BullionStar has recently started a new series of posts highlighting charts relating to some of the most important gold markets, gold exchanges and gold trends around the world. The posts include charts of the Chinese Gold Market, the flow of gold from West to East via the London and Swiss gold markets, and the holdings of gold-backed Exchange Traded Funds (ETFs). This is the second post in the series. Please see the November 2016 chart post article for background about the charts chosen for this series.

All of the charts featured below originate from the excellent GOLD CHARTS R US website run by Nick Laird. For BullionStar’s customizable gold and silver price charts, go to BullionStar Charts where, for example, you can measure a wide variety of financial assets in terms of gold and other precious metals.

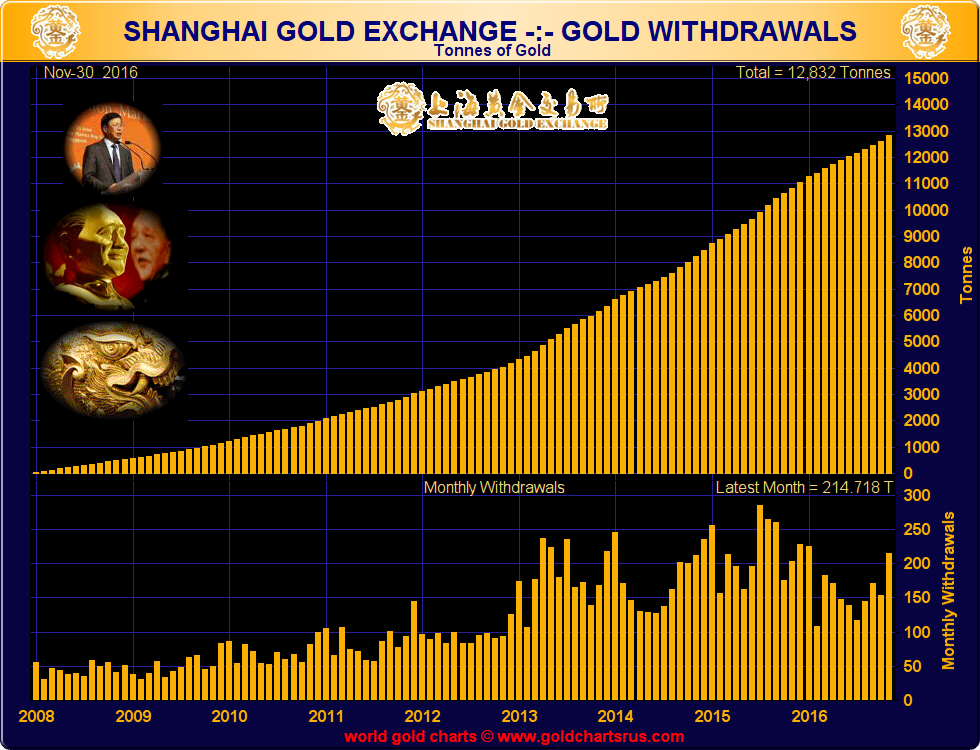

Shanghai Gold Exchange (SGE) – Gold WithdrawalsTotal physical gold withdrawals from the SGE in November 2016 reached a substantial 214.7 tonnes, over 40% higher than gold withdrawals from the Exchange during October. November was also the second highest monthly withdrawal total of the year, only surpassed by January’s withdrawal numbers. Year-to-date to November, gold withdrawals from the SGE have reached 1,774 tonnes. As a reminder, gold withdrawals from the Shanghai Gold Exchange are a suitable proxy for Chinese wholesale gold demand because all non-monetary gold imported into China has to be sold on the SGE, and most Chinese gold mining output as well as most Chinese scrap gold is also sold through the SGE as ‘standard’ gold. November’s strong Chinese gold demand occurred in an environment of falling international gold prices, which is to be expected since Chinese gold buyers generally buy at lower prices (‘buy the dips’), and unlike Western buyers, the Chinese do not chase upward gold price momentum. |

Shanghai Gold Exchange |

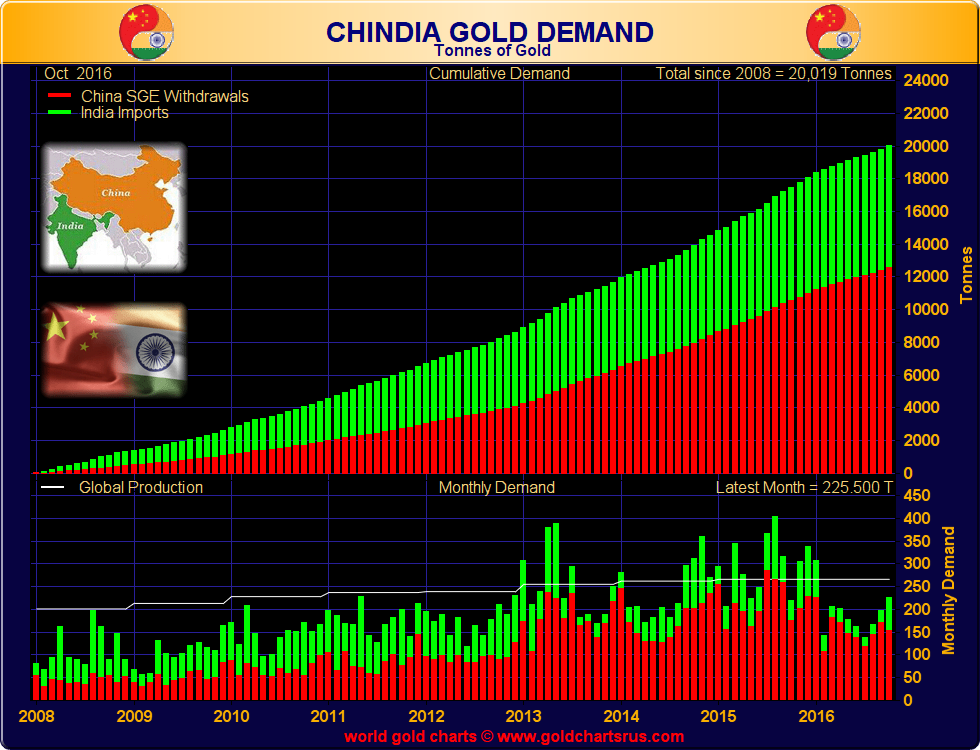

Chinese and Indian Gold DemandA suitable proxy of Chinese and Indian gold demand can be constructed by adding Shanghai Gold Exchange withdrawals to Indian gold imports. Gold import figures into India are an acceptable proxy for Indian gold demand since Indian domestic gold mining is virtually non-existent. On a combined basis, CHINDIA gold demand for October 2016 totalled 225 tonnes, which incredibly, pushed the cumulative gold demand from these two major gold markets above the 20,000 tonne mark for the nine-year period 2008 – 2016. Note that this latest version of the CHINDIA chart is to the end of October 2016. |

Chinese and Indian Gold Demand |

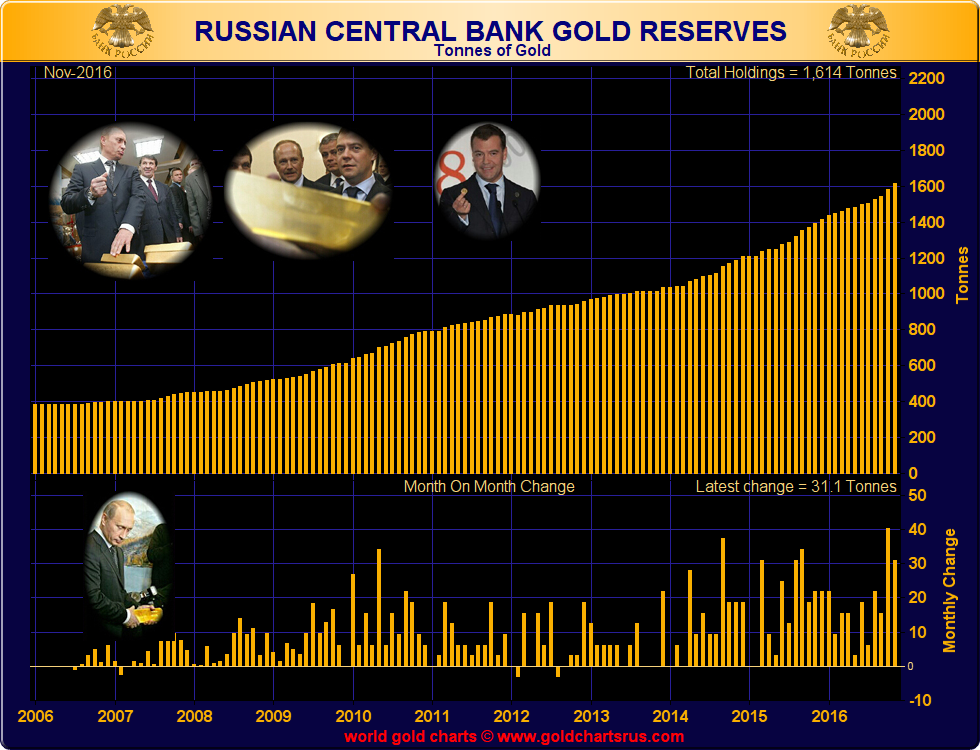

Russian Gold ReservesThe Bank of Russia, Russia’s central bank, is one of the most active buyers of gold on the planet, and has been pursuing a massive physical gold accumulation strategy since the early 2000s. In November 2016, the Bank of Russia added another 1 million ounces of gold (31.1 tonnes) to its gold reserve holdings. This follows a 40 tonne gold purchase by the Bank of Russia in October and makes November the second highest monthly addition of the year for the Russians. With the October and November additions, the Bank of Russia is now well on target to realise its planned purchase of 200 tonnes of gold during 2016. |

Russian Central Bank Gold Reserves |

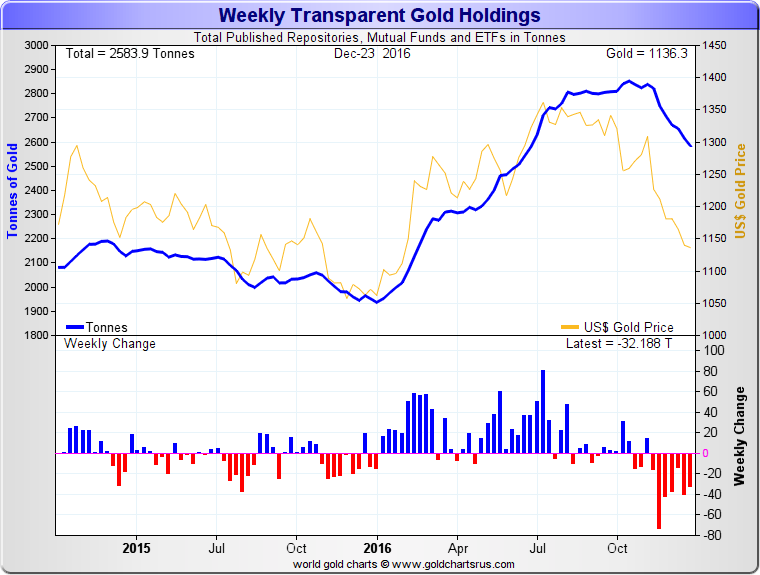

Transparent Gold Holdings – ETFs and OthersThis chart features a large group of products and vehicles, such as ETFs, which hold physical gold and which regularly report their gold holdings, thereby providing a window into the cumulative position and changes in such gold holdings on a week to week basis. As a group, these vehicles continued to see a net outflow of gold during December, with the outflow trend that began in early November continuing. As of 23 December, these tracked transparent products held a combined 2583.9 tonnes of gold, which was 134 tonnes less than their aggregated total holdings of 2717.9 tonnes on 23 November 2016. In a similar manner to November, the gold outflows in December occurred in an environment of a falling US dollar gold price. |

Weekly Transparent Gold Holdings |

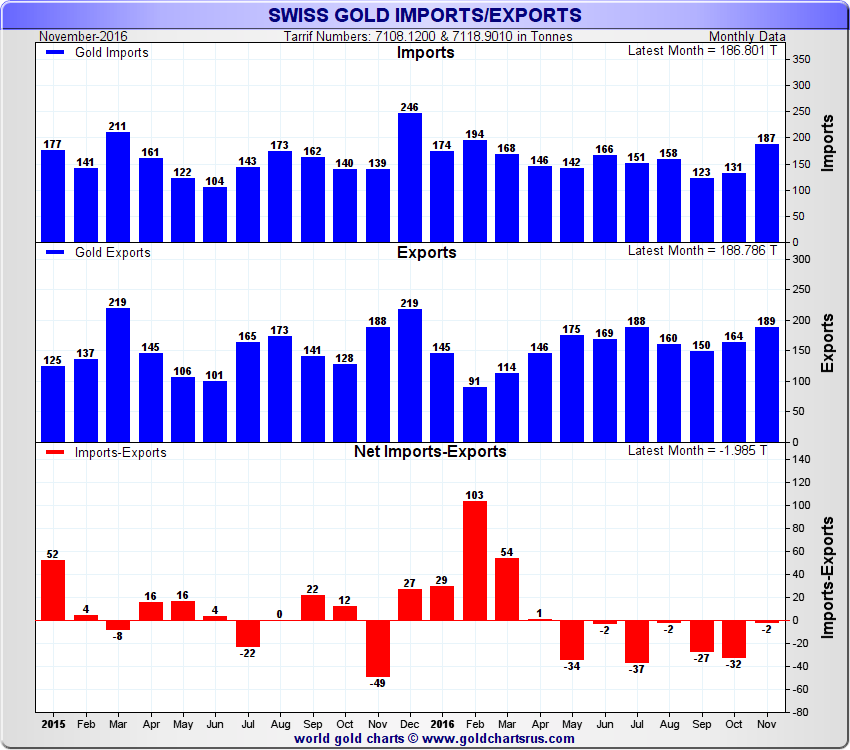

Swiss Gold Imports and Gold ExportsNovember was a notable month for Swiss gold trade flows and it actually recorded the highest monthly gold trade flows of the year. The Swiss refining and financial sector imported 187 tonnes of gold and exported 188.8 tonnes during November. November gold imports were the second highest of the year, and only a few tonnes short of the 194 tonnes imported in February 2016. Switzerland’s November gold exports were the highest monthly exports of the year. |

Swiss Gold Imports / Exports |

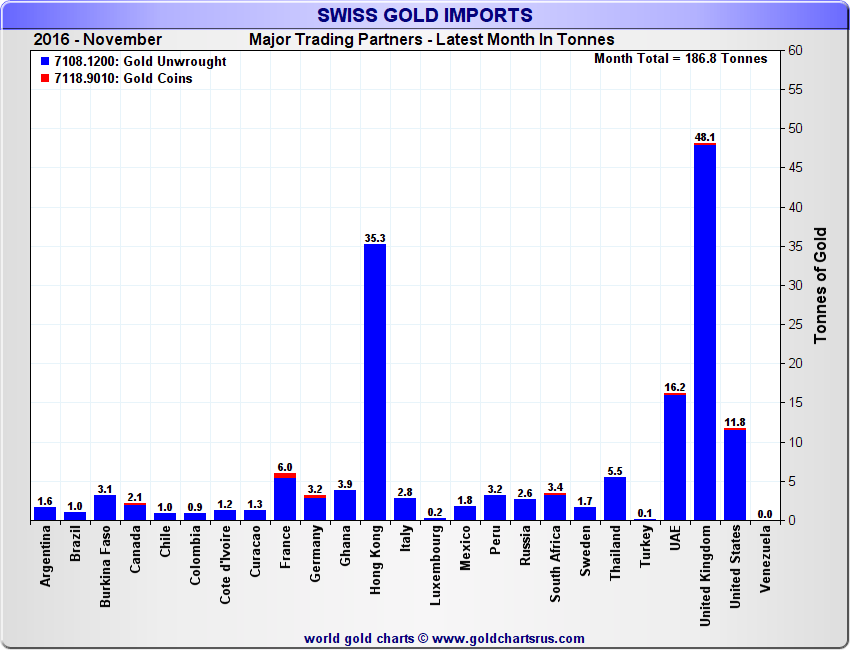

| During November, the UK (London) re-emerged as the main provider of gold to Switzerland, with the Swiss importing 48 tonnes of gold from London. This is the highest monthly gold import flow from the UK to Switzerland since last January. The second largest source of gold flowing into Switzerland during November was Hong Kong which provided 35 tonnes, with the UAE (Dubai) a distant third providing 16 tonnes, and the US sending just under 12 tonnes to the Swiss. |

Swiss Gold Imports |

|

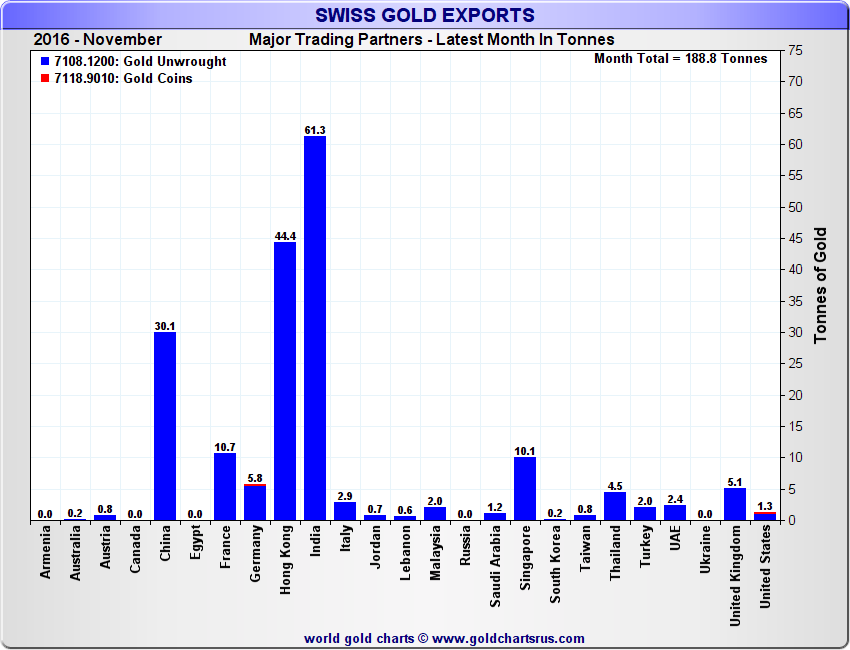

On the export side, Switzerland exported a sizeable 61.3 tonnes of gold to India during November as Indian demand improved on the back of the marriage season and jewellery industry restocking following the Diwali festival. Hong Kong received 44 tonnes from the Swiss, China was sent 30 tonnes, and remarkably France received over 10 tonnes of gold from Switzerland during November, nearly twice as much gold as was transported from Switzerland to the German market during the same period. |

Swiss Gold Exports |

|

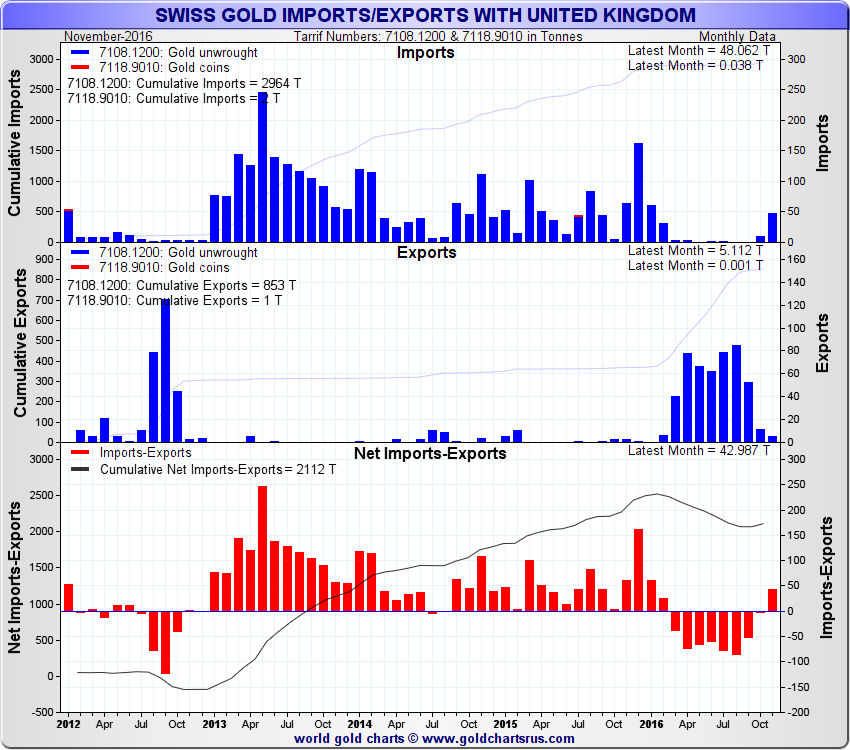

After exporting gold to the UK (London) for most of 2016, the tide reversed In November and Switzerland again became a substantial importer of gold from London receiving 48 tonnes. Although Switzerland also exported 5 tonnes of gold to the UK in November, Swiss net gold imports minus gold exports were still a sizeable 43 tonnes. This reversal of trend was signaled in the October UK-Swiss gold trade data, when Swiss gold imports from the UK reappeared, and Swiss gold exports to the UK began ebbing. As stated in BullionStar’s November commentary about the October UK-Swiss gold flow data: “Is the recent tide of UK imports from Switzerland about to turn back to UK exports to Switzerland? The October data may provide some clues, but additional month’s data is required before know whether a new trend is being established.” Now that November’s data is in, it adds to the confirmation that the reversal of gold flows has indeed been established, so we should expect see continued exports of gold from London (UK) to Switzerland in December’s Swiss data, which is released on about 23rd of January. The continued outflow of gold from the large ETFs which store their gold in London, e.g. SPDR Gold Trust and iShares Gold Trust, also points to further flows of gold from London to Switzerland as bullion banks distribute 400 oz gold bars previously held within the ETFs. |

Swiss Gold Import / Exports with UK |

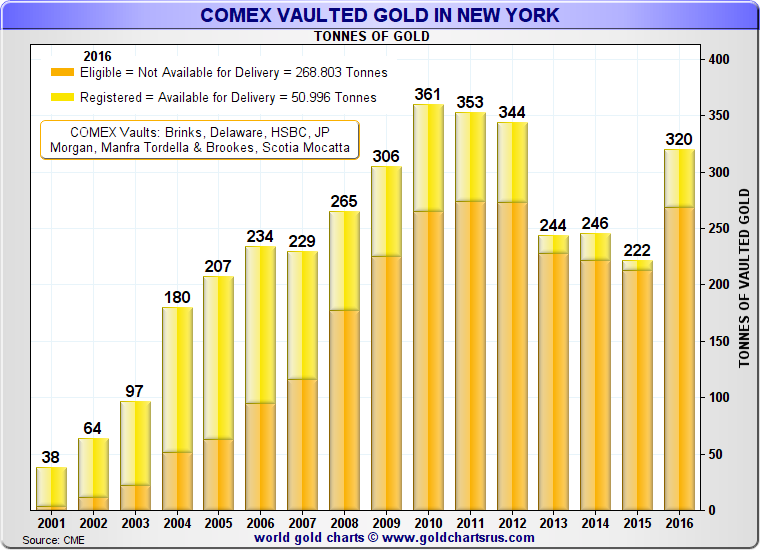

COMEX – Vaulted gold in New York approved vaultsThe amount of gold held in COMEX approved vaults for which warrants have been issued against COMEX gold futures contracts (Registered gold) totalled approximately 50 tonnes as of the end of December 2016. This was about 15 tonnes less than the 65 tonnes which was in the registered category at the end of November. The amount of eligible gold stored in the reporting vaults in the form of gold kilobars and 100 oz gold bars – which is acceptable by the COMEX for delivery against its gold futures contracts but for which warrant have not been issued – stayed relatively flat at 269 tonnes compared to the previous month’s figure of 264 tonnes. See the recent BullionStar blog “COMEX and ICE Gold Vault Reports both Overstate Eligible Gold Inventory” for more detail on Eligible vs Registered gold reported by COMEX. |

|

This article originally appeared on BullionStar’s website under the title “Gold Market Charts – December 2016“.

Full story here Are you the author? Previous post See more for Next postTags: China,Dubai,economy,Finance,France,Gold,Gold as an investment,Hong Kong,India,investment,money,newslettersent,Precious Metals,Russian central bank,Silver as an investment,Switzerland