philly Fed survey and the weekly jobless claims. Recall that housing starts surged 11.3% in December and some payback is likely in January. Permits, which are included in the Leading Economic Indicators are expected to edge higher after falling 0.2% in December. The Philly Fed survey rose from 8.7 in November to 23.6 in January. It has been higher only a handful of times since the end of the financial crisis. Some moderation is expected, and the Bloomberg median forecast calls for an 18.0 reading. |

U.S. Housing Starts, January 2017(see more posts on U.S. Housing Starts, ) Source: Investing.com - Click to enlarge |

| After Yellen and Dudley recent comments, there is unlikely to be new news from Fischer today. He appears on Bloomberg TV shortly, and San Fran’s Williams speaks at a fintech conference toward the end of the North American session. While many still see March as too early to move, given the tone of Yellen and Dudley’s comments, many see June as too far away. There is beginning to be a greater focus on May. Although there is no press conference or updated forecasts at the May meeting, the thinking is that by raising rates then, it would create new degrees of freedom for the Fed moving forward. |

U.S. Initial Jobless Claims, January 2017(see more posts on U.S. Initial Jobless Claims, ) Source: Investing.com - Click to enlarge |

Several trend moves of the past couple of weeks are correcting. Signs of the correction began yesterday in North America. The dollar was unable to sustain gains despite a string of stronger than expected data, including January CPI, retail sales, industrial output, and the Empire State manufacturing survey for February.

There does not appear to be a fundamental trigger. Market expectations for more Fed hikes this year than the last two combined solidified. This is evident in the Fed funds futures strip, and the US 2-year premium over Germany edged closer to 2.05% multi-year high set at the end of last year. Comments from NY Fed President Dudley, on the back of Yellen’s testimony to Congress, also suggested the strengthening of the Fed’s conviction by acknowledging that the balance of risks is shifting to more growth than expected rather than less.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,Australia Participation Rate,Australia Unemployment Rate,EUR/CHF,gbp-chf,newslettersent,U.S. Housing Starts,U.S. Initial Jobless Claims