Swiss Franc |

EUR/CHF - Euro Swiss Franc, January 12(see more posts on EUR/CHF, ) |

|

If you are buying or selling the Swiss Franc the next week is vital to expectations. The pending Supreme court case will shape the next twist and turns of Brexit which in turn will of course affect the pound and also risk sentiments. I expect GBPCHF could easily slip below 1.20 if the Court Case is rejected, this is really what CHF sellers should be aiming for. If you are a buyer all hope is not lost, the market concensus seems to be GBP strength after the government loses its appeal. GBPCHF exchange rates have slipped in the last week owing to Theresa May’s comments that have been interpretted as her seeking a hard Brexit. Market sentiment remains of the opinion that a harder Brexit is more likely. And also that the pending Supreme Court case will uphold the previous decision. These potentially conflicting views are reflective of the uncertainty apparent in the market and the dichotomy present for the pound. If you are looking to buy or sell the Swiss Franc the big news is really the pending Supreme Court case which is due any day. Expectations are for the pound to rise of the previous decision is upheld forcing Theresa May and the government to seek parliamentary approval in order to trigger Article 50. Article 50 is the legal mechanism for the UK to leave the EU and this issue is central to the future direction on GBPCHF rates now and in the future. The Swiss Franc is a safe haven currency so it also reacts in times of uncertainty globally. The Brexit is a prime example, the market is expecting to see some strengthening of the CHF further if we continue to see global uncertainty. I think for now much of the uncertainty is priced into the Franc but a further deterioration of current trends and themes ie Russia, Trump and political fears in the Eurozone could all foster Swiss Franc strength. Distinctions can be drawn between these issues, they are not one and the same. Political fears in Europe itself may see a weakening of the Franc as investors seek alternative safe havens such as the Japanese Yen or US dollar. |

GBP/CHF - British Pound Swiss Franc, January 12(see more posts on GBP/CHF, ) |

FX RatesAfter a choppy North American session yesterday, the dollar and US yields remain under pressure. The dollar is lower against all the major currencies and most emerging market currencies, including the recently shellacked Turkish lira and Mexican peso. The main consideration appears to be the further unwinding of positions when no more details of the new administration’s policies were provided. The one economic element, a reiteration that is going forward pharmaceutical companies will have to bid for the US government contracts appeared to weigh on the share prices of some companies in that space. For example, the Nikkei’s 1.2% decline was paced by a 3.3% decline in pharmaceuticals/biotech. In Europe, the Dow Jones 600 is off about 0.5% in late morning turnover, with health care the weakest sector, and within that pharmaceuticals/biotech is off 2.1%. The Dollar Index fell it its lowest level since December 14, the day the Fed hiked rates. The low on that day was 100.73. Today’s low, thus far, is 100.81. The US 10-year bond yield reached almost 2.3% today. That is the lowest yield since November 30. The two-year yield has slipped to 1.14%, its lowest level in about a month. However, the intraday technicals suggest the North American session is likely to see the dollar recover. Most of the dollar’s drop was recorded in Asia, and European participants showed little appetite to extend the move. Yesterday, amid trendless and particularly choppy activity, the euro fell to almost $1.0450 but quickly popped back to record new session highs just below $.10625. Follow through buying in Asia lifted it to $1.0665. It has drifted lower in Europe and the intraday technical indicators are rolling over. A break below $1.0580-$1.0600 now would lend credence to the idea that a near-term high may be in place.

|

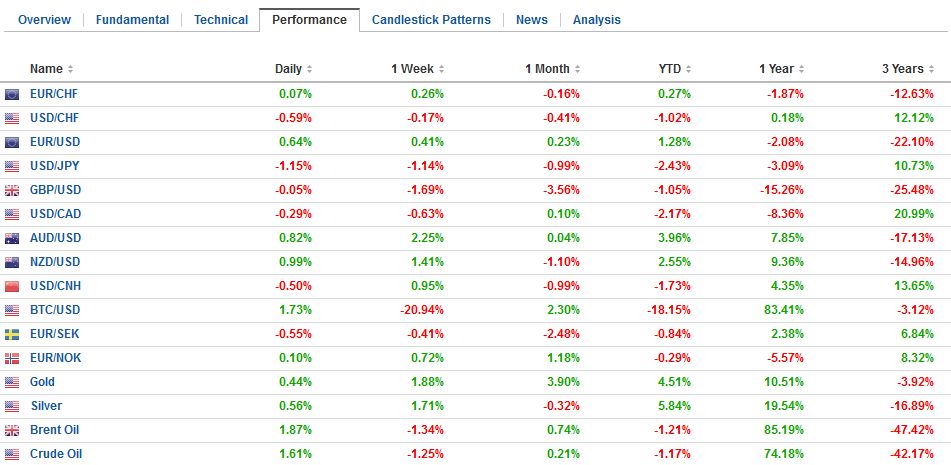

FX Daily Rates, January 12 |

| We had recognized the risk that a push lower in the US rates could see the dollar slump toward JPY114.25-JPY114.50. Late in the Asian session, the dollar reached almost JPY113.75. Yesterday’s high was near JPY116.90. The technical indicators are suggesting the low may be in place. The JPY114.50 now offers resistance, but a move above there would see JPY115.00-JPY115.50, perhaps ahead of the weekend, with the help of a robust US retail sales report.

Sterling broke below $1.22 to start the week for the first time in more than two months. In managed to close back above it yesterday, and follow through buying lifted it to almost $1.2320. While the momentum has eased, it has found some bids near $1.2250 on the pullback. The intraday technicals are not generating as strong a signal as was the case for the euro and yen. The dollar-bloc currencies are strong. The Australian dollar briefly poked through $0.7500 for the first time since the Fed’s rate hike. It is retaining its gains better than most of the other majors, but the intraday indicators also warn of a pullback. Initial support is near $0.7480 and then $0.7450. The US dollar has fallen to its lowest level against the Canadian dollar since October 20. Growing confidence in the pick-up in the Canadian economy, higher oil, and commodity prices, and being seen as a proxy for the US dollar appear to be fueling demand. A US dollar low near CAD1.3030 seen in early Europe, however, may either be the session low or very close to it. An initial greenback recovery could carry back to CAD1.3100-CAD1.3120. |

FX Performance, January 12 |

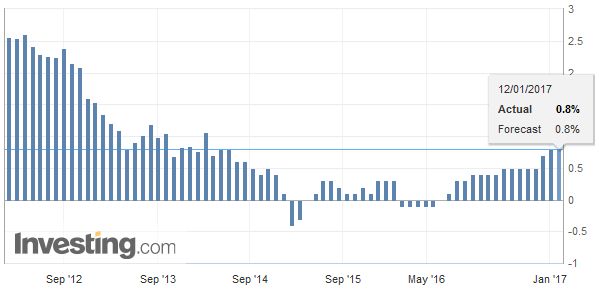

SwedenThe Swedish krona has gained nearly one percent against the dollar. It was helped by new of a somewhat higher than expected inflation. Many understand this to mean that there is less likelihood of additional monetary easing. CPI rose 0.5% in December to lift the year-over-year rate to 1.7% from 1.4%. It is the strongest pace since early 2012. The measure of inflation that uses fixed mortgage interest rates (CPIF) rose 1.9% year-over-year. This is the highest since 2010. Swedish bond is under performing as a result too. |

Sweden Consumer Price Index (CPI) YoY, December 2016 Source: Investing.com - Click to enlarge |

EurozoneThe bonds are essentially flat while most European yields are being dragged lower by the fall in US yields. German, French, and Italian 10-year yields are off 2-3 bp, while Spain, Portugal, and the UK are seeing 4-7 bp declines. |

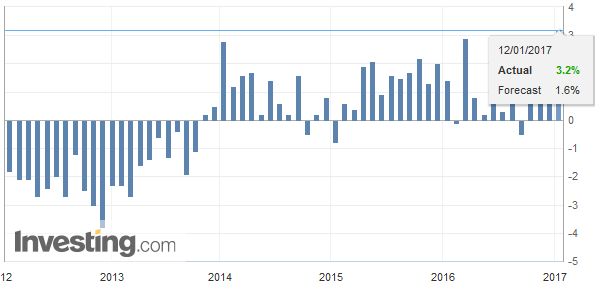

Eurozone Industrial Production YoY, December 2016(see more posts on Eurozone Industrial Production, ) Source: Investing.com - Click to enlarge |

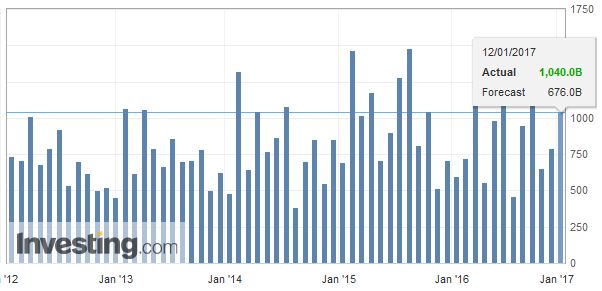

ChinaLastly, China reported a larger than expected increase in new yuan loans in December (CNY1.04 trillion), which is a three-month high. However, the aggregate financing pace slowed to CNY1.63 trillion from a CNY1.74 trillion. This would seem to reflect a decline in shadow banking activity. The onshore yuan rose 0.5% today and the offshore yuan a little less. Although the squeeze in the Hong Kong money market rates has unwound almost fully, the fact that the offshore yuan (CNH) is trading stronger than the onshore yuan (CNY) suggests speculative pressures have not reemerged (yet). |

China New Loans, December 2016(see more posts on China New Loans, ) Source: Investing.com - Click to enlarge |

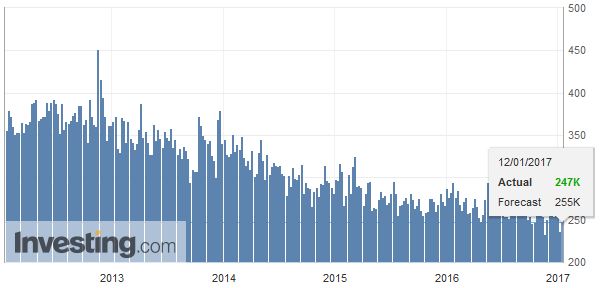

United StatesThe North American session features import prices and weekly jobless claims. However, no fewer than six Fed officials speak today. Five regional presidents will speak throughout the day. Yellen speaks this evening. |

U.S. Initial Jobless Claims, December 2016(see more posts on U.S. Initial Jobless Claims, ) Source: Investing.com - Click to enlarge |

France |

France Harmonised Index of Consumer Prices (HICP) YoY, December 2016(see more posts on France Harmonised Index of Consumer Prices, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$CAD,$EUR,China New Loans,EUR/CHF,Eurozone Industrial Production,France Harmonised Index of Consumer Prices,FX Daily,gbp-chf,newslettersent,U.S. Initial Jobless Claims,yuan